What the ILOE Unemployment Insurance Scheme Is

The unemployment insurance scheme established by the UAE government provides financial safety nets for private sector workers who face unexpected job termination. This mandatory program reflects the nation’s commitment to workforce stability and social protection, aligning with international labor standards while addressing the unique dynamics of the UAE labor market.

ILOE Insurance: Definition and Purpose

ILOE stands for involuntary loss of employment. The insurance scheme serves as a contributory protection mechanism designed to provide temporary financial assistance to employees who lose their jobs through no fault of their own. The insurance program functions as a stabilization tool, offering income replacement for a defined period while beneficiaries seek new employment opportunities.

According to guidance from the UAE Ministry of Human Resources and Emiratisation, the scheme addresses the financial vulnerability that arises when employment terminates unexpectedly. The insurance policy ensures that workers maintain basic subsistence during transition periods, reducing economic hardship and supporting labor market flexibility.

The official ILOE portal administers the program, managing subscriptions, premium collections, and claim processing through integrated digital platforms. Workers who pay the monthly premium gain access to compensation mechanisms calibrated to their salary levels and contribution history.

Mandatory Subscription to ILOE

ILOE insurance is mandatory for all private sector employees working under UAE labor law. The requirement extends to both mainland establishments and certain free zone entities, depending on the applicable regulatory framework within specific economic zones.

Employers must register workers within the insurance scheme for at least the initial month of employment. Failure to comply results in penalties for both the employing entity and potentially the employee in the UAE, particularly when non-subscription leads to gaps in coverage continuity.

The UAE government has stipulated that subscription becomes effective immediately upon employment commencement. Premium payment obligations begin concurrently, with monthly contributions calculated as a percentage of the employee’s basic salary. The insurance within this framework operates on a pay-as-you-go basis, requiring consistent monthly contributions to maintain active coverage.

All employees who hold valid work permits issued by the UAE Ministry of Human Resources fall under the mandatory subscription requirement unless specifically exempted by ministerial resolution.

Exemption Categories under the ILOE Scheme

Certain employment categories remain exempt from mandatory participation. These exemptions typically include:

- Federal and local government employees covered under alternative pension and protection schemes

- Domestic workers employed in private households

- Investors holding ownership stakes in UAE companies who do not draw regular employment salaries

- Certain categories of temporary or seasonal workers as defined by ministerial directives

Workers who operate under free zone employment contracts may be subject to different regulatory provisions depending on whether the free zone authority has adopted the federal scheme or established independent unemployment protection mechanisms.

Employers bear responsibility for accurately classifying workers and ensuring that only genuinely exempted individuals remain outside the scheme. Misclassification can result in retroactive premium assessments and administrative penalties.

Benefits of ILOE Insurance in the UAE for Job Loss

The insurance certificate issued upon successful subscription confirms the worker’s eligibility to file a claim to receive unemployment compensation. Benefit levels depend on the insured’s basic salary at the time of job loss, with compensation calculated as a percentage of earnings.

Key benefits include:

- Financial Compensation: Eligible claimants receive monthly payments for up to three consecutive months per claim period, subject to having maintained active coverage for at least 12 consecutive months before termination.

- Income Replacement: Compensation typically ranges from 60% of the basic salary, capped at specified maximum amounts adjusted periodically by regulatory authorities.

- Claim Accessibility: The ILOE portal or mobile app streamlines the submission process, enabling employees who lose their jobs to initiate claims rapidly without extensive documentation delays.

- Reactivation Rights: After exhausting claim benefits, workers who secure new employment can resubscribe and rebuild eligibility for future claims by maintaining continuous premium payments.

The scheme provides claim only for the workers who meet specific termination criteria—primarily involuntary dismissal due to business restructuring, economic downturns, or organizational changes. Voluntary resignations and terminations for disciplinary reasons typically do not qualify for compensation.

How to Pay ILOE Insurance Online

The digitalization of premium collection has streamlined compliance processes significantly. Multiple payment channels now operate across the UAE, facilitating ILOE insurance premium transactions through secure, user-friendly platforms.

Paying ILOE Insurance Online: A Step-by-Step Guide

To pay ILOE insurance online through the official channels:

- Access the Official Portal: Navigate to the ILOE website or mobile app using registered credentials. First-time users must complete registration by providing Emirates ID details and employment information.

- Verify Coverage Details: Review displayed policy information, including coverage period, premium amount, and payment due dates. Ensure that basic salary data accurately reflects current employment terms.

