Requirements and Necessity of a Trade License

Filing a complete and legally valid application necessitates precise adherence to documentation rules, including authentication and legal identity verification tailored to the business structure.

Need for a Trade License: Necessity and Purpose

A trade license is a mandatory requirement for conducting any commercial, professional, or industrial operation within the UAE. This legal document serves as formal authorization from government authorities, permitting entities to engage in specified economic activities within defined jurisdictional boundaries. Without valid licensing, businesses cannot legally operate, open corporate bank accounts, sponsor employee visas, or enter into enforceable commercial contracts.

The regulatory framework governing business activities ensures that all enterprises comply with national economic policies, maintain transparency in operations, and contribute appropriately to the jurisdiction’s fiscal systems. Whether establishing a small consultancy or a large-scale manufacturing operation, the type of license obtained directly determines the scope of permissible activities and the geographical area of operation.

For entrepreneurs and established corporations alike, understanding licensing requirements represents the first critical step toward successful market entry. The licensing regime protects both business operators and consumers by establishing clear operational boundaries, quality standards, and accountability mechanisms.

Legal Authorities and Rules: Who Issues the License?

The responsibility for issuing trade licenses in Dubai primarily rests with the Department of Economic Development (DED), now operating under the unified brand Dubai Economy. This government entity oversees mainland company formation and regulates commercial activities conducted outside designated free zones. The Department of Economic Development Dubai establishes fee structures, approves business names, determines eligible activities, and monitors ongoing compliance with operational standards.

For businesses choosing to establish operations in one of Dubai’s numerous free zones—such as Dubai Multi Commodities Centre (DMCC), Dubai International Financial Centre (DIFC), or Jebel Ali Free Zone (JAFZA)—each free zone authority maintains independent regulatory oversight. These specialized economic zones offer distinct advantages, including full foreign ownership, streamlined incorporation procedures, and specific tax exemptions.

Authorities like the Dubai Chamber of Commerce and Industry work alongside regulatory bodies to support business development, facilitate international trade connections, and provide advisory services to both local and foreign investors. The integrated approach between licensing authorities, economic development agencies, and chambers of commerce creates a comprehensive support ecosystem for business establishment and growth.

Federal-level coordination ensures consistency across emirates while allowing individual jurisdictions to maintain competitive advantages through tailored policies and incentive structures. This multi-tiered regulatory approach balances national economic objectives with emirate-specific development goals.

Documents Necessary for the Trade License Application

Filing a trade license application requires submission of specific documentation demonstrating legal identity, business intent, and compliance capacity. The exact requirements vary depending on business structure, ownership nationality, and chosen jurisdiction, but standard documentation typically includes:

For Individual Proprietorships:

- Valid passport copies of the business owner

- Emirates ID (for UAE residents)

- Passport-size photographs meeting biometric standards

- Entry stamp or visa page copies

- No Objection Certificate (NOC) from current sponsor if applicable

For Corporate Entities:

- Memorandum of Association (MOA) outlining ownership structure and business objectives

- Articles of Association detailing governance frameworks

- Shareholder resolutions authorizing business establishment

- Parent company documentation if establishing a branch or subsidiary

- Board resolution appointing authorized signatories

Universal Requirements:

- Approved trade name reservation certificate

- Initial approval certificate from licensing authority

- Tenancy contract or lease agreement for registered office space

- Physical office address proof meeting authority specifications

- Bank reference letters demonstrating financial capacity

- Business activity descriptions aligned with license classification

All documents originating from outside the UAE require attestation through a structured authentication process. This typically involves notarization in the country of origin, authentication by the UAE embassy or consulate in that jurisdiction, and final attestation by the UAE Ministry of Foreign Affairs. This notarization and submission process ensures document authenticity and legal validity across jurisdictions.

Digital transformation initiatives have streamlined documentation requirements in recent years, with many authorities accepting electronic submissions and digital signatures for specific document categories. However, physical document submission remains mandatory for certain critical items, particularly ownership documentation and tenancy agreements.

Trade License Types and Activities in the UAE

The regulatory framework in the UAE distinguishes between several license types, each corresponding to distinct economic activity categories, ensuring businesses operate within defined legal boundaries. Selecting the correct license is the first step in aligning operational goals with regulatory mandates.

