Starting a Business in Dubai South

Dubai South has emerged as a critical component of the UAE’s economic diversification strategy, positioning itself at the intersection of global logistics, aviation, and commercial services. The free zone attracts businesses requiring multimodal transport advantages and proximity to both maritime and aviation infrastructure.

Strategic Positioning Within UAE Economy

The free zone serves as the centerpiece of a 145-square-kilometer master-planned development anchored by Al Maktoum International Airport. This positioning creates a unique advantage for businesses involved in international trade, logistics coordination, and cross-border services. The zone’s proximity to Jebel Ali Port enables goods movement from sea to air in under four hours under a single customs bond.

Target Business Profiles

Dubai South primarily appeals to three categories of investors:

- Logistics and freight companies requiring rapid cargo processing capabilities

- Aviation service providers including maintenance, repair, and overhaul operations

- Trading enterprises focused on import-export activities across emerging markets

- Service-based startups seeking cost-effective entry into the UAE market

The regulatory framework administered by Dubai South Authority provides transparent procedures with clearly defined timelines, making it accessible for first-time investors in the region.

What Is Dubai South?

Dubai South operates as a dedicated free zone established under Law No. (8) of 2006, originally known as Dubai World Central. The jurisdiction functions with independent regulatory authority while maintaining alignment with federal UAE legislation on taxation, anti-money laundering, and immigration.

Governance and Regulatory Structure

The Dubai South Authority serves as both regulator and service provider, managing business licensing, real estate allocation, and investor relations. This consolidated administrative model reduces bureaucratic complexity compared to jurisdictions requiring coordination across multiple government departments.

Geographic and Economic Focus

Located in the southern corridor of Dubai, the free zone encompasses multiple specialized districts including logistics parks, aviation zones, and commercial developments. The master plan accommodates both light industrial operations and professional services, with infrastructure designed to support a population of one million residents and employment for 500,000 professionals upon full development.

The zone’s economic orientation emphasizes logistics, aviation services, general trading, and business services, with licensing frameworks tailored to these sectors.

Advantages of Establishing Your Business in Dubai South

Selecting a free zone requires evaluation of specific operational benefits that align with your business model. Dubai South offers several structural advantages that distinguish it from alternative UAE jurisdictions.

Complete Foreign Ownership

All Dubai South entities permit 100% foreign ownership without requirement for UAE national partners. This ownership structure applies to all legal forms available in the jurisdiction, providing full control over business operations, profit distribution, and strategic direction.

Federal Tax Framework and Exemptions

The UAE implemented federal corporate tax effective June 1, 2023, with a standard rate of 9% on taxable income exceeding AED 375,000. However, Dubai South companies can qualify for a 0% corporate tax rate on “Qualifying Income” by meeting specific criteria:

- Maintaining adequate physical presence with qualified employees

- Deriving income from transactions with other free zone entities or qualifying activities

- Ensuring arm’s length pricing for related party transactions

- Preparing audited financial statements annually

Companies with revenue below AED 3,000,000 qualify for Small Business Relief until end of 2026, providing temporary exemption from corporate tax obligations.

Sector Specialization and Activity Permissions

The licensing structure accommodates diverse business activities across commercial, service, logistics, aviation, and light industrial categories. This flexibility allows companies to hold multiple activity classifications under a single license, reducing administrative overhead for diversified business models.

Professional services, IT consulting, and software development activities face minimal restrictions, while trading licenses provide clear pathways for import-export operations with or without physical inventory requirements.

Digital-First Administrative Processes

Dubai South utilizes an integrated online portal for license applications, document submissions, and fee payments. This digital infrastructure reduces processing timelines and provides real-time application status tracking, eliminating the opacity common in traditional government processes.

Infrastructure Integration

The zone’s physical infrastructure includes dedicated business centers, logistics facilities, and warehouse complexes with connectivity to both Al Maktoum International Airport and Jebel Ali Port. This integration reduces supply chain friction for businesses requiring rapid goods movement between transport modes.

Companies benefit from simplified customs procedures, with designated zones allowing goods to remain “outside the UAE” for VAT purposes, creating significant cash flow advantages for import-export operations.

