VAT Framework in the UAE: Foundation and Structure

The UAE introduced Value Added Tax (VAT) on January 1, 2018, as part of the Gulf Cooperation Council’s coordinated approach to taxation. The Federal Tax Authority (FTA) oversees VAT administration, ensuring businesses comply with established regulations while supporting the UAE’s economic diversification goals.

The VAT rate in the UAE is set at a standard 5%, making it one of the lowest globally. This indirect tax applies to most goods and services, with certain categories receiving zero-rated or exempt VAT treatment in line with FTA guidelines.

Key Categories in UAE Business Operations

The FTA classifies supplies into three primary categories:

- Standard-rated supplies (5%): Most goods and services fall under this category

- Zero-rated supplies (0%): Includes exports, international transport, and precious metals

- Exempt supplies: Financial services, residential property sales, and local passenger transport

Understanding these classifications is crucial when you calculate charges in Dubai or any UAE emirate, as each category affects your levy liability differently.

Step-by-Step Guide to Calculate Charges on Sales and Purchases

Basic Calculation Formula

To calculate the amount on standard-rated supplies, follow this fundamental formula:

Amount = Net Price × 0.05

Total Price Including Charge = Net Price + Amount

Practical Example: Standard Calculation

Consider a Dubai-based consulting firm providing services worth AED 10,000:

- Net price: AED 10,000

- Amount: AED 10,000 × 5% = AED 500

- Total price including charge: AED 10,000 + AED 500 = AED 10,500

This calculation demonstrates how businesses collect charges on behalf of the FTA, adding the levy to their service prices.

Reverse Calculation: Finding Net Price from Charge-Inclusive Amount

When dealing with prices that include levy, businesses need to separate the net amount from the charge component:

Net Price = Total Price ÷ 1.05

Amount = Total Price – Net Price

Example of reverse calculation:

- Total price including levy: AED 5,250

- Net price: AED 5,250 ÷ 1.05 = AED 5,000

- Amount: AED 5,250 – AED 5,000 = AED 250

Input and Output: Understanding the Mechanism

Output Calculation

Output charges represent the levy businesses collect on sales of goods and services to customers. Every registered entity must charge output levy at the applicable percentage and remit these collections to the FTA.

When you calculate charges in the UAE for sales transactions, the output charge becomes a liability on your books until payment to the authority.

Input Recovery Process

Input charges encompass the levy businesses pay on purchases, expenses, and imports. The UAE system allows eligible entities to recover input charges, effectively making it a flow-through levy rather than a cost.

Key considerations for input recovery:

- Maintain proper invoices and supporting documentation

- Ensure purchases relate to taxable business activities

- Meet FTA requirements for recovery claims

- File timely returns to claim input credits

Payable Calculation

The net payable to the FTA equals:

Payable = Output Collected – Input Paid

If input exceeds output, businesses may claim a refund from the FTA, subject to verification and compliance requirements.