Commercial, Professional, Industrial, and Tourism Licenses

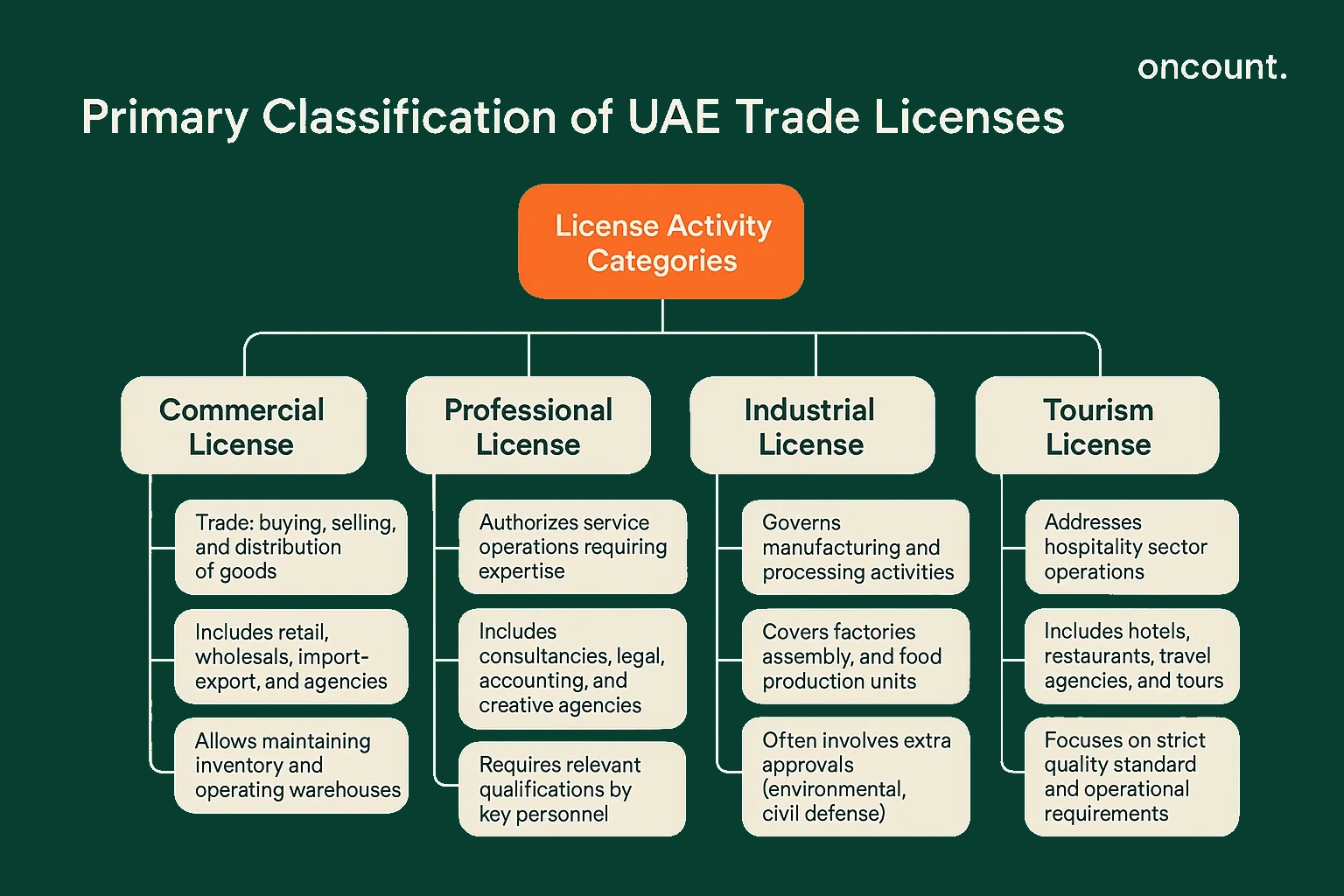

The UAE regulatory framework categorizes business licenses into four primary classifications, each corresponding to distinct economic activity categories:

- Commercial License: A commercial license in Dubai allows a company to conduct trade activities involving the buying, selling, and distribution of goods. This classification encompasses retail operations, wholesale trading, import-export businesses, and commercial agencies. The commercial license in Dubai allows enterprises to maintain inventory, operate warehouses, and engage in commodity trading across diverse sectors.

- Professional License: Professional licenses authorize service-based operations requiring specialized expertise or technical qualifications. This category includes consultancies, legal practices, accounting firms, engineering services, medical practices, educational institutions, and creative agencies. A professional trade license typically requires demonstration of relevant qualifications, professional certifications, or technical expertise by key personnel.

- Industrial License: Industrial licenses govern manufacturing operations, production facilities, and processing activities. This classification covers factories, assembly plants, food production units, and any operation involving transformation of raw materials into finished or semi-finished products. Industrial licensing often involves additional approvals from environmental authorities, civil defense departments, and specialized regulatory bodies depending on production nature.

- Tourism License: Tourism licenses specifically address hospitality sector operations including hotels, restaurants, travel agencies, tour operators, and entertainment venues. Given Dubai’s positioning as a global tourism hub, this license category receives significant regulatory attention with strict quality standards and operational requirements.

Each license type supports specific activity categories pre-defined by licensing authorities. Businesses must ensure chosen activities align precisely with their license classification to maintain regulatory compliance and avoid operational restrictions.

General Trading License: Activities and Definition

The general trading license represents one of the most comprehensive commercial authorizations available within the UAE licensing framework. This license type permits holders to engage in trading activities across multiple commodity categories without restriction to specific product lines. A general trading license cost varies significantly based on jurisdiction and chosen operational structure, but it provides maximum commercial flexibility.

Unlike specialized trading licenses limited to defined product categories—such as electronics, textiles, or food products—the general trading license encompasses broad trading authority. This makes it particularly attractive to import-export companies, wholesale distributors, and trading houses managing diverse product portfolios.

However, certain high-sensitivity categories remain excluded from general trading authorizations and require specific approvals regardless of license type. These typically include:

- Pharmaceutical products and controlled medications

- Weapons, ammunition, and security equipment

- Alcoholic beverages and tobacco products

- Precious metals and gemstones in certain contexts

- Radioactive materials and hazardous chemicals

Businesses pursuing general trading operations must maintain adequate physical infrastructure, including warehouse facilities meeting authority specifications. The scope of permitted activities under general trading licenses makes them among the most sought-after authorizations, though they generally command higher licensing fees compared to specialized alternatives.