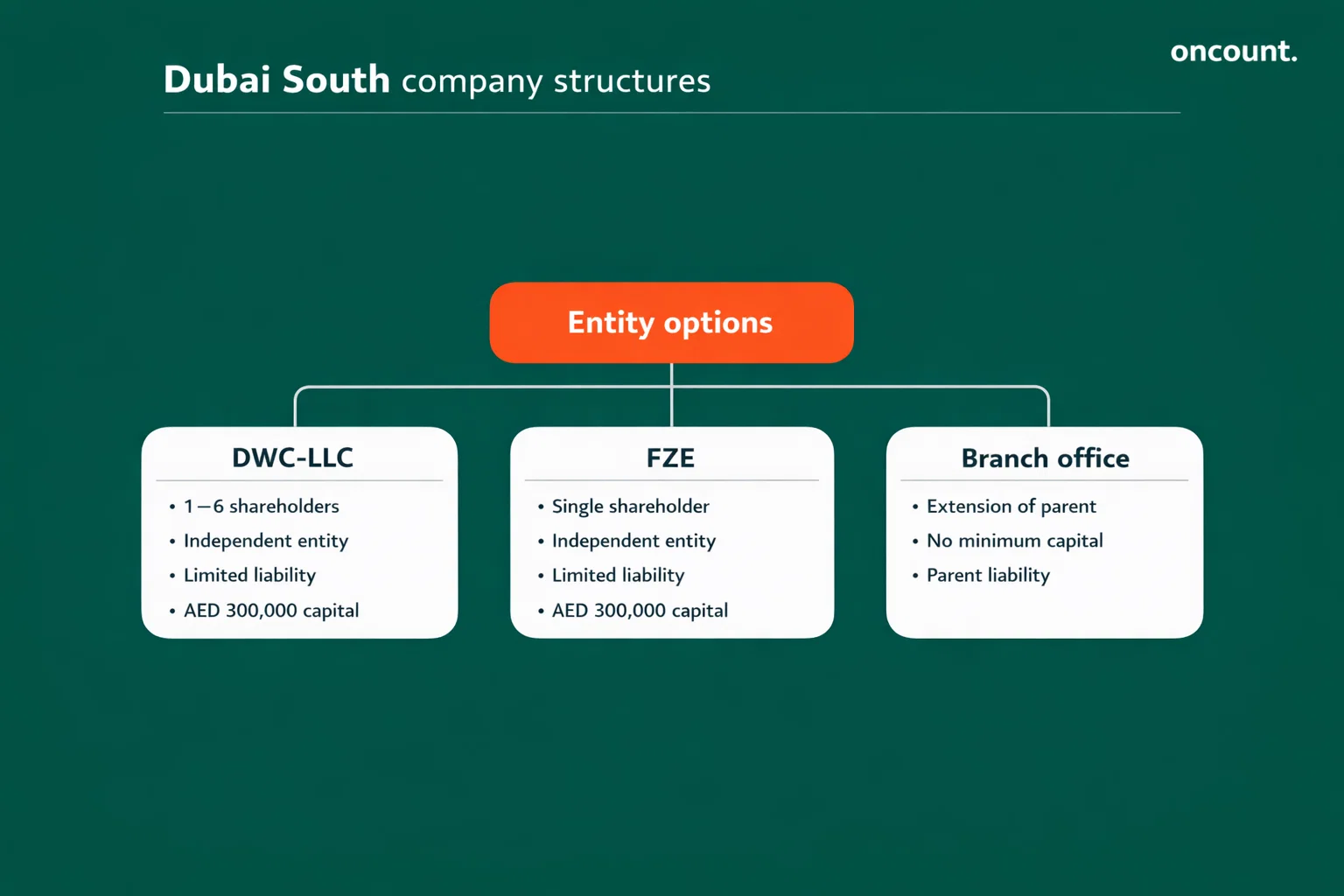

Types of Companies You Can Register in Dubai South

Dubai South offers three distinct legal structures, each designed for specific ownership configurations and liability preferences. Understanding these options is fundamental to proper entity selection.

Free Zone Limited Liability Company (DWC-LLC)

The DWC-LLC functions as an independent legal entity with limited liability protection for shareholders. This structure accommodates one to six shareholders, which may be natural persons or corporate entities.

