Reverse Charge Mechanism Overview

To grasp the RCM completely, we begin by establishing its core definition and how it contrasts with the standard VAT application.

Definition and Core Principle

The reverse charge mechanism is a regulatory procedure where the tax liability for the supply of goods or services is shifted from the supplier to the recipient. Under the standard, or forward charge mechanism, the registered supplier is responsible for collecting the charge from the buyer and paying that vat amount directly to the government (the Federal Tax Authority – FTA).

In contrast, under this principle, the registered recipient is required to pay the applicable tax directly to the FTA on behalf of the non-resident supplier. The key principle is that the recipient accounts for the tax as both output vat (VAT on sales) and input vat (The Levy same return period, effectively neutralizing the immediate cash flow impact, provided the supply qualifies for full input tax credit.

Forward Charge vs Reverse Charge Mechanism

The distinction between the forward charge and reverse charge basis dictates which party is responsible for paying vat.

| Feature | Forward Charge Mechanism | Reverse Charge Mechanism (RCM) |

| Party Liable to Pay VAT | The supplier (seller) | The recipient (buyer) |

| VAT Collection | Supplier charge to the recipient on the invoice. | No vat amount is explicitly charge

$$d$$ by the supplier. |

| Mechanism | Supplier collects, then pays FTA. | Recipient self-assesses, accounts, and pays the fta. |

| Primary Use Case | Domestic taxable supplies between two UAE registered for tax entities. | Cross-border transaction s and specific domestic supplies like crude or refined oil. |

Purpose of VAT Reverse Charge Mechanism

The primary objective of the tax reverse charge mechanism is to simplify vat payment for cross-border goods and services and prevent tax evasion by foreign entities. When a foreign supplier provides goods or services to a registered recipient in the uae, that foreign entity is often outside of the uae and required to file any uae returns. The rcm is applicable here to ensure that the charge in the uae is still accounted for by shifting the compliance obligation to the local party. This mechanism ensures that vat leakage is minimized on import ed goods or services.

Legal Basis and UAE VAT Law Framework

The reverse charge mechanism under uae is stipulated in Article 48 of the UAE Federal Decree-Law No. 8 of 2017 and further elaborated upon in the UAE VAT Executive Regulations (Cabinet Decision No. 52 of 2017). Specifically, the provisions outline the conditions under which a registered recipient becomes liable for tax under the reverse charge, particularly in situations involving taxable supplies from foreign suppliers. The fta issues detailed guidance (e.g., VAT Public Clarifications) to clarify ambiguous areas, such as determining the place of supply for vat purposes, which is crucial for RCM applicability.

To move from the foundational definitions to practical use, the next section explores the specific situations where the Reverse Charge Mechanism must be applied in the UAE.

