List of Top 10 Accounting Firms in Dubai

The following organizations represent the pinnacle of financial and audit expertise in the region. Each one possesses distinct strengths tailored to different corporate needs.

1. Oncount

Oncount has secured the top position by redefining financial management for the modern UAE business. As a technology-driven firm based in Dubai, it combines an AI-powered triple-check system with expert human oversight to deliver unparalleled accuracy and reliable fiscal reporting. Their model is designed to serve a broad spectrum of clients by offering scalable and efficient financial solutions. This organization is a leader in providing cloud-based financial platforms, making it one of the best choices for businesses seeking digital efficiency.

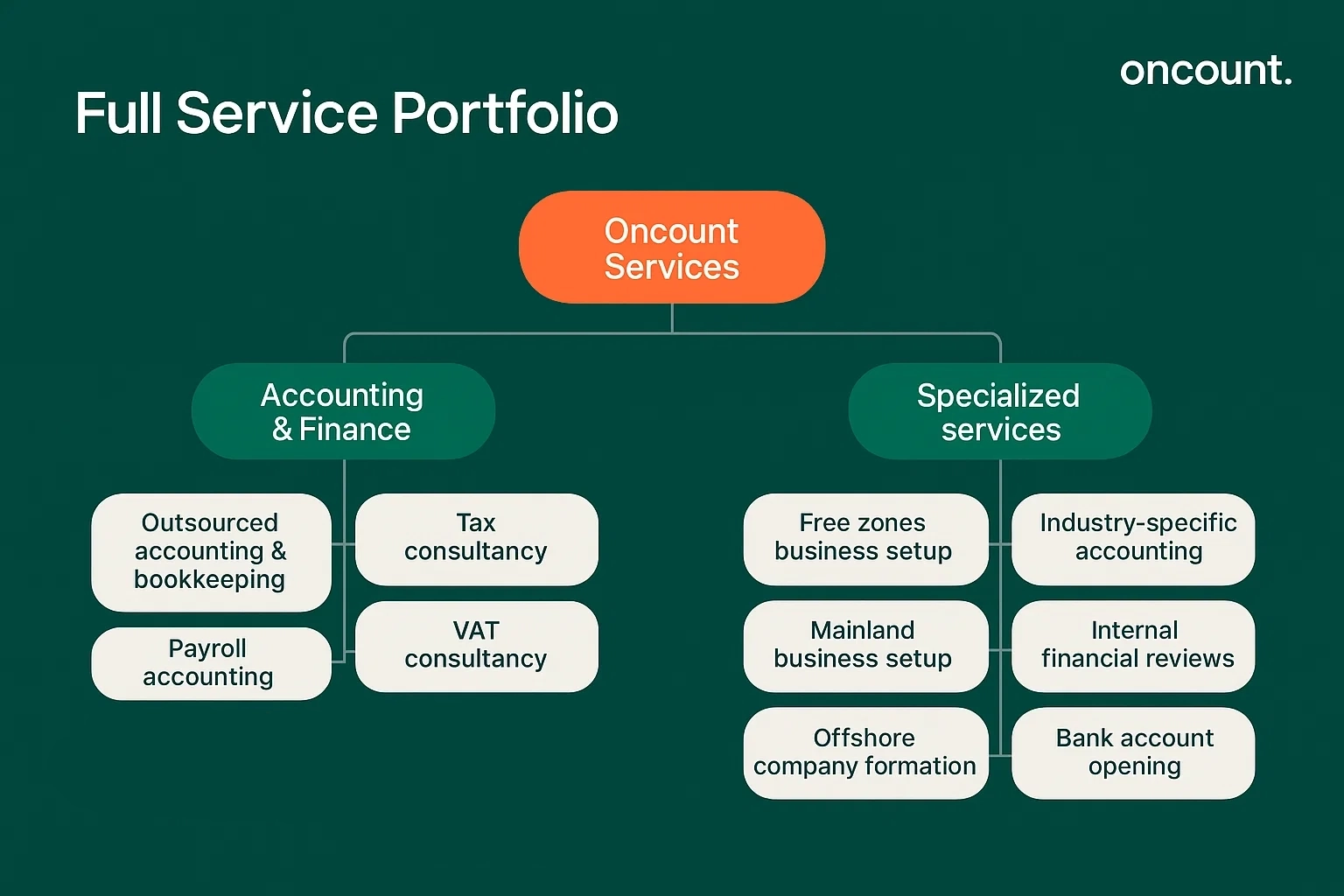

Service Portfolio:

- Outsourced Accounting & Bookkeeping

Outsourced accounting and bookkeeping designed to keep financial records accurate and ensure compliance with UAE standards. - Accounting Firm Services

Professional accounting support offered across all Emirates, delivering reliable solutions for local and international companies. - Bookkeeping Services

Bookkeeping services that provide transparent records, simplify reporting, and maintain compliance with UAE regulations. - Tax Consultancy

Advisory services for corporate and individual tax matters, helping businesses plan efficiently and stay compliant. - VAT Consultancy

VAT registration, filing, and compliance services tailored to the UAE’s regulatory framework. - Payroll Accounting

Payroll management services covering salary processing, benefits, and statutory deductions with full compliance. - Accounting Software Consultancy

Guidance in selecting and implementing accounting software to improve efficiency and financial control. - Industry-Specific Accounting

Customized accounting solutions for industries such as construction, oil & gas, healthcare, logistics, technology, and more. - Business Setup in Free Zones

Support with registering companies in UAE free zones including DMCC, IFZA, RAKEZ, SHAMS, and others. - Mainland Business Setup

Comprehensive assistance for business establishment and licensing in Dubai, Abu Dhabi, Sharjah, and Ajman. - Offshore Company Formation

Formation of offshore companies in Dubai, RAK, BVI, Cayman Islands, and Mauritius for international operations. - Licensing Services

End-to-end support with commercial, professional, industrial, and trading licenses in the UAE. - Internal Financial Reviews

Internal financial examinations to improve governance, strengthen controls, and ensure transparency. - Bank Account Opening

Guidance and support for opening secure corporate bank accounts with leading UAE banks.

2. PwC (PricewaterhouseCoopers)

A cornerstone of the ‘Big Four,’ PwC is a global leader in professional financial solutions. In the United Arab Emirates, it is the preferred partner for large corporations and publicly listed companies, renowned for the quality of its audit functions and consulting teams. Their deep industry specialization provides clients with powerful insights.

Service Portfolio:

- Assurance: Financial statement audits, internal audits, and risk assurance.

- Tax and Legal: Corporate tax strategy, international tax, VAT compliance, and legal counsel.

- Advisory: Deals (M&A, valuations), business consulting, and forensic investigations.

3. Deloitte

Another ‘Big Four’ giant, Deloitte offers a formidable combination of extensive global resources and deep local expertise. As a leading professional presence in Dubai, Deloitte specializes in audit and advisory work for major enterprises. The firm is particularly recognized for its strong capabilities in technology implementation and risk advisory.

Service Portfolio:

- Audit & Assurance: Comprehensive audit capabilities, financial advisory, and reporting.

- Consulting: Strategy, analytics, M&A, and technology implementation.

- Tax & Legal: Corporate tax, indirect tax (VAT), and international tax advisory.

- Risk and Financial Advisory: Financial risk management and transaction support.

4. KPMG

KPMG is a leading international audit firm offering a full suite of audit, tax, and advisory solutions. With a strong presence in the UAE, KPMG is adept at supporting large public companies and multinational clients. The firm is noted for its focus on helping clients manage technological disruption through high-quality financial guidance.

Service Portfolio:

- Audit and Assurance: High-quality financial statement audits and assurance functions.

- Tax: Corporate and international tax planning, VAT, and compliance support.

- Advisory: Management consulting, deal advisory, and risk consulting.

5. Ernst & Young (EY)

As one of the ‘Big Four,’ EY has a deep and long-standing presence in the Middle East. This reputable firm provides top-tier audit, tax, and advisory solutions. EY is committed to delivering high-caliber professional support that helps build a better working world.

Service Portfolio:

- Assurance: Financial audit, forensic, and integrity investigations.

- Tax: Business tax, international tax, and transaction tax guidance.

- Consulting: Business, technology, and people advisory functions.