Business Activities Supported by License Type

The relationship between license classification and permissible business activities follows strict regulatory parameters. A license in Dubai allows only those activities explicitly listed on the license certificate. Engaging in activities outside approved categories constitutes a regulatory violation subject to penalties, operational suspension, or license revocation.

When determining appropriate license type, business owners must carefully analyze their operational model, revenue streams, and expansion plans. Many successful enterprises require multiple licenses to accommodate diverse activity categories. For example, a technology company might need both a professional license for software development and consulting services plus a commercial license for hardware sales and distribution.

The licensing structure within the UAE permits activity additions and modifications through formal amendment processes. As businesses evolve and expand their service offerings, they can apply to add activities to existing licenses or transition to alternative license categories better suited to their operational reality.

Certain activities carry specific prerequisites beyond basic licensing requirements. Medical services require health authority approvals and professional qualification verifications. Educational institutions need knowledge authority clearances. Food-related businesses must secure food safety certifications. These supplementary requirements ensure that businesses in sensitive sectors maintain appropriate standards and professional competence.

Free Zone, Offshore, and Mainland License Differences

Strategic market entry and significant cost optimization depend fundamentally on the chosen operational jurisdiction within the UAE, as Mainland, Free Zone, and Offshore structures offer distinct benefits and operational scopes.

Mainland, Free Zone, and Offshore License Differences

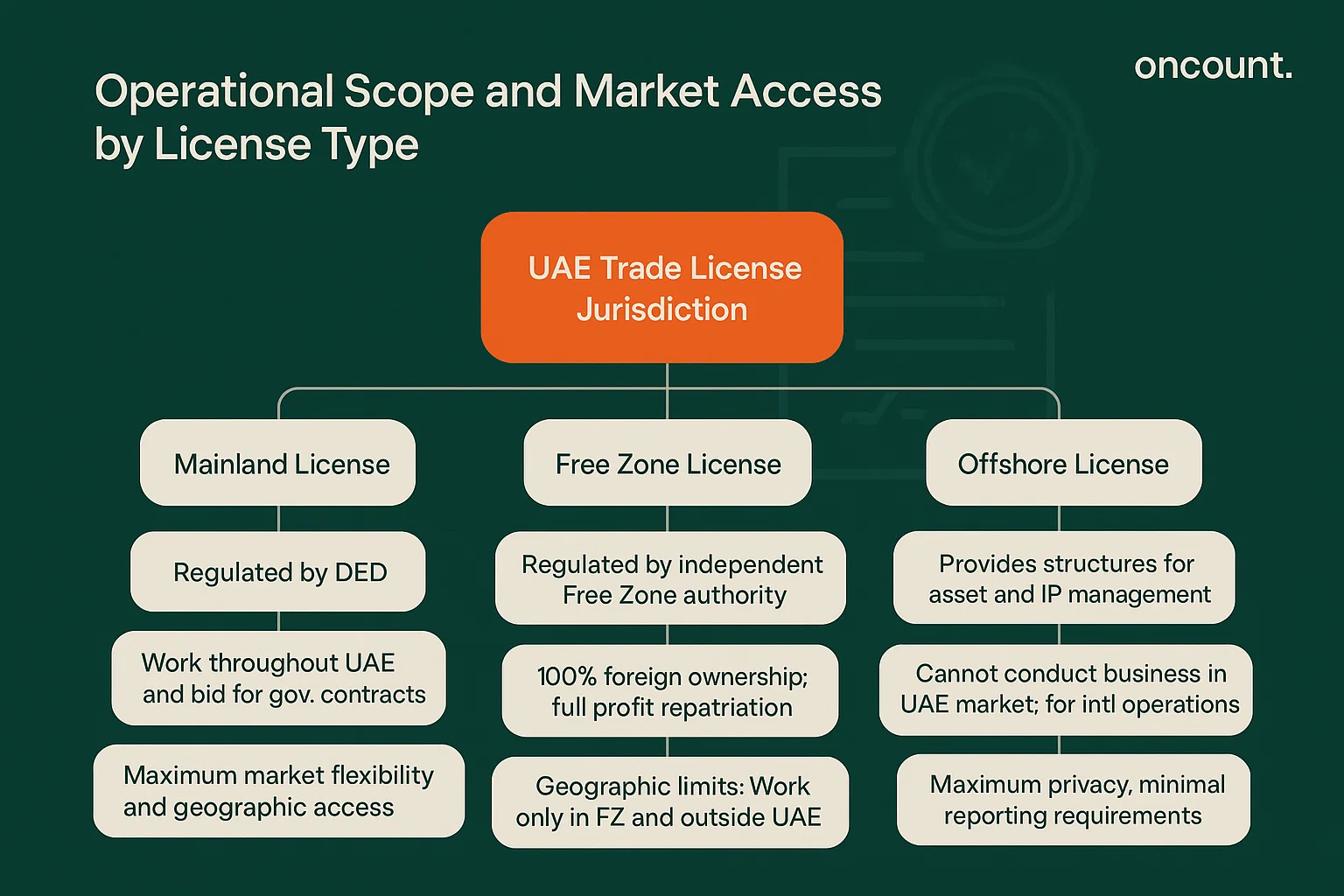

Understanding the distinctions between mainland, free zone, and offshore license structures proves essential for strategic business planning and cost optimization.