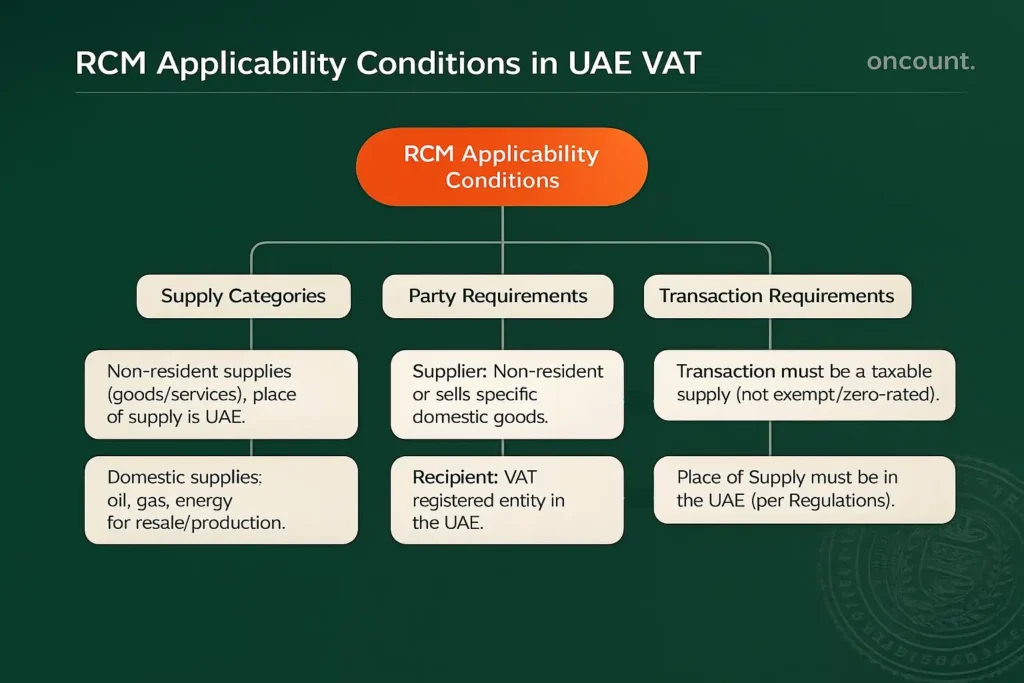

Applicability of RCM in UAE VAT

The application of the RCM is not universal; it is limited to specific categories of supplies defined by the FTA. It is essential to correctly identify these transactions.

Identifying Reverse Charge Supplies

The RCM applies primarily in two broad categories of taxable supplies:

- Cross-Border Services and Imported Goods: Any goods or services supplied by a foreign supplier to a registered recipient in the uae are subject to RCM, provided the place of supply for tax purposes is deemed to be in the UAE. This prevents the foreign entity from having to register for vat in the UAE solely for these transaction s.

- Specific Domestic Supplies (Notified Supplies): The UAE tax law extends the reverse charge basis to certain domestic notified supplies between two VAT-registered UAE entities to combat fraud in specific sectors. These generally include:

- Crude or refined oil.

- Natural gas.

- Any form of energy supplied for the purpose of production and distribution or resale.

RCM on Services from Non-Residents

If a UAE-based registered recipient receives products or services (e.g., legal consultation, cloud computing, maintenance) from a non-resident entity that does not have a fixed establishment in the UAE, the RCM must be applied. The recipient of services is legally required to pay the amount to the fta. This ensures tax neutrality since the same recipient can generally claim the amount back as input vat, provided the services are used for making their own taxable supplies.

RCM on Certain Goods and Specific Transaction Types

The mechanism specifically impacts commodities like natural gas and crude or refined oil within the UAE supply chain. If a registered supplier in the UAE provides these specific goods or services to another registered recipient for either the purpose of resale or use in the production and distribution process, the supplier does not charge the charge. Instead, the recipient must apply the reverse charge basis and account for the vat as both output and input tax. This applies even if both parties are locally registered.

Reverse Charge Mechanism Requirements Under VAT Law

For the rcm is applicable, the following conditions must be met:

- The supplier is typically a non-resident (or supplying specific domestic commodities).

- The recipient is an entity registered in the uae for VAT purposes.

- The transaction constitutes a taxable supply (not zero-rated or exempt).

- The place of supply for vat must be in the UAE as defined by the uae tax executive regulations.

Once applicability is confirmed, a business must adhere to strict procedural guidelines for reporting and settling the tax.

Compliance and Obligations

Adherence to RCM rules requires specific internal procedures to correctly manage tax liabilities and avoid non-compliance penalties.

Procedures for Businesses

Businesses must implement robust financial systems to accurately identify and manage RCM transaction s. FTA guidance stipulates that the moment a supply is identified as RCM-liable, the recipient accounts for the vat internally.

In practice, free zone entities often engage in a high volume of cross-border transactions, making RCM a daily operational requirement. An effective procedure includes:

- Verifying the vat registration status of the supplier (especially if local) and verifying the non-resident status for international transactions.

- Determining the correct place of supply for vat and confirming the rcm is applicable.

- Generating the self-invoice documentation.

Obligations under RCM

The registered recipient has two primary obligations under the reverse charge tax system:

- Payment/Accounting: The recipient must calculate the applicable vat on the value of the goods or services received and record this as output (tax due).

- Reporting: This output vat liability, as well as the corresponding reclaimable input tax, must be correctly reported in the relevant sections of the standard vat return form 201.

Mandatory Registration for RCM Payers

A crucial point is that a non-registered entity (one whose turnover is below the mandatory registration threshold) that only receives reverse charge supplies may still be required to register for if the value of these mechanism’s-liable supplies exceeds the voluntary or mandatory registration thresholds. This is because the recipient of services is the party required to pay the tax. This mandatory vat registration ensures all RCM tax liability is correctly settled.

Ensuring Compliance with UAE VAT Rules

To ensure strict tax compliance, businesses must maintain accurate vat records, including clear documentation of supplies received under RCM. The application of the reverse charge mechanism to ensure that the revenue stream remains intact is a key focus during fta audits. Any omission or incorrect reporting of RCM transactions can lead to significant penalties under the vat law.

