Setting Up an Offshore Company in Dubai: Complete Requirements and Steps

The creation of non-resident organizations follows precise guidelines that deviate markedly from mainland or free zone frameworks. Unlike local uae companies, these offshore vehicles are restricted from operating directly within the domestic uae marketplace, prioritizing global activities instead. This distinction is crucial for business planning, as it defines the legal boundaries within which the registered unit must operate to maintain its tax-exempt status and avoid potential legal complications with local authorities.

Key Takeaways for Global Entrepreneurs Guide to Offshore Success

The uae acts as a vital bridge between various continents, offering unique access to emerging markets. To build a robust corporate architecture, you must select an appropriate jurisdiction tailored to your unique operational goals. Success depends on:

- Precise documentation and verification.

- Following the mandates set by the chosen authority.

- Appointing a qualified local representative.

- Maintaining accurate financial records for annual reporting.

Overview of Offshore Companies in Dubai and UAE Entities

A remote setup serves as an instrument for worldwide trade, investment holding, and wealth preservation. Within the UAE, these firms are considered “tax residents” due to their geographical presence but maintain non-resident status for local retail or service tasks. Notable jurisdictions include jafza offshore along with rak icc sites, each offering a specific set of rules that cater to different types of international investment strategies and corporate governance models.

Strategic Advantages of Choosing an Offshore Jurisdiction

Picking the right location opens doors to foreign capital and markets. The uae provides numerous perks, such as operational privacy, seamless movement of funds, and a reliable legislative foundation for governance. This environment is supported by top-tier infrastructure and a pro-business governmental stance that continuously adapts to meet the needs of modern digital businesses and global conglomerates seeking a secure base for their assets.

Key Benefits of Dubai Offshore Company Formation for Global Business

Dubai offers a superior landscape for organizations aiming for international growth. By utilizing a specialized entity, owners can insulate their global ventures from individual or domestic liabilities. The following table summarizes the differences between the most popular zones:

| Feature | JAFZA | RAK ICC | AJMAN |

| Real Estate Ownership | Permitted in Dubai | International Only | International Only |