Key characteristics:

- Minimum share capital: AED 300,000 (share value: AED 1 per share)

- Independent legal personality separate from shareholders

- Limited liability restricted to share capital contribution

- Requires appointment of Manager, Director, and Secretary

- Suitable for partnerships and multi-investor ventures

Capital deposit into UAE bank accounts is not mandatory at initial registration unless registered capital exceeds AED 1,000,000, when proof of capital may be requested.

Free Zone Establishment (FZE)

The FZE structure is designed exclusively for single-shareholder entities, whether individual entrepreneurs or wholly-owned corporate subsidiaries. This legal form provides the same limited liability protection as the DWC-LLC but eliminates administrative complexity associated with multiple partners.

Operational profile:

- Single shareholder only (individual or corporate)

- Independent legal personality

- Minimum share capital: AED 300,000

- Ideal for consultants, freelancers, and parent company subsidiaries

- Simplified governance structure with single decision-maker

Branch Office

A Branch Office operates as an extension of an existing parent company registered either in UAE mainland or internationally. Unlike LLC and FZE structures, a branch lacks separate legal personality and remains legally bound to conduct identical business activities as its parent entity.

Structural considerations:

- No minimum share capital requirement

- Parent company assumes full liability for branch operations

- Requires General Manager appointment

- Restricted to parent company’s licensed activities

- Suitable for established corporations expanding into Dubai South logistics or aviation corridors

