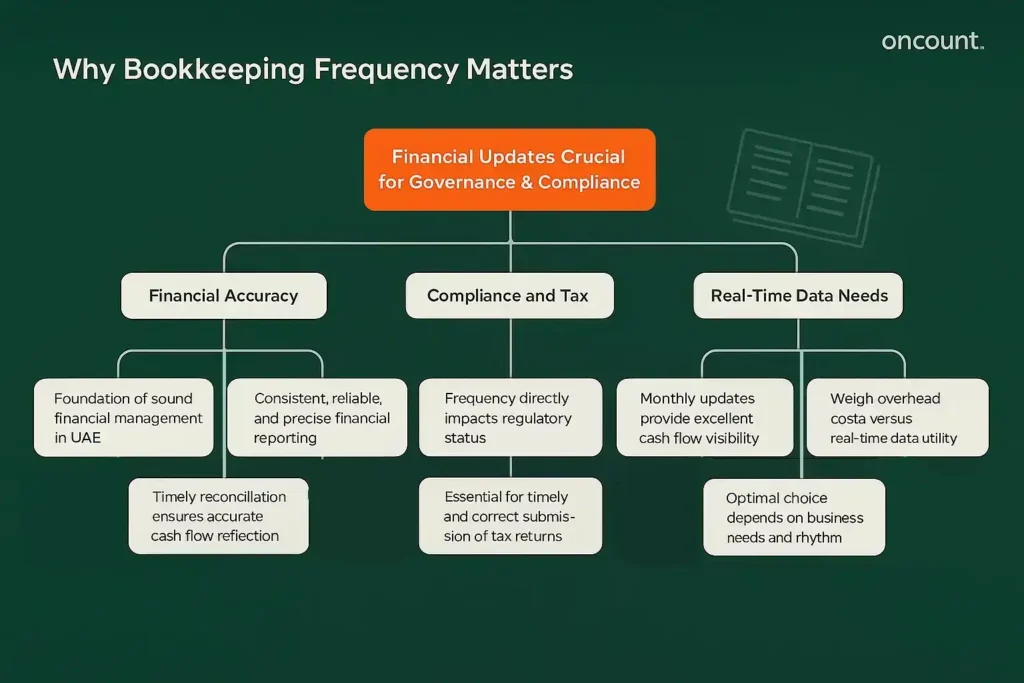

Why Bookkeeping Frequency Matters

The consistency and timing of your financial updates are crucial for both internal governance and external compliance. Understanding these impacts is the first step in setting up an effective financial system.

Financial Accuracy Importance

Accurate bookkeeping is the foundation of sound financial management in the UAE. Whether you choose a monthly or quarterly format, the core objective is consistent, reliable, and precise reporting. Periodic updating of financial records allows for prompt identification of misclassified transactions and maintains high data quality. Timely reconciliation is necessary to ensure that financial records truthfully reflect your company’s cash flow, which is a critically important indicator for every business owner.

Compliance and Tax Impact

With the mandatory introduction of UAE Corporate Tax compliance and the existing Federal Tax Authority (FTA) VAT system, accounting frequency directly impacts your regulatory status. The FTA requires VAT returns to be filed quarterly for most registered entities (though some large organizations file every month), making the reconciliation of all income and expenses essential for timely and correct submission. Quality bookkeeping is not just about tracking money; it’s about providing an auditable trail for the tax authority. For example, FTA guidance stipulates that all tax-related financial transactions must be documented for five years.

Real-Time Data Needs for Small Business

While large corporations invest heavily in daily finance functions, many small business owners must weigh the overhead cost against the utility of up-to-the-minute data. Monthly updates ensure excellent cash flow visibility, enabling immediate and informed business decisions. However, if your transaction volume is small, quarterly updates may initially be sufficient. The optimal choice depends on your business needs and operational rhythm.

Monthly Bookkeeping: Real-Time Financial Control

Regular financial updates provide the highest level of control and transparency, making it the preferred method for businesses seeking continuous, dynamic oversight of their operations.