| Setup Speed | Moderate | Fast | Very Fast |

| Cost Level | High / Premium | Economical | Budget-friendly |

| Prestige | Very High | High | Moderate |

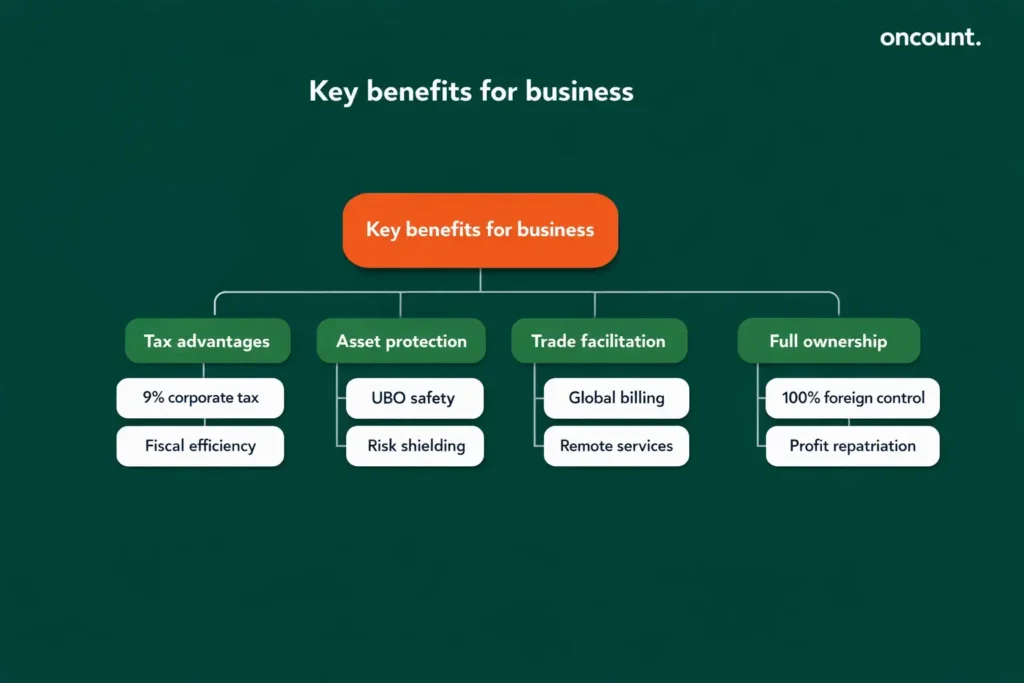

Tax Advantages and Financial Incentives for UAE Offshore Companies

A major incentive for launching a venture in the uae is the efficient fiscal policy. Although a 9% corporate tax now exists, these registered units typically remain exempt if they avoid local uae trading and satisfy specific legal conditions. Fiscal efficiency is central to this business model, allowing founders to reinvest a larger portion of their revenue back into their core international operations and technology development.

Asset Protection and Privacy Provisions within an Offshore Structure

The statutes for legal entities in dubai prioritize the safety of stakeholder interests. Such corporate models are frequently employed to hold equity in external firms or land, establishing a protective barrier for the ultimate beneficial owner (UBO). This legal separation ensures that personal assets remain shielded from corporate risks, providing a secure environment for long-term wealth accumulation and succession planning for families and high-net-worth individuals.

International Trade Facilitation and Market Access for Dubai Offshore Company

This specific setup grants the freedom to bill global partners and oversee logistics without maintaining a local physical office. This makes it a perfect tool for:

- Dropshipping and e-commerce platforms.

- International consultancy and remote services.

- Global distribution networks.

- Software development and licensing.

Full Foreign Ownership and Capital Repatriation in the UAE

The uae permits 100% external ownership for these non-resident units. Additionally, no caps exist on moving profits or capital abroad, granting founders total command over their monetary assets. This level of control is a significant draw for entrepreneurs who want to ensure their capital is accessible at all times for quick reinvestment or distribution across their various global interests without bureaucratic delays.

Selecting the Right Offshore Jurisdiction in the UAE: JAFZA vs. RAK ICC vs. DMCC

The uae comprises various regions, each with unique regulatory bodies. Determining the optimal zone is a critical step for sustainable business operations. Your choice will influence everything from your initial costs to your future banking relationships and the types of assets you can legally hold within the structure, making thorough research and expert consultation essential before making a final commitment.

Jebel Ali Free Zone (JAFZA) Unique Features for Offshore Business Setup

The jebel ali free zone authority (jafza) stands out as the primary body allowing a non-resident firm to hold dubai real estate (pending land department consent). This makes it the top option for holding vehicles targeting the local property sector. Furthermore, its proximity to one of the world’s largest ports provides added prestige and logistical advantages for companies involved in heavy industry or large-scale international shipping and logistics.

Ras Al Khaimah International Corporate Centre (RAK ICC) Cost Efficiency

The ras al khaimah international corporate centre is famous for offering economical packages for business creation. It provides a versatile setting for enterprises to supervise global assets and is favored by remote workers and consultants. The jurisdiction is known for its flexible regulations and user-friendly online portal, which significantly simplifies the management of corporate records and annual renewals for busy international business owners.

Dubai Multi Commodities Centre (DMCC) Industry Recognition

While DMCC functions mainly as a free zone, it offers advanced systems for corporate development. It is often chosen by groups dealing in raw materials and high-end services due to its prestigious standing. Being part of this ecosystem provides access to world-class networking opportunities and a highly regulated environment that is recognized and respected by major financial institutions and global trading partners alike.

Identifying Popular Offshore Jurisdiction Options Based on Business Activity

Your selection should hinge on the need for local property, the desired status of your banking profile, and the project budget. Alternatives like ajman offshore and the ajman free zone also offer rapid registration solutions. Each of these options has unique strengths, so it is vital to match the jurisdiction’s specific capabilities with your long-term commercial objectives and expected transaction volumes.

