Why Start an E-commerce Business in the UAE

The UAE presents a compelling value proposition for digital commerce ventures, combining regulatory support with market accessibility and infrastructure excellence.

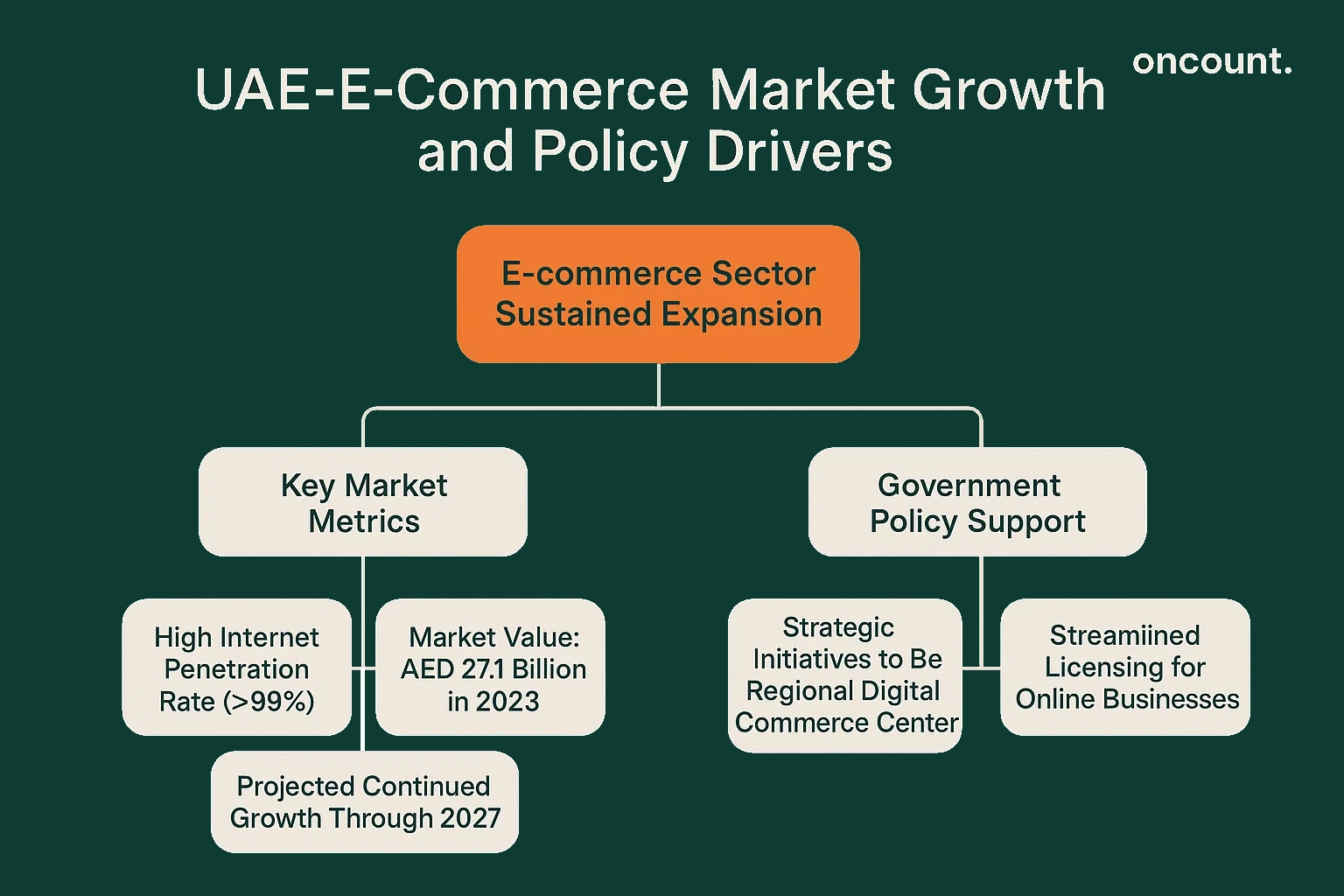

Growing E-commerce Market Trends

The UAE’s e-commerce sector has demonstrated sustained expansion, driven by high internet penetration rates exceeding 99% and smartphone adoption across demographic segments. According to recent market analysis, the UAE e-commerce market reached approximately AED 27.1 billion in 2023, with projections indicating continued growth through 2027. This trajectory reflects evolving consumer preferences toward digital purchasing channels, accelerated by infrastructure investments and payment system modernization.

The Dubai Department of Economic Development has implemented strategic initiatives to position the emirate as a regional digital commerce center, including dedicated free zone offerings and streamlined licensing procedures for online businesses in the UAE. These policy frameworks support both local market penetration and regional export strategies.