Mainland Licenses: Mainland operations, regulated primarily by the Department of Economic Development in respective emirates, allow businesses to operate throughout the UAE and bid for government contracts. A trade license in Dubai issued through DED provides maximum geographical flexibility and market access. Mainland structures previously required Emirati national partners holding minimum 51% ownership in most sectors, though recent regulatory reforms have eliminated this requirement for many business activities, allowing 100% foreign ownership in numerous categories.

Free Zone Licenses: Dubai offers over 30 specialized free zones, each targeting specific industries or business types. Free zone establishments benefit from 100% foreign ownership, full profit repatriation, zero corporate taxation (subject to meeting economic substance requirements), exemption from import-export duties, and streamlined business setup procedures. However, free zone companies face geographical restrictions—they can only conduct business directly within their designated free zone and with entities outside the UAE. Trading within the UAE mainland market requires appointing a local distributor or establishing a separate mainland entity.

Offshore Licenses: Offshore company formations in jurisdictions like Jebel Ali Offshore (RAK ICC) provide asset holding, international trading, and intellectual property management structures with maximum privacy and minimal reporting requirements. Offshore entities cannot conduct business within the UAE market itself but serve effectively for international operations, holding structures, and investment vehicles.

The choice between these jurisdictional options significantly impacts both initial establishment costs and ongoing operational expenses. Free zone trade license fees in Dubai vary substantially between zones, with some offering competitive packages for startups while others target established enterprises requiring premium facilities and services.

Step-by-Step Process to Get a Trade License

Acquiring formal authorization to operate requires systematic progression through several interconnected stages, commencing with name registration and culminating in final license issuance.

Trade Name Registration and Initial Approval

The licensing journey begins with selecting and registering an appropriate trade name that complies with regulatory naming conventions while reflecting business identity and activities. Trade name selection follows specific rules:

- Names cannot include religious references or symbols

- Names must not conflict with existing registered entities

- Names should reflect the nature of business activities

- Names cannot suggest government affiliation or endorsement

- Names must not violate trademark rights or intellectual property protections

Applying to DED Dubai for trade name approval involves submitting proposed names (typically three alternatives in order of preference) through the authority’s digital portal. The system immediately checks availability and regulatory compliance, providing instant feedback on name acceptability. Upon approval, the trade name receives temporary reservation valid for a specified period during which the applicant must complete remaining licensing steps.

After securing trade name approval, businesses must obtain initial approval certificates. This preliminary authorization confirms that proposed activities, ownership structure, and operational plans meet basic regulatory requirements. Initial approval serves as conditional clearance allowing the applicant to proceed with securing office space, finalizing incorporation documents, and preparing for final license issuance.

Trade License Application Steps and Procedure

Following initial approval, the formal licensing procedure involves systematic progression through several interconnected stages:

- Stage One: Business Activity Selection Determine precise business activities from the standardized activity codes maintained by licensing authorities. Each activity carries specific requirements and may influence overall licensing costs. Businesses can select multiple activities provided they align with chosen license type.

- Stage Two: Corporate Structure Finalization Complete corporate formation documentation including Memorandum of Association, Articles of Association, and shareholder agreements. These documents require legal drafting, notarization, and attestation through appropriate channels.

- Stage Three: Office Space Confirmation Secure physical office space meeting authority requirements for business type. This involves executing tenancy contracts, obtaining landlord NOCs, and ensuring premises comply with any sector-specific requirements (such as accessibility standards, safety equipment, or specialized infrastructure).

- Stage Four: Application Submission File a trade license application along with all required documentation through the designated authority’s submission channels. Most jurisdictions now offer digital submission options, though certain document originals may require physical submission.

- Stage Five: Fee Payment Complete payment of all applicable fees including license fees, registration charges, and administrative costs. Licensing authorities provide detailed fee schedules and accepted payment methods.

- Stage Six: License Issuance Upon successful review and approval, the licensing authority issues the official trade license certificate. This document specifies approved activities, license validity period, registered address, and any conditions or restrictions applicable to the authorization.

Documents Required: Notarization and Submission

The documentation portfolio required for trade license applications must meet strict authentication standards. International documents require multi-stage attestation:

- Notarization: Documents must be notarized by licensed notaries in the country of origin, confirming authenticity and signatory authority.

- Ministry Authentication: Following notarization, documents require authentication by the relevant government ministry in the country of origin (typically Foreign Affairs or Justice Ministries).

- UAE Embassy Attestation: Documents then require attestation by the UAE embassy or consulate in the originating country, confirming the validity of local authentication.

- MOFA Attestation: Finally, documents need attestation by the UAE Ministry of Foreign Affairs, completing the authentication chain and establishing legal validity within the UAE.

This comprehensive authentication process ensures that documents submitted to UAE authorities meet international legal standards and can be relied upon for official purposes. The process typically requires 2-4 weeks depending on document origin country and embassy processing times.

How to Get Approved for a Trade License

Getting approved for a trade license requires demonstrating compliance with both basic business establishment requirements and sector-specific regulations. The approval process evaluates:

- Financial Capacity: Evidence of sufficient financial resources to establish and sustain operations, typically demonstrated through bank statements, financial guarantees, or capital commitment letters.

- Professional Qualifications: For professional and specialized licenses, proof of relevant educational credentials, professional certifications, and technical expertise.

- Regulatory Compliance: Confirmation that proposed business activities comply with all applicable UAE laws, including restrictions on certain activities, ownership requirements, and operational standards.