Legal Framework for Offshore Companies and UAE Regulations

The statutes governing non-resident firms have been updated to meet international transparency requirements. Compliance is now a pillar of the local business environment, ensuring that all registered entities operate under a clear and modern legal framework that protects both the investors and the integrity of the national financial system from potential abuses or external scrutiny.

UAE Commercial Companies Law Compliance for Offshore Company Registration

While the uae commercial companies law sets the general tone, every local authority enforces its own specific set of rules. Meeting these requirements is vital to avoid fines or losing your status. Professional guidance is often necessary to navigate the nuances of these regulations, ensuring that all corporate actions, from share transfers to director appointments, are fully documented and filed correctly with the registrar.

Recent Legislative Updates and Amendments for Setup in the UAE

The uae has introduced modern laws to prevent illicit financial activities. This includes:

- Maintaining comprehensive UBO (Ultimate Beneficial Owner) data.

- Implementing stricter reporting rules for designated categories.

- Enhancing transparency in financial statements.

- Adopting digital verification for all stakeholders.

International Compliance Standards and Regulations for UAE Offshore

The uae follows many global pacts, including OECD standards. Therefore, firms must ensure clear financial tracking to avoid being labeled as passive “shell” entities. This alignment with international norms helps uae-based businesses maintain their credibility when dealing with foreign banks and regulators, facilitating smoother cross-border transactions and reducing the risk of being caught in global tax enforcement actions.

Role of Registered Agents in Legal Framework for Offshore Governance

Most organizations must designate a local representative. These professionals serve as the bridge to the relevant authority, managing essential filings and official communications. They play a crucial role in ensuring that the company remains in good standing by notifying owners of upcoming deadlines and changes in local law that might affect the entity’s operations or compliance status.

Eligibility Requirements for Setting Up an Offshore Company

The criteria for enterprise creation ensure the security and reputation of the regional market. Prospective owners must undergo a thorough vetting process, which is designed to maintain the high standards of the UAE business community and ensure that all new ventures contribute positively to the country’s economic stability and global reputation.

Shareholder and Director Criteria for Offshore Company Formation in Dubai

A registered unit can be owned by people or other firms. Most zones allow solo shareholders and require at least one person to act as director. Nationality is rarely an obstacle, though some regions face more intense checks. This flexibility allows for a wide range of corporate structures, from simple individual holdings to complex multi-layered subsidiary networks used by large multinational corporations for global asset management.

Residency and Nationality Considerations for Offshore Companies in the UAE

Establishing a non-resident unit does not lead to a uae residency permit. This is a major difference compared to a free zone or mainland setup in dubai. These structures are built for cross-border work outside the uae. For those specifically seeking a residency visa, alternative formation models must be explored, as the offshore route is strictly intended for international wealth management and foreign commercial activities.

Minimum Share Capital Standards for Successful Company Setup

Generally, uae regulatory bodies do not require a massive paid-up capital. This makes it accessible for small ventures and private holding groups. However, while the legal minimum is low, investors should ensure the company has enough initial funding to cover its first year of operation and the costs associated with opening and maintaining its corporate banking relationships.

Appointment of Company Secretary and Registered Agent in Dubai

Rules often dictate the naming of a secretary to handle official paperwork. Often, the representative handles this task as part of their broader professional services. This ensures that all corporate resolutions and meeting minutes are kept in accordance with the law, providing a clear paper trail for any future audits or due diligence requests from financial institutions or potential buyers.

Essential Documentation for UAE Offshore Company Registration

The path to incorporation involves gathering several documents to meet KYC standards. Preparation is key, as incomplete or incorrectly formatted paperwork can lead to significant delays in the approval process. Common documents required include:

- Passport copies for all shareholders and directors.

- Proof of residential address (utility bills or bank statements).

- Professional reference letters.

- Detailed business plan or CV of the founders.

Corporate Documents: MOA and AOA for Offshore Company Setup

The Memorandum and Articles of Association (MOA & AOA) outline the internal rules and business goals. These must be drafted to align with the specific authority requirements. These documents serve as the company’s constitution, defining the powers of the directors and the rights of the shareholders, making them essential for resolving internal disputes and guiding the long-term strategic direction of the enterprise.