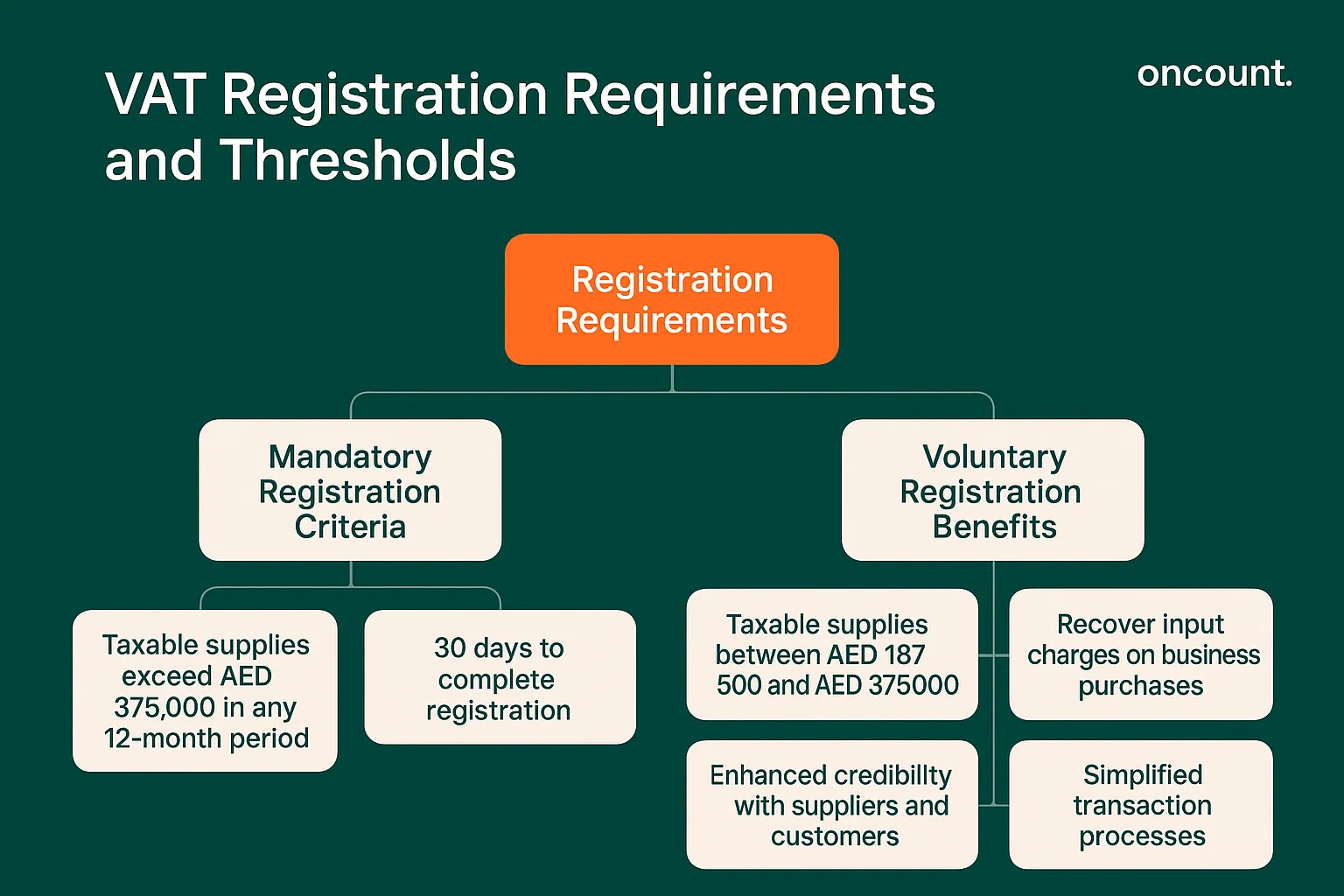

Registration Requirements and Thresholds

Mandatory Registration Criteria

Businesses must register when their taxable supplies exceed AED 375,000 in any 12-month period. The FTA guidance stipulates that companies reaching this threshold have 30 days to complete registration.

Voluntary Registration Benefits

Companies with taxable supplies between AED 187,500 and AED 375,000 may choose voluntary registration. This option provides several advantages:

- Ability to recover input charges on business purchases

- Enhanced credibility with suppliers and customers

- Simplified transaction processes with other registered entities

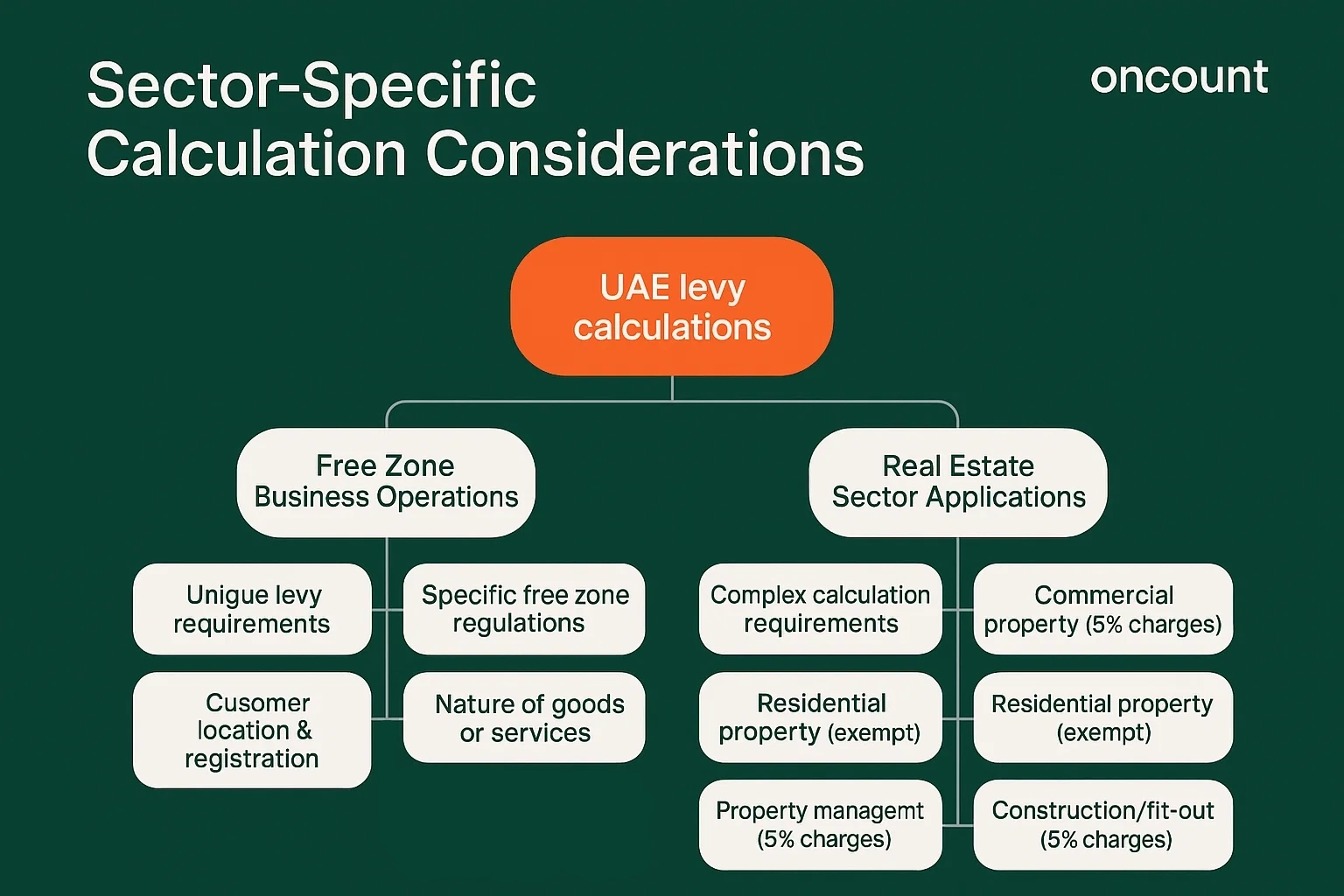

Sector-Specific Calculation Considerations

Free Zone vs. Mainland Business Operations

Free zone entities face unique levy calculation requirements. While many free zone activities qualify for zero-rating, businesses must carefully evaluate each transaction’s treatment based on:

- Customer location and registration status

- Nature of goods or services provided

- Specific free zone regulations and FTA interpretations

Real Estate Sector Applications

The UAE real estate sector involves complex calculations, particularly for:

- Commercial property transactions (5% charges)

- Residential property sales (exempt)

- Property management services (5% charges)

- Construction and fit-out services (5% charges)

Real estate companies must understand how to calculate charges for different transaction types while maintaining compliance with ESR and other regulatory requirements.

Technology Solutions for Accurate Management

Automated Calculation Systems

Modern enterprises leverage technology to manage effectively, implementing solutions that:

- Calculate charges automatically across all transactions

- Generate compliant invoices and credit notes

- Integrate with accounting systems for seamless reporting

- Provide audit trails for FTA compliance verification

Return Preparation and Filing

Businesses registered must file returns quarterly, declaring output charges, input levies, and net amounts payable. Advanced software solutions streamline this process while ensuring accuracy and regulatory compliance.

Common VAT Calculation Errors and Prevention Strategies

Frequent Calculation Mistakes

Based on FTA audit findings, common errors include:

- Incorrect rate application on mixed supplies

- Improper treatment of zero-rated exports

- Inadequate documentation for input recovery

- Timing differences in recognition and payment

Best Practices for Compliance

Businesses collect charges, responsibilities extend beyond basic calculations. Implementing robust processes ensures ongoing compliance:

- Regular training for finance teams on regulations

- Quarterly compliance reviews and reconciliations

- Proactive engagement with specialists for complex transactions

- Maintenance of comprehensive documentation systems

Expert Insights: Maximizing Efficiency in UAE Operations

Strategic Planning Considerations

Successful UAE enterprises integrate considerations into broader financial planning. Experts recommend evaluating:

- Supply chain structures for optimal efficiency

- Customer and supplier registration status impacts

- Cross-border transaction planning and documentation

- Technology investments for automated compliance management

Regulatory Updates and Future Developments

The FTA continues refining regulations based on implementation experience. Enterprises should monitor official announcements regarding:

- Industry-specific guidance updates

- Digital services developments

- Enhanced compliance requirements and audit procedures

- Regional coordination initiatives

Building Calculation Competency

Mastering how to calculate charges in the UAE requires understanding both technical requirements and practical applications. Enterprises that invest in proper calculation procedures, maintain accurate records, and stay current with regulatory developments position themselves for long-term success in the UAE market.

The standard rate is 5% represents just one component of comprehensive compliance. By implementing systematic approaches to calculation, enterprises can minimize compliance risks while optimizing their positions within the UAE’s evolving fiscal framework.

For complex scenarios or specialized industry requirements, consider engaging qualified professionals who understand the nuances of UAE regulations and can provide tailored guidance for your specific circumstances.