- Infrastructure Adequacy: Verification that proposed business premises meet authority requirements for size, location, facilities, and accessibility.

The approval timeline varies based on business complexity, authority workload, and application completeness. Standard applications typically process within 5-10 business days for straightforward cases, though complex applications involving specialized activities or multiple approvals may require several weeks.

Instant E-Trader License in Dubai

In response to modern business models, Dubai has introduced streamlined pathways, allowing qualified entrepreneurs to secure authorization rapidly or cater specifically to home-based digital operations.

Getting Your Dubai Trade License Instantly

Digital transformation initiatives have revolutionized business licensing procedures in Dubai, introducing expedited pathways for entrepreneurs meeting specific criteria. The instant license program represents a significant innovation in business facilitation, allowing qualified applicants to obtain full commercial authorization within hours rather than days or weeks.

This accelerated pathway targets specific business categories deemed low-risk and high-value for economic development objectives. Eligible activities typically include consultancy services, digital services, e-commerce operations, and various professional services. The instant approval mechanism relies on automated compliance checking, pre-approved activity lists, and digital documentation verification.

To qualify for instant licensing, applicants must meet stringent criteria including clean regulatory history, complete documentation submission, pre-approved business activities, and payment of all applicable fees. The system conducts real-time verification of submitted information against government databases, immediately flagging any discrepancies or compliance concerns.

E-Trader License for Home-Based Businesses

The e-trader license in Dubai specifically addresses the needs of home-based entrepreneurs, freelancers, and digital business operators who do not require traditional commercial office space. This innovative license category acknowledges evolving business models and the growing gig economy while maintaining regulatory oversight.

An e-trader license in Dubai allows individuals to conduct business operations from residential premises without requiring separate commercial office leases. This significantly reduces startup costs and provides flexible operating structures suitable for consultants, online retailers, digital content creators, and service providers.

The e-trader framework comes with specific limitations designed to protect residential community character. Permitted activities exclude those requiring customer visits, inventory storage beyond minimal levels, or activities generating noise, traffic, or environmental impacts. The license type primarily suits knowledge workers, digital service providers, and online business operators.

Financial benefits of e-trader licensing include substantially reduced total cost compared to traditional commercial licenses. Without office lease requirements, business setup costs can decrease by 60-70%, making entrepreneurship accessible to a broader population segment. However, operators must carefully evaluate whether business model constraints align with e-trader restrictions before pursuing this option.

