Understanding Dubai’s Business Setup Landscape

Dubai’s strategic location between Europe, Asia, and Africa, combined with world-class infrastructure and investor-friendly policies, has reinforced its reputation as a global commercial hub. The emirate issued over 180,000 new licenses in 2023, underscoring its strong appeal to international entrepreneurs and investors.

The regulatory framework in the UAE has advanced considerably, with reforms simplifying procedures for foreign companies establishing operations. Whether launching an enterprise focused on the local market or planning regional expansion, selecting the right jurisdiction is vital for long-term success. Dubai remains one of the most accessible destinations worldwide for entrepreneurs, attracting both expatriates and overseas investors seeking to set up a business in the region.

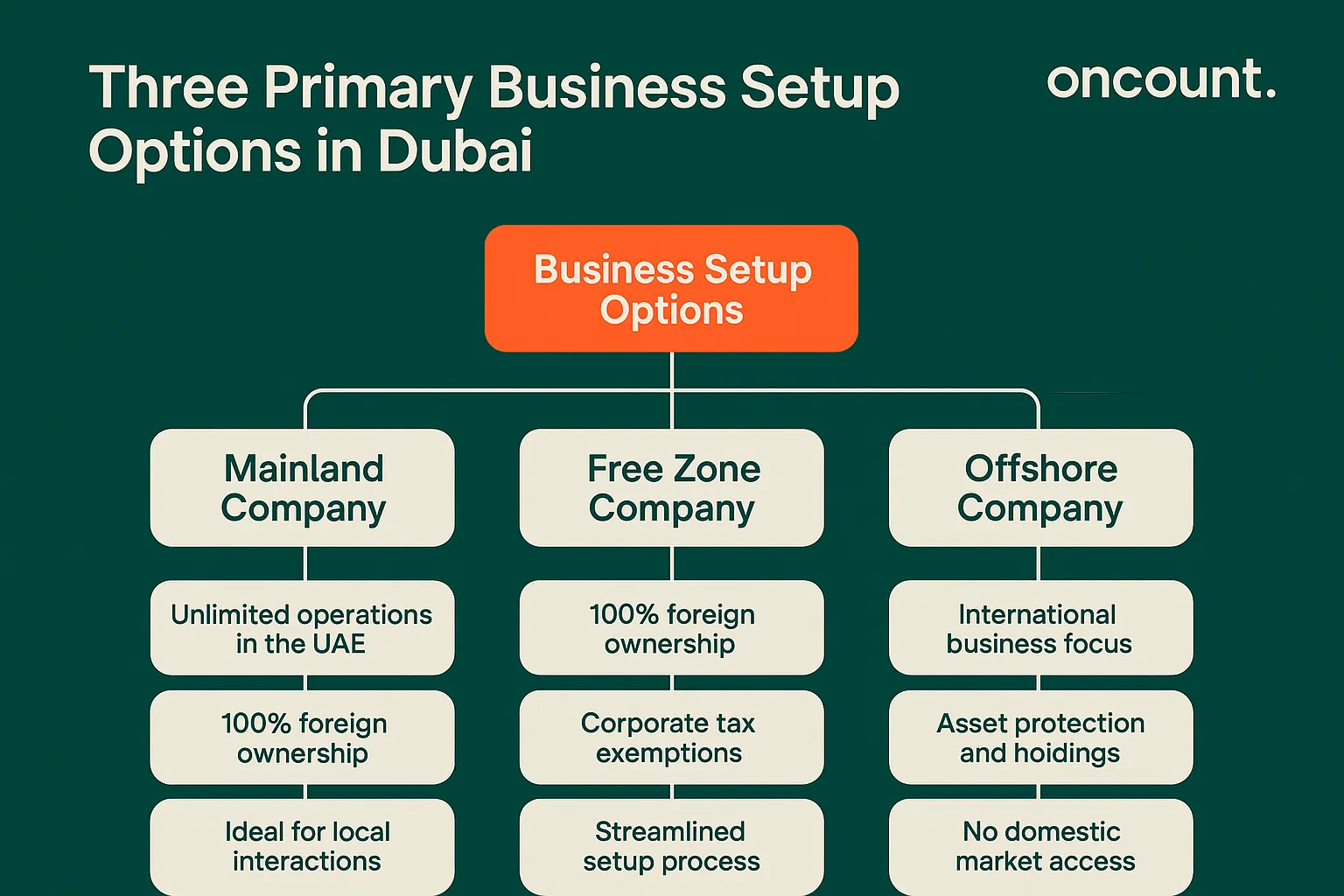

Three Primary Business Setup Options in Dubai

The types of structures available in Dubai cater to diverse operational requirements and market access needs. Each option provides distinct advantages based on the nature of your business and target markets.

Mainland Companies: Maximum Market Access

Mainland companies, registered with the Department of Economic Development, provide unrestricted access to the UAE’s domestic market. This structure suits businesses targeting local consumers or requiring extensive operations in Dubai and across the UAE.

Key advantages include:

- Unlimited operations anywhere in the UAE

- Eligibility for government contracts and tenders

- Flexible visa allocation based on office space requirements

- Direct market access without intermediaries

- 100% foreign ownership for most types of licenses

Regulatory requirements:

- UAE must have a physical office requirement (minimum 200 square feet)

- Annual audit obligations for certain categories

- Higher initial investment (AED 15,000-30,000 typical setup costs)

- Ejari registration for lease agreements

Mainland structure is ideal for companies that practice the business activity requiring direct customer interaction or those planning extensive operations within the local market.

Free Zone Companies: Tax Efficiency and Speed

