VAT in the UAE: Amount, Tax-Free Scheme, and Refund Process

Understanding the UAE VAT system is the first step for any tourist planning to reclaim tax. The following section clarifies the standard 5% rate, how this amount is calculated, and the mechanism of the Tax Refund for Tourists Scheme itself.

What is VAT in the UAE: General Information

Value Added Tax in the UAE operates as a consumption-based levy applied to most goods and services. Introduced on January 1, 2018, at a standard rate of 5%, this taxation mechanism aligns the Emirates with international fiscal standards while maintaining competitive pricing relative to regional markets. The Federal Tax Authority oversees VAT administration, ensuring compliance across all seven emirates, including Dubai, Abu Dhabi, Sharjah, and others.

The tax applies to transactions involving goods and services consumed within UAE borders. Businesses exceeding the mandatory registration threshold of AED 375,000 in annual taxable supplies must register for VAT purposes, collect the appropriate tax from customers, and remit collections to the FTA. For visitors, this means most retail purchases, restaurant meals, and hotel accommodations include a 5% VAT component that appears separately on invoices and receipts.

The Tourist Refund Scheme specifically addresses international travelers who purchase goods for export. This framework distinguishes the UAE’s approach from purely domestic tax systems, recognizing that visitors should not bear permanent tax burdens on items they transport outside the country. The refund mechanism thus serves both economic and competitive objectives, positioning Dubai and the broader UAE as attractive shopping destinations.

How is VAT in the UAE Calculated?

VAT calculation follows straightforward arithmetic principles. The 5% rate applies to the net price of eligible goods and services. For instance, an item priced at AED 1,000 before tax carries a total cost of AED 1,050 after VAT inclusion. The additional AED 50 represents the tax component subject to potential refund for qualifying tourists.

Retailers typically display prices inclusive of VAT, meaning the advertised amount already incorporates the 5% levy. Tax invoices must separately itemize the VAT amount paid, as this documentation proves essential for refund claims. The invoice should clearly identify the supplier’s Tax Registration Number (TRN), a 15-digit identifier confirming the business’s registration with the Federal Tax Authority.

Certain goods and services qualify for zero-rating or exemption. Healthcare, education, and specific financial services generally fall outside standard VAT application. For tourists, these distinctions matter less than understanding which retail purchases qualify for refunds—predominantly tangible goods rather than consumed services.

