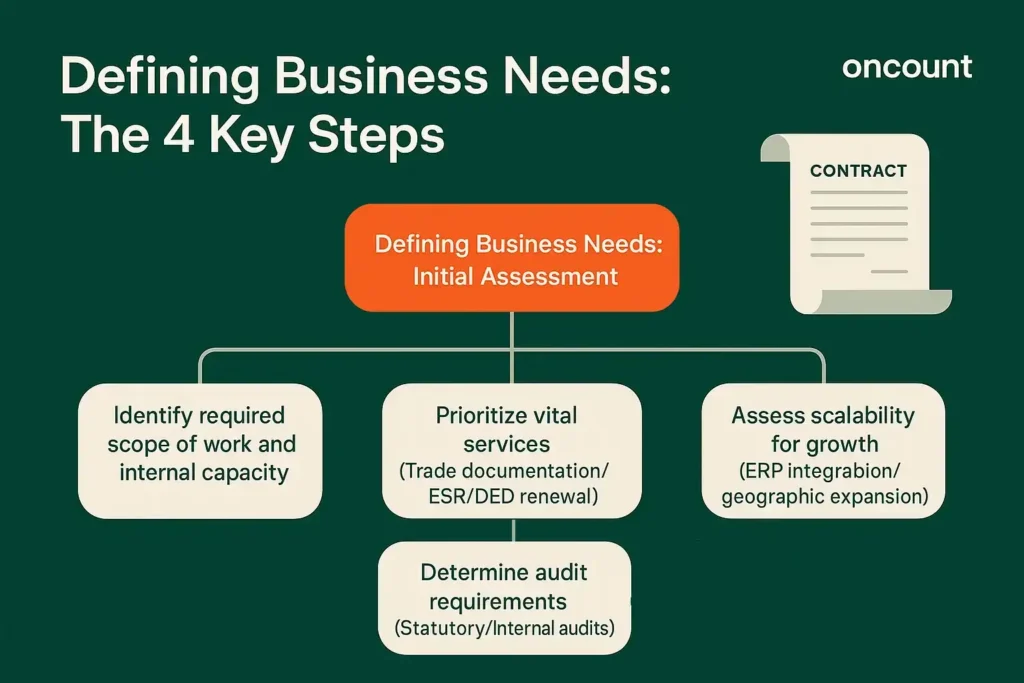

Define Business Needs

Understanding your company’s internal capabilities and external compliance obligations is the essential first step in selecting an accounting partner. This phase requires meticulous self-assessment to clearly define the required scope of work and the standards expected from your future financial service provider.

Identify Required Accounting Services Scope

Before initiating a search, businesses must choose a firm after defining the exact scope of services required. This involves assessing current internal capacity against operational needs. Do you require full outsourced bookkeeping services in the UAE, periodic financial reviews, or specialized support for complex transactions? Clear definition prevents mismatch and ensures you select the right accounting service provider. The scope should meticulously outline which financial functions remain in-house and which are delegated. Core functions to consider include:

- Daily transaction recording and invoice management.

- Monthly or quarterly financial statement preparation (IFRS interpretation).

- Payroll management and expense reconciliation.

- Fixed asset register maintenance and depreciation calculations.

- Initial setup, registration, and charting of accounts compliant with local regulatory standards.

Prioritize Businesses in Dubai Needs

The regulatory landscape varies significantly between mainland Dubai and its numerous free zones. Businesses operating in trade, real estate, or technology will have different reporting requirements. Prioritization means determining which services—such as specific trade finance documentation support or Economic Substance Regulations (ESR) compliance—are immediately vital to your operating model.

For companies in free zones, the ability of the firm to manage the “Qualifying Income” definition under the Corporate Tax Law is paramount. Mainland entities, conversely, require expertise in DED licensing renewal financial documentation and municipal fee reconciliation. Your prioritized list should act as a blueprint, guiding the selection toward a firm that provides services precisely where internal knowledge gaps are greatest.

Assess Scalability Requirements

Growth is a constant in the UAE. A reliable accounting firm should be able to scale their services as your business expands. This includes handling increased transaction volumes, geographical expansion across the UAE, or the addition of new legal entities, ensuring seamless and accurate accounting throughout the growth cycle.

Scalability involves the firm’s capability to integrate different enterprise resource planning (ERP) systems as your business matures, and to advise on the financial structuring of international expansion or new lines of business. When interviewing potential partners, inquire about their client portfolio growth and how their service teams handle significant, rapid increases in client activity without compromising service quality. A firm’s proactive stance on technology adoption is usually a good indicator of their scalability potential.