Access to a Diverse Customer Base

Dubai serves as a gateway to over 2 billion consumers across neighboring markets in the GCC, wider Middle East, North Africa, and South Asia. The multicultural population within the UAE itself—comprising over 200 nationalities—creates opportunities for niche market segmentation and multilingual commerce strategies.

Cross-border trade facilitation agreements and Dubai’s status as a logistics nexus enable ecommerce businesses to service regional demand efficiently. Free zones like Dubai CommerCity and Meydan Free Zone offer specific advantages for businesses targeting both domestic and international customer segments.

Advanced Infrastructure and Logistics

The UAE maintains world-leading logistics infrastructure, including Dubai International Airport (the world’s busiest for international passenger traffic), Jebel Ali Port (the largest in the Middle East), and extensive last-mile delivery networks. This infrastructure supports efficient inventory management, rapid order fulfillment, and cost-effective distribution across the region.

Third-party logistics providers and fulfillment center operators have established substantial operations across the UAE, enabling e-commerce companies to scale operations without proportional capital investment in warehousing and distribution assets. Integration with regional carriers and customs pre-clearance systems further streamlines international shipping for businesses in Dubai.

Business-Friendly Regulations and Setup

The UAE government has implemented progressive regulatory frameworks designed to facilitate business formation and operation. The Department of Economic Development and various free zone authorities offer transparent licensing procedures with clearly defined timelines and requirements.

Recent regulatory reforms have expanded permissible business activities for e-commerce entities, simplified documentation requirements, and introduced digital application systems that reduce administrative burden. Foreign ownership restrictions have been substantially relaxed for mainland establishments, allowing 100% international ownership across most commercial sectors.