Proper documentation is essential for compliance, leading us to the specific requirements for invoicing and accounting.

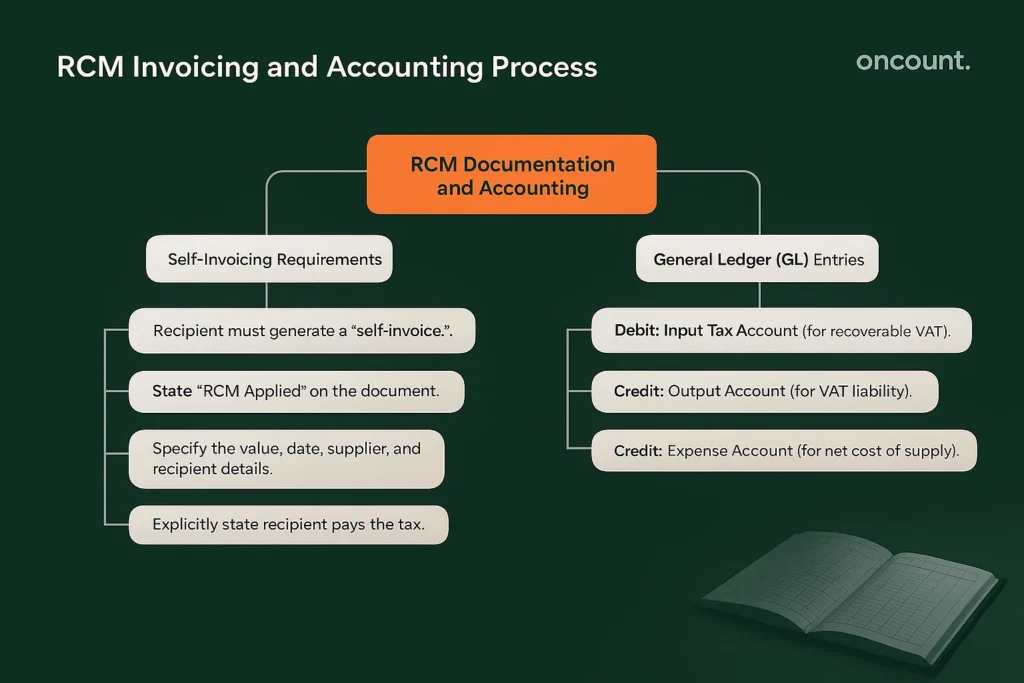

Invoicing and Accounting for RCM Transactions

RCM necessitates a specialized approach to documentation, as the traditional supplier-issued invoice is replaced by internal mechanisms.

Self-Invoicing Rules for RCM Transactions

Since the supplier to the recipient does not charge on mechanism’s supplies, the recipient of services or buyer of goods is required to generate a “self-invoice.” This internal document serves as the substantiating evidence required to record the output vat liability and simultaneously claim the input tax credit.

Format of Invoice Under Reverse Charge Mechanism

While the RCM self-invoice is an internal document, it must meet specific requirements to be valid for tax reporting and audit purposes:

- Clearly state the words “Reverse Charge Mechanism” or “RCM Applied.”

- Identify the registered recipient (buyer) and the supplier (seller).

- Specify the date of the transaction and the value of the taxable supplies.

- Crucially, explicitly state that the recipient is responsible for paying vat.

Accounting Entries for VAT Reverse Charge Mechanism

The accounting treatment of the reverse charge mechanism is unique as it involves recording both sides of the VAT equation in the general ledger (GL). When a registered recipient receives a service:

- Debit the Input Tax Account (for the recoverable input vat).

- Credit the Output Account (for the calculated output vat liability).

- Credit the relevant Expense Account (for the net cost of the supply).

This double entry on the Tax accounts effectively makes the tax cash-neutral for the recipient (assuming full recovery) but ensures the vat liability is correctly recorded and reported.

Reporting RCM Transactions

The return process is where the RCM is settled. On standard vat return form 201:

- The value of RCM-liable supplies is included in the total value of purchases.

- The calculated output tax (tax due) is reported in Box 1 (Taxable supplies value) and Box 4 (Output Tax).

- The corresponding recoverable input vat is reported in Box 10 (Input Tax).

This ensures the is still accounted for correctly.

Understanding the accounting cycle for RCM naturally leads to the consideration of how the recipient utilizes the tax component, primarily through Input Tax Credit.

Input Tax Credit (ITC) on RCM

While RCM shifts the payment liability, the right to reclaim the tax paid remains subject to standard Input Tax Credit rules.