Pros of Monthly Bookkeeping

Regular accounting provides real-time financial transparency. By engaging a professional bookkeeping service to reconcile accounts every month, companies gain precise control over cash flow.

Key advantages include:

- Precise Cash Flow Control: Identify potential liquidity risks before they escalate.

- Reliable Reports: Generate regular reports invaluable for proactive management.

- Valuable Insights: Timely reporting offers insights critical for high-velocity operations.

Who Should Opt for Monthly Bookkeeping

Businesses with high transaction volume, rapid growth, or those seeking external financing benefit most from frequent updates.

Consider monthly records if you have:

- High transaction volume and rapid growth.

- Need for regular bank financing or external investment.

- Complex inventory or multiple inter-company financial transactions (common in free zone entities).

Accurate record-keeping on a periodic basis suits your business needs if timely performance reporting to stakeholders is paramount.

Drawbacks of Monthly Bookkeeping

While beneficial, the monthly approach has certain constraints regarding resources and time commitment.

The primary drawbacks are:

- Higher Cost: Associated with more frequent services.

- Continuous Commitment: The accounting involves a constant workflow.

- Internal Strain: Can be a strain if internal staff lack sufficient expertise for the task.

For many small business owners, this cost difference is the main consideration when choosing between monthly and quarterly options.

How Long Should Monthly Bookkeeping Take

The time required for regular record-keeping is directly proportional to the size of your business and the complexity of its financial operations. For a small business with moderate activity (e.g., 50–100 transactions), the process of reconciliation and report creation takes approximately 8–15 hours, which is significantly less than the concentrated effort needed to reconcile three months of records every three months.

Better Cash Flow Management

Monthly tracking allows owner stakeholders to forecast liquidity with significantly greater accuracy. When income and expenses are reconciled every month, cash flow projections are reliable, enabling managers to make timely business decisions regarding capital expenditures, inventory, or creditor payments.

Simpler Tax Preparation

Although UAE Corporate Tax is filed annually, maintaining regular records radically simplifies the year-end closing process. Monthly tracking ensures that all necessary supporting documentation is collected, making the final tax calculation faster, less error-prone, and reduces the potential for penalties, which is particularly important for firms navigating the complexities of VAT filing in Dubai.

Faster Error Detection

When financial transactions are reviewed every month, discrepancies are discovered quickly, often within 30 days of their occurrence. This minimizes the risk of significant financial misstatements or fraud, ensuring accurate record-keeping is maintained throughout the fiscal year and preventing small issues from turning into major annual difficulties.

Improved Decision-Making for Business Owner

Timely reports, including the Income Statement (P&L) and Balance Sheet, provide the business owner with current performance data. This continuous view of operational activity is what’s best for your business operating in Dubai’s dynamic market, allowing for course correction based on current, not historical, facts.

Quarterly Bookkeeping: Cost-Effective Simplified

For certain businesses, a quarterly approach to record-keeping offers a balance between meeting compliance requirements and minimizing administrative costs.

Pros of Quarterly Bookkeeping

Quarterly accounting is usually more cost-effective and streamlined for lower-volume operations.

Key benefits include:

- Cost Efficiency: Generally more cost-effective due to less frequent processing.

- Compliance Meeting: Businesses with fewer transactions can still meet compliance needs.

- Reduced Burden: Updating the general ledger four times a year is less burdensome than continuous monthly processing.

Who Should Opt for Quarterly Bookkeeping

Businesses with low transaction volume, such as sole professional services or real estate investment companies with minimal operating income and expenses, often find that quarterly updates work well. Small business owners whose business needs do not require real-time financing data often start with quarterly accounting and evaluate the possibility of switching to a more frequent format later.

Drawbacks of Quarterly Bookkeeping

The less frequent nature of quarterly record-keeping introduces certain risks regarding delayed information and error correction.

The main risks are:

- Delayed Insights: Waiting every three months to reconcile financial records.

- Error Accumulation: Potential errors can compound, complicating correction efforts.

- Outdated Information: The difference between regular and quarterly bookkeeping is the risk of having outdated information for 90 days.