UAE free zones operate as special economic territories with independent regulatory frameworks, offering attractive incentives for international companies. A business in a free zone provides significant operational flexibility while maintaining access to regional markets.

Primary benefits:

- Guaranteed 100% foreign ownership across all activities

- Corporate tax exemptions and customs duty relief

- Streamlined setup process (2-7 business days in leading zones)

- Flexible office solutions, including virtual offices

- Lower barrier to entry with packages starting from AED 6,000

Operational limitations:

- Restricted UAE local market without local distributors

- Business activities limited to zone-approved categories

- Visa quotas tied to office package selection

Offshore Companies: International Business Focus

Offshore structures cater to international operations, asset protection, and holding company requirements without UAE domestic market access. These are particularly suitable for business without physical UAE operations or those focusing on markets outside the UAE.

Benefits of Starting a Business in Dubai

The benefits of starting a business in Dubai extend beyond regulatory advantages to encompass strategic, operational, and financial considerations. Company formation in Dubai offers entrepreneurs access to one of the world’s most dynamic business environments.

| Benefit Category | Specific Advantages | Impact |

| Market Access | Gateway to Middle East, Africa, and Asia markets | Access to 2+ billion consumers within 4-hour flight |

| Tax Efficiency | 0% personal income tax, competitive corporate rates | Higher profit retention and reinvestment capacity |

| Infrastructure | World-class airports, ports, and telecommunications | Reduced operational costs and enhanced connectivity |

| Regulatory Environment | Streamlined processes, business-friendly policies | Faster setup times and lower compliance burden |

| Talent Pool | Multicultural workforce, skilled professionals | Access to diverse expertise and languages |

| Financial Services | Robust banking sector, easy capital access | Simplified financing and international transactions |

| Quality of Life | Modern lifestyle, safety, excellent facilities | Employee attraction and retention advantages |

| Strategic Location | Time zone advantages, cultural bridge | Enhanced business relationships across regions |