ITC Eligibility and Conditions for RCM

The right to claim input tax credit (ITC) on mechanism’s transactions is subject to the same general rules as any other purchase. The registered recipient must ensure the underlying goods and services were acquired for the purpose of making their own taxable supplies in the UAE. If the RCM supply relates to exempt supplies, the input tax credit will be restricted or completely disallowed.

Claiming ITC on RCM Transactions

Since the recipient accounts for the vat as both payable and recoverable, the net effect on the return is typically zero. This is a significant administrative advantage. However, the claim must be substantiated by the self-generated documentation and the mechanism’s liability must be reported correctly. FTA guidance stipulates that if the liability (Box 4) is omitted, the ITC (Box 10) cannot be claimed.

Beyond the reporting and credit mechanisms, the accurate determination of when a supply occurs is vital for compliance.

Time of Supply Rules

Correctly determining the time of supply is crucial as it establishes the tax period in which the RCM liability must be reported.

Time of Supply for Goods under RCM

The time of supply dictates when the transaction must be included in the vat return. For RCM on goods or services, the time of supply is the earliest of:

- The date the goods were made available to the buyer of goods.

- The date of payment for the goods or services.

- The date of issuance of the invoice.

For import ed goods, the time of supply is usually the date the goods are imported, as determined by the Customs Declaration.

Time of Supply for Services under RCM

For RCM on recipient of services from non-residents, the time of supply is the earlier of:

- The completion of the services.

- The date of payment or part payment.

- The date the invoice is issued.

Professional advice from tax consultants is often required to correctly determine the time of supply, especially for continuous or long-term service contracts.

With the core mechanics established, it is useful to review the practical implications, including the major upsides and potential pitfalls of the mechanism.

Challenges and Benefits

The implementation of RCM brings about several distinct advantages for the UAE’s fiscal environment, alongside some key operational challenges.

Advantages of Reverse Charge Mechanism

The RCM offers several advantages:

- VAT Neutrality: It ensures that is still accounted for while maintaining neutrality for the end user if full ITC is recoverable.

- Compliance Simplification for Foreign Entities: Non-resident foreign suppliers are not burdened with the administrative and fiscal requirement to register for vat in the UAE.

- Security: This principle to ensure against fraud in specific high-value domestic sectors (like crude or refined oil) and cross-border transactions.

Challenges of Reverse Charge Mechanism

Challenges often stem from misidentification and documentation:

- Misclassification: Businesses may incorrectly apply RCM to supplies that should be subject to forward charge (known as the forward charge mechanism), or vice versa.

- Documentation: Lack of proper self-invoicing and failure to retain accurate tax records is a common audit finding.

- Tax Liability Awareness: Non-VAT registered entities often fail to realize that receiving reverse charge supplies may trigger a mandatory registration obligation.

Common Errors in RCM Compliance

Based on audited data from 2023, common mechanism’s errors include:

- Failing to report the output vat liability in the tax return while still claiming the input vat.

- Incorrectly applying RCM to supplies from locally registered vendors who should have charged forward charge.

- Incorrect application of the time of supply rules, leading to late vat payment and penalties.

Given the complexities and potential risks associated with RCM, specialized assistance is often necessary to ensure continuous compliance.

Professional Services and Expertise

Due to the complexity and high penalty risk associated with RCM, professional assistance is highly recommended for accurate implementation and continuous compliance.

Why Accounting Firm Required to Handle RCM Transactions

The complexities surrounding the mechanism’s transactions necessitate specialized expertise. A dedicated accounting or financial services firm can:

- Accurately assess the vat registration status of all counterparties.

- Provide robust assurance on the correct place of supply for tax determination.

- Ensure that all documentation of supplies meets FTA requirements.

- Mitigate the risk of penalties related to late filing or incorrect reporting of vat liability.

VAT Consulting Services

Specialized tax consultants offer advisory services focused on optimizing the handling of reverse charge mechanism under vat rules. They help businesses:

- Set up compliant internal processes for managing rcm transactions.

- Conduct quarterly reviews to prevent common errors.

- Provide support during fta audits related to the reverse charge supplies.

Audit and Assurance

Comprehensive audit and assurance services are crucial. They verify that the dual recording of output and input vat is handled correctly, ensuring that the company’s financial statements and vat reporting align with IFRS and the UAE Tax law. Independent verification reduces the exposure to fines for non-compliance.

Finally, we address the most common questions that arise regarding the practical application of the mechanism, providing quick clarity on key operational areas.