Personal KYC Documents for Stakeholders in Dubai

Owners and managers must submit passport scans and residential proof. Sometimes, a letter of reference from their financial institution is required to verify their financial standing and history. This level of scrutiny is standard across all reputable jurisdictions and helps ensure that the UAE remains a safe and transparent place for international business and investment.

Proof of Address and Identity Standards for Company Formation in the UAE

Address verification should be recent, typically within the last three months. For corporate owners, the original firm’s founding documents and a board resolution for the new uae branch are needed. All personal identification documents must be high-quality scans to ensure that the biometric data and security features are clearly visible to the registration officers during the review stage.

Authentication and Legalization Procedures for Offshore Registration in Dubai

Documents from abroad might require notarization and embassy attestation in the home country followed by local uae ministry validation. This process can be time-consuming, so it is recommended to start the legalization work early to ensure that all necessary papers are ready by the time the application is submitted to the chosen offshore registrar.

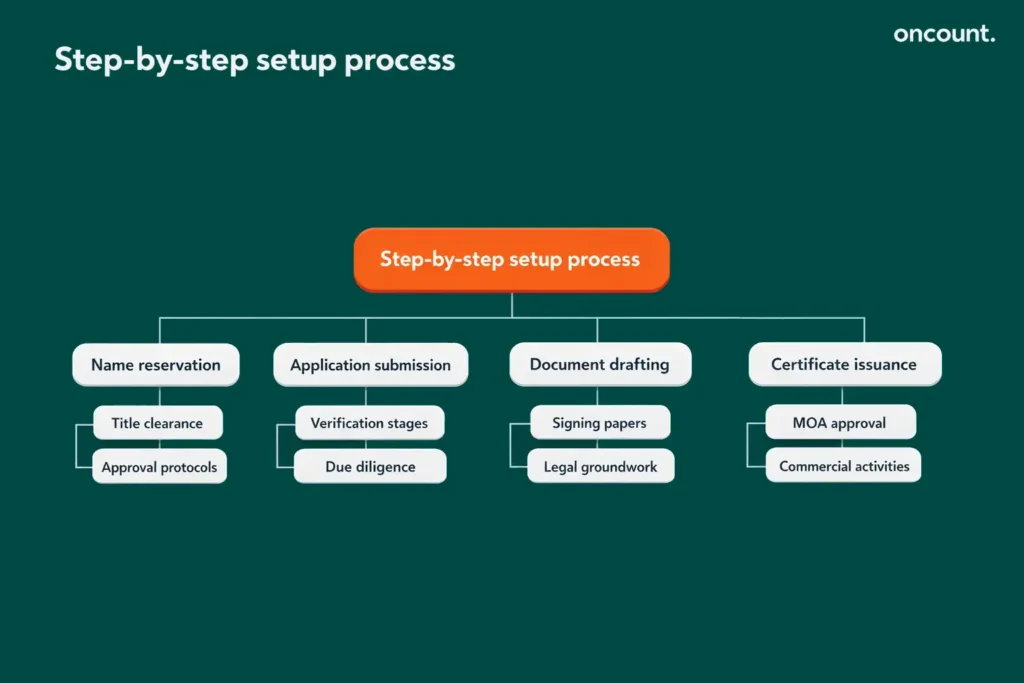

Step-by-Step Process of Offshore Business Setup in the UAE

The sequence of incorporation is methodical and requires attention to detail. By following a structured approach, investors can minimize errors and complete the registration in the shortest possible timeframe.

Name Reservation and Approval Protocols for Company Setup in Dubai

Initially, a unique title must be chosen. It cannot use protected terms such as “Capital” or “Global” without additional review. The registrar will check the proposed name against existing entities to prevent confusion, and once approved, the name is typically reserved for a limited period during which the final incorporation documents must be submitted.

Application Submission and Verification Stages for Offshore Jurisdiction

Following title clearance, the full file goes to the authority. This phase includes checking the background of all involved parties. This is the most critical stage of the process, as the authority will perform a detailed due diligence check to ensure that all shareholders and directors meet the legal requirements for operating a business within the jurisdiction.