Timeline to Get Approved for a Trade License

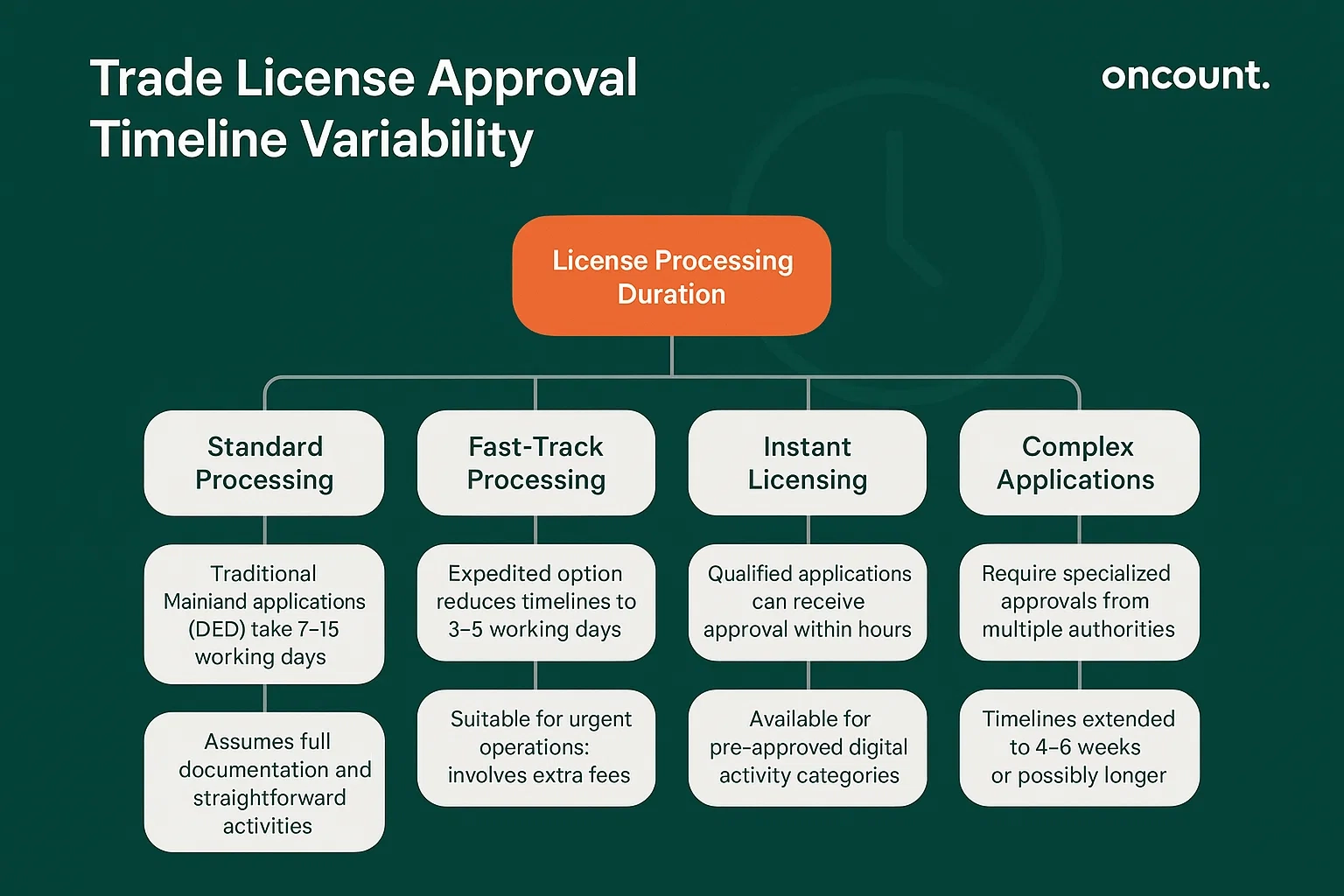

The timeline to get approved for a trade license varies significantly based on several factors:

- Standard Processing: Traditional mainland applications through the Department of Economic Development typically complete within 7-15 business days assuming complete documentation and straightforward business activities.

- Fast-Track Processing: Many authorities offer expedited processing options for additional fees, reducing timelines to 3-5 business days. This option suits businesses with urgent operational requirements or time-sensitive market opportunities.

- Instant Licensing: As discussed, qualified applications may receive approval within hours through digital instant licensing platforms available for pre-approved activity categories.

- Complex Applications: Businesses requiring specialized approvals, regulatory clearances from multiple authorities, or involving restricted activities may face extended timelines of 4-6 weeks or longer.

Factors influencing processing speed include documentation completeness, activity complexity, authority workload during peak periods, required third-party approvals, and applicant responsiveness to any queries or additional information requests.

Experienced business setup services in Dubai often accelerate timelines through professional documentation preparation, established authority relationships, and proactive query resolution. While these services add to upfront costs, the time savings and reduced administrative burden often justify the investment.

Trade License Cost Breakdown in Dubai

Determining the final financial outlay requires a detailed examination of several variable and fixed components, as the total cost is heavily influenced by specific business choices and regulatory mandates.

Factors Affecting the Cost of a Trade License

The cost of obtaining a trade license in Dubai results from multiple variable and fixed components, each influenced by specific business decisions and regulatory requirements. Understanding these cost drivers enables accurate budgeting and informed strategic choices.

Jurisdiction Selection: Mainland versus free zone establishments carry dramatically different cost structures. Free zones generally offer package-based pricing including license, visa allocations, and office space, while mainland licensing involves separate fees for each component.

License Classification: Commercial, professional, and industrial licenses carry different fee schedules, with industrial licenses typically commanding higher charges due to additional regulatory oversight and environmental considerations.

Activity Quantity: Most authorities charge incremental fees for each business activity added to the license. While initial activities may be included in base fees, additional activities often incur supplementary charges.

Share Capital Requirements: Certain license types require minimum share capital, which while not directly payable as fees, represents committed financial resources that must be available.

Office Space Standards: Depending on your business type and chosen jurisdiction, minimum office size requirements vary significantly. Premium business districts command substantially higher rental rates than emerging areas, directly impacting the total cost of establishment.

General Trading License Cost: Free Zones vs. Mainland

The cost breakdown of obtaining a general trading authorization differs markedly between mainland and free zone jurisdictions. Mainland general trading typically requires:

Mainland General Trading Costs:

- Basic trade license fee: AED 15,000 – 25,000 annually

- Commercial registration: AED 600 – 1,200

- Trade name reservation: AED 600 – 1,000

- Initial approval fees: AED 500 – 1,500

- Memorandum of Association attestation: AED 800 – 2,000

- Chamber of Commerce membership: AED 1,000 – 3,000 annually

Free Zone General Trading Costs: Free zone packages typically range from AED 18,000 to AED 50,000 annually depending on the specific zone and included benefits. Premium zones like DMCC or DIFC charge at the higher end but offer superior infrastructure, international recognition, and networking opportunities. Budget-conscious free zones like Ajman Free Zone or RAK ICC provide entry-level options for cost-sensitive businesses.

The cost of a trade license within Dubai varies not only by jurisdiction but also by auxiliary services included. Some free zones bundle visa processing, office space, and business support services, while others maintain à la carte pricing structures allowing businesses to select only required services.

DED Trade License Fee and Additional Costs

The Dubai Economic Department trade license fee structure comprises base licensing charges plus various supplementary fees. For 2024-2025, typical DED licensing costs include:

Core License Fees:

- Professional license: AED 10,000 – 15,000

- Commercial license: AED 15,000 – 25,000

- Industrial license: AED 20,000 – 35,000

Mandatory Additional Charges:

- Business registration certificate: AED 600

- Initial approval fee: AED 500

- Trade name reservation: AED 600

- Memorandum of Association: AED 1,000

- License issuance fee: AED 1,500

- Innovation fee: AED 100

- Knowledge fee: AED 10

These figures represent baseline costs for standard applications. Specialized activities, multiple activity additions, or expedited processing requests incur supplementary charges. The fee structure remains subject to periodic adjustment by regulatory authorities to align with economic policy objectives.

Additional License Costs and Hidden Fees for Business in Dubai

Beyond the core government fee, prudent budget planning must account for essential supporting expenses, including residency permits, professional services, and mandatory infrastructure requirements.