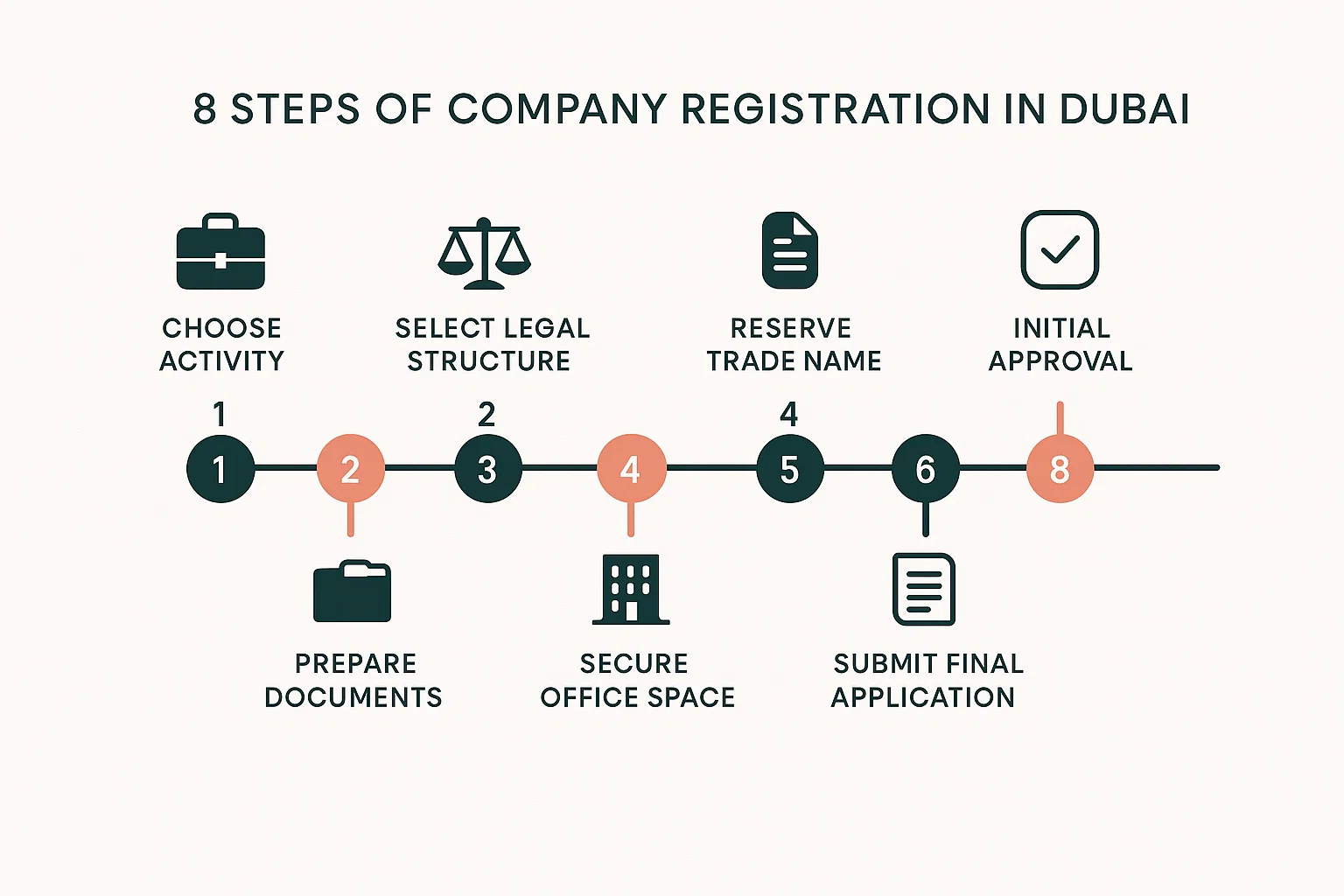

Step-by-Step Business Setup Process

Learning how to start a successful venture in Dubai requires understanding the systematic approach to business setup in dubai. This comprehensive guide on how to start ensures compliance while minimizing setup timeframes.

Step 1: Choose Your Business Activity

Identify the nature of your business activity from over 2,000 economic activities available in the UAE. The type of activity you select determines your license type and regulatory requirements. FTA guidance stipulates that businesses in the UAE must operate strictly within their licensed activities to maintain compliance.