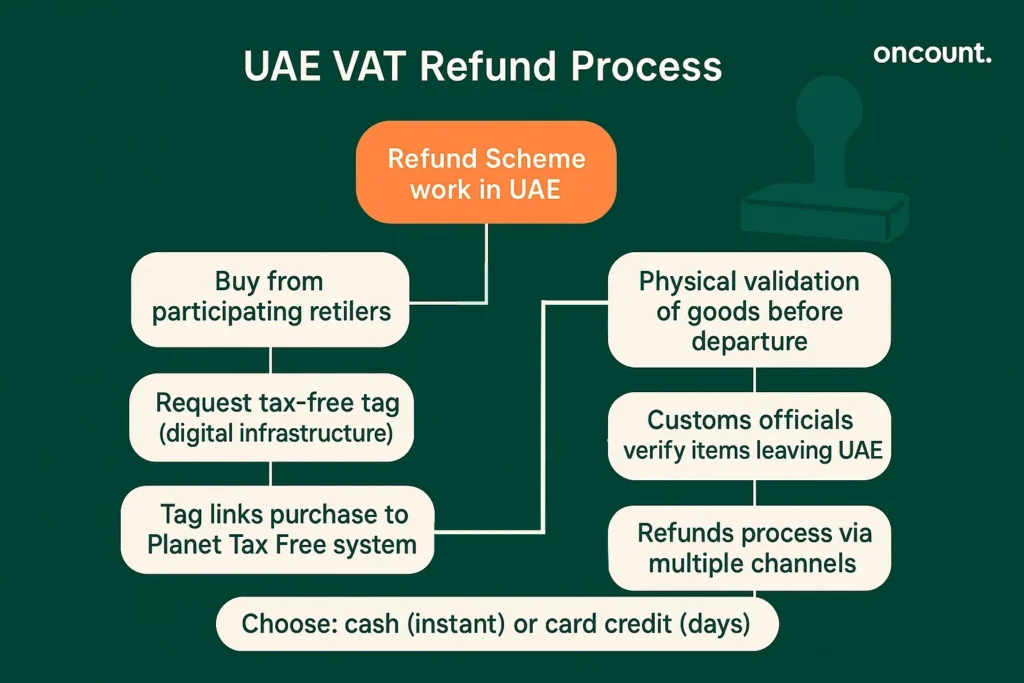

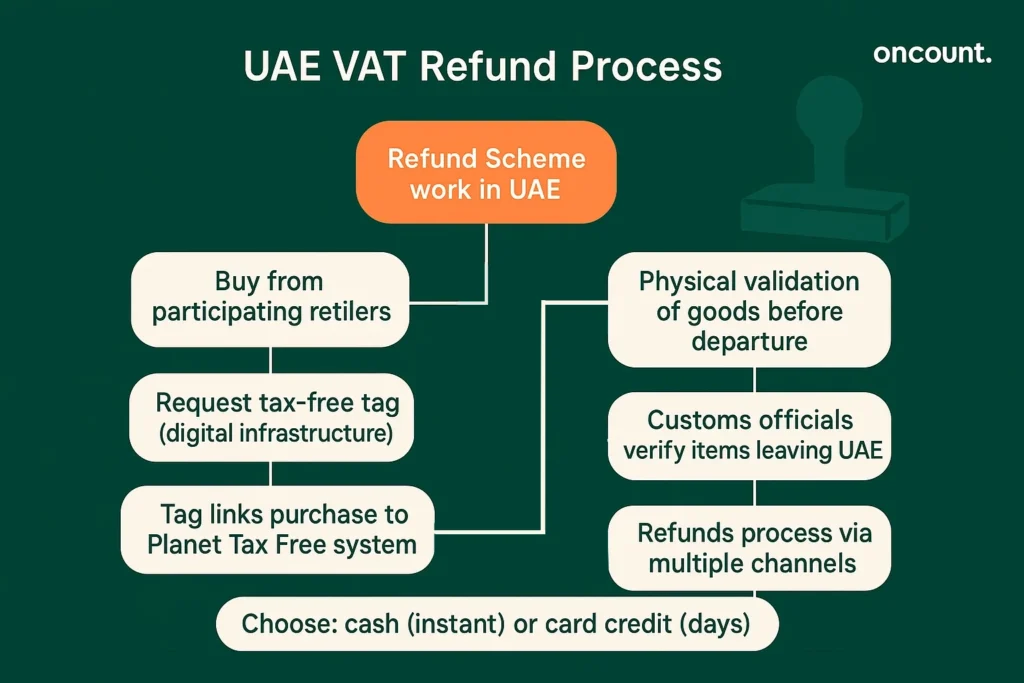

How Does the Tourist Refund Scheme Work in the UAE?

The Tax Refund for Tourists Scheme enables eligible visitors to reclaim VAT on qualifying purchases made at participating retailers. Administered through Planet Tax Free, the system operates via digital infrastructure that streamlines validation and refund processing. Participating stores display clear signage indicating their enrollment in the refund scheme.

When making purchases, tourists request tax-free documentation from retailers. The merchant generates a tax-free tag linked to the transaction, which contains essential information including purchase details, VAT amount paid, and the visitor’s identification data. This electronic record integrates with the broader refund system maintained by Planet Tax Free in coordination with the FTA and UAE customs authorities.

The scheme requires physical validation of goods before departure. Customs officials verify that purchased items leave the UAE, ensuring the refund mechanism applies only to exported goods rather than items consumed domestically. This validation occurs at designated points within airport terminals or land border crossings, depending on the departure route.

Refunds process through multiple channels, offering flexibility based on traveler preferences and transaction values. The system accommodates immediate cash disbursements for eligible amounts, card credits to original payment methods, or transfers to alternative accounts. Processing times vary by refund method, with cash payments providing instant settlement while card credits may require several business days.

How Much VAT is Subject to Refund?

The refundable VAT amount equals the 5% tax component paid on eligible purchases, minus applicable administrative fees. Planet Tax Free, as the authorized refund operator, deducts service charges that typically range between 4.5% and 6% of the gross VAT paid, depending on transaction value and refund method selected.