Visa Costs: Investor and Employee

Beyond the direct license fee, visa processing represents a significant cost component in the breakdown of obtaining a trade license. Each license allocation includes specific visa quotas based on office size, business activity, and jurisdiction rules.

Investor Visa Costs: Business owners and partners qualify for investor visas, typically valid for 2-3 years. Investor visa processing involves:

- Immigration application fee: AED 500 – 800

- Emirates ID application: AED 370

- Medical fitness testing: AED 300 – 500

- Status adjustment fee (if applicable): AED 500

- Typing center services: AED 150 – 300

- Health insurance (mandatory): AED 500 – 1,500 annually per person

Total investor visa costs typically range from AED 3,000 to AED 5,000 per person, excluding health insurance which varies by coverage level and provider.

Employee Visa Costs: Each employee visa carries similar processing fees plus additional requirements:

- Work permit application: AED 300

- Entry permit: AED 500 – 700

- Status change fee: AED 500

- Medical fitness test: AED 300 – 500

- Emirates ID: AED 370

- Labor contract typing: AED 200

- Health insurance: AED 500 – 1,200 annually

Employee visa processing totals approximately AED 2,500 – 4,000 per person annually, creating substantial cumulative costs for businesses requiring significant workforce numbers.

Office Space Requirement and Lease Costs

Physical office requirements significantly impact the cost in Dubai for business establishment. Regulatory authorities mandate office space that meets minimum size specifications and facility standards appropriate to business type and scale.

Mainland Office Requirements: Mainland licenses require physical office space within Dubai’s commercial zones. Minimum size requirements vary by activity:

- Professional services: Typically 200-300 square feet minimum

- Commercial trading: Generally 400-600 square feet minimum

- Industrial operations: Varies substantially based on production requirements

Annual rental costs in Dubai vary dramatically by location:

- Premium business districts (Downtown, DIFC, Business Bay): AED 80 – 150 per square foot

- Mid-range commercial areas (JLT, Barsha): AED 50 – 80 per square foot

- Budget commercial zones (Al Quoz, Ras Al Khor): AED 35 – 50 per square foot

A modest professional office of 300 square feet in a mid-tier location might cost AED 18,000 – 24,000 annually, while commercial operations requiring 600 square feet could face rental expenses of AED 36,000 – 48,000 yearly.

Free Zone Office Options: Free zones offer multiple workspace solutions:

- Flexi-desk arrangements: AED 6,000 – 12,000 annually

- Private offices: AED 18,000 – 40,000 annually

- Warehouse facilities: AED 30 – 60 per square foot annually

The cheapest trade license in Dubai options typically emerge from free zones offering flexi-desk or virtual office packages, though these carry operational limitations suitable only for certain business types.

PRO Services and Accounting Fees

Professional assistance fees represent another significant cost component often overlooked during initial budget planning. Public Relations Officer (PRO) services facilitate interaction with government authorities, manage documentation processing, and ensure compliance with evolving regulatory requirements.

PRO Service Costs:

- Initial company formation support: AED 3,000 – 8,000 one-time

- Annual PRO retainer services: AED 6,000 – 15,000

- Individual visa processing support: AED 500 – 1,000 per visa

- License renewal management: AED 1,500 – 3,000 annually

Accounting and Compliance Fees: Mandatory accounting requirements include:

- Annual accounting services: AED 8,000 – 20,000 depending on transaction volume

- VAT registration and filing: AED 5,000 – 12,000 annually

- Corporate tax compliance: AED 6,000 – 15,000 annually

- Audit services (when required): AED 10,000 – 30,000+ depending on company size

These professional service costs vary significantly based on business complexity, transaction volumes, and chosen service provider expertise level. While tempting to minimize these expenses, quality professional support often prevents costly compliance failures and regulatory penalties that far exceed service fees.

Renewing a Trade License: Fees and Penalties

Maintaining legal compliance is an annual obligation, and understanding the renewal costs, procedural requirements, and escalating consequences of any delay is crucial for business continuity.

Renewal Cost and Fine Structure

Trade license renewal represents an annual obligation requiring timely attention to maintain legal business operations. The cost of renewing a trade license typically mirrors initial licensing fees, though certain components may vary based on regulatory adjustments or business changes.

Standard Renewal Costs: Annual license renewal costs generally include:

- Base license renewal fee: 90-100% of original license fee

- Trade name renewal: AED 300 – 600

- Chamber of Commerce membership renewal: AED 1,000 – 3,000

- Registration certificate renewal: AED 300 – 600

- Document processing fees: AED 500 – 1,000

Most businesses should budget approximately AED 12,000 – 30,000 for annual mainland license renewals depending on license type and activity complexity. Free zone renewals typically align with initial package costs, ranging from AED 15,000 – 45,000 annually.

Late Renewal Penalties: Failing to complete the renewal process at least one month before expiration triggers escalating penalties:

- 1-30 days late: AED 1,000 penalty plus daily fines

- 31-60 days late: AED 2,000 penalty plus daily fines

- Beyond 60 days: AED 4,000+ penalty, possible license cancellation

Daily late fees typically range from AED 50-100 per day, creating substantial cumulative penalties for extended delays. Beyond financial penalties, late renewal jeopardizes visa statuses, bank account access, and business operations continuity.

Dubai Economic Department Trade License Renewal Process

The renewal process for mainland licenses follows structured procedures designed to verify ongoing compliance and operational legitimacy. Beginning 90 days before license expiration, businesses can initiate renewal through the Dubai Economic Department’s digital platforms.

