Free Zone Basics and What it Means for Your Business in the UAE

Free zones function as designated economic territories within the United Arab Emirates, operating under distinct regulatory frameworks that differentiate them from mainland jurisdictions. These specialized areas were established through federal and emirate-level legislation to attract foreign direct investment and diversify the national economy beyond hydrocarbon sectors.

Understanding the fundamental characteristics of these zones enables informed decision-making regarding jurisdictional selection for company formation.

Key Benefits of UAE Free Zones for Foreign Ownership

The primary advantage of establishing operations within a free zone lies in the provision of 100% foreign ownership without requiring a local sponsor or service agent. This ownership structure contrasts with historical mainland requirements, though recent legislative reforms have expanded foreign ownership options in certain mainland sectors.

Additional benefits include:

Tax exemptions: Most free zone entities benefit from zero percent corporate tax on qualifying income, though recent federal corporate tax legislation introduced in 2023 requires careful analysis of qualifying free zone person status under Federal Decree-Law No. 47 of 2022.

Customs duty relief: Goods imported into free zones for re-export or storage typically benefit from suspension of customs duties, reducing landed costs for trading and logistics operations.

Simplified company formation: Free zone authorities streamline the process of business setup through standardized documentation requirements and accelerated approval timelines, often completing incorporation within five to ten business days.

Repatriation rights: Free zone regulations permit full repatriation of capital and profits without restrictions, providing financial flexibility for international investors.

Access to skilled talent: Most free zone packages offer competitive visa allocation tied to the number of employees and office space leased, facilitating workforce development.

Difference Between UAE Free Zone and Mainland Business Setup

The distinction between free zone and mainland establishment extends beyond ownership structures to encompass operational scope, market access, and regulatory compliance requirements.

Geographic market access: Mainland companies possess unrestricted rights to conduct business throughout the UAE domestic market. Free zone companies face limitations when trading with mainland customers, typically requiring appointment of a local distributor or agent, though regulations vary by emirate and free zone authority.

Physical presence requirements: Mainland setup generally requires a physical office within the emirate of license issuance. Depending on the free zone selected, businesses may choose between flexi-desk arrangements, serviced offices, or dedicated commercial space.

Regulatory oversight: Mainland entities fall under the jurisdiction of the Department of Economic Development in their respective emirate. Free zone companies report to their specific free zone authority, which administers licensing, compliance monitoring, and annual renewals.

VAT implications: Both structures require VAT registration when taxable supplies exceed AED 375,000 annually, as stipulated in Federal Decree-Law No. 8 of 2017. However, transactions between free zones designated as designated zones under FTA guidance may qualify for zero-rating.

Types of Free Zones to Choose: Industry-Specific vs General

Free zones in the UAE offer varying degrees of sectoral specialization. Understanding whether your business operations align with a specialized or general-purpose zone affects licensing options and available infrastructure.

Industry-specific zones cater to defined sectors such as media, healthcare, aviation, finance, or technology. Dubai Internet City exemplifies this model, focusing exclusively on information technology and digital businesses. These zones typically provide sector-tailored infrastructure, regulatory frameworks adapted to industry standards, and access to specialized talent pools. The trade-off involves potential restrictions on permissible business activities outside the designated sector.

General-purpose zones such as Jebel Ali Free Zone Authority (JAFZA) accommodate diverse business activities across trading, logistics, manufacturing, and services. This flexibility benefits entrepreneurs pursuing multiple revenue streams or anticipating business model evolution. The ecosystem in these zones supports varied industries, though specialized facilities may require additional investment.

The choice between models depends on the nature of your business, growth trajectory, and whether operational focus benefits from industry clustering or requires operational flexibility.

Key Factors to Consider When You Choose a Free Zone in the UAE

Selecting the right free zone in UAE requires systematic evaluation of multiple variables that directly impact operational efficiency, cost structures, and regulatory compliance. The following factors represent critical decision criteria supported by practical market experience.

Aligning Business Activities with Free Zone Offers

Each free zone authority maintains a defined list of permitted business activities, typically organized by commercial, industrial, or service classifications. Before initiating company formation, verify that the free zone allows your specific business activities under its licensing framework.

For example, a technology startup developing artificial intelligence solutions would naturally align with Dubai Silicon Oasis or Dubai Internet City, which offer licenses for software development, IT consulting, and e-commerce platforms. Conversely, a logistics enterprise specializing in import-export operations would benefit from proximity to transportation infrastructure offered by zones near Dubai International Airport or Jebel Ali Port.

Misalignment between your business model and permitted activities necessitates either modifying your operational scope or selecting a different zone, potentially causing delays and additional setup costs.

Location and Accessibility of the Free Zone

Geographic positioning influences supply chain efficiency, customer accessibility, and employee recruitment. Companies engaged in international trade prioritize proximity to major transportation nodes—the International Financial Centre location near Dubai International provides advantages for professional services firms, while JAFZA’s position adjacent to Jebel Ali Port serves maritime logistics operations.

