Mainland Company Setup in UAE: Key Features

A mainland business entity is licensed by the Department of Economy and Tourism (DET) in Dubai (or the relevant Economic Development Department in other Emirates) and registered with the UAE Ministry of Economy. This is often referred to as an “onshore company.”

Business Scope and Activities for Mainland Companies

The defining feature of a UAE mainland entity is its unrestricted access to the local market. A mainland company can:

- Conduct business directly with the public, other mainland companies, and government entities across the entire UAE.

- Establish physical offices and warehouses anywhere in the respective Emirate.

- Bid for major government tenders and contracts.

- Open branches, subject to regulatory approval, anywhere in the UAE without significant geographical limitations.

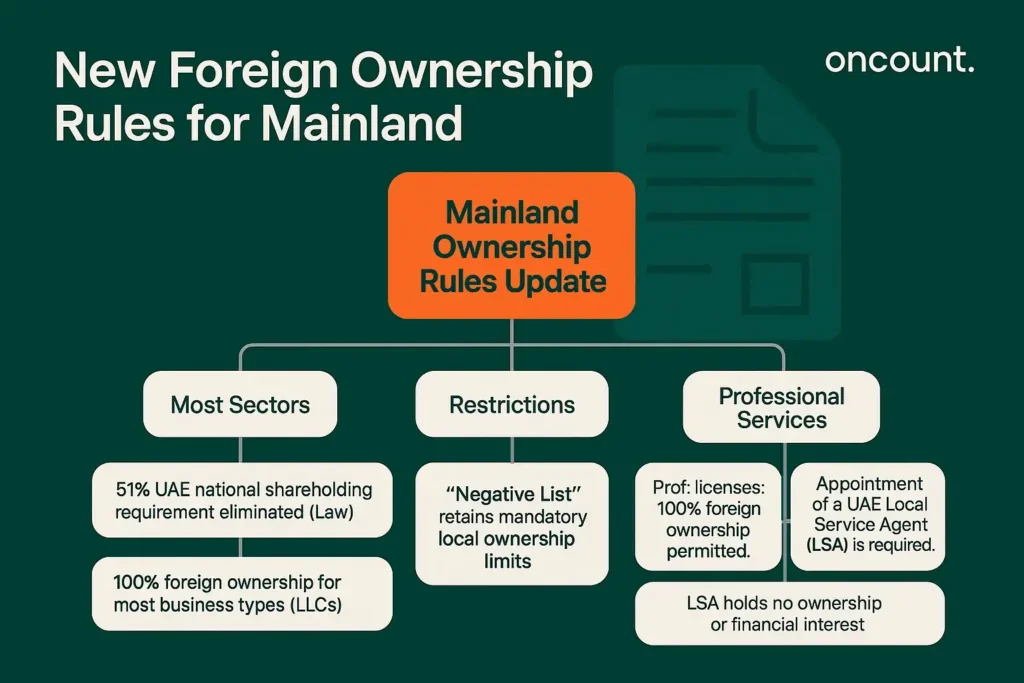

Mainland Company Formation Ownership and Requirements

The landscape for mainland company formation dramatically changed following the amendments to the Commercial Companies Law, which eliminated the requirement for a 51% UAE national shareholding in most sectors.

- Foreign Ownership: For the majority of commercial, industrial, and service business activities, 100% foreign ownership is now permitted. This applies to Limited Liability Companies (LLCs).

- Strategic Activities: A limited “Negative List” of strategic sectors (e.g., specific telecommunications, utilities, and defense) still retains mandatory local ownership limits.

- Professional Licenses: For professional business activities (like consulting or legal services), 100% foreign ownership is granted, but the appointment of a UAE national Local Service Agent (LSA) is usually required to handle administrative processes, with the LSA holding no ownership or financial interest.