Tax-Friendly Environment

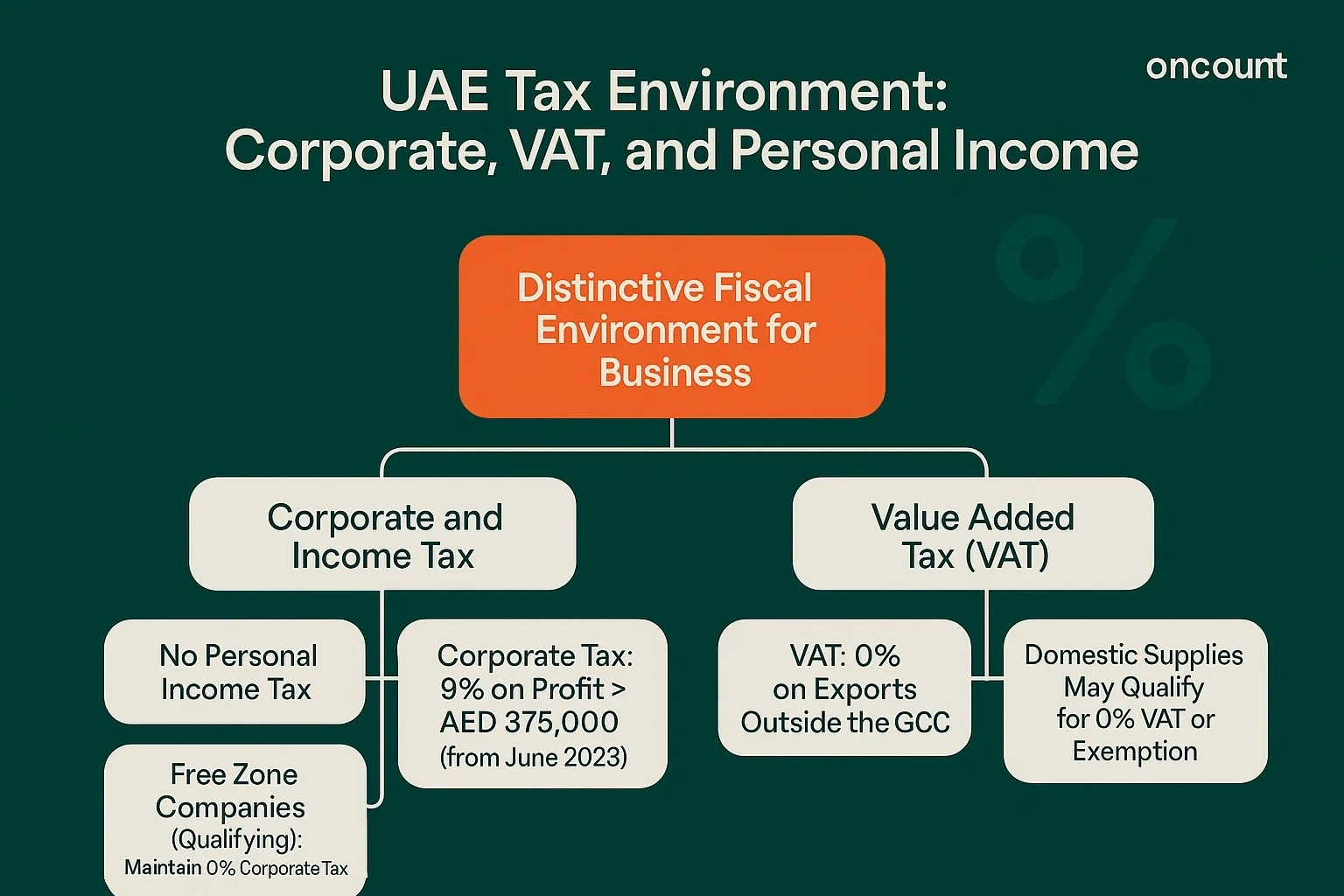

The UAE offers a distinctive fiscal environment with no personal income tax and, until recently, no federal corporate taxation. The introduction of UAE Corporate Tax at 9% on taxable profits exceeding AED 375,000 (effective from June 2023) maintains the jurisdiction’s competitive position relative to regional and international markets.

Importantly, qualifying free zone companies that meet specific substance requirements can maintain 0% corporate tax rates on qualifying income. No value-added tax applies to exports outside the GCC, and certain categories of domestic supplies qualify for zero-rating or exemption under UAE VAT regulations.

Seamless Incorporation Process

Company formation timelines in the UAE have improved substantially, with many free zones offering incorporation completion within 5-7 business days for standard applications. Digital licensing platforms enable remote application submission, document verification, and license issuance without physical presence requirements during initial stages.

The setup process for e-commerce ventures typically involves fewer regulatory approvals compared to industrial or professional service operations, particularly when establishing within specialized free zones designed for digital commerce.

Market Growth Potential

The UAE’s strategic positioning, continued infrastructure investment, and supportive government policies create favorable conditions for sustained e-commerce expansion. The National E-Commerce Strategy and various emirate-level initiatives demonstrate governmental commitment to sector development.

Dubai’s ambition to become a global digital economy leader, supported by initiatives such as the Dubai Digital Economy Strategy, provides institutional backing for innovative business models and emerging technologies in retail commerce. These policy frameworks reduce regulatory uncertainty and support long-term investment planning for e-commerce entrepreneurs.

Steps to Start Your E-commerce Business in Dubai

Establishing an e-commerce company in the UAE requires systematic navigation of regulatory requirements, strategic planning, and operational preparation.

Market Research and Business Planning for E-commerce

Comprehensive market analysis forms the foundation of a viable e-commerce venture. Business owners should evaluate competitive positioning, target customer demographics, pricing strategies, and supply chain logistics before committing capital to company formation.

A detailed business plan should address:

- Market Analysis: Assessment of consumer demand patterns, competitive landscape analysis, and identification of underserved market segments within the UAE and target export markets.

- Financial Projections: Revenue forecasting based on realistic customer acquisition costs, conversion rate assumptions, average order values, and operational expense modeling including fulfillment, marketing, and platform maintenance costs.

- Regulatory Compliance Strategy: Identification of applicable licensing requirements, product-specific regulations (particularly for health, food, or controlled items), and consumer protection obligations under UAE consumer rights frameworks.

- Technology Architecture: Platform selection decisions (proprietary development versus marketplace integration), payment gateway requirements, inventory management systems, and customer relationship management infrastructure.

Well-documented business planning facilitates subsequent steps including bank account opening, investor discussions, and strategic partnership negotiations.

Select Your Niche and Strategy for E-commerce Businesses

Product or service selection directly influences licensing requirements, logistics complexity, and competitive positioning. The UAE market demonstrates particular strength in fashion and apparel, electronics and technology products, health and beauty categories, and specialty food items.

Strategic considerations include:

- Product Sourcing: Whether to maintain physical inventory within the UAE, utilize dropshipping models, or implement hybrid approaches affects warehouse requirements, working capital needs, and delivery timeframes.

- Pricing Strategy: Competitive pricing analysis must account for import duties (where applicable), logistics costs, VAT at 5% on taxable supplies, and payment gateway fees typically ranging from 2.5% to 3.5% per transaction.

- Market Entry Approach: Decision between marketplace integration (Amazon.ae, Noon, etc.), independent e-commerce platform development, or omnichannel strategies combining both approaches impacts initial investment requirements and time to market.