Consider these location-dependent factors:

- Travel time for clients and business partners visiting your office space

- Commuting accessibility for employees across different emirates

- Proximity to residential areas in Abu Dhabi, Dubai, or other emirates where talent concentrations exist

- Access to complementary businesses within the broader ecosystem

Certain free zones across the UAE occupy remote locations offering lower costs but potentially limiting networking opportunities and talent attraction.

Cost of Company Formation and Business Setup

Business setup costs vary significantly across different free zones, influenced by factors including license type, office space requirements, visa allocations, and administrative fees. Understanding the complete cost structure prevents budget overruns during incorporation.

Initial expenses typically include:

- License issuance fees set by the free zone authority

- Share capital deposit requirements (though most zones have eliminated minimum capital mandates)

- Office lease commitments, ranging from virtual offices to physical office facilities

- Immigration card fees for UAE residence visa processing

- Document attestation and government processing charges

Some zones offer competitive packages bundling license, visa, and workspace at discounted rates for startups, while premium zones in Dubai command higher fees justified by brand recognition and infrastructure quality.

Infrastructure and Facilities in Different Free Zones

Physical infrastructure directly impacts operational capabilities. Manufacturing enterprises require industrial plots with utilities infrastructure, while technology companies prioritize high-speed internet connectivity and modern office buildings.

Evaluate infrastructure across these dimensions:

Telecommunications: Verify availability of fiber-optic connectivity, redundant internet service providers, and telecommunications infrastructure supporting digital business operations.

Utilities: Industrial operations need reliable electricity supply, water access, and waste management systems compliant with environmental regulations.

Transportation: Assess road connectivity, parking availability, and public transportation access for employee commuting.

Amenities: Many free zones include retail facilities, dining options, banking services, and recreational spaces that enhance employee satisfaction and client experiences.

Dubai Multi Commodities Centre exemplifies comprehensive infrastructure with Grade A office towers, conference facilities, and integrated business support services, whereas industrial zones prioritize warehouse space and logistics connectivity.

Licensing and UAE Residence Visa Options

Each free zone establishes visa quotas tied to license types and office space categories. A flexi-desk arrangement might permit two to three visas, while dedicated office space enables visa allocation proportional to square footage leased.

Visa categories available include:

- Investor visas for shareholders holding minimum equity percentages

- Employee visas for staff across all organizational levels

- Dependent visas allowing family members to reside in the UAE

- Golden visa opportunities in certain zones for investors meeting capital thresholds

The number of employees anticipated for your first operational year should align with visa capacity. Underestimating requirements necessitates costly office upgrades mid-term.

Reputation and Business Ecosystem Assessment

Brand perception influences customer trust, investor confidence, and talent acquisition. Established zones such as Dubai International Financial Centre carry premium market positioning that benefits professional services firms and financial institutions.

Beyond reputation, assess the ecosystem quality:

- Presence of industry peers facilitating networking and partnerships

- Track record of regulatory stability and transparent governance

- Responsiveness of the free zone authority to tenant inquiries and issues

- Availability of business support services including legal, accounting, and consulting firms

Newer zones may offer competitive pricing but lack the established community networks that support business development.

Deep Dive into Business Activities and Setup Needs

Defining permitted activities with precision ensures regulatory compliance and operational flexibility throughout your company’s lifecycle in the UAE.

Permitted Business Activities and License Types

Free zone authorities issue commercial, industrial, or service licenses depending on the nature of business. Commercial licenses authorize trading activities including import, export, and distribution. Industrial licenses cover manufacturing and production operations. Service licenses apply to consulting, professional services, and other service-based business models.

Within each category, authorities specify detailed activity descriptions. For example, a commercial license might list “trading in electronics” as distinct from “trading in textiles.” These specifications appear on the trade license and determine permissible operational scope under UAE commercial regulations.

Certain regulated activities—financial services, healthcare, educational services, and food production—require additional approvals from federal regulatory bodies beyond free zone licensing. Understanding these requirements prevents operational disruptions after company formation.