For example, purchases totaling AED 10,000 carry AED 500 in VAT. After deducting administrative fees averaging 5%, the net refund approximates AED 475. While visitors do not recover the full tax paid, the scheme still provides meaningful value, particularly on higher-value purchases where absolute amounts become substantial.

Minimum thresholds apply per tax-free tag. The UAE government established these floors to ensure administrative efficiency. Currently, each tax-free tag must represent purchases totaling at least AED 250 excluding VAT, meaning approximately AED 262.50 inclusive of tax. Transactions below this threshold do not qualify for processing through the refund scheme.

Maximum refund limits per visit do not formally exist under FTA regulations, though practical constraints emerge through customs validation requirements. Extremely high-value purchases may attract additional scrutiny during the validation process to confirm legitimate tourist activity rather than commercial importation disguised as personal shopping.

Eligibility for VAT Refund: Rules for Tourists

Before commencing shopping activities, it is crucial to confirm your status, as the refund system is strictly limited to non-residents. Here we detail the concrete criteria required for both international tourists and specific business visitors to be eligible for a refund.

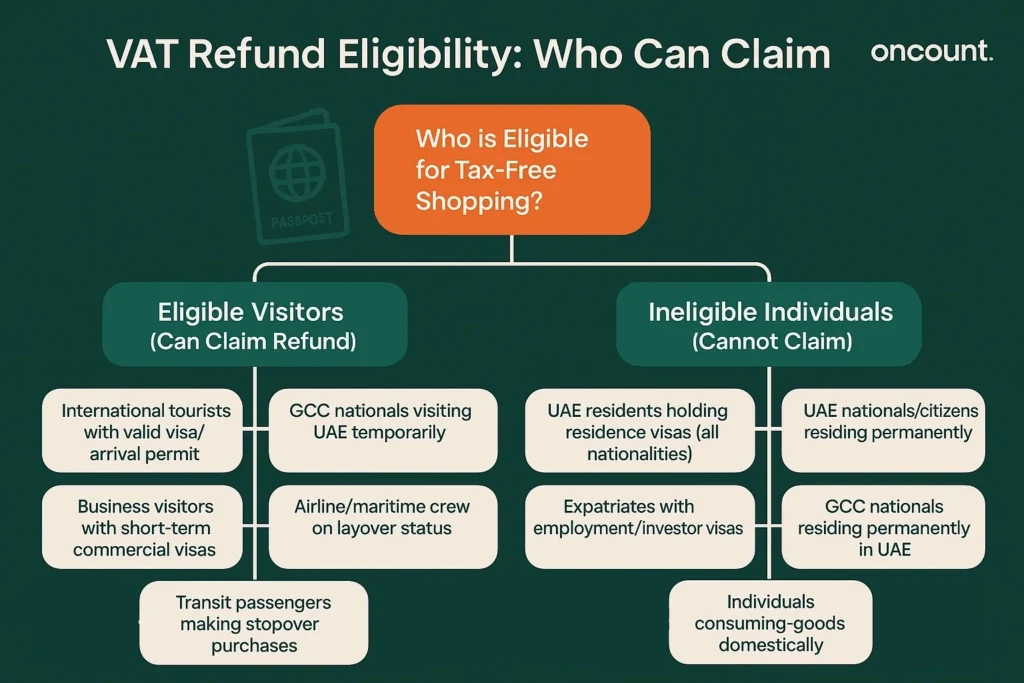

Who is Eligible for Tax-Free Shopping in Dubai?

Eligibility for the VAT refund scheme extends specifically to international visitors who maintain non-resident status within the UAE. The determination of residency follows Federal Tax Authority guidelines, which distinguish tourists from individuals residing or working in the Emirates. Qualifying visitors typically hold tourist visas or enter through visa-on-arrival arrangements available to numerous nationalities.