Risks to Watch Out For

A critical risk for companies in the UAE is compliance lag. Even if the business can manage with quarterly, there is a risk of accumulating three months of unreconciled financial operations, where the discovery of errors could compromise the integrity of previous VAT filings. Quarterly record-keeping may also hinder proactive tax planning.

Reduced Administrative Burden

For businesses with fewer transactions, quarterly bookkeeping means a less disruptive workflow compared to a regular basis, requiring concentrated time four times a year rather than every month. This allows the business owner and key personnel to focus on core activities.

Alignment with VAT Reporting

For many VAT-registered entities in the UAE, the standard FTA filing period is every three months. Quarterly accounting naturally aligns with this cycle, helping ensure that financial records are prepared just in time for the submission deadline without excessive last-minute effort.

Cost Comparison

When choosing between monthly and quarterly record-keeping, cost savings are a major factor. Quarterly accounting may reduce the annual cost of a professional accounting service by consolidating the workload, making it the preferred choice for businesses operating on tighter budgets.

Core Difference: Monthly vs. Quarterly Bookkeeping

Understanding the fundamental distinction between these two approaches is key to selecting the right process for your organization’s financial health.

What Is Monthly Bookkeeping

Monthly accounting involves updating your financial records every month. This record-keeping means updating your books by recording, classifying, and reconciling all financial transactions on a periodic basis to generate timely monthly reports.

What Is Quarterly Bookkeeping

Quarterly accounting means updating your ledger every three months. This includes compiling three months of financial transactions, reconciling them, and generating quarterly updates and reports. Records every three months are generally sufficient for compliance in businesses with low transaction volume.

Quick Comparison: Monthly vs. Quarterly

The key difference between regular vs. quarterly bookkeeping is the speed and depth of insight. The table below summarizes the core comparison:

| Feature | Regular (Monthly) Record-Keeping | Quarterly Bookkeeping |

| Data Timeliness | Detailed, real-time data for control | Aggregated, retrospective data |

| Insight | Proactive control, minimal surprises | Reactionary, after period concludes |

| Suitability | High transaction volume, rapid growth | Low transaction volume, predictable finances |

Hidden Impact: Bookkeeping Frequency Shapes Financial Health

Accounting frequency matters because it dictates your ability to manage cash flow and make timely business decisions. Monthly record-keeping offers proactive control and minimizes surprises, whereas quarterly bookkeeping may only provide reactionary insights after the period has concluded.