| Feature | DWC-LLC | FZE | Branch Office |

| Ownership | 1-6 Shareholders | Single Shareholder | 100% Parent Company |

| Legal Status | Independent Entity | Independent Entity | Extension of Parent |

| Share Capital | AED 300,000 | AED 300,000 | Not Applicable |

| Liability | Limited to Capital | Limited to Capital | Parent Fully Liable |

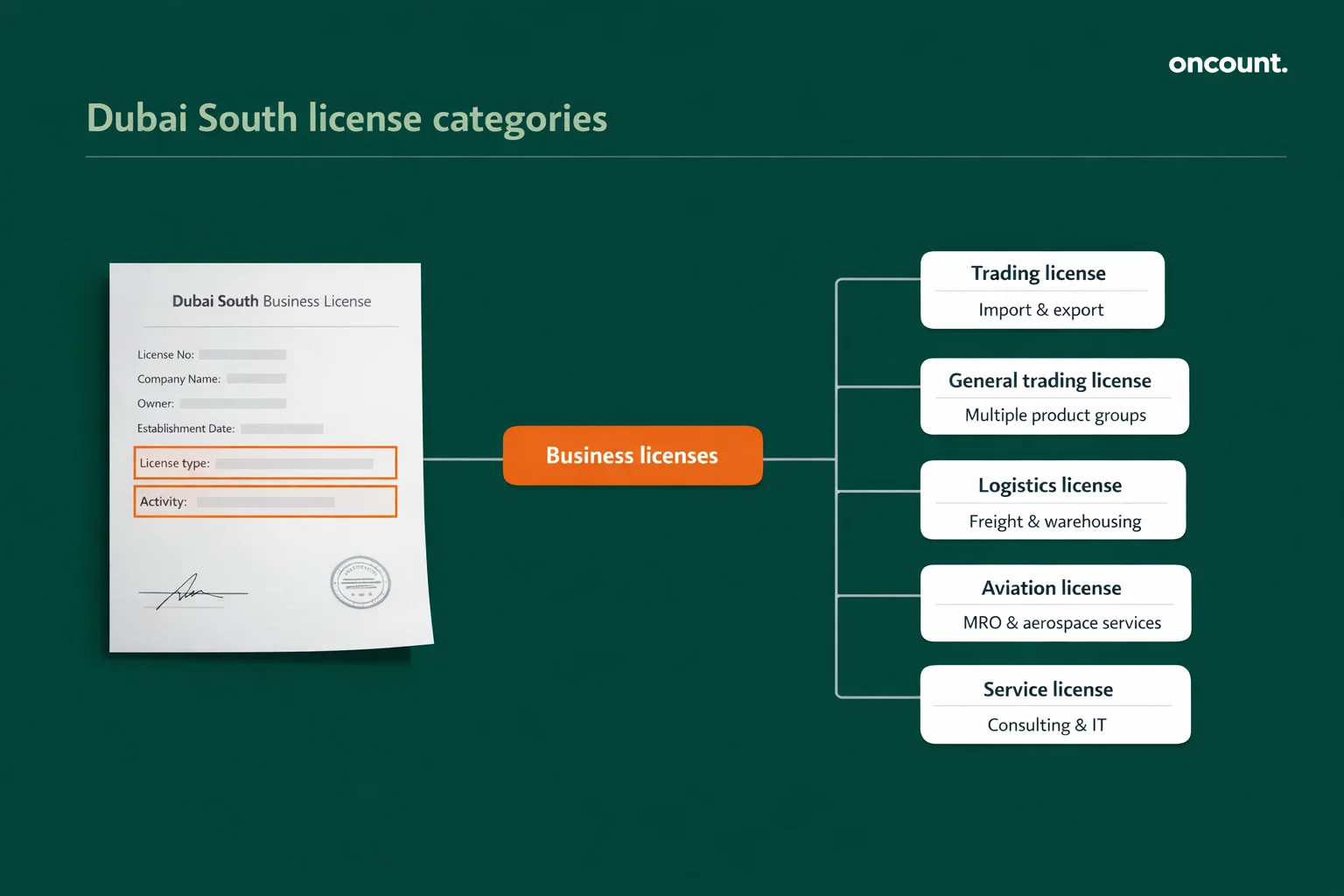

Types of Business Licenses in Dubai South

License selection determines operational scope, market access, and regulatory obligations. Dubai South offers activity-driven licensing that aligns with the zone’s economic focus areas.

Commercial and Trading Licenses

Trading License permits import, export, storage, and distribution of specified goods listed on the license. Direct sales into UAE mainland market require engagement of registered local distributors or commercial agents. Annual fee typically stands at AED 10,000.

General Trading License provides broader scope, allowing import and trade of diverse product categories under single permit. This license suits businesses handling multiple product lines without activity restrictions typical of standard trading licenses. Annual fee: AED 20,000.

Logistics and Freight Services

Logistics License targets freight forwarders, third-party logistics providers, and transportation firms. Covered activities include cargo sorting, forwarding, customs clearing, and inventory management. This license type aligns with Dubai South’s core infrastructure advantages in multimodal transport.

Aviation and Aerospace Services

Aviation License applies to entities providing specialized aerospace services including maintenance, repair, and overhaul (MRO) activities. These licenses require No Objection Certificates (NOCs) from Dubai Civil Aviation Authority to ensure compliance with airspace safety regulations and international aviation standards.

Professional Services

Service License enables consultants, IT professionals, and software developers to provide professional services within the free zone and, subject to emirate-level regulations, elsewhere in the UAE. This license category supports knowledge-based businesses without physical product requirements.

Educational and Training Services

Education License applies to training institutions and consultancy firms focusing on educational programs. This specialized license category addresses businesses providing certification programs, professional development courses, and educational consulting services.

Light Manufacturing Operations

Industrial License permits light manufacturing activities including blending, assembling, repacking, and wrapping. Operations must utilize noiseless machinery and must not generate environmental pollutants exceeding the zone’s light industry thresholds.