- Select Payment Method: Choose from available payment instruments—debit cards, credit cards, or integrated digital wallets supported by UAE financial institutions.

- Complete Transaction: Follow on-screen prompts to authorize payment. The system generates immediate confirmation once the insurance premiums are successfully processed.

- Download Receipt: Retain the digital receipt and certificate of insurance for employment records and potential claim documentation.

The ILOE insurance online platform operates 24/7, allowing both employers and employees to make the payment at their convenience without visiting physical service centers.

Using ILOE Quick Pay for Fast Payment

The quick pay service represents an expedited payment mechanism designed for users in the UAE who require immediate transaction processing. Using ILOE Quick Pay eliminates the need for full portal navigation, enabling direct access to the payment gateway.

To use the ILOE Quick Pay function:

- Access the dedicated Quick Pay section on the ILOE website or mobile app

- Enter your Emirates ID or policy reference number

- Verify the outstanding premium amount displayed

- Select your preferred payment method and authorize the transaction

This streamlined process proves particularly valuable for workers nearing payment deadlines or those who need to clear outstanding balances rapidly to avoid fines.

Pay via the MOHRE App

The MOHRE app integrates unemployment insurance management with broader labor services, creating a unified digital ecosystem for employment-related transactions. The application supports:

- Premium payment processing

- Coverage status verification

- Renewal notifications

- Fine assessment queries

To pay through the MOHRE app:

- Download the application from official app stores (iOS or Android platforms)

- Register using Emirates ID and established credentials

- Navigate to the unemployment insurance section

- Review payment obligations and select “Pay Now”

- Complete the transaction using supported payment methods

The mobile app offers push notifications for upcoming payment deadlines, helping workers maintain uninterrupted coverage.

Pay ILOE Insurance via the MOHRE Website

Desktop users can manage subscriptions through the Ministry’s comprehensive web portal. The MOHRE website provides detailed dashboard views of employment records, insurance status, and payment history.

Payment through the website follows similar authentication and transaction processes as the mobile application, with additional features for bulk employer payments and comprehensive reporting functionality.

Alternative Methods to Pay ILOE Insurance

Beyond digital channels, the UAE maintains physical payment infrastructure for workers who prefer in-person transactions or lack reliable internet access.

Authorized Exchange Houses: Providers such as Al Ansari Exchange maintain service agreements enabling customers to pay ILOE insurance premiums at branch locations across the UAE. Workers present their Emirates ID and policy details to complete transactions, receiving printed receipts as proof of payment.

Bank Transfers: Some insurance provider entities accept direct bank transfers, though this method typically requires advance registration to link bank account details with policy records.

Call Center Assistance: The ILOE call centre provides telephone support for payment processing, particularly for workers experiencing technical difficulties with online platforms. Operators guide callers through alternative payment arrangements while verifying account security credentials.

Check and Pay ILOE Fines

Non-compliance with premium payment obligations triggers automated penalty assessments. Understanding the fine structure and payment procedures helps workers regularize their status efficiently and minimize financial exposure.

ILOE Fines: Penalties for Non-Compliance

The UAE imposes a fine of AED 400 for each month of non-payment. Penalties accumulate monthly until the worker settles outstanding premiums and associated fines. The regulatory framework treats non-payment as a breach of mandatory insurance requirements rather than a discretionary lapse.

Key aspects of the penalty structure include:

- Automatic Assessment: The insurance policy will be cancelled if workers fail to pay the insurance premium for extended periods—typically three consecutive months—resulting in both accumulated fines and loss of coverage.

- Employer Liability: In cases where employers bear responsibility for premium deduction and remittance, regulatory authorities may pursue penalties against the business entity rather than individual workers.

- Impact on Employment Services: Unresolved fines can complicate labor card renewals, visa processing, and other employment-related transactions administered through Ministry systems.

Workers must pay accumulated penalties in addition to outstanding premiums to restore active coverage and avoid further complications.

How to Check Your ILOE Fine Online

To check ILOE fine obligations:

- Log into the ILOE website or mobile app using your credentials

- Navigate to the “Fine Inquiry” or “Payment Status” section

- Review the displayed fine amount, noting the period of non-compliance

- Verify the calculation corresponds to the number of months in arrears

The system provides detailed breakdowns showing the original premium amount, penalty additions, and total balance required to pay. Workers can also check for fines through the MOHRE app by accessing the integrated compliance dashboard.