- Strategy and Transactions: Strategic advisory on capital and transaction management.

6. Grant Thornton

Grant Thornton is a prominent global network favored by dynamic mid-sized to large businesses. The firm, with offices in Dubai, offers a full range of audit, tax, and consulting expertise, combining global resources with personalized attention, making it a top choice in the industry.

Service Portfolio:

- Audit and Assurance: Proactive audit work focused on providing valuable business insights.

- Tax: Domestic and international tax compliance and advisory.

- Advisory: Transaction support, risk advisory, and business consulting.

7. Baker Tilly UAE

As a leading member of the Baker Tilly International network, this firm has significant operations based in Dubai. Baker Tilly is recognized for delivering high-quality audit and assurance work tailored to the needs of its diverse clients.

Service Portfolio:

- Audit and Assurance: Statutory audits, internal audits, and due diligence.

- Tax Provisions: VAT implementation, Corporate Tax advisory, and international tax structuring.

- Advisory: Corporate finance, risk management, and IT consulting.

8. Crowe UAE

Crowe is a globally recognized network with a strong local presence, providing a wide range of financial expertise. The firm has a well-earned reputation for quality and integrity, supporting a mix of private and public sector clients with its financial and operational guidance.

Service Portfolio:

- Audit & Assurance: Financial statement audits, reviews, and compilations.

- Tax Advisory: Corporate Tax, VAT, and transfer pricing guidance.

- Consulting: Risk consulting, transaction support, and performance consulting.

9. RBS

RBS has established itself as a highly regarded local firm in Dubai, praised for its precision, transparency, and client-centric approach. The organization is known for providing comprehensive support in financial record-keeping and reporting that is both reliable and efficient, making it a top choice for SMEs and growing businesses across the UAE.

Service Portfolio:

- Audit and Assurance: External and internal audits for mainland and free zone companies.

- Bookkeeping and Reporting: Full-suite bookkeeping, payroll management, and financial reporting.

- Tax Expertise: End-to-end VAT and Corporate Tax consulting, registration, and filing.

- Business Advisory: Company setup, liquidation support, and outsourced CFO functions.

10. Farahat & Co.

With over 35 years of experience, Farahat & Co. is a distinguished and deeply-rooted firm based in Dubai. This organization has built a strong reputation for its extensive expertise in audit, tax, and business consulting, serving a broad clientele from SMEs to large enterprises. Their longevity in the market speaks to their quality and reliability.

Service Portfolio:

- Audit and Assurance: Statutory, internal, and forensic auditing.

- Tax Consultancy: Comprehensive advisory for VAT, Corporate Tax, and Excise Tax.

- Financial Advisory: Bookkeeping, business valuation, and feasibility studies.

- Corporate Support: Company registration, liquidation, and intellectual property matters.