Eligible visitors include:

- International tourists holding valid tourist visas or visa-on-arrival permits

- GCC nationals from Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia visiting the UAE temporarily

- Business visitors with short-term commercial visas who export purchased goods

- Airline and maritime crew members on layover status

- Transit passengers making purchases during stopovers

Ineligible individuals who cannot claim refunds:

- UAE residents holding residence visas, regardless of nationality

- UAE nationals and citizens residing permanently in the Emirates

- Expatriates with employment, investor, or family sponsorship visas

- Individuals conducting business operations within the UAE who consume goods domestically

- GCC nationals who reside in the UAE on a permanent or semi-permanent basis

Eligibility Criteria for VAT Refund for Tourists

Several concrete criteria determine participation eligibility. First, visitors must possess valid international passports or, for GCC citizens, national identity cards confirming citizenship in a member state other than the UAE. The travel document must contain entry stamps or electronic records demonstrating recent arrival for tourism purposes.

Core eligibility requirements:

- Valid Travel Documentation – International passport with UAE entry stamp or GCC national ID card for Gulf citizens

- Purchases at Participating Retailers – Goods bought from merchants enrolled in the Tourist Refund Scheme displaying Planet Tax Free signage

- Timely Departure – Leave the UAE within 90 days from the purchase date with all claimed goods

- Physical Goods Export – Present purchased items during customs validation, particularly high-value items like electronics, jewelry, and luxury fashion

- Minimum Purchase Threshold – Each tax-free tag must represent at least AED 250 in purchases (excluding VAT)

- Proper Documentation – Retain original tax invoices showing VAT amounts and retailer TRN alongside tax-free tags

How to Claim a VAT Refund: Key Requirements

Successful claims depend on meticulous documentation and procedural compliance. The process begins at the point of purchase, where tourists must specifically request tax-free processing from participating retailers. Merchants require presentation of the visitor’s passport or GCC ID to initiate digital tax-free tag generation.

The tax invoice constitutes the foundational document. This invoice must meet FTA standards, clearly itemizing purchased goods, showing the VAT amount separately, displaying the retailer’s TRN, and providing complete transaction details. Retailers issue this alongside the tax-free tag, which contains a unique reference number linking the purchase to the refund system.

Visitors must retain all original invoices and accompanying tax-free tags throughout their UAE stay. These documents face verification at multiple points—customs validation and refund collection—making their preservation essential. Digital copies provide useful backup, though officials typically require original documentation for processing.

Departure through designated points enables claim completion. Dubai International Airport, Abu Dhabi International Airport, and major land border crossings maintain equipped facilities. Visitors departing via smaller airports or points without full refund infrastructure may face claim difficulties, making advance verification of facility availability prudent.

Claiming a VAT Refund: Preparation and Step-by-Step Process

The journey from purchase to successfully obtaining your funds involves several mandatory steps, starting at the retail store and concluding at the departure gate. This guide outlines the detailed procedure to ensure you get VAT refund efficiently.

Before Shopping: Preparation for VAT Refund

Strategic preparation maximizes refund success and efficiency. Before commencing shopping activities in Dubai or elsewhere in the Emirates, visitors should verify their eligibility status and understand the documentation requirements. Confirming that their travel documents meet standards and that their visa classification supports tourist status prevents downstream complications.

Pre-shopping preparation checklist:

- Verify your eligibility status and visa classification before making significant purchases

- Confirm your passport contains a valid UAE entry stamp and remains valid for your entire stay

- Identify major shopping destinations with high retailer participation such as The Dubai Mall, Mall of the Emirates, Dubai Marina Mall, and City Walk

- Calculate minimum spend requirements per retailer to meet the AED 250 threshold per tax-free tag

- Budget for administrative fees (approximately 5% of VAT paid) when calculating expected refunds

- Plan departure timing to allow at least four hours at the airport for validation and refund processing

- Research terminal-specific facilities at your departure airport to understand available services

- Consider consolidating purchases at fewer retailers to simplify documentation and maximize per-tag values

Digital Tax-Free Form and the ‘Tax-Free’ Tag

The tax-free tag represents the core of the refund system’s digital infrastructure. When requesting tax-free processing at participating retailers, merchants access the Planet Tax Free platform to generate unique tags linked to specific transactions. The system captures the visitor’s passport details, purchase information, VAT amount, and retailer identification.

This electronic tag replaces older paper-based systems, streamlining processing and reducing fraud potential. The digital record synchronizes across the refund network, enabling customs validation points and refund counters to access transaction details instantly. Visitors receive printed confirmations containing QR codes that facilitate downstream processing.