Niche selection should align with entrepreneur expertise, available capital, and realistic market penetration timeframes based on competitive intensity within chosen categories.

Company Naming and Trade Name Registration

Company name selection is subject to regulatory approval by the relevant licensing authority. Names must comply with nomenclature guidelines established by the Department of Economic Development for mainland entities or by specific free zone authorities for free zone establishments.

General naming requirements include:

- Names must not conflict with existing registered business names or trademarks

- Religious references, obscene language, and politically sensitive terminology are prohibited

- Legal form designations (LLC, FZE, FZCO) must be included based on company structure

- Descriptive terms should reasonably relate to registered business activities

Following initial name reservation (typically valid for 6 months), businesses proceed to formal license application and company registration with the relevant authority.

Free Zone Options for E-commerce Businesses in Dubai

The UAE offers approximately 45 free zones across various emirates, each providing specific advantages for different business categories. Several free zones have developed specialized offerings for e-commerce operations.

Choosing the Right Jurisdiction

Jurisdiction selection between mainland and free zones represents a fundamental strategic decision affecting taxation, market access, operational flexibility, and cost structure.

Mainland Advantages:

- Unrestricted ability to conduct business throughout UAE markets

- Direct government contracting eligibility

- Wider range of permissible trade license activities

- Flexibility to establish multiple branch locations

Free Zone Benefits:

- 100% foreign ownership with no local sponsor requirement

- Simplified visa quota allocation based on office space

- Potential corporate tax exemption on qualifying income

- Customs duty advantages on imported goods

- Streamlined licensing with reduced documentation

The optimal choice depends on the business requirements, target market geography, anticipated physical presence needs, and long-term expansion strategies.

Meydan Free Zone: The Digital Ecosystem

Meydan Free Zone positions itself as a digital commerce enabler, offering packages specifically structured for online business operations. The free zone provides:

- Flexi-Desk Solutions: Cost-effective licensing without dedicated physical office requirements, suitable for businesses operating entirely through digital channels.

- E-Commerce License Categories: Pre-approved activity lists encompassing online retail, digital marketplace operation, and technology-enabled service provision.

- Processing Timelines: Standard incorporation completion within 5 business days for complete applications.

- Cost Structure: Entry-level packages beginning at approximately AED 10,750 annually, including license, visa allocation, and shared service access.

The free zone’s location adjacent to Dubai’s central business districts and proximity to logistics infrastructure supports operational efficiency while maintaining cost competitiveness for establishing an e-commerce business.

Dubai CommerCity: Dedicated E-commerce Free Zone

Dubai CommerCity represents the UAE’s first purpose-built free zone exclusively for e-commerce and related logistics operations. Developed as a comprehensive ecosystem, it offers:

- Integrated Infrastructure: Purpose-designed facilities combining office space, warehousing, fulfillment centers, and last-mile delivery operations within a unified location.

- Activity Diversity: Licensed activities encompass online retail, marketplace operation, digital payment services, logistics coordination, and technology platform development.

- E-commerce-Specific Support: Dedicated business support services including payment gateway facilitation, logistics provider connections, and marketplace integration assistance.

- Strategic Partnerships: Formal relationships with major regional and international e-commerce platforms, financial services providers, and logistics operators.

The free zone offers particularly strong value propositions for businesses requiring substantial warehousing capacity or integrated fulfillment operations. License costs typically range from AED 25,000 to AED 50,000 annually depending on space requirements and visa allocations.

IFZA Free Zone

IFZA (International Free Zone Authority) operates facilities in Dubai and Fujairah, offering competitive positioning for cost-conscious e-commerce startups. Key attributes include:

- Flexible Licensing: Multiple license categories supporting various online business models, including general trading licenses suitable for diverse product categories.

- Cost Efficiency: Among the most economical free zone options, with basic packages starting around AED 8,500 annually, making it accessible for bootstrapped e-commerce ventures.

- Rapid Processing: Streamlined approval procedures with typical incorporation timelines of 3-5 business days.

- Visa Allocation: Competitive visa quotas tied to license category and office space leased.

While physical infrastructure may be less specialized than dedicated e-commerce zones, IFZA provides solid foundational requirements for businesses prioritizing cost management during initial operations.

Sharjah Publishing City (SPC)

Sharjah Publishing City caters specifically to creative, content, and digital media businesses, including content-driven e-commerce platforms. The free zone offers:

- Creative Industry Focus: Licensing framework designed for digital content creation, multimedia production, and content-based commerce platforms.

- Competitive Costs: Package pricing generally ranging from AED 12,000 to AED 30,000 annually based on office requirements and visa needs.