Determine Audit Requirements

Nearly all companies in Dubai are required to have their financial statements audited annually. Whether you need a local partner for statutory reporting or a firm with international affiliations for global consolidation, defining your audit requirements upfront is essential to find the right accounting firm that can provide comprehensive accounting and auditing services.

For larger entities or those planning IPOs, the requirement may extend to internal audits, risk management assessments, and assurance services. Furthermore, firms providing audit services must be registered with the relevant free zone authorities (like DMCC or DIFC) and the Ministry of Economy, ensuring their reports are legally recognized. Clear communication about the expected level of audit rigor, independence, and the chosen reporting framework (IFRS or IFRS for SMEs) is vital before engagement.

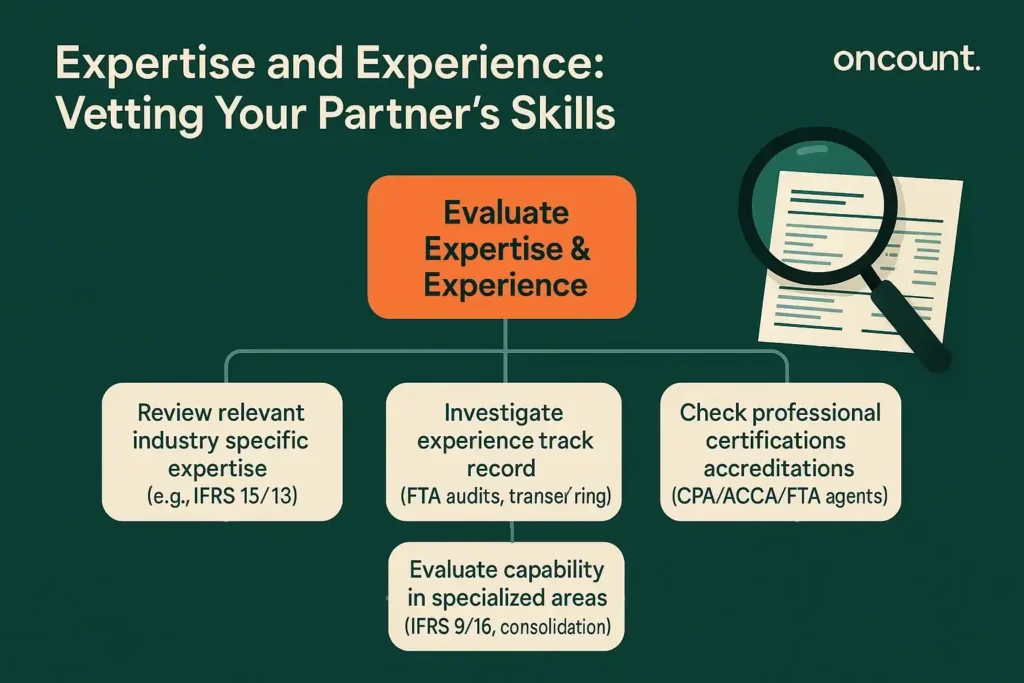

Evaluate Expertise and Experience

The competence of your chosen accounting firm is directly tied to the experience and depth of knowledge held by its team. Evaluating their track record across various metrics, especially in the context of the UAE’s evolving tax and financial regulations, is non-negotiable for mitigating financial and compliance risks.

Review Relevant Industry-Specific Expertise

Look for firms that have proven experience within your specific sector, be it construction, hospitality, or financial services. This specific expertise ensures the firm understands the standard operational challenges and industry-specific financial reporting nuances, which is particularly crucial for complex sectors like real estate or cryptocurrency trading in designated zones.

Industry-specific knowledge means they are familiar with revenue recognition under IFRS 15 for construction projects or valuation methods under IFRS 13 for financial assets. Without this specialized understanding, your firm runs the risk of misclassification, leading to material misstatements in financial reports or non-compliance penalties from the FTA. Seek out firms that can demonstrate a deep portfolio within your sector.

Investigate Experience Track Record

When selecting an accounting firm, investigate their history. Firms with proven success in handling challenging compliance or large-scale financial reporting projects demonstrate the depth of knowledge necessary for high-stakes advisory. Ask for anonymized case studies or client testimonials that reflect their ability to navigate complex UAE tax laws.