Licensing Process and Mainland Business Setup

The setup process involves securing initial approval from the DET, reserving a trade name, finalizing the Memorandum of Association (MoA) with a notary, and obtaining a physical lease agreement (Ejari registration in Dubai) before the final business license is issued. The mainland company is registered centrally, ensuring seamless access to the national market.

Free Zone Company Setup and Zones in Dubai and UAE

Free Zone companies are specialized entities established within geographically defined areas subject to their own regulatory framework, often offering highly competitive incentives to attract foreign direct investment. The UAE offers over 40 free zones, with many located in Dubai, such as DIFC, DMCC, JAFZA, and DAFZA.

Key Features of Free Zone Companies

The primary incentive for establishing free zone entities is the regulatory ease and tax structure designed to facilitate international trade.

- Ownership: 100% foreign ownership is standard for all free zone companies.

- Repatriation: Full repatriation of capital and profits is permitted.

- Customs: Often exempt from customs duties on goods imported and exported within the zone.

Major Free Zones Across UAE and Industry Focus

Each free zone is typically sector-specific, offering tailored infrastructure:

- Dubai: DMCC (Commodities, Trade), DIFC (Financial Services), JAFZA (Logistics, Trade, Manufacturing), TECOM Group Zones (Media, Tech, Internet City).

- Abu Dhabi: ADGM (Financial Services), KIZAD (Industrial).

- Other Emirates: RAKEZ (Ras Al Khaimah), UAQ Free Trade Zone (Umm Al Quwain). Selecting the correct jurisdiction for your business is critical, as the choice impacts the available business activities and infrastructure.

Regulatory Compliance and Authority for Free Zone Setup

Each free zone has its own independent authority that governs company registration, licensing, and compliance.

- Authority: Licensed by the respective free zone authority, not the local DED.

- Mandatory Audits: Most free zones, especially in Dubai, mandate the submission of annual audited financial statements for license renewal, aligning with IFRS standards. This requirement pre-dates the Corporate Tax regime and remains a compliance cornerstone.

Office Space and Physical Presence in Free Zone Companies

Free zones often require a demonstrable physical presence in the UAE to meet licensing and economic substance requirements.

- Leasing: Companies must have a registered office, ranging from flexible desk options (flexi-desk) to dedicated, permanent offices, depending on the activities and the number of visa quotas requested.

- ESR Compliance: Entities performing “Relevant Activities” (e.g., Headquarter Business, Distribution and Service Centre) must demonstrate adequate Economic Substance (Core Income-Generating Activities) within the free zone, including sufficient personnel and expenditure.

Offshore Company Setup and Business in the UAE

Offshore companies (International Business Companies or IBCs) are purely administrative or holding structures designed to own assets outside the UAE or protect wealth. They are governed by specific laws in certain Emirates, such as Ras Al Khaimah (RAK International Corporate Centre – RAKICC) and Jebel Ali Free Zone (JAFZA Offshore).

Key Features of Offshore Companies

Offshore companies offer privacy and capital protection but come with significant restrictions on local trade.

- Tax Residency: While UAE entities, they are typically considered non-resident for tax purposes in most other jurisdictions.

- Confidentiality: They offer a high degree of privacy regarding beneficial ownership and financial details, although they are still subject to strict UBO (Ultimate Beneficial Owner) disclosure requirements with the relevant registrar.

Purpose and Restrictions of an Offshore Company in the UAE

The purpose of an offshore setup is narrow, focusing strictly on international functions.

- Restrictions: Offshore companies cannot trade directly within the UAE market, lease physical office space, or conduct business activities within the UAE (with exceptions for professional advice and opening a local bank account).

- Visas: They are not eligible to apply for visa quotas for employees or shareholders.

- Uses: Ideal for holding intellectual property, real estate outside the UAE, and international trading operations where the goods never enter the UAE mainland.

Capital Requirements and Timeline for Offshore Company Formation

The initial setup costs for an offshore company formation are generally lower than Mainland or Free Zone setup options, and the setup process is faster.