- Strategic Location: Proximity to Sharjah International Airport and connectivity to Dubai’s commercial centers via major highways.

- Sector-Specific Community: Networking opportunities within creative and digital sectors, facilitating collaboration for content-driven e-commerce businesses.

SPC represents a suitable option for entrepreneurs in niches such as digital publishing, educational content sales, or media licensing where content creation integrates with commerce functions.

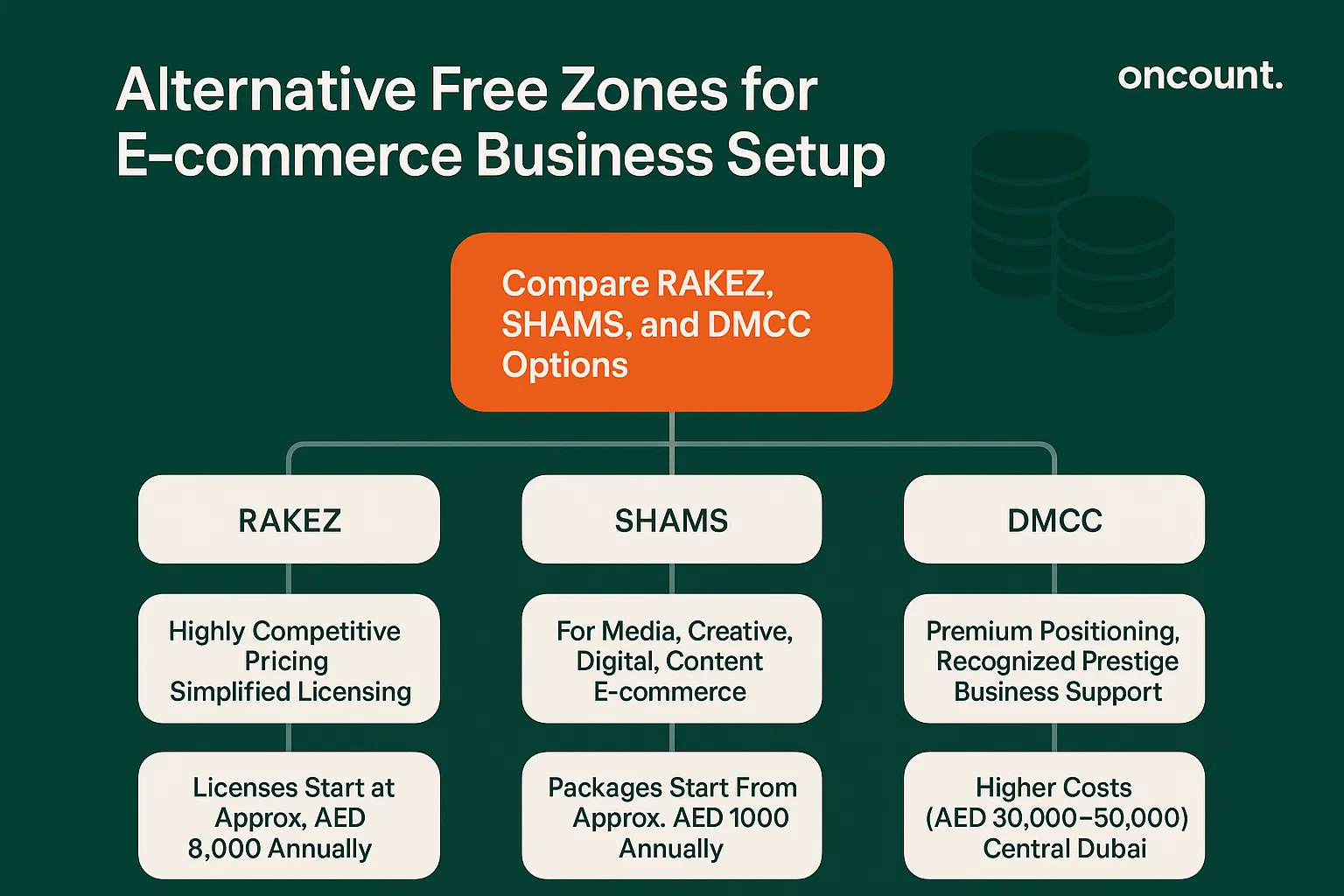

RAKEZ, SHAMS, and DMCC Options

Additional free zones provide viable alternatives depending on specific business needs:

- RAKEZ (Ras Al Khaimah Economic Zone): Offers highly competitive pricing structures and simplified licensing procedures. General trading licenses suitable for e-commerce start at approximately AED 8,000 annually. The free zone’s location in Ras Al Khaimah provides cost advantages while maintaining reasonable proximity to Dubai’s logistics infrastructure.