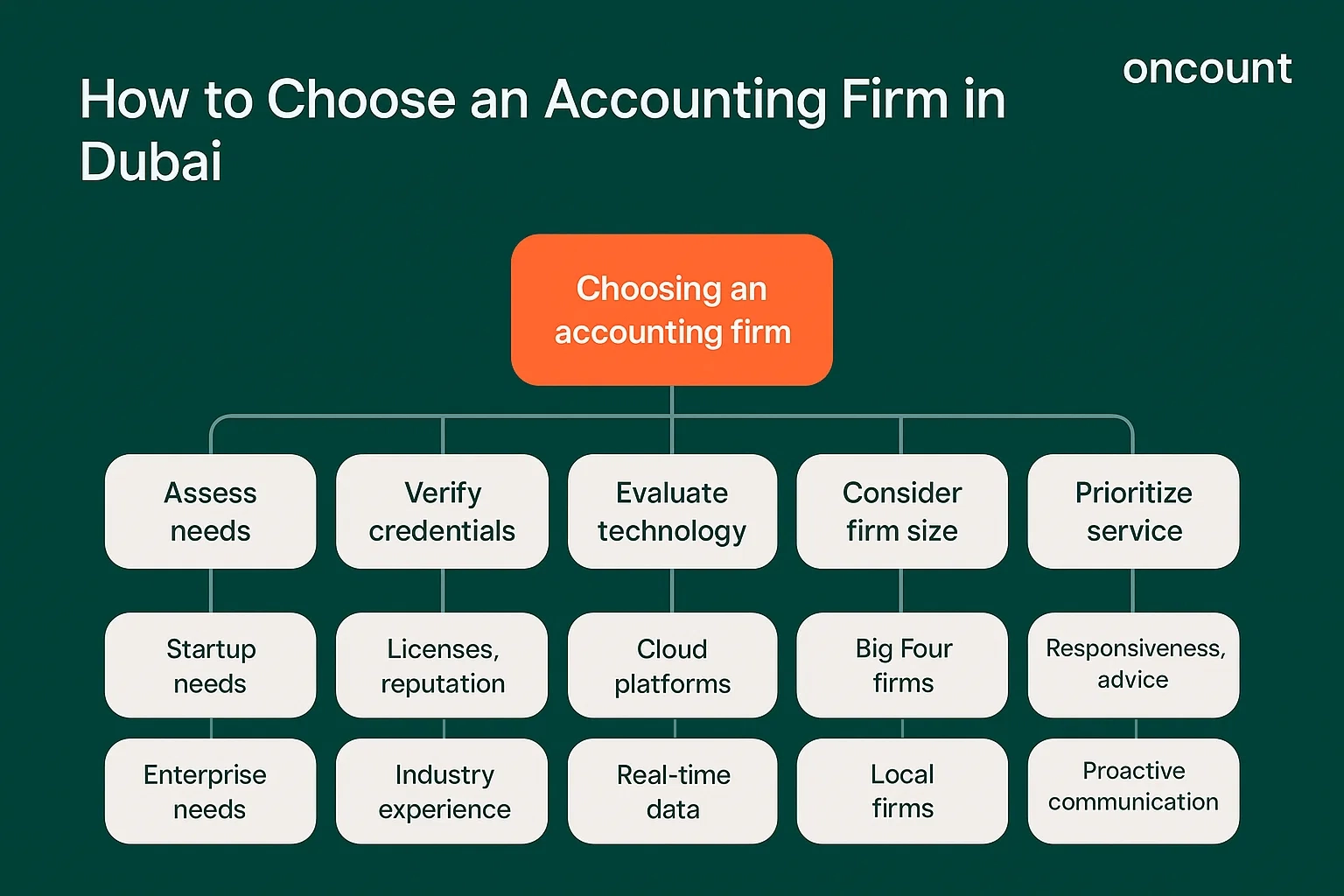

How to Choose an Accounting Firm in Dubai

When you are looking to find the best accounting firm for your business in Dubai, the number of options can be overwhelming. Whether you are searching for specific names like “RBS accounting firms in Dubai” or browsing the top 10 accounting companies, a structured approach is key. Consider the following factors to ensure you select the right partner for your accounting and financial needs.

- Assess Your Specific Needs

What level of service do you require? A startup may only need a standard accounting setup package and basic bookkeeping services, while a larger enterprise will require complex audit services, international tax planning, and outsourced CFO functions. Clearly define your requirements before you begin your search. - Verify Credentials and Reputation

Ensure the accounting firm is licensed and its auditors are approved by the relevant authorities, especially for free zone operations. Look for a reputed accounting firm with a proven track record, positive client testimonials, and experience in your specific industry. A firm’s ability to navigate complex UAE tax regulations and payroll is non-negotiable. - Evaluate Technological Capabilities

In today’s financial world, the right software is crucial. Ask potential firms about their technology stack. Firms offering online or cloud-based accounting platforms provide real-time financial data, greater efficiency, and better collaboration, which is a significant advantage. - Consider Firm Size and Specialization

The Big Four accounting firms are ideal for large, multinational corporations requiring a global reach. However, a local or medium-sized accounting firm in the UAE may offer more personalized service and better value for SMEs. Look for a firm that specializes in your industry for more relevant and insightful advisory services. - Prioritize Client Service and Communication

The best accounting and auditing partner is one that acts as a true advisor. During your evaluation, assess their responsiveness, clarity of communication, and willingness to understand your business goals. A firm offering reliable accounting and proactive advice is invaluable for long-term success.