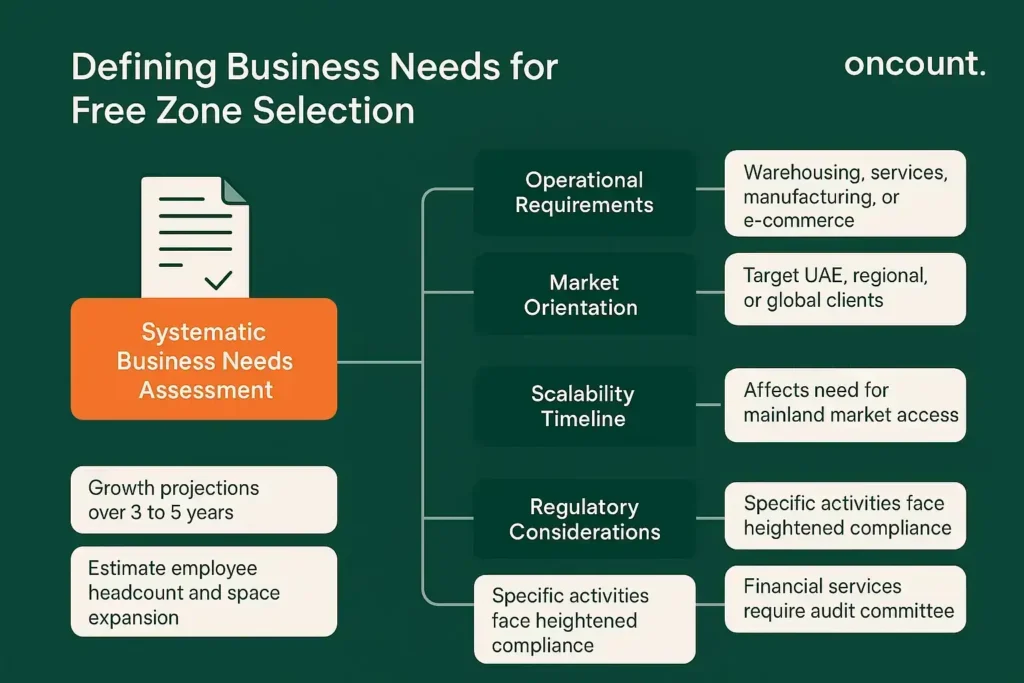

How to Define Your Business Needs for Free Zone Selection

Systematic assessment of current and projected business needs provides clarity for selecting the right free zone. Begin by documenting:

Operational requirements: Will your enterprise engage in warehousing, office-based services, light manufacturing, or e-commerce fulfillment? Each model demands different infrastructure.

Market orientation: Does your business model target UAE customers, regional markets, or global clients? This distinction affects the importance of mainland market access versus international connectivity.

Scalability timeline: Estimate growth projections over three to five years, including anticipated employee headcount, space expansion, and additional licenses for subsidiary activities.

Regulatory considerations: Specific business activities face heightened compliance requirements. Financial services operations require audit committee establishment and Economic Substance Regulations compliance, while trading companies must maintain proper customs documentation.

This analysis narrows the suitable free zone options from over 40 choices to a shortlist of three to five candidates warranting detailed evaluation.

Options for Combining Multiple Business Activities

Most free zone licenses permit multiple business activities under a single license, provided all activities fall within the zone’s permitted scope and the entrepreneur pays applicable fees for additional activity listings.

For example, a technology company might combine “software development,” “IT consulting,” and “e-commerce platform operation” on one license. This consolidation avoids establishing separate legal entities for related operations.

However, combining significantly different activities—such as trading and manufacturing—may require multiple licenses or specific approvals. Certain zones limit the number of activities per license or charge incremental fees beyond a base allocation.

When planning to combine activities, confirm with the specific free zone authority whether proposed combinations are permissible under their regulations and request a cost breakdown for multi-activity licensing.

Cost Evaluation for Business Setup in a Free Zone

Comprehensive cost analysis extends beyond initial company formation to encompass recurring operational expenses that affect long-term financial sustainability in the UAE.

Initial Incorporation and Annual Free Zone Fees

Setup costs comprise one-time incorporation expenses and recurring annual fees. Initial costs include:

- License application and issuance fees varying by activity type

- Commercial registration charges

- Lease deposit and advance rent for office space

- Visa processing fees for initial personnel

- Legal documentation and attestation expenses

Annual renewal costs typically include license renewal fees, office lease payments, visa renewal charges, and any regulatory compliance expenses such as audit requirements or Economic Substance Regulations filings.

Budget for total first-year costs ranging from AED 15,000 for minimal flexi-desk setups in cost-effective zones to AED 150,000 or higher for comprehensive packages in premium Dubai locations with multiple visas and dedicated office facilities.

Request detailed quotations from multiple free zones, ensuring breakdowns specify all mandatory versus optional costs. Hidden fees sometimes emerge during the application process, particularly for document processing or government approvals.