- Capital: Minimum capital requirements are often symbolic (e.g., AED 1,000) or non-existent.

- Timeline: Formation can take as little as two to three working days once all compliance checks are completed.

Key Differences: Mainland vs. Free Zone vs. Offshore

Choosing the right structure hinges on a careful assessment of market focus, compliance appetite, and financial goals.

| Aspect | Mainland Company | Free Zone Company | Offshore Company |

| Market Scope | Unrestricted access to the entire UAE market. | Restricted to operating within the free zone or outside the UAE. Can sell to Mainland via a local distributor/agent. | Strictly prohibited from conducting business within the UAE. |

| Ownership | 100% foreign ownership allowed for most non-strategic sectors. | 100% foreign ownership standard. | 100% foreign ownership standard. |

| Corporate Tax | 9% on taxable profits exceeding AED 375,000 (SME relief available). | 0% on “Qualifying Income” for a “Qualifying Free Zone Person” (QFZP). 9% on non-qualifying income. | Typically 0%, as income usually originates outside the UAE. |

| VAT | Standard 5% VAT on all taxable supplies in the UAE market. | VAT status depends on whether the zone is a ‘Designated Zone’ for physical goods. Services are generally 5%. | VAT compliance is usually minimal unless assets are held in the UAE. |

| Audits | Mandatory audited financial statements required only for certain legal forms or meeting specific thresholds. | Mandatory annual audit submission to the Free Zone Authority is the norm. | Mandatory filing of accounts/financial statements with the registrar. |

Business Activities Comparison: Mainland vs. Free Zone vs. Offshore

The critical factor is defining where the value chain and end consumption occur. A free zone offers specialized licenses for logistics, trading, and services geared toward the global market. A mainland company is essential for retail, contracting, and direct consumer services within the UAE market. Offshore companies cannot perform operational business activity in the UAE at all.

Office Space Requirements: Free Zone vs. Mainland vs. Offshore

- Mainland: Requires a verifiable office space (Ejari), implying a genuine physical presence in the UAE.

- Free Zone: Requires a minimum registered address (Flexi-desk or dedicated office) to satisfy economic substance and license requirements.

- Offshore: Does not require a physical office lease; the registered address is provided by the registered agent.

Regulatory Requirements and Financial Compliance

All three structures must adhere to the UAE’s mandatory financial compliance laws:

- UBO (Ultimate Beneficial Ownership) Disclosure: All entities must file and maintain accurate UBO registers with their respective licensing authority, aligning with AML (Anti-Money Laundering) standards.

- ESR (Economic Substance Regulations): Applies to mainland companies and free zone entities performing specific “Relevant Activities.” The intensity of the test is often higher for free zone entities seeking the 0% tax rate. Offshore companies may also fall under ESR if they conduct Holding Company or High-Risk IP activities.

- VAT Compliance: All entities with taxable supplies exceeding AED 375,000 must register with the Federal Tax Authority (FTA).

Advantages and Disadvantages of Business Setup Options

Choosing the optimal structure requires a clear risk-benefit analysis, integrating commercial strategy with fiscal and regulatory obligations.