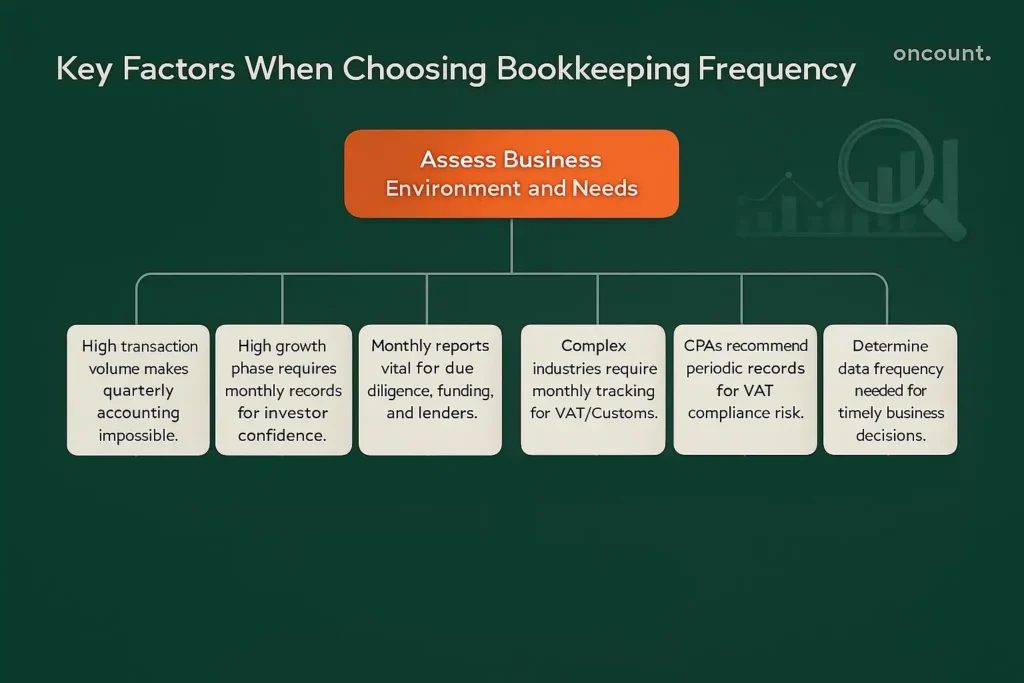

Factors to Consider When Choosing Bookkeeping Frequency

The decision between monthly and quarterly is rarely one-size-fits-all. Several variables specific to your business environment must be assessed.

Transaction Volume Assessment

The higher your transaction volume, the more critical regular tracking becomes. Businesses processing hundreds of financial transactions every month will find it practically impossible to manage quarterly accounting accurately or efficiently.

Business Growth Rate

If your business is in a high-growth phase, especially if you plan to raise capital in the DIFC or ADGM, you will require monthly records. Fast-growing businesses benefit from periodic tracking to monitor burn rate and maintain investor confidence.

Loan and Funding Needs

Lenders and investors require current, accurate financial records. If you plan to apply for loans or seek funding, having monthly reports is vital for due diligence, making regular services the accepted standard.

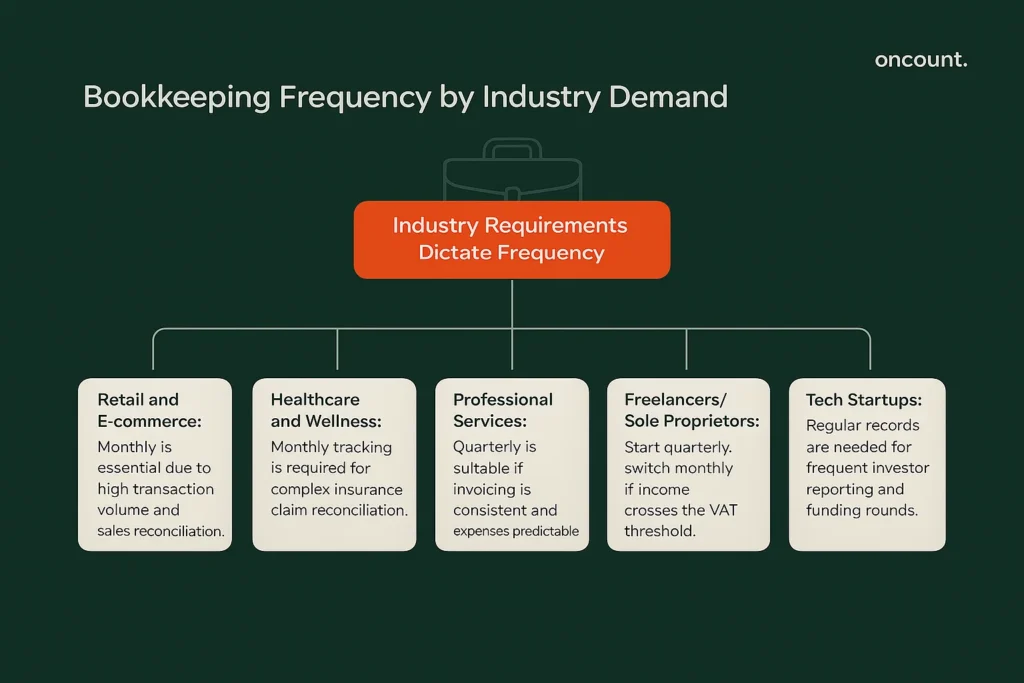

Industry Requirements

Certain industries in the UAE, such as general trading with complex international logistics, inherently require monthly tracking due to the complexity of VAT recovery and customs documentation. The record-keeping schedule must be tailored to your business needs.

What Most CPA Firms Recommend

Most professional accounting consultants recommend periodic records for any VAT-registered entity due to the continuous compliance risk. They often suggest small business owners start with quarterly accounting and upgrade to monthly as transaction volume or complexity increases.