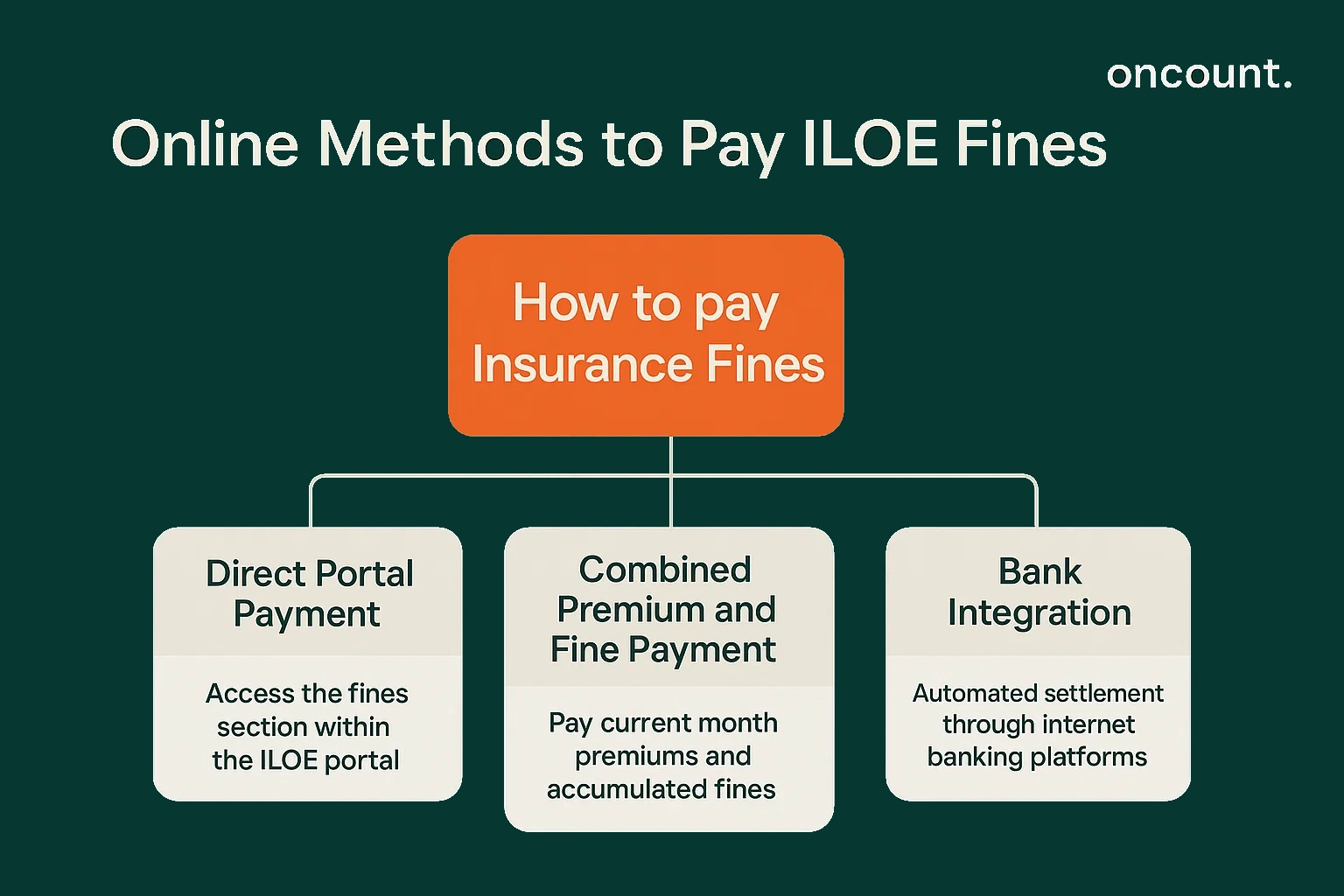

Paying ILOE Insurance Fines Online: Methods

To pay fines and regularize coverage status:

- Direct Portal Payment: Access the fines section within the ILOE portal, select “Settle Outstanding Fines,” and proceed with payment authorization. The system allows workers to pay the fine in full or arrange installment schedules in specific circumstances.

- Combined Premium and Fine Payment: Workers can simultaneously pay current month premiums and accumulated fines through a single transaction, simplifying compliance restoration.

- Bank Integration: Some UAE financial institutions offer direct bill payment services linked to ILOE fine accounts, enabling automated settlement through internet banking platforms.