Step 2: Select Your Legal Structure

Understanding the nature of the business you plan to operate is necessary for an owner to select the most suitable structure. Whether you’re looking to start a small business in Dubai or a larger enterprise, common company structures include:

- Limited Liability Company (LLC) – Most popular mainland option

- Free Zone Establishment (FZE) – Single shareholder free zone entity

- Free Zone Company (FZC) – Multiple shareholders free zone entity

- Sole Establishment – Individual proprietorship for specific activities

Step 3: Reserve Your Trade Name

Register a unique company name with the relevant authority (DET for mainland, Free Zone Authority for free zones). This step is crucial when you set up your company, as the trade name becomes your legal identity. The name must comply with UAE naming conventions and be distinct from existing registered companies.

You can check availability and officially reserve your company name through the Dubai Department of Economy and Tourism’s book a trade name service.

Step 4: Apply for Initial Approval

Submit your initial approval application to start your business in Dubai with required documents:

- Registration form

- Passport copies of shareholders/directors

- Feasibility study or business plan outlining operations

- Proof of residence/visa status

The approval process varies based on your business structure and chosen jurisdiction. The UAE has significantly streamlined its setup procedures in recent years.

Step 5: Prepare Legal Documents

Create essential corporate documents when you set up a business in Dubai:

- Memorandum of Association (MOA) – Outlines company structure and activities

- Local Service Agent (LSA) agreement – For certain mainland structures

- Articles of Association – Internal governance rules

Proper documentation preparation ensures compliance with all regulatory requirements for your company formation process.

Step 6: Secure Office Space

The office selection process directly impacts your business needs and operational capabilities.

Mainland Requirements:

- Physical office space mandatory – UAE must have a physical office space requirement

- Minimum 200 sq ft for most activities

- Must register the lease with the Ejari system

Free Zone Options:

- Flexi-desks, shared offices, or private offices

- Virtual offices are permitted in many zones

- Office size affects visa eligibility

Step 7: Submit Final Application

Provide all required documentation for final approval to start your company:

- Initial approval receipt

- Lease agreement (RERA attested for mainland)

- MOA/LSA agreements

- Additional government approvals (if required)

Step 8: Pay License Fees

License fees must be paid within 30 days of approval to collect the business license. The cost to start varies by structure:

- Mainland: AED 15,000-30,000 total setup costs

- Free Zone: AED 6,000-20,000 depending on package

This completes your company formation process, enabling you to commence business operations.

Essential Business Licensing Categories

Understanding the types of business licenses available helps entrepreneurs select the most appropriate framework for their intended business operations. Each license category governs specific activities and compliance requirements.

Commercial License

Covers trading, import/export, retail, and distribution activities. A company in dubai holding a commercial license can include up to 10 related activities under a single license, providing operational flexibility for diversified enterprises.

Professional License

Required for service-based businesses, including consultancy, legal services, healthcare, and technology. Professional licenses often require specific qualifications or experience certificates from relevant authorities.

Industrial License

Mandatory for manufacturing and production activities. Industrial operations must comply with environmental regulations and obtain additional approvals from relevant authorities such as Dubai Municipality.

Tourism License

Covers hospitality, travel and tourism services, and tourism-related activities. The Department of Tourism and Commerce Marketing oversees licensing and compliance for this sector.