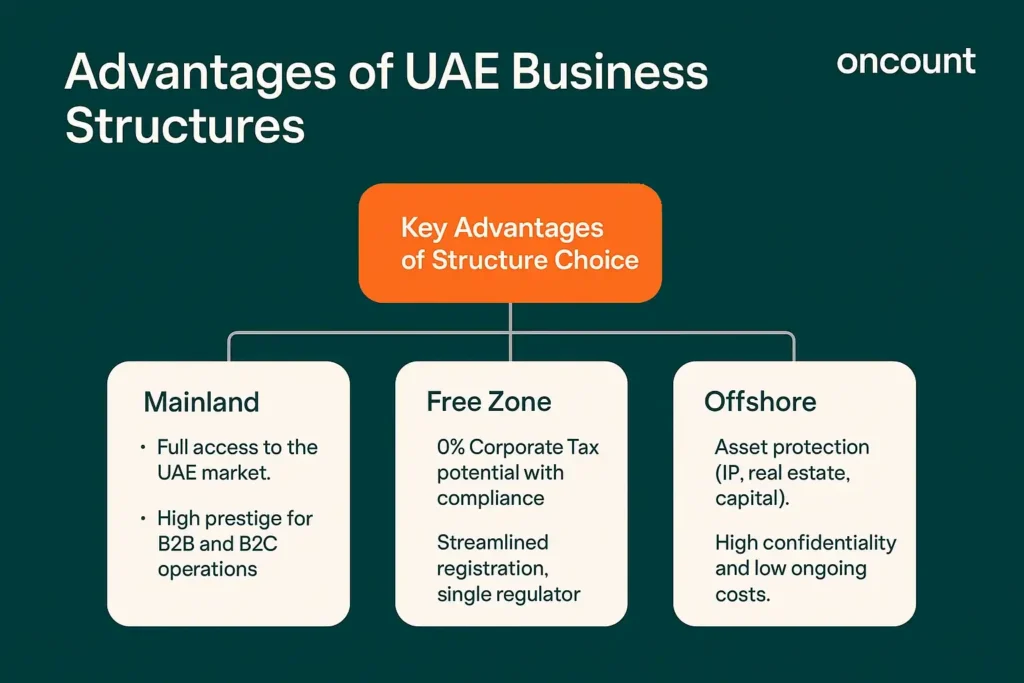

Advantages of Mainland Company Setup

- Full Market Access: Immediate, direct access to the lucrative UAE market, including all Emirates.

- Reputation: Considered highly prestigious for consumer-facing and B2B operations in the region.

- Flexibility: Minimal restrictions on the type or number of business activities that can be licensed under one entity (subject to approval).

Advantages of Free Zone Company Setup

- Tax Efficiency: Potential for 0% Corporate Tax on qualifying income, provided strict substance requirements are met.

- Ease of Setup: Streamlined setup process and administrative procedures governed by a single authority.

- Infrastructure: Access to highly specialized industry clusters and world-class infrastructure (e.g., JAFZA for logistics, DMCC for trading).

Advantages of Offshore Company Setups

- Asset Protection: Excellent vehicle for wealth management, international assets, and intellectual property holding.

- Privacy: High degree of confidentiality, making it attractive for private investment structures.

- Low Cost: Minimal setup costs and zero ongoing office expenses.

Business Setup Pros and Cons Quick Breakdown

| Structure | Pros | Cons |

| Mainland | Full local market access, 100% foreign ownership, strong reputation. | Subject to 9% Corporate Tax on profits > AED 375,000, generally higher office costs. |

| Free Zone | 0% Corporate Tax potential, 100% foreign ownership, easy international operations. | Restricted local market access, strict ESR/QFZP compliance, mandatory annual audits. |

| Offshore | Asset protection, tax neutral on non-UAE sourced income, low compliance burden. | Cannot conduct business in the UAE, no eligibility for visa services. |