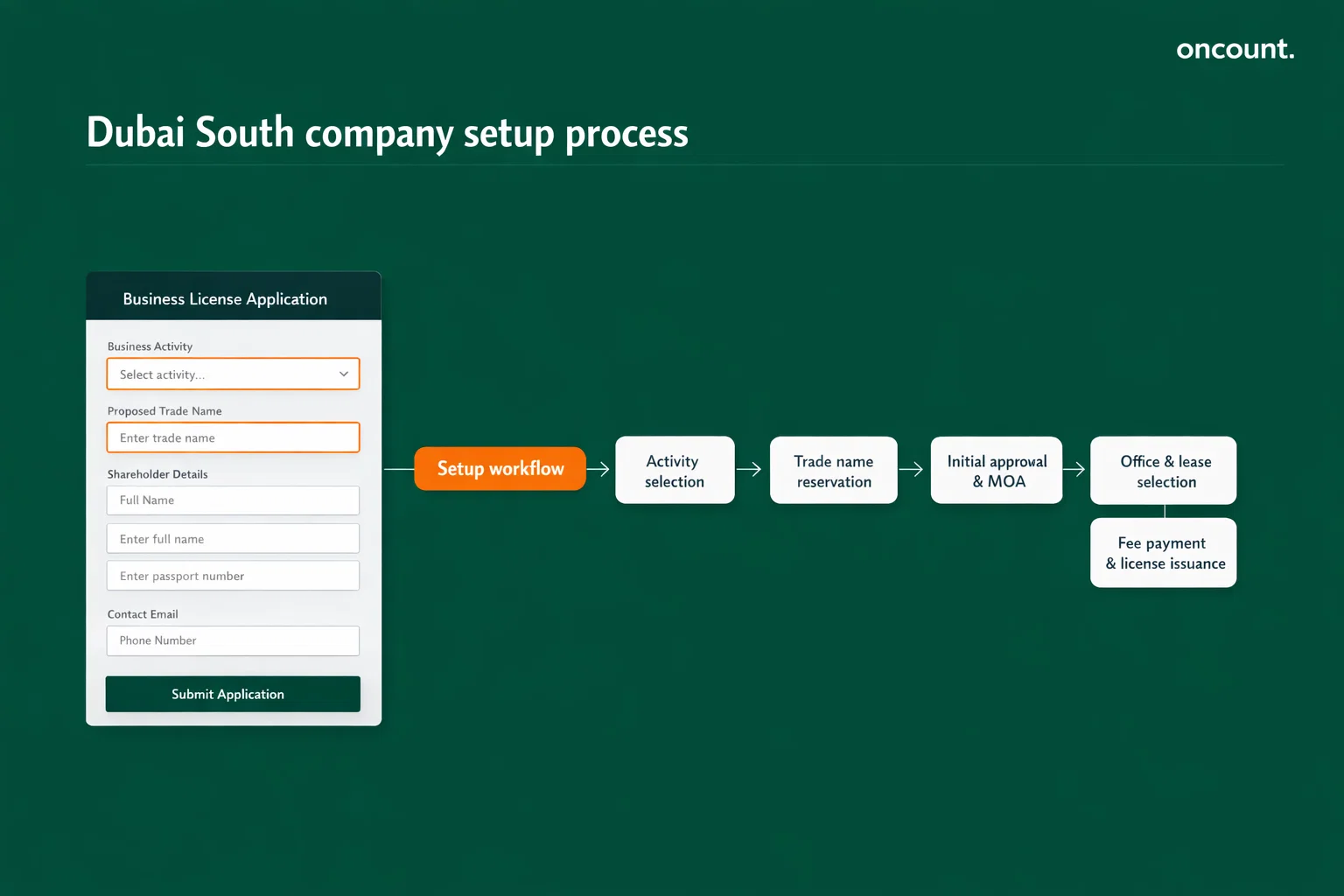

Step-by-Step Process to Set Up a Business in Dubai South

The incorporation process follows a structured digital workflow through Dubai South’s integrated portal. Understanding each phase prevents delays and ensures regulatory compliance.

Phase 1: Pre-Qualification and Activity Selection

Begin with pre-qualification application providing basic contact details, proposed company type, and desired business activities. This initial assessment ensures your intended activities align with Dubai South’s regulatory framework.

Initial setup fee of approximately AED 2,000 initiates the booking process and advances your application to formal submission phase. Clearly articulate your business model during this stage to avoid activity classification issues later.

Phase 2: Trade Name Reservation

Submit three unique trade names in order of preference. Names must include legal form designation (FZE or DWC-LLC) and comply with UAE naming regulations prohibiting offensive content or trademark infringement.

Simultaneously prepare required documentation including:

- Clear passport copies for all shareholders, directors, and managers

- High-resolution passport-sized photographs

- Comprehensive business plan (mandatory for service licenses and certain industrial activities)

- UAE visa or entry stamp copies for residents

Phase 3: Initial Approval and Constitutional Documents

Upon trade name approval, Dubai South Authority issues initial approval enabling drafting of Memorandum of Association (MOA) and Articles of Association (AOA). These constitutional documents must clearly define capital structure, board powers, and profit distribution mechanisms.

For corporate shareholders, this phase requires submission of legalized and attested incorporation documents from the parent company’s jurisdiction, following the complete attestation chain outlined in later sections.