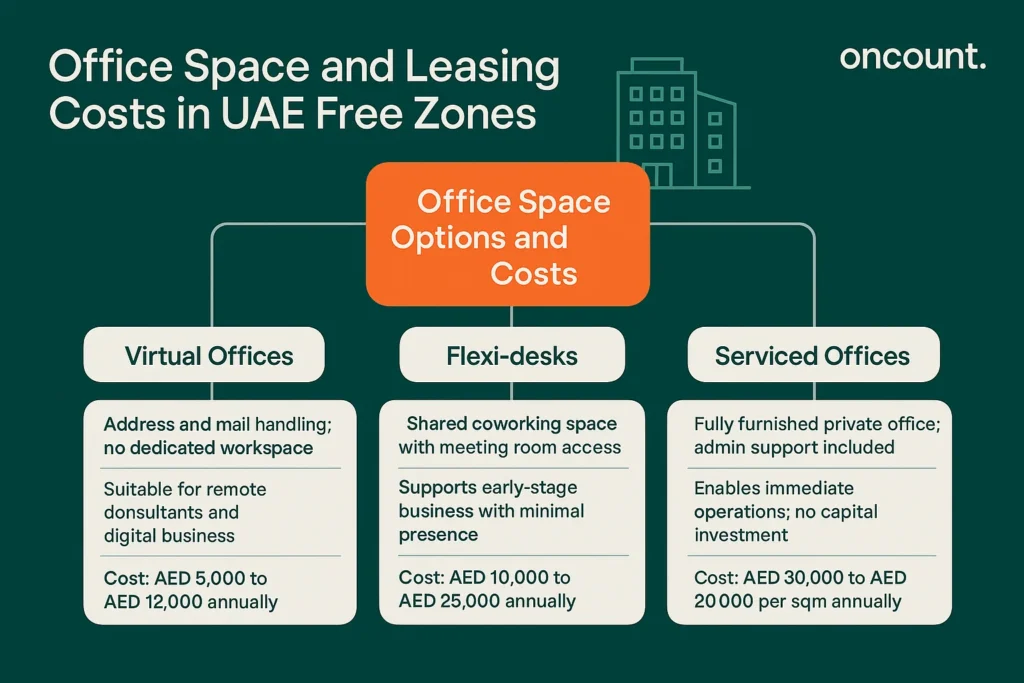

Office Space and Leasing Costs

Office space represents the most significant variable cost when you set up your business in a free zone. Options range across these categories:

Virtual offices: Provide a business address and mail handling without dedicated workspace. Suitable for consultants and digital entrepreneurs operating remotely. Cost ranges from AED 5,000 to AED 12,000 annually.

Flexi-desks: Shared coworking arrangements with access to common areas and meeting rooms. Supports early-stage businesses requiring minimal physical presence. Annual costs typically range from AED 10,000 to AED 25,000.

Serviced offices: Fully furnished private offices with utilities, internet, and administrative support included. Enables immediate operations without capital investment in fit-outs. Pricing varies from AED 30,000 to AED 100,000 annually depending on size and location.

Dedicated space: Unfurnished or shell offices leased on multi-year terms. Provides customization flexibility for established businesses. Costs depend on square footage and zone location, ranging from AED 600 to AED 2,000 per square meter annually.

Ensure the free zone’s office space options align with visa requirements, as most authorities tie visa quotas to minimum space thresholds.

Understanding Visa Allocation and Associated Expenses

UAE residence visa allocation follows formulas established by each free zone authority, typically based on office space size and license type. A standard pattern allocates one visa per 100-150 square feet of office space, though specific rules vary.

Visa-related expenses include:

- Immigration card fees charged by the General Directorate of Residency and Foreigners Affairs

- Medical fitness test costs

- Emirates ID card issuance fees

- Typing center charges for document processing

- Visa change status fees for employees transferring from other sponsors

Total per-visa costs typically range from AED 3,000 to AED 5,000 when processing through free zone channels. Multiply this by your anticipated team size to budget employee onboarding expenses.

For businesses requiring more visas than standard allocations permit, upgrading to larger office space becomes necessary, creating cascading cost implications.

Location, Infrastructure, and Office Space Requirements

Physical positioning within the broader UAE commercial landscape and the quality of available facilities materially affect operational performance and growth potential.

Proximity to Key Logistics Hubs (Ports, Airports)

Businesses engaged in international trade, logistics, or import-export operations derive significant efficiency gains from locating near major transportation infrastructure. Jebel Ali Port handles approximately 60% of UAE container traffic, making adjacent free zones optimal for maritime logistics operators.

Similarly, free zones near Dubai Airport or Abu Dhabi International Airport benefit air cargo operations, courier services, and businesses requiring frequent international travel for principals and employees.

Calculate the impact of location on:

- Transit times for goods movement and customs clearance

- Transportation costs for inventory distribution

- Employee and client travel convenience

- Emergency logistics responses

Remote zones may offer lower rents but impose higher transportation overhead that erodes nominal savings.

Availability of Skilled Labor in the Free Zone

Access to qualified professionals varies by zone location and the surrounding emirate. Dubai and Abu Dhabi host the largest talent pools across professional services, technology, finance, and creative industries, supported by established residential communities and lifestyle amenities.

Northern emirates offer lower living costs that appeal to cost-conscious employees, though specialized skill availability may be limited, requiring businesses to sponsor visa transfers from other emirates or recruit internationally.