Specifically, inquire about their experience in dealing with FTA audits, VAT voluntary disclosures, or complex transfer pricing documentation, especially for multi-jurisdictional businesses. A strong track record in mitigating financial risks and achieving favorable audit outcomes provides a tangible measure of their capability and the value they can bring to your organization. Experience in implementing the Corporate Tax structure is now a paramount indicator of a firm’s currency and competence.

Check Professional Certifications and Accreditations

Verify that the staff, particularly the senior team, hold internationally recognized certifications (like CPA or ACCA) and are registered as chartered accountants with local authorities. This ensures the delivery of accurate accounting and adheres to professional standards.

Furthermore, ensure the firm is registered with the relevant free zone and mainland regulatory bodies. Beyond international qualifications, look for local accreditation, such as FTA-registered tax agents, which is mandatory for specific tax advisory roles. This blend of global expertise and hyper-local certification is the definitive marker of a truly competent and compliant accounting partner in the UAE market. Always request to see the registration status of the lead partner who will oversee your account.

Evaluate Industry-Specific Expertise

Beyond general accounting, assess their capability in specialized areas. For example, if you are a holding company, can they competently handle consolidation and inter-company transactions? For financial institutions, their experience with IFRS 9 is paramount.

The firm should possess expertise in areas like asset capitalization policies for heavy industries (IFRS 16 Leases), derivative accounting for commodities traders, or specialized inventory valuation for retail. This focused competence transforms the firm from a simple service provider into a strategic advisor capable of optimizing your sector-specific financial performance and minimizing compliance exposure in highly regulated areas.

Assess Mastery of UAE Corporate Tax and VAT

With the introduction of UAE Corporate Tax, mastery of the Federal Tax Authority (FTA) regulations is non-negotiable. The trusted accounting firm you choose should be able to provide detailed advisory on VAT filing, corporate tax assessment, and international tax treaties, distinguishing clearly between the mainland and free zone regimes.

This mastery is critical for tax efficiency and covers several complex areas:

- Tax grouping applications and related-party transaction disclosures.

- Transfer pricing documentation in line with OECD guidelines.

- VAT expertise in the reverse charge mechanism, imports/exports, and property sector transactions.

- Understanding the 9% Corporate Tax rate application, particularly for free zone entities qualifying for the 0% regime.

By mastering these details, the firm ensures you benefit from all eligible VAT refund schemes while avoiding costly compliance errors.

Check Credentials, Licenses, and Team Structure

A professional accounting partnership relies on verified credentials, full licensing, and the organizational structure of the team providing the service. Due diligence in this area confirms the firm’s legal standing, operational capacity, and commitment to international standards of professionalism.

Confirm Full Service Team Support

The best accounting firm is not a single consultant, but a dedicated team. Ensure the firm includes specialized roles such as tax experts in the UAE, auditors, and financial analysts, guaranteeing comprehensive support across all financial domains.

A quality firm should use a multi-layered support structure, typically involving:

- A dedicated Account Manager for daily operations.

- A senior Chartered Accountant for review and assurance.

- A specialized Tax Specialist for quarterly VAT and annual Corporate Tax filings.

This structure minimizes single-point-of-failure risks and ensures that even complex, time-sensitive queries are addressed by the appropriate subject matter expert, guaranteeing seamless coverage throughout the year.

Verify Regulatory Registration

All accounting firms in Dubai must hold valid trade licenses and professional registrations. For audit firm services, they must be registered with the relevant licensing authority (like the Department of Economic Development or a Free Zone Authority) and the Ministry of Economy. This verification step is fundamental to ensure compliance with UAE regulations.

Request proof of their professional indemnity insurance (PII). PII is a critical safeguard, offering assurance that you are protected against any professional negligence or errors in their service delivery, thereby underscoring their professionalism and commitment to risk management. This registration verification should be conducted annually as part of your ongoing due diligence process.

Research Top Accounting Firms’ Reputation and References

A reputable accounting firm will have transparent and verifiable client testimonials. Look beyond marketing material and seek independent references from businesses of similar size and complexity. The stability and longevity of the firm in the UAE often speak volumes about their trustworthiness.

Specifically, ask for references from companies within your free zone or mainland jurisdiction, as their regulatory experiences will be most relevant. A high-integrity firm should be comfortable providing contact details for non-competing clients who can vouch for the reliability, responsiveness, and strategic value of the service provided. Remember, reputation in the financial services sector in Dubai is meticulously guarded and serves as an excellent proxy for quality.