Each tax-free tag accommodates multiple items from a single retailer on a single day. If shopping at the same store across multiple visits, separate tags apply to each shopping session. The consolidation feature allows retailers to group multiple items purchased together, simplifying documentation while ensuring all goods receive appropriate processing.

Visitors should verify tag accuracy immediately upon receipt. Confirm that passport details appear correctly, purchase amounts match actual spending, and the VAT calculation aligns with invoice figures. Errors identified early can be corrected through retailer reprocessing, whereas discovering inaccuracies during airport validation may delay or jeopardize claims.

How to Get a VAT Refund: Detailed Process

The refund process unfolds across several distinct stages, each requiring specific actions and attention. Initial steps occur during shopping, progressing through airport validation and culminating in refund collection. Understanding this sequence enables efficient navigation of each checkpoint.

Step 1: Purchase and Documentation

Select goods from participating retailers. At checkout, present your passport or GCC ID and explicitly ask for a tax-free tag. The merchant processes the transaction through the Planet Tax Free system, generating the digital tag and providing printed documentation. Verify all details before leaving the store.

Step 2: Secure Storage Until Departure

Maintain all tax-free tags and invoices in accessible locations throughout your UAE stay. Keep purchased goods in original packaging where possible, as validation may require display. Organize documents systematically to facilitate rapid retrieval during airport processing.

Step 3: Airport Arrival and Pre-Security Validation

Arrive at the airport terminal with adequate time before your flight—typically at least four hours for international departures when claiming refunds. Locate the customs validation area, which at Dubai International Airport resides in departures halls before security screening. Present your passport, boarding pass, tax-free tags, invoices, and physical goods for verification.

Step 4: Customs Validation

Customs officials examine documentation and goods to confirm legitimate tourist purchases intended for export. They may request to see high-value items or randomly selected goods. Upon satisfaction, officials validate your tax-free tags electronically, authorizing refund processing. This validation must occur before checking baggage containing refund-eligible goods.

Step 5: Security Clearance and Refund Collection

After validation and security screening, proceed to designated refund counters or self-service kiosks located in the departure areas beyond security. Present your validated tags and select your preferred refund method—cash, credit to original payment card, or alternative account transfer.

Step 6: Refund Receipt

Collect your refund through your chosen method. Cash refunds disburse immediately at staffed counters. Card credits process through the payment network, typically appearing in accounts within 5 to 10 business days. Retain all receipts confirming successful refund completion.

Purchase Validation: How to Validate Purchases at the Airport

Validation represents the critical verification step confirming goods leave the UAE as required by the refund scheme. This process occurs at customs validation points within airport terminals before passengers enter secure departure areas. The Federal Tax Authority mandates this checkpoint to ensure system integrity.

At Dubai International Airport, validation desks operate in each terminal’s departures level. Clear signage directs passengers to these locations, typically situated near airline check-in areas. Passengers must complete validation before surrendering baggage containing purchased goods, as officials may require physical inspection.

Present all relevant documentation: passport showing entry stamp, boarding pass confirming imminent departure, completed tax-free tags from retailers, and original tax invoices. Customs officers verify document authenticity and cross-reference details with digital records in the Planet Tax Free system. This verification confirms merchant participation and transaction legitimacy.

Physical inspection frequency varies based on purchase type and value. Electronics, jewelry, luxury fashion, and other high-value categories face higher inspection probability. Officials assess whether goods appear new and unused, as the scheme applies to exported merchandise rather than items consumed during the UAE visit. Minor wear from transport typically does not disqualify goods, though evidence of substantial use may trigger questions.

Validation timestamps matter significantly. Officials electronically stamp tax-free tags during validation, creating time-stamped records. Passengers must depart on the flight indicated during validation, as discrepancies may invalidate claims. Changes to travel plans after validation necessitate consultation with customs officials to update records appropriately.

Obtaining the VAT Refund: Receiving Funds

Following successful validation, passengers proceed to collect their refunds. Multiple collection points exist within airport terminals, positioned beyond security screening in international departure areas. These facilities include both staffed service counters and self-service kiosks, providing options based on traveler preferences and transaction complexity.