When evaluating zones, research:

- Commuting accessibility from major residential areas

- Presence of other employers in your sector that signal talent availability

- Educational institutions nearby that supply graduate talent

- Cost of living in the emirate affecting salary requirements

Successful business growth depends on attracting and retaining qualified personnel, making labor market accessibility a strategic consideration.

Specific Needs for Warehousing or Industrial Plots

Manufacturing enterprises and distribution operations require industrial facilities that general commercial zones cannot accommodate. Dedicated industrial free zones provide:

- Industrial land plots for custom facility construction

- Pre-built warehouse facilities with loading docks and logistics access

- Utility infrastructure supporting high-power machinery

- Zoning permissions for manufacturing processes and chemical storage

- Proximity to raw material suppliers and transportation networks

Dubai Industrial City, Ras Al Khaimah Economic Zone, and similar specialized areas cater to these requirements with industrial-grade infrastructure.

Assess whether your operations involve hazardous materials, require environmental permits, or need specialized utilities such as high-voltage power or industrial water supply. These factors necessitate selecting zones equipped for industrial operations.

Digital Infrastructure in City Free Zone Offers

Technology-dependent businesses—including e-commerce platforms, software development firms, digital marketing agencies, and fintech startups—require robust digital infrastructure that not all zones provide equally.

Dubai Internet City pioneered technology-focused infrastructure with redundant fiber-optic networks, cloud service provider access points, and telecommunications carrier diversity. These capabilities enable:

- High-bandwidth internet connectivity supporting data-intensive operations

- Low-latency networking for real-time applications

- Reliable uptime meeting service level agreements for digital products

- Cybersecurity infrastructure and compliance with data protection regulations

Before selecting a zone for digital business operations, verify available internet service providers, typical bandwidth specifications, and any limitations on connectivity options.

Legal Structure and UAE Residence Visa Management

Establishing the appropriate corporate structure and managing visa compliance represents foundational elements of successful business in the UAE.

Choosing the Right Legal Entity for Your Free Zone Business

Free zone companies typically incorporate as Free Zone Limited Liability Companies (FZ-LLC) with one or more shareholders. This structure provides:

- Limited liability protection, restricting shareholder exposure to invested capital

- Corporate personality separate from owners

- Flexibility to issue shares to multiple investors

- Eligibility for corporate banking relationships

Alternative structures exist for specialized situations:

Branch offices: Foreign companies may establish branches to conduct activities identical to the parent company’s operations. This structure benefits international corporations expanding UAE presence without creating independent subsidiaries.

Free Zone Establishments (FZE): Single-shareholder entities offering simplified governance. Suitable for solo entrepreneurs or wholly-owned subsidiaries.

Consult with legal advisors familiar with UAE commercial law to determine which structure best supports your governance requirements, liability concerns, and future capital-raising plans.

Understanding Minimum Capital and Liabilities

Most free zones have eliminated minimum share capital requirements, allowing companies to incorporate with nominal capital of AED 1,000 or less. This reform lowered barriers for startups and small businesses entering the market.

However, certain regulated activities maintain capital requirements:

- Financial services companies may require minimum paid-up capital ranging from AED 1 million to AED 10 million depending on license type

- Insurance agencies and brokers face specific capital adequacy requirements

- Industrial operations sometimes require demonstrated financial capacity for environmental compliance

Beyond regulatory minimums, consider maintaining adequate working capital to support initial operating losses, inventory purchases, and receivables financing. Undercapitalization represents a common cause of early-stage business failure.