- SHAMS (Sharjah Media City): Positions itself for media, creative, and digital businesses, offering packages from approximately AED 10,000 annually. Suitable for content-heavy e-commerce operations or businesses combining media services with product sales.

- DMCC (Dubai Multi Commodities Centre): While traditionally focused on commodities trading, DMCC accommodates diverse business categories including e-commerce. The free zone offers premium positioning, recognized prestige, and comprehensive business support services. Costs are higher—typically AED 30,000-50,000 annually—reflecting the premium positioning and central Dubai location.

Selection among these options should reflect business priorities regarding cost, location, industry ecosystem, and long-term scalability requirements.

Requirements for Getting an E-commerce License in Dubai

Obtaining an e-commerce trade license involves specific documentation, procedural steps, and compliance requirements established by the relevant licensing authority.

Choose Your Legal Structure (Mainland vs. Free Zone)

Legal structure selection determines ownership parameters, operational flexibility, and regulatory obligations:

- Mainland Limited Liability Company (LLC): Permits 100% foreign ownership across most commercial sectors following recent regulatory reforms. Suitable for businesses requiring unrestricted UAE market access or government contracting. Requires registered physical office space meeting commercial specifications.

- Free Zone Establishment (FZE): Single-shareholder corporate entity available in free zone jurisdictions. Provides 100% ownership, simplified governance, and free zone advantages. Restricted to free zone operations, other free zones, and international markets unless obtaining separate mainland distribution arrangements.

- Free Zone Company (FZCO): Multi-shareholder corporate structure in free zones, accommodating partnership arrangements and investor participation. Subject to same operational parameters as FZE regarding market access.

Most e-commerce entrepreneurs opt for free zone structures due to cost efficiency, simplified establishment procedures, and sufficient market access for digital commerce operations targeting customers across the UAE and internationally.

License Types and E-commerce Company Activities

License categories differ between mainland and free zone jurisdictions, though core e-commerce activities remain consistently available:

- Trading License: Permits buying, selling, and distribution of goods through online channels. Appropriate for businesses maintaining inventory and conducting retail transactions.

- Service License: Suitable for marketplace platforms, digital service provision, or technology platform operation without physical product inventory.

- E-Commerce License: Specialized category offered by certain free zones (particularly Dubai CommerCity and Meydan Free Zone) specifically structured for online retail operations.

Licensed activities must be explicitly stated on trade license documentation. Common e-commerce-related activities include:

- Online retail trading

- E-commerce portal operation

- Digital marketplace services

- Online payment processing facilitation

- E-commerce logistics coordination

- Digital marketing services

- Web design and development

Activity selection should encompass anticipated business operations comprehensively while avoiding unnecessary activities that increase license costs without operational benefit.

Mandatory Documents Checklist

Application for e-commerce license registration requires submission of specified documents, with specific requirements varying between mainland and free zone jurisdictions:

Shareholder Documentation:

- Valid passport copies for all shareholders and managers

- Visa copies for UAE residents

- Passport-sized photographs

- Emirates ID copies (where applicable)

Business Documentation:

- Completed license application forms

- Proposed company name reservations

- Initial approval certificate (following name approval)

- Memorandum of Association outlining company structure

- Proof of office space (tenancy contract or free zone agreement)

Additional Requirements (jurisdiction-dependent):

- No objection certificates from current sponsors (for UAE residents)

- Bank reference letters from shareholders’ banking institutions

- Business plan documentation (for certain mainland applications)

- Proof of financial capability (bank statements)

Free zone applications generally require fewer documents and simplified procedures compared to mainland licensing, particularly regarding physical presence verification and local sponsor arrangements.

Initial Approval Certificate Process

Following submission of complete application documentation, the licensing authority conducts review and issues initial approval certification. This certificate confirms:

- Approved company name reservation

- Preliminary activity approval

- Authorization to proceed with office lease finalization

- Clearance to open corporate bank account

Initial approval validity typically extends 6 months, during which period applicants must complete remaining setup requirements including office space formalization and final license fee payment.

Duration of License Issuance

Processing timelines for e-commerce license issuance vary by jurisdiction:

- Free Zones: Most specialized e-commerce free zones complete license issuance within 3-7 business days for complete applications with all supporting documentation.

- Mainland: Department of Economic Development processing typically requires 7-15 business days, depending on application complexity and business activity approvals required.

- Expedited Processing: Some free zones offer accelerated services for additional fees, enabling same-day or next-day license issuance for urgent requirements.

Realistic total timelines from application initiation to final license receipt range from 1-3 weeks, assuming efficient document preparation and no complications in verification procedures.