Drafting and Signing Incorporation Documents for UAE Offshore Companies

The agent prepares the final papers for the shareholders to sign. While some zones allow digital tools, others may require physical signatures or a legal power of attorney. This stage formalizes the commitment of the owners to the new entity and sets the legal groundwork for its future operations and governance under the laws of the selected zone.

Issuance of Certificate of Incorporation for Your Dubai Offshore Company

Once approved, the agency provides the formal certificate and approved MOA. This marks the successful end of the process, and the new entity is now legally recognized and ready to begin its commercial activities, including applying for bank accounts and entering into contracts with international clients and service providers.

Cost Analysis of Offshore Company Formation Services and Fees

Planning for the financial aspect is vital for any project in dubai. A clear understanding of both initial and recurring costs allows for better budgeting and ensures that the company can meet its financial obligations without straining its resources.

Registration and Annual License Fees Available for Offshore Companies

The first year involves administrative and licensing fees. Prices change based on the zone; for instance, RAK ICC is often more budget-friendly than JAFZA. These government fees are mandatory and must be paid in full before the registration can be finalized, making it important to factor them into the initial startup capital of the venture.

Comparison of Jurisdiction Costs for Offshore Company Formation in Dubai

While some areas cost more, they might offer unique rights. Evaluating the total spend over several years is recommended. A more expensive jurisdiction might provide better banking options or a more prestigious image, which can be invaluable for certain types of businesses, such as wealth management firms or high-end international consultancies.

Annual Maintenance and Renewal Expenses for Offshore Structure

Entities must pay for license renewal every year. This typically includes authority fees and the agent’s service charge. Failure to renew on time can lead to significant penalties and may eventually result in the company being struck off the register, which can have serious legal and financial consequences for the owners and their assets.

Professional Consultation Rates for Offshore Company Formation Consultants

Specialized advisors offer guidance through the complexities of the law. Their rates depend on the complexity of the compliance and the level of support required. While hiring a consultant adds to the initial cost, their expertise can prevent expensive mistakes and ensure that the company is set up correctly from day one, saving time and money in the long run.

Banking Solutions and Account Opening for Offshore Companies in Dubai

Securing a corporate account is a critical part of the setup. Without a functional bank account, the entity cannot perform its primary role as a vehicle for international trade and investment management.

Local Corporate Bank Account Requirements for Offshore Business Setup

UAE lenders have high standards for non-resident firms. To open an account, a firm must show “substance,” such as:

- Clear commercial reasons for a UAE-based account.

- Detailed history of business activities and major partners.

- Evidence of the source of funds for the initial deposit.

- A local contact person or representative.

International Banking Relationships and Networks for UAE Offshore

Many groups use digital banks or foreign institutions that are more accustomed to these structures than traditional local uae banks. These neobanks often offer faster onboarding and lower fees, making them an attractive alternative for startups and smaller holding companies that do not require the full suite of services offered by traditional retail banks.

AML and KYC Compliance Procedures for Offshore Company Registration

Banks perform deep checks into the source of funds and the expected transaction patterns to ensure safety. This is part of the global effort to prevent money laundering and terrorist financing, and all companies must be prepared to provide detailed information about their financial activities and the backgrounds of their ultimate beneficial owners.

FATCA and CRS Reporting Standards for International Entities

The UAE uses the Common Reporting Standard (CRS). Financial data for account holders is shared with their home country tax offices to ensure global compliance. This means that transparency is no longer optional, and all business owners must ensure that their tax affairs are in order in both the UAE and their country of primary residency to avoid legal issues.

Economic Substance Regulations and Tax Compliance for Dubai Offshore Company

Adhering to rules is a necessity for any business in the United Arab Emirates. The introduction of ESR has changed the landscape, requiring firms to prove they have a real economic presence if they engage in specific sectors, ensuring that the UAE is not used merely for artificial profit shifting without real commercial activity.

Mandatory Economic Substance Reporting for Company Setup in Dubai

Firms doing “relevant activities” (like shipping or intellectual property management) must file a notification every year. If they fall within the scope of the law, they must also provide a detailed report showing that they meet the substance test, including having adequate staff, expenditure, and physical assets related to their activities within the country.