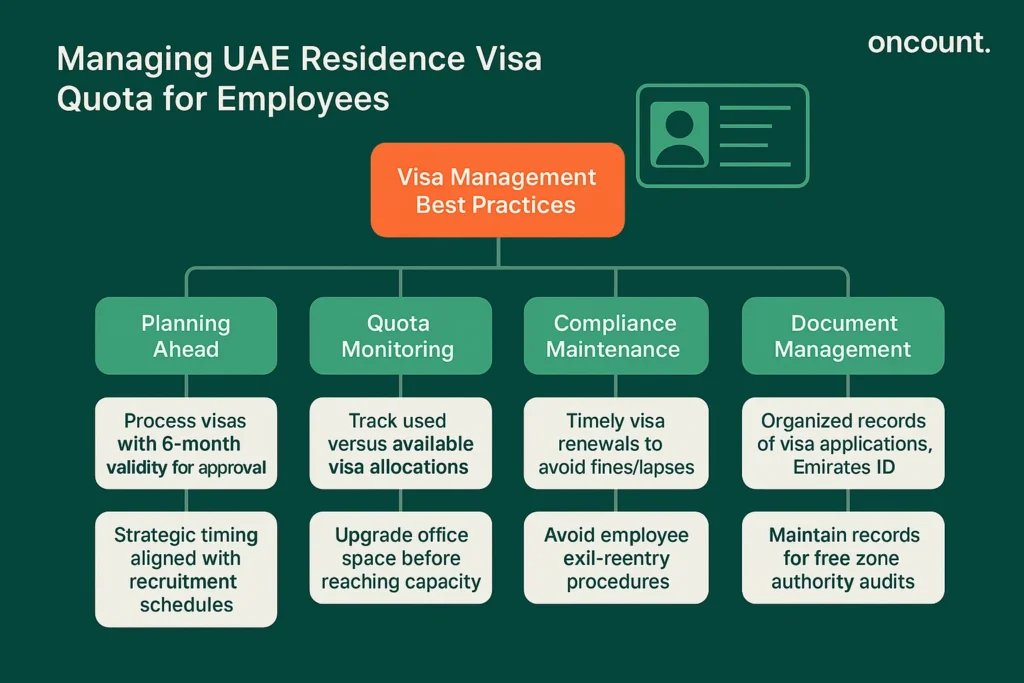

Managing UAE Residence Visa Quota for Your Employees

Effective visa management ensures adequate allocation for current team requirements while maintaining flexibility for future hires. Best practices include:

Planning ahead: Process visa applications allow six months validity after approval, requiring strategic timing to align with recruitment schedules.

Quota monitoring: Track used versus available visa allocations, initiating office upgrades before reaching capacity to prevent hiring delays.

Compliance maintenance: Ensure timely visa renewals, avoiding lapses that trigger fines and require employee exit-reentry procedures.

Document management: Maintain organized records of visa applications, medical tests, Emirates ID cards, and labor contracts satisfying free zone authority audits.

Some zones permit visa quota increases through additional fee payments without office expansion, though verification of specific policies is necessary.

Corporate Bank Account Opening for Free Zone Companies

Establishing banking relationships represents a critical milestone, often requiring two to four weeks after company incorporation. UAE banks apply stringent due diligence standards under Central Bank Anti-Money Laundering regulations.

Required documentation typically includes:

- Trade license and memorandum of association

- Passport copies and Emirates ID for all shareholders and signatories

- Board resolution authorizing account opening and designating signatories

- Business plan outlining activities, funding sources, and projected transactions

- Proof of office address through tenancy contract or ejari registration

- Detailed shareholder structure with ultimate beneficial ownership disclosure

Certain business activities—money services, precious metals trading, high-risk jurisdictions—face enhanced scrutiny or account denials. Prepare for extended due diligence timelines and potential requests for additional documentation.

Comparing banking packages across multiple institutions often reveals significant differences in fees, transaction limits, and international banking capabilities relevant to your specific business model.

Spotlight on Popular Free Zones to Choose: Dubai and Abu Dhabi

The UAE’s diverse free zone landscape includes specialized jurisdictions catering to specific industries alongside general-purpose zones accommodating varied business models. The following zones represent frequently selected options, though entrepreneurs should evaluate all alternatives before making an informed decision.

Dubai Multi Commodities Centre (DMCC) Overview

Located in Jumeirah Lakes Towers, DMCC ranks among the world’s largest free zones by company count, hosting over 20,000 registered entities. The zone emphasizes commodities trading, precious metals, and related services, though it accommodates diverse business activities.

Key advantages include:

- Strategic location in central Dubai with extensive office tower inventory

- Established reputation attracting multinational corporations and commodity traders

- Competitive license packages with flexible office space options

- Strong regulatory framework and transparent fee structures

- Extensive networking opportunities through regular business events

DMCC offers general trading licenses, specialized commodity trading permissions, and service licenses across consulting, marketing, and professional services. The zone’s focus on gold and diamond trading provides specialized infrastructure including vaults and certification services.

Annual costs vary significantly based on office selection, with flexi-desk arrangements starting around AED 15,000 and premium tower offices commanding AED 100,000-plus for dedicated space. Visa allocations follow standard formulas based on office size.

Jebel Ali Free Zone (JAFZA)

Operating since 1985, JAFZA represents the UAE’s largest and oldest free zone, strategically positioned adjacent to Jebel Ali Port. The zone accommodates over 8,500 companies engaged in logistics, manufacturing, and international trade.

Distinctive features include:

- Direct access to the Middle East’s busiest container port

- Extensive warehouse facilities and industrial land plots

- Customs duty suspension for goods transiting through the zone

- Established logistics ecosystem with freight forwarders and shipping lines

- Multiple office complexes serving diverse business sizes

JAFZA suits businesses prioritizing maritime logistics, import-export operations, and manufacturing. The zone offers flexible licensing including general trading, industrial manufacturing, and service company options.

Entry-level costs begin around AED 12,000 for license-only packages, though operational businesses typically invest AED 40,000-AED 80,000 annually including office space and initial visa allocations.