Decision-Making Framework for Business Owner

Every business owner must ask: “How often do I need reliable data to make timely business decisions?” The answer determines whether you choose the regular or quarterly record-keeping, selecting the option that best fits your business model.

Hybrid Approach: Best of Both Worlds

Some companies find an optimal solution by combining the strengths of both methods, creating a customized strategy that maximizes efficiency and control.

Best of Both Worlds Strategy

Some businesses adopt a hybrid model, balancing cost efficiency with control—the best of both worlds. This might involve:

- In-house: Daily data entry for immediate cash flow monitoring.

- Outsourcing: Complex monthly reconciliation and reporting to a professional accounting service.

When to Consider Mixing Bookkeeping Frequency

Businesses with significant seasonal spikes in transaction volume may opt for periodic services during peak seasons and quarterly updates during quieter periods. The strategy must be tailored to your business.

Transitioning from Quarterly to Monthly

Upgrading to monthly accounting is a proactive step often initiated when the business owner finds that quarterly updates work but the data volume is becoming unmanageable, or when external financing is sought. The transition from quarterly to regular should be managed smoothly by your advisor.

Monthly vs. Quarterly Bookkeeping by Industry

Industry demands often dictate the necessary frequency of financial updates due to factors like transaction complexity, inventory management, or regulatory oversight.

Retail and E-commerce

High transaction volume and the need to reconcile daily sales channels mean that monthly record-keeping is virtually essential. Accurate timely records are critical for managing inventory and supplier payments.

Healthcare and Wellness

Moderate to high volume; monthly tracking is often required regularly due to the complexity of insurance claim reconciliation and strict record-keeping standards.

Professional Services (Law, Consulting)

Often moderate volume; many business owners in this sector can manage with quarterly accounting, especially if invoicing is consistent and expenses are predictable. They may initially find quarterly accounting suitable.

Freelancers and Sole Proprietors

Typically low transaction volumes; they can start with quarterly accounting but should monitor volume and consider switching to a monthly basis if income increases significantly or they cross the VAT threshold.

Tech Startups

These businesses require regular records due to continuous fundraising rounds, high capital expenditure tracking, and the need for frequent monthly reports for investors, making the regular vs. quarterly accounting decision straightforward.

Cost Comparison

While cost is a significant driver in the decision, it is essential to consider the overall value derived from regular financial insights versus the potential savings from less frequent processing.

Is Monthly Really That Much More Expensive

Yes, monthly accounting involves three times the number of reconciliation cycles annually, inherently increasing the cost compared to quarterly bookkeeping. However, quarterly accounting may incur higher costs if significant cleanup is required before quarterly tax or audit deadlines.

Estimated Pricing Based on Market Averages

In the UAE, the price difference for an accounting service typically ranges from 30% to 50% higher for periodic services, depending heavily on your transaction volume and the complexity of financial operations.

Monthly Bookkeeping Reduces Year-End Accounting Fees

Accurate bookkeeping, maintained every month, substantially reduces the time required for external auditors or tax consultants during the year-end process, often offsetting the higher cost of regular services with lower annual fees.

Final Verdict: Which Is Right for Your Business

The final choice depends on a clear assessment of your cash flow needs, growth ambitions, and tolerance for compliance risk.

Which Option Is Best for Your Business

The choice between monthly vs. quarterly record-keeping depends on your business needs, transaction volume, and growth trajectory. What’s best for your business is the option that provides sufficient data to make timely business decisions while minimizing unnecessary costs.

Go for Monthly Bookkeeping If

You should opt for regular record-keeping if your business profile matches the following criteria:

- High transaction volume.

- Aggressive growth plans.

- Need for constant cash flow monitoring.

- Operation in highly regulated sectors where accurate record-keeping is critical.

This is the better bookkeeping option for scale.

Go for Quarterly Bookkeeping If

Quarterly updates are typically sufficient if:

- You have fewer transactions and predictable income and expenses.

- The size of your business allows you to manage with quarterly updates without losing control of cash flow.

This choice best fits your business when resources are constrained and volume is low.