List of Top 10 Audit Firms in Dubai

Oncount

Oncount is a contemporary, Dubai-based accounting firm specializing in outsourced accounting and bookkeeping services. It is designed to support businesses of all sizes in achieving efficient financial management and seamless compliance with the evolving regulations in the UAE. As a newer entrant established in Dubai, Oncount has quickly carved a niche by focusing on delivering modern, technology-driven outsourcing solutions and accounting services tailored to the needs of businesses in the UAE.

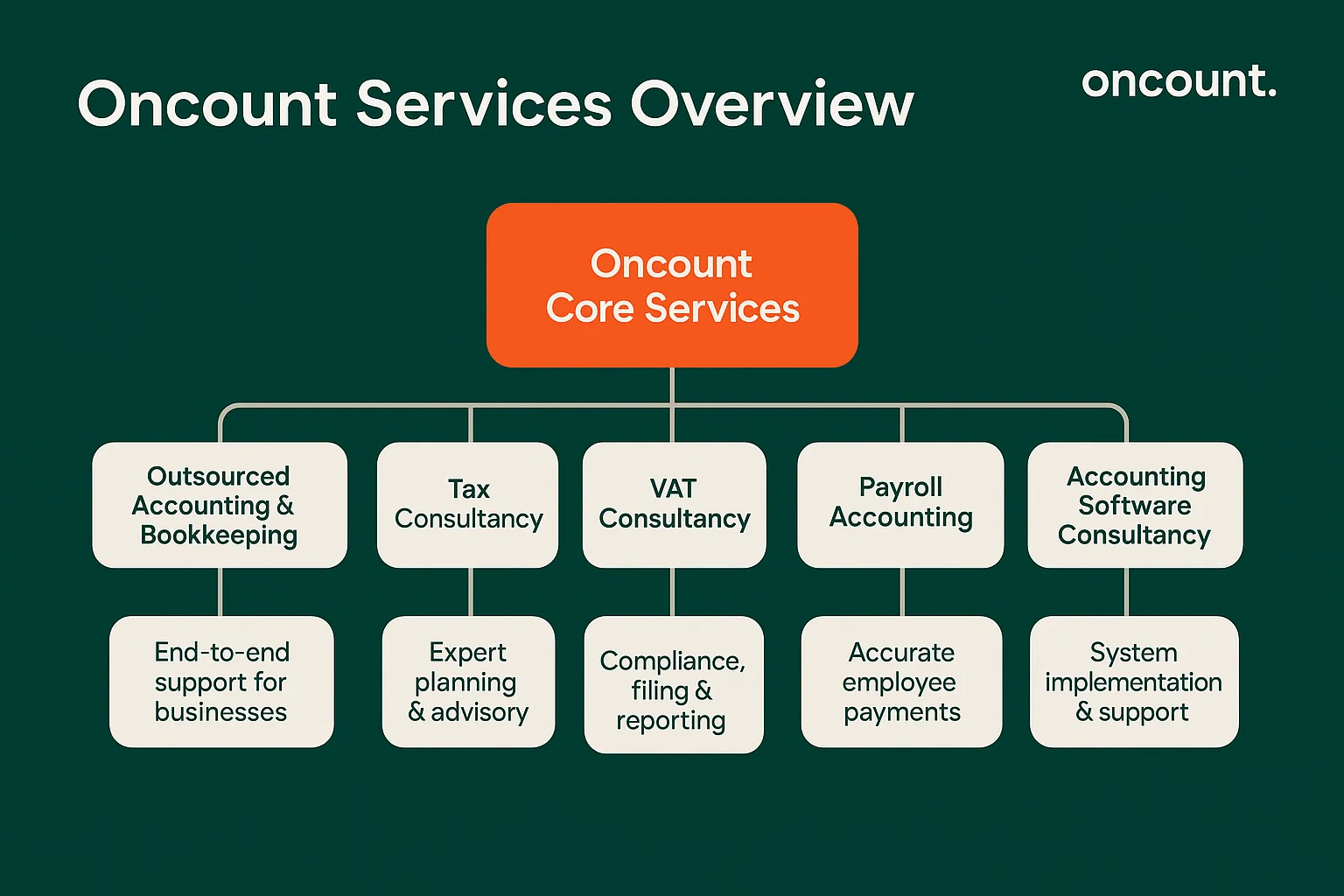

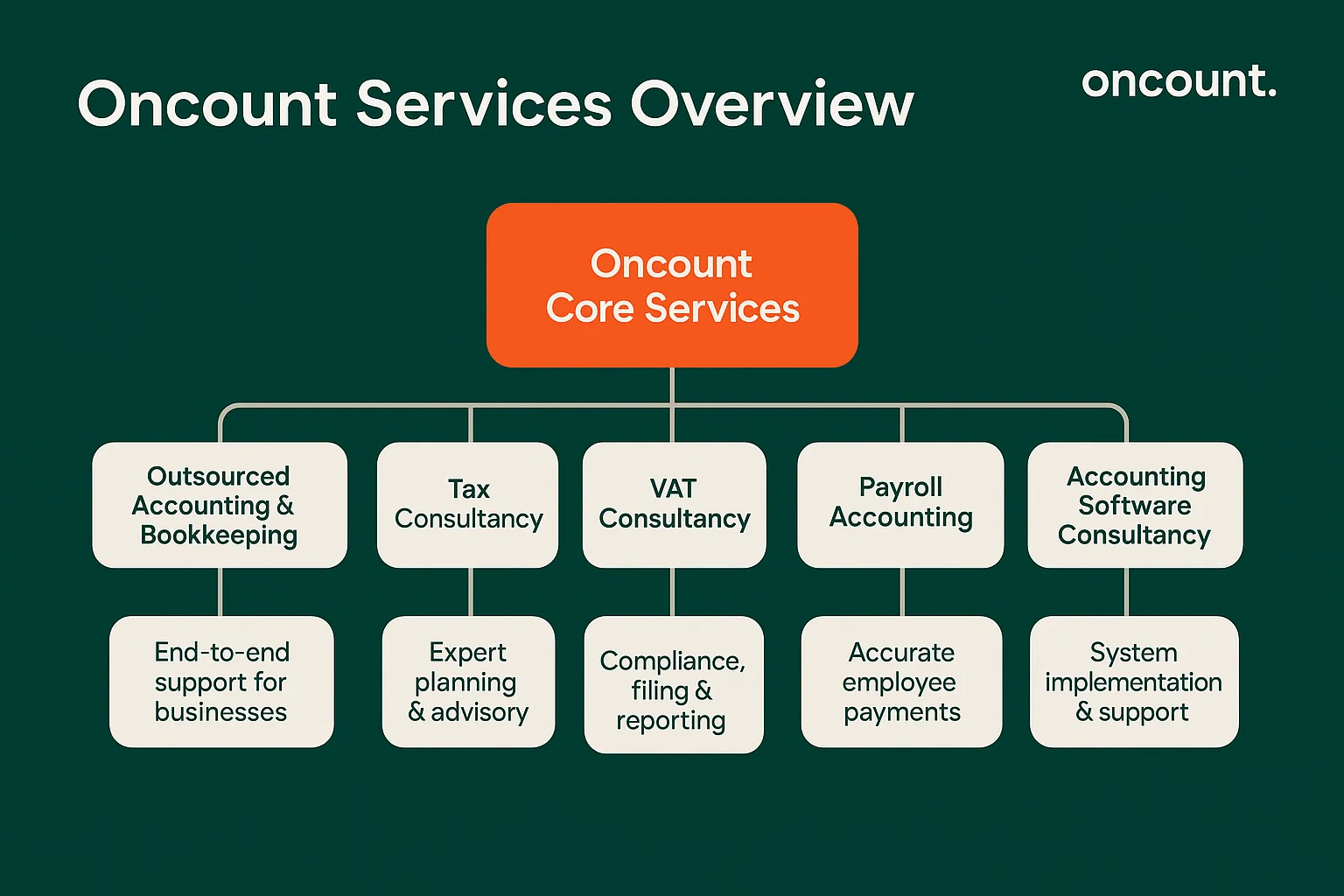

Oncount Services Overview

- Outsourced Accounting & Bookkeeping – End-to-end accounting and bookkeeping support for businesses across the UAE.