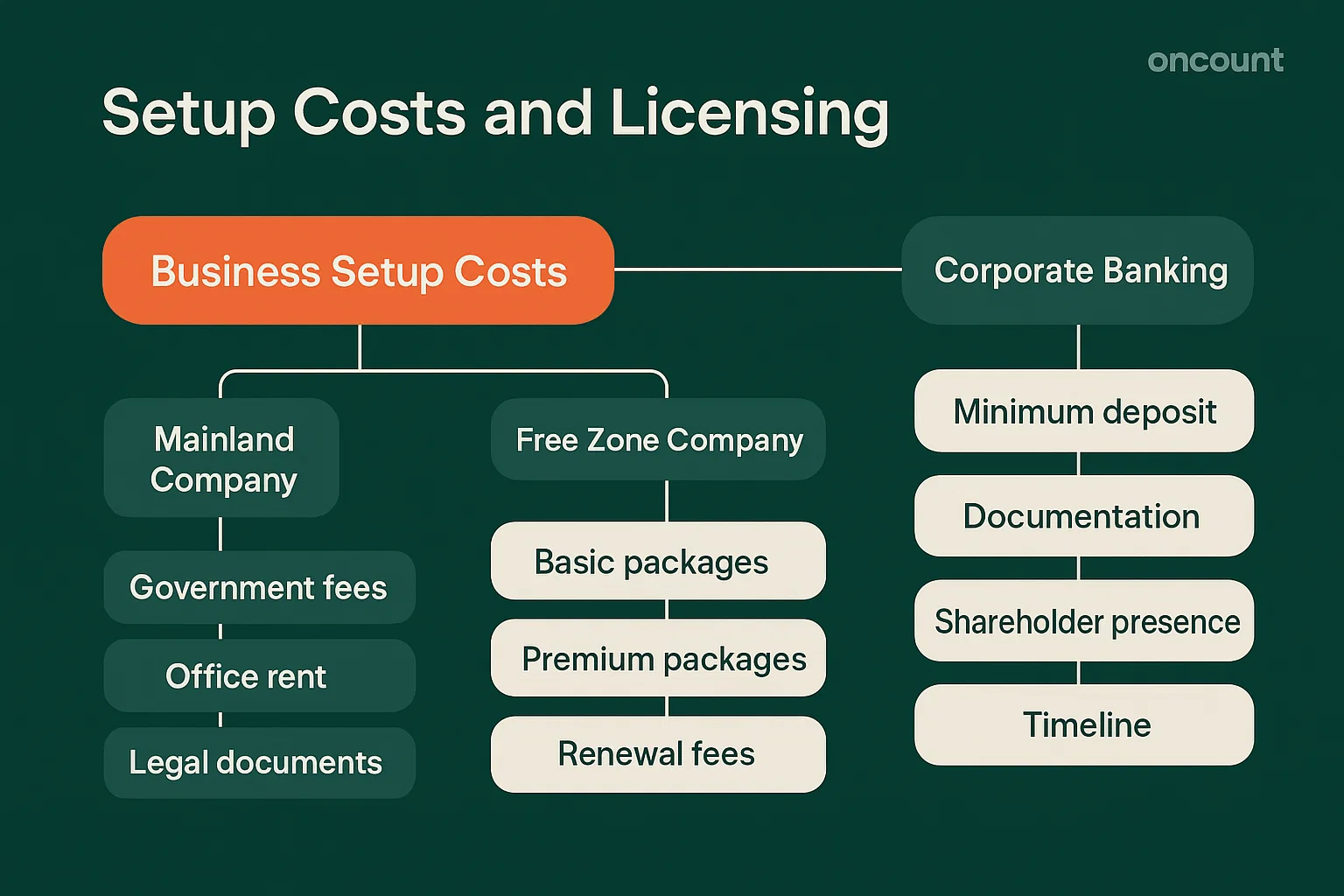

Financial Requirements and Banking Considerations

The cost to start a business in dubai without money is a common concern for entrepreneurs. While some capital is required, various financing options and flexible payment structures make company establishment accessible to diverse investor profiles.

Setup Costs Breakdown

Mainland company costs:

- Government fees: AED 10,000-15,000

- Office rent: AED 20,000-100,000 annually

- Legal documentation: AED 3,000-5,000

- Total initial investment: AED 35,000-50,000

Free zone packages:

- Basic setup: AED 6,000-15,000

- Premium packages: AED 20,000-40,000

- Annual renewal fees: 85-95% of initial costs

For entrepreneurs exploring opportunities in Dubai without substantial initial capital, many business setup company providers offer flexible payment plans and consultation on minimum investment structures.

Corporate Banking Requirements

Opening a bank account requires comprehensive documentation and typically involves:

- Minimum deposit requirements: AED 25,000-500,000

- Corporate documents attestation

- Shareholder presence during account opening

- Processing timeline: 2-4 weeks average

Based on audited data from 2023, approximately 75% of new businesses secure banking facilities within one month of license issuance, with free zone companies experiencing faster approval rates.