Ras Al Khaimah Economic Zone (RAKEZ)

Positioned in the northern emirate of Ras Al Khaimah, RAKEZ provides cost-effective establishment options while maintaining comprehensive business support services. The zone serves over 14,000 companies across manufacturing, trading, and consulting sectors.

Competitive advantages include:

- Lower setup costs compared to Dubai-based alternatives

- Simplified incorporation processes with accelerated approval timelines

- Industrial infrastructure supporting manufacturing and production

- Growing business ecosystem across diverse sectors

- Proximity to the Port of Ras Al Khaimah for maritime trade

RAKEZ offers flexible office solutions including flexi-desks, serviced offices, and industrial facilities. The zone particularly appeals to cost-conscious startups and manufacturing enterprises seeking affordable industrial space.

Typical first-year costs range from AED 10,000 for basic packages to AED 50,000 for comprehensive setups including dedicated office space and multiple visas. The zone’s distance from Dubai—approximately 90 minutes by road—represents the primary trade-off against cost savings.

Sharjah Publishing City Free Zone (SPC FZ)

Specialized for publishing, printing, media production, and content creation businesses, Sharjah Publishing City offers sector-focused infrastructure and regulatory frameworks. The zone serves approximately 5,000 entities, primarily small to medium enterprises.

Notable characteristics include:

- Printing and production facilities available for lease

- Media-specific licensing covering publishing, broadcasting, and content distribution

- Cultural orientation aligning with Sharjah’s UNESCO designation as World Book Capital

- Cost-effective packages relative to Dubai alternatives

- Proximity to Sharjah International Airport

The zone suits publishers, media producers, advertising agencies, and creative enterprises. License types accommodate traditional publishing, digital media, and multimedia production.

Annual costs typically range from AED 12,000 to AED 45,000 depending on activity scope and office requirements. The emirate’s lower operational costs benefit businesses prioritizing budget optimization over central Dubai positioning.

Masdar City Free Zone Offers in Abu Dhabi

Masdar City represents Abu Dhabi’s initiative for sustainable development and clean technology innovation. The free zone attracts companies focused on renewable energy, environmental technology, and innovation-driven sectors.

Distinguishing elements include:

- Purpose-built sustainable infrastructure meeting LEED certification standards

- Focus on clean technology, renewable energy, and research-intensive businesses

- Access to Khalifa University research facilities and talent pipeline

- Government support for innovation through grants and partnerships

- Modern office facilities and laboratory spaces

The zone particularly suits technology startups, research entities, and companies seeking alignment with sustainability-focused branding. Licensing covers renewable energy services, environmental consulting, and technology development.

Costs reflect Abu Dhabi’s premium market positioning, with typical packages ranging from AED 20,000 to AED 80,000 annually. The zone’s specialized focus means entrepreneurs should verify activity alignment before pursuing establishment.

Alternative Free Zone Options in Other Emirates (Fujairah, Ajman, UAQ)

Beyond major zones in Dubai and Abu Dhabi, several emirates offer free zone alternatives providing specific advantages:

Fujairah Free Zone: Maritime focus leveraging the emirate’s Indian Ocean port. Suits trading companies requiring access to Asian markets without navigating the Arabian Gulf. Competitive pricing and simplified procedures appeal to international traders.

Ajman Free Zone: Budget-conscious option with general trading and service licenses. Lower costs attract startups willing to operate from smaller emirates. Reasonable access to Dubai and Sharjah labor markets.

Umm Al Quwain Free Zone: Cost-effective choice for manufacturing and trading operations. Industrial land availability at competitive rates benefits production-focused businesses.

These alternatives warrant consideration when cost optimization takes precedence over premium locations, particularly for businesses serving international rather than local UAE markets.

Step-by-Step Guide to Set Up Your Business in a UAE Free Zone

Systematic approach to free zone selection and company formation reduces errors, accelerates timelines, and ensures regulatory compliance from inception.

Determine Your Core Business Needs and Goals

Begin by documenting comprehensive requirements across operational, financial, and strategic dimensions:

Operational scope: Define primary business activities, ancillary services, and potential future expansions. Clarity regarding whether your enterprise engages primarily in trading, services, or manufacturing narrows suitable zones.

Market strategy: Identify target customers—mainland UAE clients, regional markets, or international buyers. This distinction affects the importance of mainland access versus logistics connectivity.

Financial constraints: Establish realistic budgets for initial setup and first-year operations. Include contingency reserves for unexpected costs or slower-than-projected revenue generation.

Growth timeline: Project three-year growth scenarios including employee headcount, facility requirements, and potential additional licenses or subsidiary entities.

This foundational work provides objective criteria for evaluating free zone options against business requirements.