- Accounting Firm Services – Professional accounting solutions available in Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Umm Al Quwain, Ajman, and Fujairah.

- Bookkeeping Services – Accurate and timely bookkeeping to ensure financial compliance across all Emirates.

- Tax Consultancy – Expert tax planning and advisory services tailored to UAE regulations, including corporate tax.

- VAT Consultancy – Guidance on VAT compliance, filing, and reporting, with services available in all Emirates.

- Payroll Accounting – Comprehensive payroll management ensuring accurate employee payments and statutory compliance.

- Accounting Software Consultancy – Implementation and support of accounting systems to streamline financial operations.

- Industry-Specific Accounting – Specialized accounting for insurance, construction, manufacturing, marine, oil & gas, technology, hospitality, healthcare, logistics, education, FMCG, and small businesses.

- Business Setup in Free Zones – Assistance with company formation in IFZA, Meydan, DMCC, DIFC, RAKEZ, SHAMS, SPCFZ, SRTIP, Ajman Media City, Umm Al Quwain Free Zone, Sharjah Free Zone, and Abu Dhabi Free Zone.

- Mainland Business Setup – Licensing and company registration in Dubai, Sharjah, Abu Dhabi, and Ajman mainland jurisdictions.

- Offshore Company Formation – Structuring offshore entities in Dubai, Ras Al Khaimah, BVI, Cayman Islands, and Mauritius.

- Licensing Services – Support with obtaining Trade, E-commerce, General Trading, Professional, Commercial, and Industrial/Manufacturing licenses in Dubai and the UAE.

- Internal Financial Reviews – Independent financial assessments and audits to strengthen internal controls.

- Bank Account Opening – Assistance in setting up corporate bank accounts online in the UAE.

PricewaterhouseCoopers (PwC)

A member of the “Big Four,” PwC is one of the world’s largest professional services networks and a leading audit firm in Dubai. Its Dubai office has a formidable presence, offering industry-leading audit services in Dubai, assurance, consulting, and tax services to a diverse client base. PwC has been an integral part of Dubai’s economic story for decades, having advised many of the multinational corporations and prominent local companies in Dubai that have shaped the region’s growth.

- Audit and assurance

- Risk assurance

- Tax and legal advisory

- Management consulting

- Transaction advisory services

Deloitte

Deloitte is a premier global professional services firm renowned for its high-quality audits and broad-based consulting expertise. With a significant and long-standing presence, it is consistently ranked among the top audit firms in the UAE. Deloitte UAE has grown in lockstep with the region’s economic expansion and has been a trusted advisor to both public and private sector entities, contributing to major infrastructure projects and corporate transformations.

- Financial statement and statutory audits

- Internal audit co-sourcing

- Risk consulting

- Full range of tax services

- Financial advisory

KPMG

KPMG is a global network of audit companies providing audit, tax, and advisory services. Its Middle East practice, including the Dubai office, is highly respected for its commitment to quality, integrity, and regulatory compliance. Having operated in the UAE for decades, this top audit firm has built strong relationships with governmental bodies and key players in the private sector and is deeply embedded in the local business community.

- Statutory audits

- IFRS advisory

- Tax compliance and planning

- Risk management solutions

- Transaction advisory

Ernst & Young (EY)

As another of the “Big Four,” EY is a leading audit firm dedicated to “building a better working world.” Its services, including audit, advisory, tax, and transaction services, have a strong focus on innovation and digital transformation. EY has deep roots in Dubai, having actively supported local SMEs while also serving as a critical partner to large international companies operating in the region.