Visa and Immigration Pathways

Dubai, as a foreign destination, offers multiple visa pathways for business owners and their families. The immigration framework supports long-term business development and family settlement.

Business Visa Categories

Investor Visa: 2-3 year validity for owners and shareholders with renewable options based on business performance and compliance.

Golden Visa: 10-year residency for significant investors meeting specific criteria, including minimum investment thresholds and business activity requirements.

Employment Visas: For staff and key personnel with validity tied to employment contracts and business license status.

Visa Processing Requirements

- Medical fitness certificates from DHA-approved centers

- Educational certificate attestation

- Criminal background verification

- Proof of ownership in dubai or employment

Tax and Compliance Framework

Company in the UAE operations must comply with evolving tax regulations introduced to align with international standards while maintaining competitive advantages.

Corporate Tax Implementation

The UAE introduced corporate tax in June 2023, with key provisions:

- 9% tax rate on profits exceeding AED 375,000 annually

- Free zone companies may qualify for 0% tax under specific qualifying conditions

- Small business in dubai relief for qualifying enterprises

VAT Obligations

- Mandatory registration for companies exceeding AED 375,000 annual revenue

- 5% standard rate on most goods and services

- Quarterly filing requirements with Federal Tax Authority

Economic Substance Regulations (ESR)

In practice, free zone entities often must demonstrate economic substance for specific activities including banking, insurance, investment fund management, and intellectual property businesses.

Strategic Considerations for Business Success

Success in setup in dubai requires understanding market dynamics, competitive landscape, and operational requirements specific to your industry sector.

Market Entry Strategies

Dubai’s position as a regional hub enables businesses to access markets across the Middle East, Africa, and South Asia. Companies should evaluate their target markets when selecting between uae mainland and free zone structures.

Mainland advantages for local market penetration:

- Direct customer access without intermediaries

- Government contract eligibility

- Unrestricted geographical operations within UAE

Free zone benefits for international operations:

- Tax efficiency for regional headquarters

- Streamlined import/export procedures

- Access to double taxation treaties

Operational Excellence Factors

Successful companies in Dubai prioritize:

- Regulatory compliance through dedicated resources

- Strategic location selection based on business needs

- Professional advisory support for complex regulations

- Early banking relationship establishment

- Comprehensive market research and planning

Long-term Growth Considerations

Expanding your presence within the UAE requires understanding jurisdiction-specific regulations. Companies often transition from free zone to mainland structures as their operations mature and local market focus increases.

When you set up your business initially, consider future expansion plans and scalability requirements to avoid costly restructuring later.

Professional Advisory and Support Services

Professional guidance is essential when you open a business in dubai, particularly for complex regulatory requirements and industry-specific compliance obligations.

Regulatory Compliance Support

Setup consultants provide essential guidance through complex regulatory requirements, ensuring compliance with evolving UAE business laws and minimizing setup timeline delays.

Ongoing Professional Services

Established businesses benefit from:

- Annual compliance reviews and audit support

- Tax planning and optimization strategies

- Corporate restructuring advisory for expansion

- Immigration services for visa renewals and new hires

Conclusion: Capitalizing on Dubai’s Business Opportunities

Starting a business in Dubai in 2025 offers unprecedented opportunities for entrepreneurs seeking to establish operations in a strategic, business-friendly environment. Success depends on careful structure selection, thorough documentation preparation, and professional guidance through regulatory requirements.

The emirate’s commitment to innovation, combined with robust infrastructure and strategic location advantages, positions Dubai as an ideal platform for businesses targeting regional and international markets. With proper planning and expert advisory support, entrepreneurs can efficiently navigate the setup process and capitalize on the numerous opportunities this dynamic business hub provides.

Dubai is known for its pragmatic approach to business regulation, continuous process improvements, and commitment to maintaining its position as a preferred destination for international business establishment and expansion.