Phase 4: Facility Selection and Lease Agreement

Dubai South mandates physical address within the zone for all licensed entities. Select appropriate office solution based on operational requirements and visa quota needs:

Business Center Options:

| Facility Type | Usage Rights | Visa Quota | Typical Use Case |

| Smart Desk | 5 hours/week | 2 visas | Solo entrepreneurs |

| Permanent Smart Desk | Unlimited | 2 visas | Consultants |

| Smart Office | 5 hours/week | 3 visas | Small teams |

| Permanent Smart Office | Unlimited | 3 visas | Service companies |

Executive Offices: For larger operations, Business Park executive offices allocate one visa per nine square meters of leased space.

Warehouse and Industrial Space: Logistics and Aviation Districts provide warehouses with minimum three-year lease terms. Visa allocation combines office and warehouse square footage (typically one visa per 20 sq.m. of warehouse space).

The Lease Agreement becomes prerequisite for final license issuance, making facility selection a critical path item in the incorporation timeline.

Phase 5: Fee Settlement and License Issuance

After lease execution and final approvals, settle remaining license and registration fees through the online portal. Dubai South Registrar then issues:

- Certificate of Incorporation

- Business License

- Share Certificate

These documents enable subsequent steps including immigration card application, visa processing, and corporate bank account opening.

Phase 6: Post-Incorporation Requirements

Complete Establishment Card registration with immigration authorities, enabling employee and shareholder visa sponsorship. Initiate corporate bank account opening process, preferably through Dubai South’s strategic partnership with Dubai Islamic Bank for streamlined onboarding.

Documents Required for Company Registration

Documentation requirements vary based on shareholder nationality, legal form selection, and whether shareholders are individuals or corporate entities.

Personal Documents for Individual Shareholders

All individual shareholders, directors, and managers must provide:

- Clear, colored passport copy (all pages)

- High-resolution passport-sized photographs (white background)

- UAE residence visa or entry stamp (if applicable)

- Proof of address from home country (recent utility bill or bank statement)

Corporate Shareholder Documentation

When parent companies or corporate entities serve as shareholders, additional documentation undergoes rigorous legalization:

Required corporate documents:

- Certificate of Incorporation or Commercial Registration

- Memorandum and Articles of Association

- Board Resolution authorizing Dubai South company establishment

- Certificate of Good Standing or Incumbency

Attestation chain for foreign corporate documents:

- Notarization by public notary or Chamber of Commerce in country of origin

- Authentication by home country Ministry of Foreign Affairs

- Legalization by UAE Embassy or Consulate in issuing country

- Final attestation by UAE Ministry of Foreign Affairs and International Cooperation

- Legal translation (if not in Arabic or English) by UAE Ministry of Justice certified translator

This attestation process typically requires 3-6 weeks depending on country of origin and efficiency of respective authorities.

Activity-Specific Documentation

Certain licenses require supplementary materials:

- Business Plan: Mandatory for service licenses and certain industrial activities

- Professional Qualifications: Required for educational licenses and some consultancy services

- No Objection Certificates: Aviation licenses require DCAA approval

- Technical Specifications: Industrial licenses may require equipment details and environmental impact assessments

Cost of Setting Up a Business in Dubai South

Cost structures vary based on legal form, license type, visa requirements, and facility selection. Understanding the complete fee breakdown prevents budget surprises.

License and Registration Fees

Standard Trading License: AED 10,000 annually

General Trading License: AED 20,000 annually

Service License: Varies by activity, typically AED 10,000-15,000 annually

Industrial License: Depends on activity scope and environmental considerations

Initial setup fee: Approximately AED 2,000

Registration and incorporation fees: AED 5,000-10,000 depending on legal form

Facility Costs

Business Center packages provide entry-level options:

- Smart Desk (5 hours/week): Starting from AED 10,000 annually

- Permanent Smart Desk: Starting from AED 15,000 annually

- Smart Office: Starting from AED 20,000 annually

- Executive Offices: Calculated per square meter, typically AED 800-1,200 per sq.m. annually

Warehouse and industrial facilities vary significantly based on location, size, and specifications, generally requiring three-year minimum commitments.