Staffed refund counters offer personalized assistance, particularly valuable for first-time claimants or situations involving complications. Personnel process validated tags, confirm refund amounts after administrative fee deductions, and facilitate payment through chosen methods. These counters also address questions about processing times for non-cash refunds or resolve discrepancies in documentation.

Refund amounts reflect VAT paid minus Planet Tax Free administrative fees. These fees typically consume between 4.5% and 6% of the gross VAT, varying based on total claim value and selected refund method. Higher-value claims and card-based refunds often incur lower percentage fees than smaller cash refunds.

The system provides transparency regarding final amounts before completion. Displays show gross VAT, applicable fees, and net refund due. Passengers confirm acceptance of these terms before processing finalizes. This transparency allows informed decision-making about whether pursuing refunds justifies the administrative costs involved.

VAT Refund Locations and Kiosks at Dubai Airport Terminals

For most travelers, the final stage of the refund process takes place at the airport, making it essential to know where to go. This section provides specific guidance on the locations of customs validation and refund points across Dubai International Airport’s terminals.

VAT Refund Office Location at Dubai International Airport

Dubai International Airport serves as the primary departure point for most visitors, making its refund facilities critically important. The airport operates three passenger terminals—Terminal 1 serving international carriers, Terminal 2 for budget airlines, and Terminal 3 dedicated to Emirates airline operations. Each terminal maintains distinct refund infrastructure tailored to its passenger volumes and operational characteristics.

Terminal locations align with passenger flows to maximize accessibility while maintaining security requirements. Customs validation points appear in pre-security areas near check-in zones, ensuring passengers can complete validation before checking luggage containing purchased goods. Refund collection points then appear in post-security international departure areas, allowing fund collection after clearing immigration and security screening.

Signage throughout the airport directs passengers to relevant facilities. Multilingual signs in English, Arabic, and commonly encountered languages guide travelers. Information desks in each terminal can provide specific directions, though refund locations remain generally consistent and well-marked.

Operating hours typically span peak departure times, with extended availability during high-volume travel periods. Facilities generally open several hours before the day’s first international departures and close after final evening flights. During nighttime hours when limited staff coverage exists, self-service kiosks provide alternative processing options.

VAT Refund Points at Terminal 3

Terminal 3, as the Emirates airline hub and highest-volume terminal at Dubai International Airport, features the most extensive refund infrastructure. This terminal handles millions of annual passengers, many of whom seek tax refund services. Consequently, Planet Tax Free maintains multiple service points and substantial kiosk deployment throughout the terminal.

Customs validation in Terminal 3 operates near the departures level check-in areas. Passengers locate these desks by following airport signage from terminal entrances. The validation area accommodates simultaneous processing of numerous travelers, though peak departure times may generate queues. Arriving with adequate advance time—at least four hours before departure—allows comfortable validation completion even during busy periods.

Post-security refund collection points appear in multiple locations within Terminal 3’s departure areas. Primary service counters near Concourse B and Concourse C provide full-service options. These staffed locations handle cash refunds up to specified limits, process card credit requests, and assist with documentation issues.

Self-service kiosks supplement staffed counters throughout Terminal 3’s departure areas. These machines enable passengers familiar with the process to complete refunds independently, reducing wait times. Kiosks guide users through simple touch-screen interfaces, validating electronic tags, calculating refund amounts, and facilitating payment processing.

VAT Refund at Dubai Airport Terminal 1: Requirements

Terminal 1 serves numerous international carriers and consequently processes significant refund volumes. The terminal’s refund infrastructure mirrors Terminal 3 in organization, though with capacity scaled to match passenger flows. Understanding Terminal 1-specific procedures ensures smooth processing for travelers departing via this facility.

Pre-security customs validation points in Terminal 1 require the same documentation as other terminals: valid passport, boarding pass, tax-free tags, invoices, and physical goods for potential inspection. Terminal 1 validation desks accommodate the diverse passenger mix using this terminal, with multilingual staff supporting non-English speakers.

Post-security refund facilities in Terminal 1 include both staffed service counters and self-service kiosks. Counter locations appear clearly marked in departure hall areas. Staff assist passengers with refund collection, explaining fee structures and processing times for various refund methods.