How Much Does it Cost to Start an E-commerce Business

Financial planning for establishing your business requires accounting for licensing fees, operational setup costs, and working capital requirements.

E-commerce License Fee Structure

License costs vary substantially based on jurisdiction, activity scope, and visa requirements:

Budget Free Zones (RAKEZ, IFZA, Ajman):

- Basic e-commerce license: AED 8,000 – AED 12,000 annually

- Single visa allocation included

- Shared office or flexi-desk arrangement

Mid-Tier Free Zones (Meydan, SHAMS, SPC):

- E-commerce license packages: AED 12,000 – AED 25,000 annually

- 1-3 visa allocations depending on package

- Flexible workspace or small dedicated office

Premium Free Zones (Dubai CommerCity, DMCC):

- Comprehensive packages: AED 25,000 – AED 50,000 annually

- Multiple visa allocations

- Dedicated office space and business support services

Mainland Licensing:

- Department of Economic Development license fee: AED 15,000 – AED 25,000

- Additional costs for local service agent arrangements

- Trade name registration and initial approval fees

License fees typically cover one-year validity, with annual renewal at similar rates subject to minor inflationary adjustments.

Office Space Requirements

Physical office requirements differ significantly between mainland and free zone establishments:

Free Zone Options:

- Flexi-desk arrangements: AED 3,000 – AED 8,000 annually (suitable for purely digital operations)

- Shared office space: AED 10,000 – AED 20,000 annually

- Dedicated office space: AED 25,000 – AED 100,000+ annually depending on size and location

Mainland Requirements:

- Registered commercial space meeting minimum size requirements

- Annual rental costs: AED 30,000 – AED 150,000+ depending on emirate and location

- Utilities, internet, and facilities management typically additional

Many e-commerce businesses starting operations prioritize cost efficiency through virtual or flexi-desk arrangements, scaling to larger physical space as business volumes justify additional overhead.

Visa Sponsorship Costs

Employment visa sponsorship for founders, family members, and staff involves distinct cost components:

Visa Processing Fees (per visa):

- Immigration department fees: AED 3,000 – AED 5,000

- Medical fitness examination: AED 300 – AED 500

- Emirates ID issuance: AED 300 – AED 370

- Status adjustment fees (where applicable): AED 500 – AED 1,000

Visa Quota Allocation:

- Mainland companies: Visa quotas based on business size, activity, and office space

- Free zones: Quota allocation specified by free zone authority based on license package

Employee Visa Costs:

- Individual employee visa: AED 3,000 – AED 6,000 per employee

- Labor card fees: AED 1,000 per employee

- Work permit charges: AED 500 per employee

Family Sponsorship (for founders):

- Spouse visa: AED 3,000 – AED 5,000

- Dependent child visa: AED 2,500 – AED 4,000 per child

- Requires minimum salary threshold (typically AED 10,000-15,000 monthly depending on emirate)

Estimated Total Business Setup Investment

Comprehensive first-year setup investment typically ranges across the following bands:

Minimal Budget Setup (AED 15,000 – AED 30,000):

- Budget free zone license with flexi-desk

- Single founder visa

- Basic website development

- Essential business services

Standard Professional Setup (AED 40,000 – AED 75,000):

- Mid-tier free zone with shared office space

- 2-3 visa allocations

- Professional website and e-commerce platform

- Payment gateway integration

- Basic inventory and marketing budget

Comprehensive Launch (AED 100,000 – AED 200,000):

- Premium free zone or mainland establishment

- Multiple visa allocations

- Custom platform development

- Substantial initial inventory investment

- Marketing and customer acquisition budget

- Professional support services (accounting, legal, business consulting)

These estimates exclude ongoing operational costs including platform maintenance, marketing expenditure, inventory replenishment, fulfillment charges, and staff salaries where applicable.

Steps to Start Your E-commerce Business in Dubai

Following jurisdiction selection and license approval, specific operational steps enable business launch and sustainable operations.

Obtain E-commerce License Registration

Upon completing documentation submission, fee payment, and receiving initial approval, businesses proceed to final license issuance. This process involves:

- Office lease finalization with approved premises

- Submission of lease documentation to licensing authority

- Payment of outstanding license fees

- Biometric registration (if required by jurisdiction)

- Collection of physical license certificate

The license authorizes commencement of business operations, including opening corporate bank accounts, registering with regulatory authorities, and entering commercial contracts.