Visa and Immigration Costs

Establishment Card: AED 2,000-3,000

Residence Visa (per person):

- Entry permit: AED 500-700

- Medical fitness examination: AED 300-500

- Emirates ID: AED 370

- Visa stamping: AED 500-750

- Total per visa: Approximately AED 3,000-4,000

Visa quotas directly correlate with leased space, making facility selection a strategic decision affecting both operational costs and team size capacity.

Banking and Professional Service Fees

Corporate bank account opening: Most banks charge no fees, but some require minimum balance deposits (AED 25,000-100,000)

Professional setup assistance: If engaging business consultants, fees typically range AED 15,000-25,000 for complete incorporation support

Total first-year costs for minimal setup (FZE, service license, smart desk, 2 visas) typically range AED 40,000-60,000.

Free Zone vs Mainland Company Setup

Choosing between free zone and mainland incorporation requires understanding fundamental structural differences affecting operations, market access, and compliance obligations.

Ownership and Legal Structure

Free Zone: 100% foreign ownership permitted without local sponsor requirements. All profits remain fully repatriable.

Mainland: Most activities now permit 100% foreign ownership under updated Commercial Companies Law, though certain strategic sectors still require UAE national participation.

Market Access and Trading Rights

Free Zone: Direct trading within UAE mainland market requires local distributor or commercial agent for finished goods. Services can typically be provided throughout UAE subject to emirate-level regulations and appropriate licensing.

Mainland: Unrestricted ability to conduct business throughout UAE, including direct B2C and B2B sales without intermediary requirements.

Physical Office Requirements

Free Zone: Mandatory physical presence within free zone jurisdiction. Office or desk space directly determines visa allocation.

Mainland: Office requirements vary by emirate and business activity. Certain professional services may operate from approved business centers; others require dedicated premises.

Taxation and Compliance

Both structures now face federal corporate tax at 9% on taxable income exceeding AED 375,000. However, free zone entities can qualify for 0% rate on Qualifying Income by meeting substance requirements and conducting business with other qualifying free zone entities.

VAT treatment differs significantly: Free zone Designated Zones allow certain goods transactions to remain outside UAE VAT scope, creating cash flow advantages for import-export operations. Mainland entities must charge 5% VAT on all domestic supplies.

Regulatory Oversight

Free Zone: Regulated by free zone authority with streamlined digital processes and consolidated service delivery.

Mainland: Subject to Department of Economic Development oversight with more complex approval chains for certain activities.

For businesses requiring frequent mainland market interaction or consumer-facing operations, professional company formation services help evaluate whether free zone or mainland structure better aligns with your operational model.

Accounting, Tax, and Regulatory Compliance Requirements

Post-incorporation compliance extends beyond annual license renewal, encompassing financial reporting, tax obligations, and regulatory filings that maintain your company’s good standing.

VAT Registration and Compliance

VAT registration becomes mandatory when taxable supplies exceed AED 375,000 annually. Voluntary registration is permitted for businesses anticipating this threshold.

Designated Zone considerations: Supplies of goods between entities within Designated Zones or between different Designated Zones generally fall outside UAE VAT scope. However, services remain subject to standard 5% VAT regardless of location.

Reverse Charge Mechanism: Mainland recipients importing goods from free zone Designated Zones must account for 5% VAT through RCM, creating administrative obligations even when free zone supplier doesn’t charge VAT.

Federal Corporate Tax Obligations

All Dubai South entities must register for corporate tax with Federal Tax Authority, even if qualifying for 0% rate. Tax returns require annual filing with audited financial statements.

Qualifying Free Zone Person status requires:

- Adequate substance: Qualified employees and operating expenditure proportionate to business activities

- Qualifying activities: Manufacturing, logistics, distribution, or services to other free zone entities

- Arm’s length pricing: All related party transactions properly documented

- Audited financials: Annual audit by UAE-licensed accounting firm

Loss of qualifying status subjects entire income to standard 9% corporate tax rate, making compliance monitoring essential.

Economic Substance Regulations (ESR)

Companies conducting “relevant activities” (holding company activities, intellectual property, fund management, etc.) must demonstrate adequate economic substance in the UAE through:

- Adequate number of qualified employees

- Adequate operating expenditure

- Direction and management occurring in UAE

Annual ESR notifications and reports must be filed with Ministry of Finance, with penalties for non-compliance reaching AED 50,000 or more.