Corporate Tax Registration Obligations for UAE Offshore Companies

Most uae business units must register for the new corporate tax. Filing a return is required even if the tax due is zero. This new requirement is part of the UAE’s move toward a more diversified and modern tax system, and it is essential for all entities to obtain a tax registration number and maintain proper accounting records to satisfy future audit requests.

Double Taxation Avoidance Agreements Available for Offshore Companies

The UAE has many tax treaties. However, a non-resident firm might only benefit if it proves specific residency status under the treaty terms. This often requires obtaining a Tax Residency Certificate (TRC), which may have its own set of requirements, including evidence of physical presence or local management and control.

Value Added Tax (VAT) Implications for Offshore Company Setup

Since these firms usually don’t sell inside the uae, they often stay below the threshold for registration. However, local uae costs will include 5% VAT. It is important to track these expenses, as they represent a real cost of doing business in the region, even if the company itself does not charge VAT on its international invoices.

Common Use Cases and Industries for UAE Offshore Structures

This model fits a wide variety of business goals, providing a flexible and secure platform for international operations. Whether used for individual wealth management or as part of a complex corporate group, the offshore structure remains one of the most efficient tools available to modern global investors and entrepreneurs.

Holding Companies for Global Assets and International Investments

Founders often use these firms to own foreign stock, simplifying the management of dividends. This structure allows for the centralization of global assets, making it easier to track performance and manage risk across a diverse portfolio of international subsidiaries and joint ventures.

Intellectual Property Ownership and Licensing in Dubai

Holding IP rights in a specialized firm allows for global licensing while utilizing the UAE’s robust legal protections. This is an ideal way to manage royalties and protect valuable trademarks, patents, and copyrights from legal challenges in less stable jurisdictions, ensuring that the company’s core value remains secure and productive.

International Investment and Portfolio Management via Offshore Structure

Individuals use these entities to manage private wealth, including stocks and bonds, across various international exchanges. By consolidating investments in a single offshore entity, wealth managers can provide more efficient reporting and better tax planning for their clients, while also ensuring that the assets are protected by the UAE’s strong legal and financial framework.

Digital Business and Remote Entrepreneurship in an Offshore Jurisdiction

For online ventures, this structure provides a reputable image and a secure banking base without high local costs. It allows digital nomads and remote teams to operate from anywhere in the world while maintaining a professional corporate presence in a globally recognized business hub, facilitating easier contracts with major international clients and suppliers.

Recent Regulatory Changes and Future Trends in Dubai

The UAE’s alignment with global norms ensures its future as a stable financial hub. As the world moves toward greater transparency and stricter financial controls, the UAE’s proactive approach to regulation provides a safe and predictable environment for investors who value long-term stability and international cooperation.

Impact of Global Minimum Tax Initiatives on Offshore Company Formation

Initiatives by the OECD mean large groups must pay a minimum tax. The UAE’s tax changes are a direct answer to these worldwide efforts. This ensures that the country remains a competitive but compliant player in the global economy, offering a high-quality business environment that meets the expectations of the world’s most sophisticated investors and regulators.

UAE Evolving Regulatory Landscape for Offshore Jurisdiction in the UAE

We anticipate more digital tools and even higher transparency as the UAE maintains its status as a clean place for capital. This ongoing evolution will likely lead to even more streamlined registration processes and better integration with global financial systems, further solidifying the UAE’s position as a premier destination for international business and wealth management.

Digital Transformation in Company Setup and Registration

Regulatory bodies are launching more online portals, making it easier for founders to manage their firm from anywhere in the world. These technological advancements reduce the need for physical paperwork and long wait times, allowing entrepreneurs to focus more on their core business activities and less on administrative tasks and local bureaucracy.

OECD Guidelines and Transparency Standards for Offshore Companies in Dubai

Following OECD rules keeps uae-based firms in good standing globally, helping with international payments and trade deals. This commitment to transparency and fairness in the global tax system is a key factor in the UAE’s continued success and its ability to attract high-quality investment from around the world.