Open a Corporate Bank Account in the UAE

Corporate banking relationships are essential for payment processing, working capital management, and financial compliance. Account opening requirements typically include:

Documentation Requirements:

- Trade license and establishment certificate

- Memorandum and Articles of Association

- Passport copies and Emirates ID for authorized signatories

- Proof of business address

- Business plan and financial projections (for certain banks)

- Initial deposit (varies by institution, typically AED 10,000-50,000)

Bank Selection Considerations:

- Payment gateway integration capabilities

- Multi-currency account facilities for international transactions

- Online banking platform functionality

- Transaction fee structures

- Minimum balance requirements

- Account maintenance charges

Account opening timelines typically extend 2-4 weeks following submission of complete documentation. Some free zones maintain partnerships with specific banking institutions enabling expedited account opening for new license holders.

Build Your Online Store and Website Development

E-commerce platform development represents a critical investment affecting customer experience, operational efficiency, and scalability potential. Primary approaches include:

Marketplace Integration:

- Amazon.ae, Noon, Carrefour, and other regional platforms

- Advantages: Established traffic, reduced technical investment, rapid launch

- Considerations: Platform fees (typically 5-20% commission), limited branding control, competitive pressure

Proprietary Platform Development:

- Custom website design and e-commerce functionality

- Investment range: AED 15,000-100,000+ depending on complexity

- Advantages: Complete brand control, customer data ownership, flexibility

- Requirements: Ongoing maintenance, security, and hosting costs

Hybrid Approach:

- Combining proprietary website with strategic marketplace presence

- Enables brand building while leveraging marketplace traffic

- Requires coordinated inventory and order management across channels

Platform selection should account for target customer behaviors, product categories, competitive positioning, and available technical capabilities within the founding team.

Payment Gateway Integration and Financial Management

Secure payment processing is foundational to online business operations. UAE-based payment gateways include:

Major Providers:

- Network International (N-Genius)

- Telr

- PayTabs

- Amazon Payment Services (previously PAYFORT)

- 2Checkout

Selection Criteria:

- Transaction fee structures (typically 2.5-3.5% plus AED 1 per transaction)

- Supported payment methods (credit cards, debit cards, digital wallets)

- Currency processing capabilities

- Integration complexity and technical support

- Fraud detection and security features

- Settlement periods (typically 2-7 business days)

Payment gateway integration requires coordination between the e-commerce platform, banking institution, and payment processor. Most providers require valid UAE trade license, bank account details, and website verification before activation.

Financial management systems should address:

- Transaction reconciliation

- Inventory valuation and cost tracking

- VAT compliance (5% on taxable supplies)

- Expense categorization for corporate tax purposes

- Accounts receivable and payable management

Many businesses establishing an e-commerce company engage professional accounting firms to implement appropriate systems ensuring regulatory compliance from inception.

Logistics and Fulfillment Setup

Efficient product delivery directly impacts customer satisfaction and operational economics. Setup considerations include:

Fulfillment Model Selection:

- Self-fulfillment from own warehouse

- Third-party logistics (3PL) provider outsourcing

- Dropshipping arrangements with suppliers

- Hybrid models combining approaches

Logistics Provider Options:

- International couriers (Aramex, DHL, FedEx)

- Local delivery services (Fetchr, Smsa Express)

- Marketplace fulfillment programs (Fulfillment by Amazon, Noon Express)

Key Operational Elements:

- Returns and exchange procedures

- Inventory management systems

- Order tracking and customer communication

- Customs clearance procedures for imports

- Cash on delivery reconciliation (where offered)

Logistics costs typically represent 5-15% of order value, varying based on product characteristics, delivery locations, and service level commitments. Most e-commerce businesses negotiate volume-based pricing as order quantities scale.

Ensuring Ongoing Legal Compliance

Sustained business operations require adherence to multiple regulatory frameworks:

VAT Obligations:

- Mandatory registration for annual turnover exceeding AED 375,000

- Voluntary registration permitted above AED 187,500

- Quarterly VAT return filing requirements

- Invoice formatting requirements per FTA specifications

Corporate Tax Requirements:

- Registration with Federal Tax Authority

- Annual financial statement preparation per IFRS standards

- Submission of corporate tax returns

- Transfer pricing documentation (where applicable)

Consumer Protection:

- Clear pricing and product disclosure

- Return and refund policy publication

- Privacy policy and data protection compliance

- Transparent shipping and delivery timeframes

Economic Substance Regulations (for free zone entities):

- Notification requirements for relevant activities

- Annual reporting obligations

- Demonstration of adequate substance within UAE

Intellectual Property:

- Trademark registration with UAE Ministry of Economy

- Copyright protection for proprietary content

- Domain name registration and renewal

Engaging qualified legal and accounting professionals familiar with UAE e-commerce regulations reduces compliance risks and enables focus on building your business and customer acquisition.