Assess Chartered Accountants Team Qualifications

The core team of chartered accountants should have demonstrable experience in preparing financial statements under International Financial Reporting Standards (IFRS), the required framework in the UAE. Their team’s depth reflects the quality of the services you will receive.

Beyond basic qualifications, assess their continuous professional development (CPD). Given the rapid regulatory changes (Corporate Tax, ESR requirements), the team must show evidence of recent, specialized training and a commitment to staying current with the latest FTA circulars and Ministry of Finance pronouncements. A dedicated training schedule for staff is a strong indicator that the firm prioritizes sustained regulatory compliance excellence.

Examine Service Range and Technology

The modern accounting landscape demands a blend of expert human oversight and efficient technological solutions. When reviewing a potential partner, assess not only the breadth of their service offerings but also the sophistication of the tools they use to deliver them.

Detail Key Bookkeeping and Accounting Services

A good accounting firm will clearly detail how their bookkeeping and accounting processes align with your operations. These services include more than simple data entry; they are foundational to financial integrity. The core bookkeeping functions typically cover:

- Accounts Payable/Receivable (AP/AR): Managing vendor payments and client invoicing/collections.

- Bank Reconciliation: Matching internal records with bank statements weekly or monthly.

- Payroll Management: Accurate and compliant processing of monthly salaries, including WPS compliance.

- General Ledger Maintenance: Ensuring all transactions are correctly classified and recorded.

- Fixed Asset Management: Tracking asset additions, disposals, and calculating depreciation.

Evaluate Technology Tools Methodology

Modern accounting services rely heavily on technology. Evaluate the firm’s familiarity with popular accounting software and technology used in the region (e.g., QuickBooks, Zoho, SAP). Their methodology should integrate seamlessly with your internal systems, enhancing efficiency and data security.

The use of cloud-based accounting software that facilitates remote access, automated data feeds from bank accounts, and seamless integration with payment gateways demonstrates efficiency. Crucially, the firm must be proficient in the data migration process, ensuring a smooth transition during onboarding without disruption to your live financial records. This technological alignment is paramount for real-time, transparent reporting.

Assess Technology Driven Accounting Services in Dubai Solutions

In a competitive digital market, the adoption of technology-driven solutions—such as automated data feeds and cloud-based portals—demonstrates a commitment to efficiency. Accounting services in Dubai that utilize these tools can offer real-time insights, which is far more valuable than monthly historical reports. Look for proficiency in the following technology-driven solutions:

- AI-driven expense management and categorization.

- Optical Character Recognition (OCR) for automated invoice processing.

- Secure client portals for document sharing and approval workflows.

- Integration tools for connecting ERP systems with tax filing platforms.

- Advanced financial dashboards offering real-time performance indicators.

Review Scope Services Transparent Pricing

When you choose the right accounting firm, consider the range of services offered by the accounting firm and their associated costs. Ensure the proposal clearly outlines what services offered by the accounting firm are included and any potential hidden costs. Transparency in pricing builds trust from the outset.

Pricing should clearly segment the basic compliance services (bookkeeping, VAT filing) from advisory services (Corporate Tax consultation, M&A due diligence). Beware of unusually low initial quotes that may exclude essential compliance steps or charge exorbitant fees for necessary communication and documentation support. A transparent fee structure ensures you receive predictable and comprehensive professional accounting services.