All payment methods generate immediate confirmation, updating compliance records within Ministry systems to reflect the regularized status.

Pay Fines Using ILOE Quick Pay

The quick pay service extends to fine settlement, offering the same expedited processing for penalty amounts. This functionality proves essential for workers approaching employment transition deadlines or those requiring immediate compliance certification for visa or labor card procedures.

Users access the Quick Pay interface, verify combined premium and fine amounts, and complete transactions without navigating multiple system screens. The simplified workflow reduces processing time significantly compared to standard portal navigation.

Subscribe to ILOE Insurance in the UAE

Initial subscription establishes the foundational coverage relationship between workers, employers, and the insurance program. Understanding eligibility criteria and enrollment procedures ensures timely activation of protection benefits.

Eligibility for UAE ILOE

All private sector employees meeting the following criteria must subscribe to the insurance:

- Hold valid UAE residency and work permits

- Maintain active employment contracts under UAE labor law

- Receive compensation through documented salary arrangements

- Work for employers registered with the Ministry of Human Resources

Age restrictions typically apply, with eligibility extending to workers between 18 and 60 years, though specific insurance plans may vary these parameters slightly.

Foreign nationals and UAE citizens working in the private sector both fall under mandatory subscription requirements, ensuring universal coverage across the labor market.

Steps to Subscribe to ILOE Insurance

New employees should follow this enrollment process:

- Employer Registration: The employing entity initiates worker registration through the MOHRE portal, providing employee Emirates ID details, salary information, and contract particulars.

- Worker Verification: Employees receive notification of pending registration through registered mobile numbers or email addresses, prompting verification of submitted information.

- Premium Calculation: The system automatically calculates the monthly insurance premium based on basic salary, applying the regulatory percentage rate.

- First Payment: Initial premium payment activates coverage, with the insurance period commencing from the first day of the following month.

- Certificate Issuance: Upon successful subscription and payment, the system generates an official insurance certificate accessible through the worker’s portal account.

Workers should verify that employers complete registration within the first month of employment to ensure no coverage gaps develop.

ILOE Insurance Plans and Cost

The insurance scheme operates on a tiered contribution structure calibrated to salary levels:

- Standard Plan: Covers workers earning up to AED 16,000 monthly basic salary, with premiums calculated as a fixed monthly amount typically ranging from AED 5 to AED 11 depending on salary brackets.

- Enhanced Coverage: Higher earners may be subject to proportionally increased premiums, with calculations based on regulatory formulae published by the Ministry.

- Contribution Split: In most cases, workers bear the full premium cost through salary deductions, though some employers voluntarily subsidize portions as employment benefits.

The insurance premium structure undergoes periodic review to align with economic conditions and program sustainability requirements. Workers should consult the official ILOE website for current rate tables applicable to their salary category.

ILOE Insurance Renewal and Status Check

Maintaining continuous coverage requires timely renewal and regular status monitoring. The digital infrastructure supports proactive compliance management through automated reminders and real-time status displays.

ILOE Renewal Deadlines

The insurance policy operates on a monthly renewal cycle, with premium payments due by the fifth day of each month for the preceding period. Workers must ensure that payments process before the deadline to avoid penalties and coverage lapses.

The system sends automated renewal reminders via SMS and email to registered contact information approximately one week before payment due dates. These notifications include:

- Current premium amount

- Payment deadline

- Direct links to payment portals

- Outstanding balance information if previous payments remain pending

To renew your ILOE insurance efficiently, workers should establish recurring payment authorizations or calendar reminders aligned with their salary cycle timing.

How to Check Your ILOE Insurance Status

Workers can check your ILOE insurance standing through multiple channels:

- ILOE Portal: Log in and access the dashboard displaying current coverage status, expiration dates, payment history, and any pending actions.

- MOHRE App: The mobile application provides instant status verification through the insurance section, showing active coverage indicators and next renewal dates.

- SMS Inquiry: Send a text message containing your Emirates ID number to designated short codes published by the Ministry, receiving automated status responses.

Status checks should occur monthly, particularly after payment processing, to confirm that transactions have posted correctly and coverage remains continuous.

Quick Renewal Process

For workers maintaining regular payment patterns, the quick renewal function automates the process:

- Enable auto-pay authorization within the ILOE mobile app settings

- Link a default payment method to your account

- Authorize automatic monthly deductions on specified dates

- Receive confirmation notifications once each renewal processes

This approach eliminates manual payment requirements while ensuring uninterrupted coverage. Workers retain the ability to modify auto-pay settings or cancel authorization at any time through account management interfaces.