Cash refund limits at Terminal 1 counters align with standard airport facilities, typically capping immediate cash disbursements around AED 5,000 to 7,000 per passenger. Refunds exceeding these thresholds process via card credits or bank transfers, with funds arriving after departure once transaction settlement completes through banking networks.

Self-Service VAT Refund Kiosks

Self-service kiosks represent technological advancement in refund processing, offering efficiency and convenience particularly during peak travel periods. These machines deploy throughout Dubai International Airport terminals, providing 24-hour availability even when staffed counters close during off-peak hours.

Kiosk operation begins with scanning validated tax-free tags via integrated QR code readers. The system retrieves transaction details from the Planet Tax Free network, displaying purchase information for passenger verification. Users confirm details accuracy, then select preferred refund methods from available options.

The kiosks calculate net refund amounts by applying administrative fees to gross VAT totals. Clear displays show fee calculations and final amounts due. Passengers accept these terms through on-screen confirmation before processing advances to payment stages.

For card refunds, kiosks request passengers scan credit or debit cards used for original purchases. The system initiates refund credits through payment networks, typically processing within standard banking timeframes. Alternative refund methods, including transfers to bank accounts or other payment instruments, may require additional input of account details.

Cash dispensing capabilities exist on certain kiosks, though subject to the same value limits as staffed counters. Lower-value refunds often qualify for immediate cash disbursement, providing instant settlement. The machines dispense UAE Dirhams through secure cash mechanisms comparable to ATM technology.

Kiosk interfaces support multiple languages, enabling passengers to navigate processes in preferred languages. Intuitive design guides users through sequential steps, with help functions available if questions arise. For complex situations or system errors, nearby assistance buttons summon staff support.

Choosing the Refund Method: Cash or Card Options

After validation, the choice of how to receive your money impacts both speed and the final amount received due to varying administrative fees. Here we compare the options to help you select the best method for your needs.

Money Without Borders: Refund Options

The UAE refund system accommodates various payment preferences through multiple refund methods. This flexibility recognizes diverse traveler needs, offering immediate cash settlement for those preferring physical currency, card credits for those valuing simplicity, and bank transfers for specific circumstances. Understanding each method’s characteristics enables selection aligned with individual priorities.

Cash refunds provide immediate availability, allowing travelers to receive UAE Dirhams before boarding flights. This immediacy appeals to visitors who value instant settlement or plan to utilize funds for additional airport purchases. However, cash refunds face value limitations—typically capping around AED 7,000—and may incur slightly higher administrative fees compared to electronic methods.

Credit to original payment cards represents the most common refund method. This approach credits refund amounts to credit or debit cards used for purchases, eliminating currency conversion needs and integrating seamlessly with travelers’ existing financial arrangements. Processing occurs through standard banking networks, typically completing within 5 to 10 business days depending on card issuer and network speeds.

Bank transfer options exist for situations where card credits prove impractical. Passengers provide international bank account details, and Planet Tax Free initiates transfers through international payment systems. This method accommodates various banking arrangements but may incur additional fees from correspondent banks involved in international transfers.

Alternative payment instruments, including digital wallets and specific money transfer services, receive limited support depending on system integration. Travelers requiring these methods should verify availability with refund service personnel before finalizing claims.

Cash or Card: Which Method is Best to Choose in Dubai?

Method selection depends on several considerations including refund value, currency preferences, processing time priorities, and administrative fee structures. Evaluating these factors enables informed decisions optimizing individual circumstances.

For smaller refunds under AED 500, cash often provides practical advantages. Immediate availability and straightforward processing justify the marginally higher administrative fees. Travelers can utilize funds immediately for airport amenities, ground transportation upon return home, or simply avoid waiting for electronic settlement.

Mid-range refunds between AED 500 and AED 7,000 merit careful comparison. Cash remains available but may incur fees exceeding those applied to card credits. If immediate access to funds lacks urgency, card credits typically offer better value through lower fees. The several-day processing delay becomes less significant when balanced against cost savings.

Large refunds exceeding cash disbursement limits necessitate electronic methods. Card credits generally prove most efficient, leveraging established banking relationships and minimizing intermediary fees. Bank transfers may incur correspondent charges reducing net proceeds, making them less optimal unless card credits face technical obstacles.