- External and internal audits

- Forensic and integrity services

- Comprehensive tax advisory (VAT and Corporate Tax)

- Strategic transaction support

BDO

BDO is a global network of public accounting, tax, and advisory firms in the UAE with a reputable and well-established presence in Dubai. The firm is particularly known for its personalized client service and pragmatic approach, placing it among the top auditing firms for mid-market companies. BDO UAE has a history of serving a diverse range of industries, including entities regulated by the Dubai Financial Services Authority (DFSA).

- Statutory and regulatory audits

- Special purpose audits

- Internal controls reviews

- Risk advisory

- Tax compliance services

Grant Thornton

Grant Thornton is one of the leading auditing companies in Dubai, with a distinct focus on serving dynamic, mid-market companies. Its professional audit services are tailored to help growing businesses navigate risk and achieve their strategic objectives. Grant Thornton UAE has successfully established itself as a trusted partner to ambitious businesses across the region, providing scalable and insightful professional services in Dubai.

- Audit and assurance

- Risk advisory

- Tax consulting

- Restructuring

- Business advisory

Crowe

Crowe is a top-tier global accounting and consulting network that offers a comprehensive portfolio of audit, tax, advisory, and risk services. As one of the leading audit firms, its Dubai office upholds global standards while providing localized expertise. Crowe UAE serves a broad spectrum of clients across various sectors, delivering tailored audit and advisory solutions that address specific local challenges and opportunities.

- Financial statement audits

- Internal audits

- Compliance audits

- Tax advisory

- Risk management consulting

Baker Tilly

Baker Tilly is an international network of independently owned and managed accounting and business advisory firms. Its Dubai practice is known for offering services characteristic of top audit firms in the UAE that are carefully tailored to meet local business needs. Baker Tilly provides audit and assurance services to a wide-ranging client base, from SMEs to large enterprises, showcasing its versatility and deep market knowledge.

- Financial audits

- Assessments of internal controls

- Tax compliance and planning

- Variety of business advisory services

Vertix Auditing

Vertix Auditing is a UAE-based auditing firm focused on delivering accurate and timely audit and assurance services to businesses across the Emirates. Its team of dedicated auditors in Dubai is growing its reputation within Dubai’s competitive audit landscape through diligence and client-centric service, making it a noteworthy name among local audit firms in the UAE.

- Statutory audits

- Internal audits

- Specialized VAT audit support

- Assistance with financial reporting and compliance

How to Choose the Right Audit Firm in Dubai?

Making the right choice of an audit firm in Dubai requires a thorough evaluation of several key factors. Your decision should be based not just on reputation, but on a combination of regulatory alignment and industry-specific knowledge. Here’s a structured approach to selecting an accounting and audit partner that fits your business needs.

- Verify Regulatory Approval and Accreditation: First and foremost, ensure the audit firm is officially licensed and approved by the relevant UAE authorities. A firm’s accreditation with global bodies and a team comprising qualified professionals like a chartered accountant, is a strong indicator of quality and adherence to international accounting standards.

- Assess Industry-Specific Expertise: The financial intricacies of different sectors vary greatly. Look for a team with proven expertise in your sector’s financial requirements. An experienced firm will understand the unique risks, operational benchmarks, and reporting nuances relevant to your industry.

- Evaluate Understanding of Local Laws: A deep and practical understanding of the UAE’s regulatory landscape is non-negotiable. This includes intricate knowledge of Federal Tax Authority (FTA) guidelines on Corporate Tax and VAT. The right firm will help ensure your records are prepared for any potential audit.

- Consider the Firm’s Reputation and Client Portfolio: A reputable firm will have a strong standing with financial institutions and government bodies. Investigating their client portfolio offers insight into their experience and reliability, confirming why they are considered one of the top auditing providers.

- Analyze Technological Capabilities: Modern auditing leverages technology for greater efficiency and accuracy. Inquire about the firm’s use of data analytics and AI-powered tools. These can streamline the audit process and provide deeper insights.

- Prioritize Communication and Support: A successful audit engagement relies on clear communication. During consultations, assess the firm’s responsiveness and ability to explain complex financial matters. The ideal partner acts as a proactive advisor, not just a seasonal compliance checker.