Dubai Insurance: Is ILOE Mandatory?

Employment regulations in Dubai align with federal requirements while accommodating the emirate’s unique economic landscape. Understanding mandatory compliance obligations specific to Dubai-based workers ensures proper risk management and regulatory adherence.

Is ILOE Mandatory for All Dubai Employees?

Yes, ILOE insurance in the UAE applies uniformly across all emirates, including Dubai. Private sector employees working in Dubai under standard labor contracts must subscribe to the insurance scheme regardless of employer size, industry sector, or business classification.

The mandatory requirement extends to:

- Mainland companies registered through Dubai’s Department of Economic Development

- Most free zone establishments, particularly those operating under federal labor law

- Branch offices of international companies maintaining UAE operations

- Small and medium enterprises across all commercial sectors

Dubai insurance compliance monitoring operates through integrated Ministry systems that cross-reference employment records with subscription databases, enabling automated detection of non-compliance.

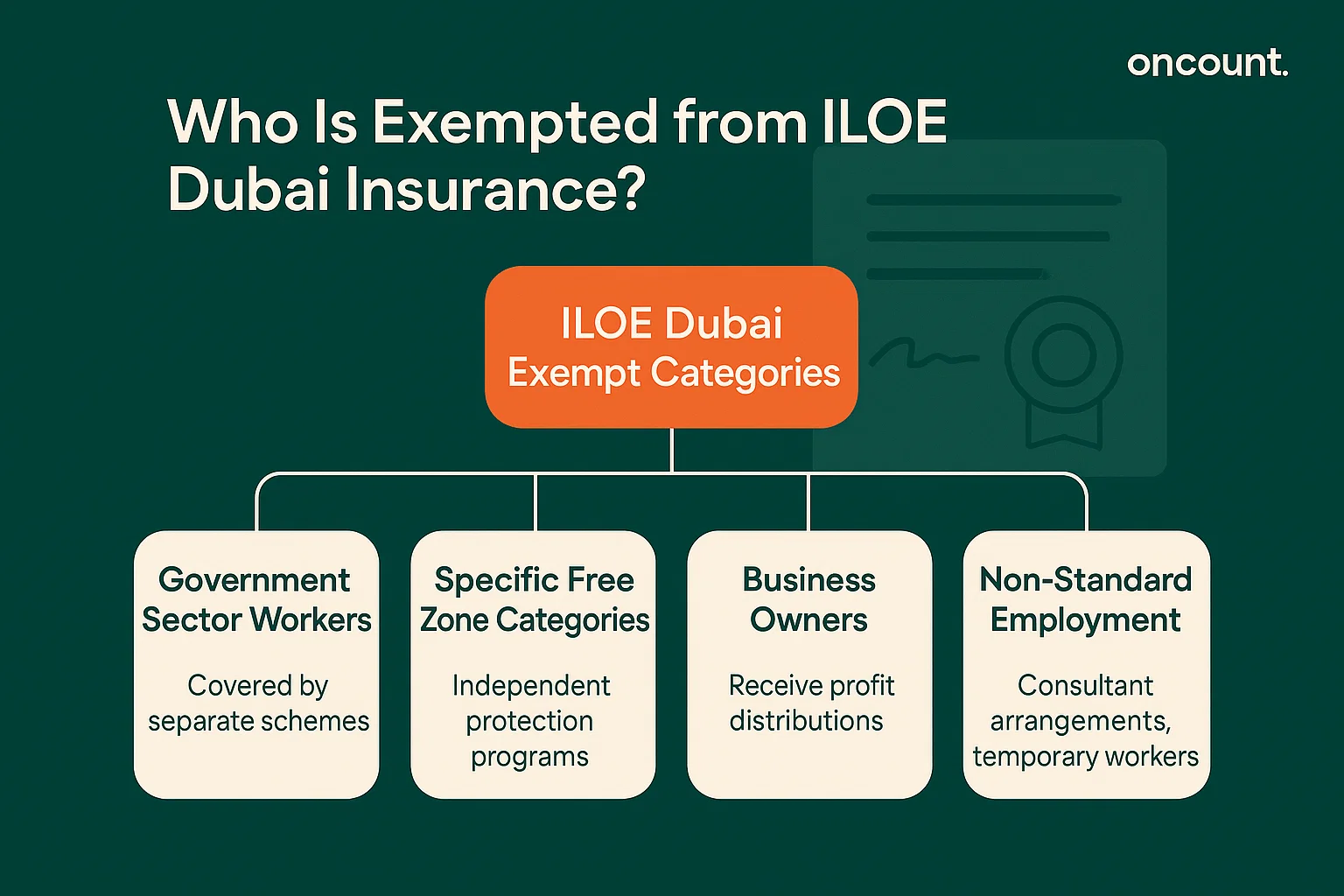

Who Is Exempted from ILOE Dubai Insurance?