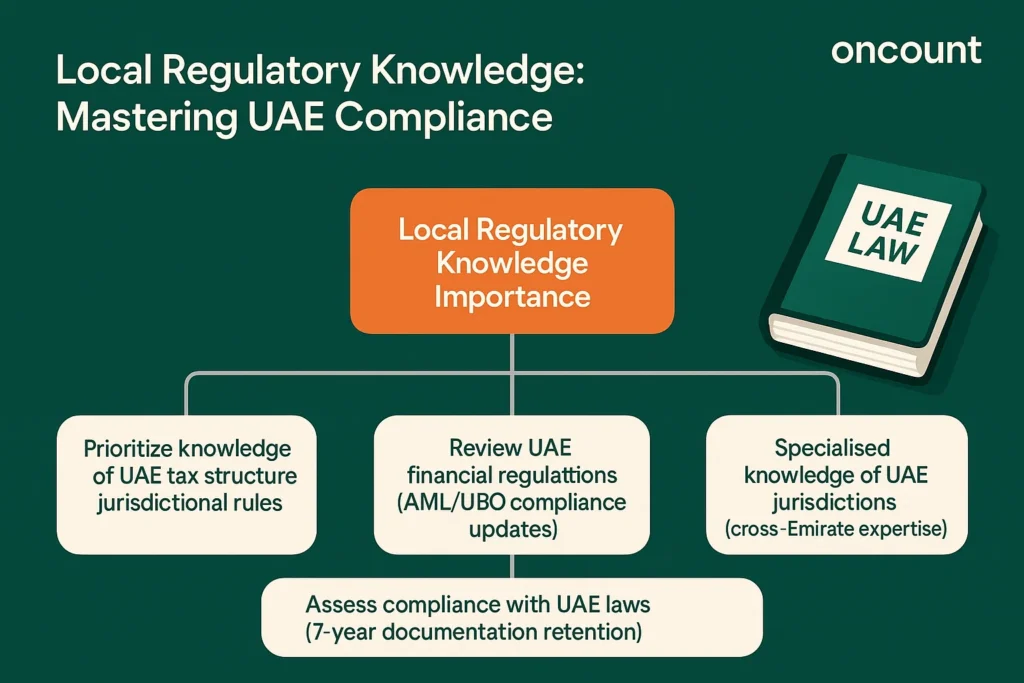

Local Regulatory Knowledge Importance

The intricate nature of the UAE’s federal and free zone laws requires an accounting partner whose local regulatory knowledge is both deep and current. This expertise is crucial for ensuring full compliance and effective tax planning in a dynamic legal landscape.

Prioritize Knowledge of UAE Tax Structure Jurisdictional Rules

The difference in corporate tax rates and VAT treatment between free zones and mainland entities is a common pitfall. Partnering with the right accounting firm means selecting one that can expertly navigate these jurisdictional rules, ensuring your business benefits from available tax incentives while remaining compliant.

This knowledge must encompass the specifics of “designated zones” for VAT purposes, and the criteria for maintaining “Qualifying Free Zone Person” status under the Corporate Tax Law, which demands strict adherence to substance and non-mainland revenue thresholds. Failure to correctly navigate these rules can result in unexpected tax liabilities at the standard 9% rate.

Review UAE Financial Regulations Governing Accounting in Dubai

Accounting in Dubai is governed by local laws and FTA circulars. A quality firm will keep your company abreast of legislative changes, such as amendments to the VAT Law or new reporting requirements for anti-money laundering (AML) or beneficial ownership (UBO) compliance.

The firm should maintain a constant watch on updates from the Ministry of Finance and the Securities and Commodities Authority (SCA) if your entity is listed. Their compliance monitoring process should be formalized, ensuring that as soon as a regulatory change is announced, your company is advised on the necessary adjustments to its financial systems and reporting.

Assess Compliance with UAE Laws

Compliance is more than just filing on time. It involves maintaining robust documentation. FTA guidance stipulates detailed record-keeping requirements for VAT-registered entities, making meticulous compliance with UAE laws essential to avoid fines.

For Corporate Tax, this includes having robust documentation for related-party transactions and maintaining permanent establishment (PE) risk assessments for international operations. The firm’s role is to ensure all source documents, internal policies, and financial records meet the seven-year retention period mandated by tax authorities and are easily retrievable in the event of an official audit.

Specialised Knowledge of UAE Jurisdictions

For companies with branches or subsidiaries across the UAE, the firm’s ability to manage varied municipal and economic regulations across Emirates (Abu Dhabi, Sharjah, etc.) is a key advantage, going beyond standard Dubai and the UAE mainland knowledge.

This includes understanding local fee structures, economic substance reporting requirements that differ across jurisdictions (e.g., ADGM vs. DIFC), and the differing financial year-end requirements that some older licenses might hold. This specialized, cross-Emirate perspective is invaluable for large groups or businesses with a decentralized operational footprint.

Communication Support Considerations

Beyond technical competence, the effectiveness of an accounting firm is profoundly influenced by its communication and support structure. A successful partnership is built on responsiveness, cultural alignment, and personalized service tailored to your business’s unique needs.

Evaluate Cultural Fit Communication

An accounting partner should feel like an extension of your team. Evaluate the cultural fit and communication style during the initial consultation. The ability to communicate complex financial information clearly and promptly is a hallmark of a professional accounting service provider.