Ultimate Beneficial Ownership (UBO) Register

All UAE companies must maintain accurate UBO registers identifying individuals owning 25% or more of shares or exercising control. This register must be filed with relevant authorities and updated within 15 days of any changes.

Anti-Money Laundering (AML) Compliance

Designated Non-Financial Businesses and Professions (DNFBPs) face comprehensive AML obligations including:

- Customer due diligence procedures

- Transaction monitoring systems

- Suspicious transaction reporting to Financial Intelligence Unit

- Staff training and compliance officer appointment

Wages Protection System (WPS)

Most free zone companies must register with WPS, requiring salary payments through approved electronic transfer systems. Non-compliance can suspend visa processing capabilities and result in financial penalties.

Common Mistakes When Setting Up a Free Zone Company

Understanding frequent errors prevents costly delays and compliance issues that compromise business operations.

License Category Misalignment

Selecting incorrect license type restricts operational scope and creates complications when securing bank accounts or entering contracts. Service companies mistakenly applying for trading licenses face restrictions when attempting to provide consultancy services outside pure trading activities.

Prevention: Thoroughly review permitted activities under each license category and consider future business expansion when making initial selection.

Banking Preparation Failures

Many investors underestimate corporate banking requirements, leading to extended delays in achieving operational liquidity. Banks require comprehensive documentation including business plans, source of funds declarations, and transaction projections.

Prevention: Initiate banking relationships early, preferably during license application phase. Utilize Dubai South’s partnership with Dubai Islamic Bank for guided onboarding.

Inadequate Substance Planning

Companies qualifying for 0% corporate tax must demonstrate adequate physical presence and economic activity. Minimal office packages with no employees fail substance requirements, exposing entire income to 9% tax rate.

Prevention: Align office space, employee hiring, and operational expenditure with business scale to satisfy substance regulations from inception.

Document Legalization Delays

International corporate shareholders frequently underestimate attestation timelines, causing license application delays of several weeks or months.

Prevention: Initiate document legalization through home country channels immediately upon deciding to establish Dubai South presence. Factor 4-8 weeks into project timeline for complete attestation chain.

Visa Quota Miscalculation

Office selection directly determines visa sponsorship capacity. Companies requiring teams larger than visa quota must upgrade facilities or face staffing limitations.

Prevention: Calculate full team requirements including founder visas, employee visas, and growth projections when selecting initial facility.

Compliance Monitoring Neglect

Failing to establish proper bookkeeping, VAT accounting, and corporate tax compliance systems from inception creates retroactive compliance burdens and potential penalties.

Prevention: Engage qualified accounting professionals familiar with UAE regulations before commencing operations, not after regulatory issues arise.

Why Work With a Professional Business Setup and Accounting Firm

While Dubai South provides streamlined digital processes, navigating the complete incorporation ecosystem requires specialized knowledge of UAE regulatory frameworks, banking protocols, and tax optimization strategies.

Jurisdiction Selection Expertise

Professional advisors conduct comparative analysis across UAE free zones based on your specific industry, target markets, and operational requirements. This prevents costly jurisdiction errors that limit business scope or create unnecessary compliance burdens.

Documentation Management

Experienced firms manage the complete attestation chain for international documents, coordinate with overseas authorities, and ensure all submissions meet Dubai South Authority specifications. This expertise eliminates the primary cause of application delays.

Banking Relationship Facilitation

Established business setup firms maintain relationships with multiple UAE banks, understanding each institution’s risk appetite, documentation preferences, and decision-making processes. This knowledge significantly accelerates bank account opening, often reducing timelines from months to weeks.

Tax Compliance Planning

Qualified accounting firms structure operations to maximize 0% corporate tax qualification while ensuring robust substance demonstration. They establish proper VAT accounting systems, ESR compliance protocols, and UBO reporting frameworks from inception.

Cost Optimization

Professional advisors identify optimal combinations of license type, facility selection, and visa allocation that minimize total costs while maximizing operational flexibility. Their fee structures often result in net savings through prevention of expensive corrections.

Ongoing Regulatory Support

Beyond initial setup, professional firms provide annual audit services, tax return preparation, ESR filing, and compliance monitoring that maintain your company’s good standing with all UAE authorities.