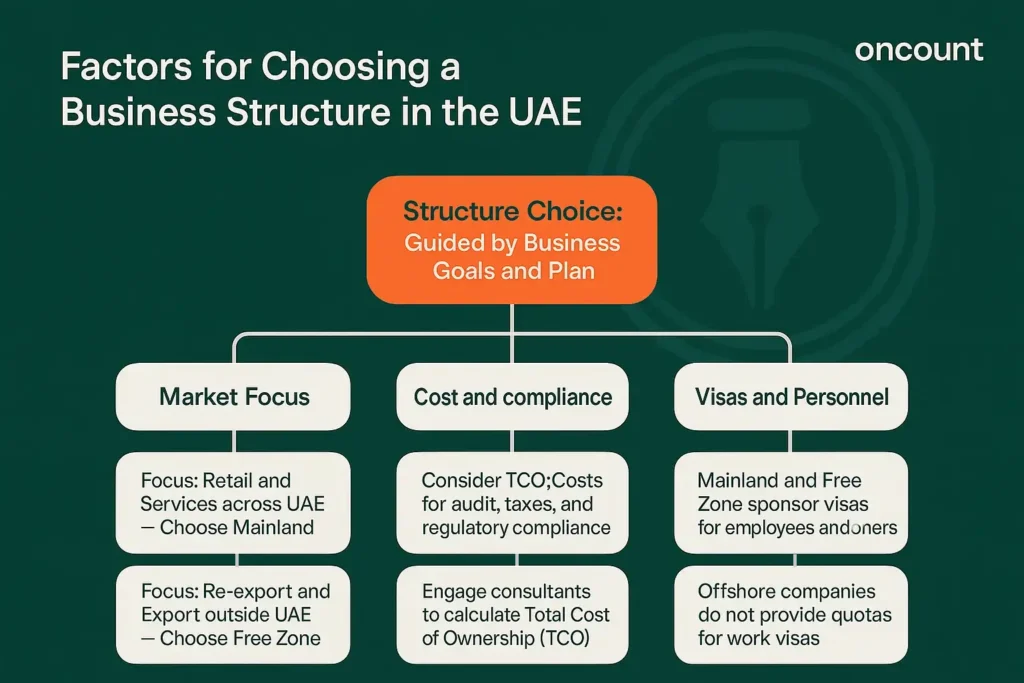

Factors to Consider When Choosing the Right Business Setup

The process to choose the right structure must be guided by clear commercial objectives and financial planning.

Market Focus and Target Audience

If your primary focus is retail, services, or manufacturing that delivers goods to consumers across the entire UAE, the mainland setup is non-negotiable. If the focus is on re-export, international services, or manufacturing for export outside the UAE, a free zone offers unparalleled advantages.

Cost and Compliance Considerations

While setup costs are important, the long-term cost of compliance (e.g., mandatory annual audit fees, complexity of separating qualifying vs. non-qualifying income for Corporate Tax) often outweighs the initial licensing expense. Engage a business setup consultant and tax specialist early to model the Total Cost of Ownership (TCO).

Visa, Staffing Needs, and Residence

A major practical consideration is staffing. Both mainland companies and free zone entities can sponsor employment visa and residence permits for owners and employees, based on the size of their office space and the nature of their business activity. Offshore companies provide no visa quotas.

Documents and Timeline for Business Setup

Documentation standards are high across the UAE. All documents originating outside the UAE must typically be notarized and attested by the relevant UAE Embassy and the Ministry of Foreign Affairs and International Cooperation (MoFAIC).

Required Documents for Mainland Setup

- Copy of passport and Emirates ID (if applicable) for shareholders and managers.

- MoA (Memorandum of Association) and AOA (Articles of Association).

- Proof of the physical office address (Ejari in Dubai).

- Initial approval and name reservation confirmation from the DET.

- Board Resolution or Power of Attorney (if corporate shareholder).

Required Documents for Free Zone Setup

- Copy of passport for shareholders and managers.

- Business Plan (required by certain authorities, e.g., DMCC).

- CVs and bank reference letters for individual shareholders.

- MoA/AOA prepared according to the free zone’s legal framework.

- Proof of registered address within the free zone (e.g., flexi-desk agreement or office lease).

Required Documents for Offshore Setup

- Copy of passport and proof of residential address for the shareholder(s).

- Bank reference letter.

- Professional CV.

- Board Resolution or Power of Attorney (if corporate shareholder).

Timeline for Business License Issuance

- Offshore Setup: Fastest, often 2–3 working days.

- Free Zone Setup: Typically 3–10 working days, depending on the authority and necessary security approvals.

- Mainland Setup: Can take 5–15 working days, often requiring more steps (notary, Ejari, approvals from multiple government bodies).