Exemption categories in Dubai mirror federal provisions:

- Government Sector Workers: Employees of Dubai government departments, agencies, and wholly government-owned entities typically maintain coverage under separate pension and protection schemes.

- Specific Free Zone Categories: Workers in certain free zones that have established independent unemployment protection programs may be exempt from the federal scheme, though they must participate in equivalent local alternatives.

- Business Owners: Shareholders and partners who do not draw regular employee salaries but instead receive profit distributions fall outside mandatory subscription requirements.

- Non-Standard Employment: Certain consultant arrangements, temporary assignment workers, and specialized visa categories may be exempt based on specific Ministry determinations.

Employers in Dubai bear responsibility for verifying exemption applicability and maintaining documentation supporting any decision to exclude workers from mandatory subscription.

Claiming Benefits from ILOE Unemployment Insurance

The ultimate value of mandatory subscription manifests when eligible workers face job loss and require financial support during employment transitions. Understanding claim procedures, documentation requirements, and benefit calculations enables effective use of the protection mechanism.

Job Loss Coverage Details

The insurance scheme provides coverage specifically for involuntary termination scenarios. Qualifying events include:

- Economic Redundancy: Layoffs resulting from business downsizing, restructuring, or closure due to market conditions.

- Contract Non-Renewal: Situations where fixed-term employment contracts expire and employers opt not to extend or renew, provided the worker did not decline renewal offers.

- Business Insolvency: Company bankruptcy or liquidation proceedings that result in workforce termination.

- Position Elimination: Organizational changes that abolish specific roles, rendering the employment position obsolete.

The scheme explicitly excludes compensation for:

- Voluntary resignations, even under duress or dissatisfaction

- Termination for cause, including disciplinary dismissals, performance failures, or misconduct

- Probation period terminations within the first six months of employment

- Mutual agreement separations where workers receive negotiated exit packages

Workers must have maintained continuous coverage under the insurance scheme for at least 12 consecutive months before job loss to qualify for benefits. The consecutive months requirement ensures program sustainability and prevents strategic enrollment immediately before anticipated terminations.

How to Claim Unemployment Benefits

To submit your claim after qualifying job loss:

- Gather Documentation: Collect termination letters, final settlement documents, last three months’ salary certificates, and proof of job search activities.

- Access Claim Portal: Log into the ILOE portal or mobile app and navigate to the “Submit Claim” section.

- Complete Application: Provide required information including termination date, reason for separation, and current employment status.

- Upload Supporting Documents: Submit scanned copies of all required documentation through the portal’s secure upload interface.

- Await Assessment: Claims processing typically requires 15 to 30 business days as administrators verify employment records, premium payment history, and termination circumstances.

- Receive Determination: The system notifies applicants of claim approval or denial, providing detailed explanations for any adverse decisions.

Approved claims generate monthly benefit payments deposited directly into the worker’s registered bank account for the duration of the benefit period—typically three consecutive months, though this may vary based on contribution history and regulatory provisions.

Workers receiving benefits must maintain active job search activities and report new employment within specified timeframes to avoid benefit overpayments that require repayment.

Resolving ILOE Disputes

Claim denials or coverage disputes require formal resolution procedures:

- Internal Review: Workers can request reconsideration by submitting additional documentation or clarifying information through the ILOE call centre or written correspondence to the administering authority.

- Appeal Process: If internal review does not resolve the dispute satisfactorily, workers may escalate matters through formal appeals filed with the UAE Ministry of Human Resources dispute resolution mechanisms.

- Documentation Requirements: Successful appeals typically require comprehensive evidence demonstrating eligibility criteria satisfaction, including detailed employment histories, correspondence with former employers, and proof of involuntary termination circumstances.

- Legal Consultation: Complex disputes may benefit from consultation with UAE labor law specialists who can assess claim strength and representation options.

The ILOE website maintains detailed dispute resolution guidelines, including submission deadlines, required documentation formats, and expected processing timeframes.