Renewal Procedure Steps:

- Review and Update: Verify all business information remains current, including activities, ownership details, and contact information. Submit activity additions or modifications if operational scope has evolved.

- Documentation Preparation: Gather renewed tenancy contracts, updated trade name certificates, and any required authority clearances or approvals.

- Clearance Verification: Ensure all previous fines, penalties, or outstanding obligations are settled. The system automatically checks for pending issues that must be resolved before processing renewal.

- Fee Payment: Complete payment of all renewal fees through approved channels. Most authorities now offer online payment options accepting credit cards, debit cards, or bank transfers.

- License Collection: Upon successful processing, collect the renewed license certificate either digitally or from authority offices as applicable.

The Dubai Economic Department trade license renewal process typically completes within 3-5 business days for straightforward renewals without complications. However, businesses should initiate the process well in advance to accommodate potential delays or unexpected requirement clarifications.

Penalties for Delayed License Renewal

Beyond immediate financial penalties, delayed license renewal creates cascading operational complications:

- Immigration Consequences: Expired licenses invalidate dependent visas, potentially requiring employees and dependents to exit the country until license status rectifies. This disrupts operations and damages employee relations.

- Banking Restrictions: Banks typically freeze accounts associated with expired licenses, preventing transactions until valid licensing documentation is provided. This can paralyze business operations and create cash flow crises.

- Contract Voidability: Commercial agreements may contain clauses invalidating contracts if a party’s business license lapses, exposing businesses to legal disputes and financial losses.

- Regulatory Scrutiny: Repeated late renewals trigger enhanced regulatory attention, potentially resulting in more frequent inspections, activity restrictions, or difficulty obtaining future approvals.

The comprehensive impact of delayed renewal extends far beyond immediate penalty fees, making timely renewal a critical operational priority for all UAE businesses.

Benefits of a Trade License for Business in Dubai

The commitment to obtaining proper authorization yields extensive returns, unlocking access to global financial systems, competitive tax frameworks, and substantial government support mechanisms.

Boost to Local and International Trade

Obtaining a trade license unlocks comprehensive market access both within the UAE and internationally. A license in Dubai allows businesses to establish credibility with suppliers, access international payment systems, and participate in government tenders and major commercial opportunities.

The regulatory legitimacy provided by proper licensing facilitates:

- Banking Relationships: Licensed businesses can open corporate bank accounts with major financial institutions, access trade finance facilities, and establish letter of credit arrangements supporting international transactions.

- Supplier Agreements: Legitimate licensing enables businesses to establish accounts with authorized distributors and manufacturers, often accessing preferential pricing and payment terms unavailable to unlicensed operators.

- Customer Confidence: Professional clients and government entities universally require valid licensing documentation before engaging in commercial relationships, making licensing essential for accessing premium market segments.

- Export-Import Capabilities: Licensed entities can register with customs authorities, obtain import-export codes, and conduct international trade operations through UAE ports and free zones.

The strategic positioning of Dubai as a global logistics hub, combined with proper licensing, enables businesses to serve markets across Africa, Asia, and Europe efficiently. This geographical advantage, accessible only through legitimate licensing, represents significant competitive value.

Tax Benefits and Strategic Location

The UAE’s favorable fiscal environment represents a primary attraction for international businesses. While recent introduction of corporate taxation at 9% for profits exceeding AED 375,000 annually affects some entities, the overall tax burden remains substantially lower than most jurisdictions worldwide.

Current Tax Framework:

- Corporate tax: 9% on profits above AED 375,000 (effective June 2023)

- VAT: 5% on most goods and services

- Zero personal income tax

- Zero capital gains tax on most investments

- No withholding tax on dividends, interest, or royalties

Free zone entities meeting economic substance requirements may qualify for 0% corporate tax rates for specified periods, though this requires genuine operational presence and adherence to substance regulations. The combination of minimal taxation, strategic location, and world-class infrastructure creates compelling value propositions for businesses across sectors.

Dubai’s position as a connecting point between Eastern and Western markets, coupled with extensive air cargo facilities, modern seaports, and efficient logistics infrastructure, amplifies the operational benefits of establishing licensed operations within the emirate.

Enhanced Credibility and Government Support

Beyond regulatory compliance, proper licensing establishes business legitimacy that opens doors to numerous growth-enabling opportunities:

- Government Contract Eligibility: Federal and emirate-level government entities exclusively engage with properly licensed contractors and suppliers. Major infrastructure projects, institutional supply contracts, and public sector opportunities require valid mainland licensing.

- Chamber of Commerce Benefits: Licensed businesses gain access to Dubai Chamber of Commerce services including international trade facilitation, business matchmaking, certificate of origin issuances, and advocacy on commercial matters affecting member interests.

- Regulatory Support: The government actively supports licensed businesses through various initiatives including startup accelerators, funding facilitation, regulatory guidance, and dispute resolution mechanisms.

- International Recognition: UAE business licenses carry strong international recognition, facilitating overseas expansion, partnership negotiations, and cross-border transactions. The regulatory rigor underlying UAE licensing processes creates confidence among international counterparties.

The comprehensive ecosystem supporting licensed businesses in Dubai encompasses not only regulatory compliance but active facilitation of business growth, market access, and operational success. This holistic support framework, combined with strategic positioning and fiscal advantages, substantiates Dubai’s positioning as a premier global business destination.