Given the diversity of the UAE market, the firm should also offer multilingual support (English and Arabic are essential) to ensure seamless interaction with internal stakeholders and government authorities when necessary. The firm’s culture should reflect the professionalism and efficiency expected in a world-class financial hub like Dubai.

Assess Communication Responsiveness

In the fast-paced business environment of the UAE, responsiveness is crucial, especially during tax deadlines or financial reporting cycles. Look for firms with clear Service Level Agreements (SLAs) for turnaround times and issue resolution.

A dedicated communication channel (e.g., a specific ticketing system or direct line to the account manager) ensures that critical financial queries are addressed within hours, not days. This proactive communication is essential for treasury management and avoiding late penalties during peak compliance periods.

Look for Personalized Support

Avoid generic, one-size-fits-all services. A trusted accounting firm in Dubai should dedicate a senior contact to your account, ensuring continuity and personalized advisory based on your company’s specific challenges and goals.

This senior contact acts as your strategic point person, accumulating institutional knowledge about your business over time, which translates into more insightful advice and less time spent explaining historical context during complex consultations.

Meet Potential Accounting Firm

During the selection process, always meet potential accounting firm partners in person (or via video conference). This face-to-face interaction allows you to gauge their professionalism and the commitment of the team that will be handling your financial data.

The meeting should include the lead partner and the operational manager who will be directly responsible for executing your services, providing a clear picture of the team’s capabilities and commitment.

Pricing Value Assessment

While expertise should be the primary factor, assessing the pricing structure and ensuring transparency is vital for sustainable cooperation. The goal is to secure the best value for money, not simply the lowest cost, by understanding the complete cost-benefit equation.

Be Clear About Pricing

Pricing structures should be transparent, whether they are based on retainer, hourly rates, or tiered packages. Being clear about pricing from the start prevents misunderstandings later and helps you accurately budget for professional accounting services.

The proposal should clearly define which compliance filings (e.g., quarterly VAT, annual Corporate Tax return) are covered under the standard fee and what constitutes a billable advisory service, avoiding ‘scope creep’ that inflates unexpected costs.

Review Plans Pricing Structure

Compare the value offered against the cost. The best accounting firm may not be the cheapest, but their value should stem from reducing compliance risk, offering strategic tax savings, and providing actionable insights that drive profitability.

A low-cost provider may overlook critical tax filing requirements, leading to FTA penalties that far exceed the initial cost savings. Evaluate the total cost of ownership, including the cost of potential non-compliance and the value of strategic advisory provided.

Cost Value for Money

Consider the long-term impact. Paying slightly more for a reliable accounting firm that ensures 100% compliance with UAE tax laws and offers forward-looking advice represents better value than a cheaper service that exposes the company in Dubai to financial penalties.

The peace of mind and strategic advantage gained from accurate, compliant, and timely financial management are intangible benefits that greatly outweigh a marginal saving on fees. The goal is to select an accounting partner, not just a vendor.

Key Roles and Responsibilities of Accounting Firms

The responsibilities of a comprehensive accounting firm are varied and specialized, ensuring all financial and regulatory aspects of your business are managed effectively. The primary service lines and their focus areas are summarized below:

| Role | Responsibility Focus |

| Financial Reporting | Timely, IFRS-compliant preparation of financial statements (position, income, cash flow). This includes applying complex standards like IFRS 15 (Revenue Recognition) and IFRS 9 (Financial Instruments) specific to your industry. |

| UAE Tax Planning & Compliance | Proactive advice on optimizing tax structures; ensuring compliance with VAT, Excise Tax, and the new UAE Corporate Tax. This encompasses tax registration, filing of periodic returns, and managing transfer pricing documentation for related-party transactions. |

| Audit Services | Independent examination of financial records for fairness and accuracy (IFRS compliance assurance). Statutory audits are mandatory, but the firm also provides internal control reviews, due diligence, and assurance services to stakeholders. |

| Forensic Accounting | Investigation of financial discrepancies, fraud, or disputes, offering specialized expertise. Services include litigation support, asset tracing, and fraud risk assessment, going beyond routine bookkeeping services in UAE. |

| Business Valuation | Expert valuation services for M&A, sales, or regulatory reporting purposes. Utilizes internationally accepted methodologies (DCF, comparable transactions) tailored to the specific regulatory and economic environment of the UAE. |

Benefits of Outsourcing Accounting Services in Dubai

Outsourcing your financial needs to accounting services in Dubai offers significant strategic and operational advantages over maintaining an in-house team, particularly for companies operating in the complex regulatory environment of the UAE. These benefits often translate directly into reduced risk and increased profitability:

- Risk & Fraud Protection: Outsourcing provides built-in internal controls and separation of duties, minimizing the risk of internal fraud and implementing modern data protection measures. The firm acts as an independent compliance layer, reducing internal control vulnerabilities.