Shortlist the Most Suitable Free Zones

Using documented requirements, compile a shortlist of three to five zones warranting detailed evaluation. Assessment criteria should include:

- Permitted business activities matching your operational scope

- Cost structures fitting within budget parameters

- Location accessibility for team and clients

- Infrastructure meeting operational requirements

- Visa capacity supporting projected hiring

- Reputation and ecosystem quality

Request detailed information packages from shortlisted zones, including fee schedules, license application forms, and sample contracts. Many zones offer consultations explaining their specific advantages and procedures.

Conduct site visits when feasible, inspecting actual office facilities, meeting zone representatives, and observing the surrounding business environment. Direct observation often reveals practical considerations not evident from marketing materials.

Consulting Experts for Accurate Selection

Engaging professional advisors familiar with UAE business setup streamlines decision-making and helps avoid common pitfalls. Business setup consultancies maintain relationships with multiple free zones, understanding nuanced differences between similar-appearing options.

Expert advisors provide value through:

Comparative analysis: Objective evaluation of shortlisted zones against your specific requirements, highlighting often-overlooked factors affecting long-term satisfaction.

Cost optimization: Identification of promotional packages, negotiation leverage points, and cost-saving alternatives within each zone.

Compliance guidance: Explanation of Economic Substance Regulations, VAT registration requirements, and other regulatory obligations varying by zone and activity.

Application efficiency: Management of documentation preparation, government submissions, and follow-up communications, reducing timelines and error-related delays.

While advisory fees represent additional costs, the expense typically proves modest relative to poor zone selection consequences or application errors causing expensive corrections.

Finalizing and Submitting the Application

Once you select a free zone, finalize the application process by:

- Company name reservation: Submit proposed names following zone naming conventions. Most authorities maintain online portals showing name availability and processing reservations within 24-48 hours.

- Document preparation: Compile required documentation including passport copies, business plans, activity descriptions, and shareholder agreements. Certain documents require attestation by UAE embassies or consulates in shareholders’ home countries.

- License application: Complete detailed application forms specifying activities, shareholders, capital structure, and initial visa requirements. Submit through the zone’s registration portal along with processing fees.

- Review and approval: Free zone authorities review applications for completeness and regulatory compliance. Processing typically requires five to ten business days, though complex applications involving multiple activities or unusual structures may require additional review.

- License issuance: Upon approval, pay final fees and receive the trade license authorizing business commencement. Simultaneously process office lease agreements and commence visa applications.

Maintain organized records throughout the process, as documentation supports subsequent banking relationships, VAT registration, and ongoing compliance requirements.

Common Mistakes to Avoid When You Choose a Free Zone

Learning from frequently observed errors helps entrepreneurs make more informed decisions and avoid costly corrections after establishment.

Neglecting Long-Term Goals of Your Business

Short-term cost optimization without considering growth trajectories leads to premature relocations. A freelancer operating from a flexi-desk arrangement initially may discover inadequate visa capacity when hiring employees necessitates expensive mid-contract office upgrades.

Similarly, selecting a zone based solely on promotional pricing without verifying activity scope accommodates future product lines creates limitations when expanding operations. Ensure the free zone’s permitted activities encompass reasonable business evolution scenarios.

Consider these forward-looking factors:

- Scalability of office space within the same zone to avoid relocation costs

- Flexibility to add business activities under existing licenses

- Track record of stable fee structures versus zones with unpredictable renewal cost increases

- Quality of business ecosystem supporting partnership development as your company matures

Making sound business decisions at inception prevents disruptive changes that distract management attention and consume financial resources.

Miscalculating Total Annual Renewal Costs

First-year promotional rates often mask higher renewal costs in subsequent years. Request multi-year cost projections including license renewals, office lease escalations, and visa processing fees to understand true ongoing expense commitments.

Particularly scrutinize:

- Base license renewal fees

- Per-activity charges if additional activities were included

- Office rent increases specified in tenancy contracts

- Visa renewal costs multiplied by projected employee count

- Government fee inflation historically applied by the zone

Compare total three-year cost projections across shortlisted zones rather than focusing solely on initial setup expenses. Some zones with higher entry costs prove more economical over time due to stable renewal pricing, while apparently cheaper alternatives impose aggressive annual increases.

Misunderstanding Mainland Market Access Rules

Free zone companies face restrictions when selling to UAE mainland customers, though specific rules vary by emirate and free zone type. Common misconceptions include:

Assumption of unrestricted access: Most free zones require appointment of a local distributor or commission agent for mainland sales, adding intermediary costs that erode margins.

Designated zone benefits: Certain free zones designated under Federal Tax Authority regulations offer enhanced mainland access for specific activities. Verify whether your zone holds designated status and whether your activities qualify.

E-commerce exceptions: Online sales to UAE consumers may require different treatment than physical goods distribution. Current regulations remain subject to interpretation, requiring professional advice.

If significant mainland sales represent a core business element, carefully evaluate whether mainland establishment provides superior long-term economics despite higher initial costs and local partnership requirements.