Currency considerations influence method selection. Travelers returning to countries using currencies other than UAE Dirhams may prefer card credits, allowing their card issuers to handle foreign exchange conversion through established rates and mechanisms. Cash refunds require currency exchange either at Dubai Airport facilities or upon returning home, introducing additional conversion costs and exchange rate exposures.

Processing time priorities vary by traveler. Those needing immediate funds for specific purposes prioritize cash despite higher fees. Passengers comfortable with delayed receipt optimize value through card credits, accepting several-day waits in exchange for reduced costs.

Common Issues, Tips, and Additional Advice for VAT Refund

Even with a smooth process, minor errors can delay or jeopardize a claim. Reviewing the most frequently encountered problems and following expert tips will significantly enhance your claim success rate.

Frequently Encountered Problems and How to Avoid Them

Despite the refund system’s relative efficiency, travelers occasionally encounter complications that delay or jeopardize successful claims. Understanding common issues and their preventive measures enhances claim success rates.

Documentation Errors

Incorrect passport details on tax-free tags represent frequent problems. Merchants occasionally transpose digits or misspell names when manually entering data. Travelers should verify all details immediately upon tag receipt, requesting corrections before leaving stores. Errors discovered during airport validation may require retailer contact, potentially delaying processing beyond practical limits.

Timing Constraints

Insufficient time between airport arrival and flight departure creates significant challenges. The validation and refund process, particularly during peak periods, can consume substantial time. Passengers should arrive at least four hours before international departures when claiming refunds, allowing adequate margin for unexpected delays or queues.

Goods Unavailable for Inspection

Checking luggage containing high-value purchased goods before customs validation prevents officials from inspecting items during verification. The refund scheme requires validation before baggage check-in for goods valued above certain thresholds. Passengers should identify high-value items requiring inspection and retain these in carry-on luggage through validation, only checking bags after successful processing.

Minimum Threshold Misunderstandings

Purchases below AED 250 per tax-free tag do not qualify for refunds. Some travelers misunderstand this requirement, expecting to aggregate multiple small purchases from different retailers. The threshold applies per individual tag issued by each merchant, meaning multiple small purchases only qualify if made at single retailers on single occasions.

Retailer Non-Participation

Not all UAE merchants participate in the Tourist Refund Scheme. Visitors occasionally assume universal eligibility, discovering only after purchase that specific retailers remain outside the system. Shoppers should verify participation before completing transactions, looking for Planet Tax Free signage or directly inquiring with sales personnel.

Validation Deadline Lapses

The 90-day window from purchase to departure requires attention for extended stays. Visitors making early purchases during lengthy UAE visits must ensure departure occurs within this timeframe. Purchases exceeding 90 days before departure lose refund eligibility regardless of other qualification criteria.

Refund Method Limitations

Expectations of unlimited cash refunds clash with system capabilities. Caps around AED 7,000 for immediate cash disbursement necessitate alternative arrangements for higher values. Travelers planning substantial purchases should anticipate card credits rather than large cash payments, adjusting expectations accordingly.

Conclusion: The Best Way of Claiming a VAT Refund at Dubai Airport

Successfully navigating the VAT refund process at Dubai Airport and throughout the UAE requires understanding regulatory frameworks, procedural requirements, and practical considerations. The Tourist Refund Scheme enhances shopping experiences for international visitors, enabling recovery of significant tax amounts on eligible purchases while supporting the Emirates’ positioning as a premier retail destination.

Optimal claim outcomes depend on preparation beginning before shopping commences. Verifying eligibility status, identifying participating retailers, and understanding documentation requirements establish foundations for success. During purchases, explicitly requesting tax-free processing and verifying tag accuracy prevents downstream complications.

Strategic timing proves essential. Airport arrival several hours before departure accommodates validation processing, queue navigation, and refund collection without flight-jeopardizing time pressure. Awareness of terminal-specific facilities—particularly the extensive infrastructure at Dubai International Airport’s Terminal 3—enables efficient facility utilization.

Documentation maintenance throughout UAE visits cannot be overstated. Preserving original tax invoices, tax-free tags, and where practical, original product packaging, facilitates smooth validation processing. Organizing these materials systematically enables rapid retrieval during airport procedures.