- Access to Specialized Expertise: Your business gains immediate access to a pool of tax experts in the UAE, chartered accountants, and regulatory advisors without the overhead of hiring full-time, highly paid specialists. This is crucial for navigating niche compliance areas like ESR or complex Corporate Tax matters.

- Cost Effectiveness: For many small to mid-sized businesses, outsourcing accounting services is significantly more cost-effective than maintaining a fully staffed, in-house finance department, particularly one specializing in complex UAE corporate tax and IFRS requirements. It converts fixed payroll costs into variable, predictable service fees.

- Optimal Utilisation of Time: By delegating compliance and transactional tasks, business leadership gains optimal utilisation of time, allowing them to focus on core competencies and revenue generation rather than complex financial administration.

- Compliance with Standards: An external accounting firm can provide an immediate and up-to-date expertise in evolving accounting standards and regulations, guaranteeing adherence to the highest compliance levels and minimizing exposure to FTA penalties.

- Technology Edge: You benefit from the firm’s investment in advanced accounting software and technology, cloud security, and automated reporting systems, which may be too costly for a single SME to acquire independently.

Mistakes to Avoid When Selecting an Accounting Partner

Recognizing and actively avoiding common pitfalls during the selection process is just as important as identifying positive attributes. Many companies compromise their future compliance by making mistakes driven by cost or lack of due diligence.

Common Mistakes to Avoid When Selecting an Accounting Firm

When selecting an accounting firm, businesses often make avoidable errors that compromise compliance and efficiency. These common mistakes include:

- Prioritizing the lowest cost over demonstrated expertise, which frequently leads to non-compliance errors.

- Failing to verify the firm’s specific local registration and track record with your free zone or mainland jurisdiction.

- Assuming a firm specializing in VAT automatically possesses the required depth of knowledge for the new Corporate Tax Law.

- Not verifying the firm’s professional indemnity insurance (PII) coverage against professional negligence.

Remember, the accounting firm is a critical component of your operational risk management.

Top Pitfalls to Avoid When Selecting a Reliable Accounting Partner

To ensure you choose a reliable accounting partner, actively avoid these top pitfalls:

- Lack of Continuity: Firms that frequently rely solely on junior, high-turnover staff for complex tasks.

- Technological Deficiency: Firms that do not use secure, reputable, and modern accounting software and cloud technology.

- Transparency Issues: A lack of clear reporting standards or non-transparent, confusing fee structures.

- Aggressive Promises: Selecting a firm that promises “guaranteed tax savings” without a detailed, compliant strategy, often indicating aggressive and risky tax positions.

A reliable accounting firm will focus on compliant optimization, not aggressive evasion.

Next Steps in the Selection Process

The final stage of selecting your accounting partner should be conducted methodically to ensure a perfect fit. Treat this as a strategic acquisition, requiring thorough preparation and evaluation before commitment.

Initial Consultation and Needs Assessment

Schedule an initial consultation to discuss your specific financial model and compliance challenges. This discovery process is crucial for both parties to assess fit. Prepare a detailed Request for Proposal (RFP) outlining your current size, transaction volume, jurisdiction (mainland/free zone), and all required services.

Reviewing Proposals and Service Agreements

Carefully review all proposals, paying close attention to the scope of services in Dubai, engagement terms, termination clauses, and indemnity provisions. Pay particular attention to the Service Level Agreement (SLA) covering response times, error correction processes, and access to senior personnel.

Book a Discovery Meeting and Ask Smart Questions

Prepare smart, specific questions about their experience with FTA audits, their methodology for calculating Corporate Tax liability, and their data security protocols. Ask how they manage the transition process and the handover of historical data to ensure continuity from your previous systems.

Ask Around for Recommendations

Leverage your professional network to ask around for recommendations for a reliable accounting firm that is already serving businesses successfully in the Dubai and the UAE market. Industry peers provide the most unbiased, actionable feedback on a firm’s operational efficiency and adherence to compliance standards.