Liquor Licensing in Dubai: Overview and Legal Requirements

The legal landscape surrounding alcohol in Dubai reflects the UAE’s cultural values while accommodating its diverse population and thriving hospitality sector. Understanding these foundational requirements is essential for anyone seeking to purchase alcohol for personal consumption or operate a business that serves alcoholic beverages.

Definition and Legal Requirement of an Alcohol License

An alcohol license in Dubai constitutes official authorization issued by relevant authorities permitting individuals or establishments to purchase, possess, consume, or sell alcoholic beverages within specified parameters. The requirement for such authorization stems from federal and emirate-level legislation that strictly prohibits the sale of alcohol in Dubai without proper permits. This regulatory framework applies universally, though exemptions exist for specific zones such as airport duty-free areas.

The licensing system distinguishes between personal permits for individual consumption and commercial authorizations for establishments. The core requirements include:

- Valid residence status: Only UAE residents with current visas qualify for personal licenses

- Age verification: Applicants must be 21 years or older to legally purchase and consume alcohol

- Religious eligibility: Non-Muslim status is required for personal license applications

- Proper authorization: All purchases from liquor stores must be supported by valid licensing

- Regulatory compliance: License holders must adhere to consumption restrictions and transport regulations

Without a license, purchasing alcohol from liquor stores remains illegal, and violations can result in substantial fines or legal complications. The regulatory structure ensures controlled distribution while preventing unauthorized sale and consumption throughout the emirate.

Who Needs a License: Eligibility for UAE Residents

Eligibility for obtaining a liquor license centers primarily on residency status and religious affiliation. The following criteria determine who can apply:

- Non-Muslim residents: Only individuals of non-Muslim faith qualify for personal licenses

- Valid residence permit holders: Current and active UAE residence visa required

- Age requirement: Applicants must be 21 years or older

- Legal documentation: Valid Emirates ID and passport essential

- Employment or residential proof: Documentation confirming legal presence in the emirate

Muslim residents face restrictions aligned with religious principles, as adherence to Islamic law prohibits alcohol consumption. The licensing framework respects these cultural considerations while providing legal access for eligible individuals. Visitors to the UAE encounter different regulations, which have evolved significantly in recent years to accommodate tourism while maintaining regulatory control.

Applicants must demonstrate legal residency through documentation including a valid visa and Emirates ID. The nature of your business or employment status does not affect personal eligibility, though commercial licensing follows separate criteria tied to establishment type and business setup parameters.

Legal Age for Alcohol Purchase and Consumption

Individuals aged 21 can obtain authorization to purchase and consume alcohol in licensed venues throughout Dubai. This age threshold applies universally to both personal licenses and consumption at licensed establishments such as hotels, bars, and restaurants. The strict regulations ensure that minors cannot legally access alcoholic beverages under any circumstances.

Establishments serving alcohol implement rigorous age verification procedures to maintain compliance with local laws. Failure to enforce age restrictions can result in severe penalties for the premise, including suspension of operating privileges and substantial financial penalties. The 21-year minimum reflects the emirate’s approach to balancing accessibility with public health considerations.

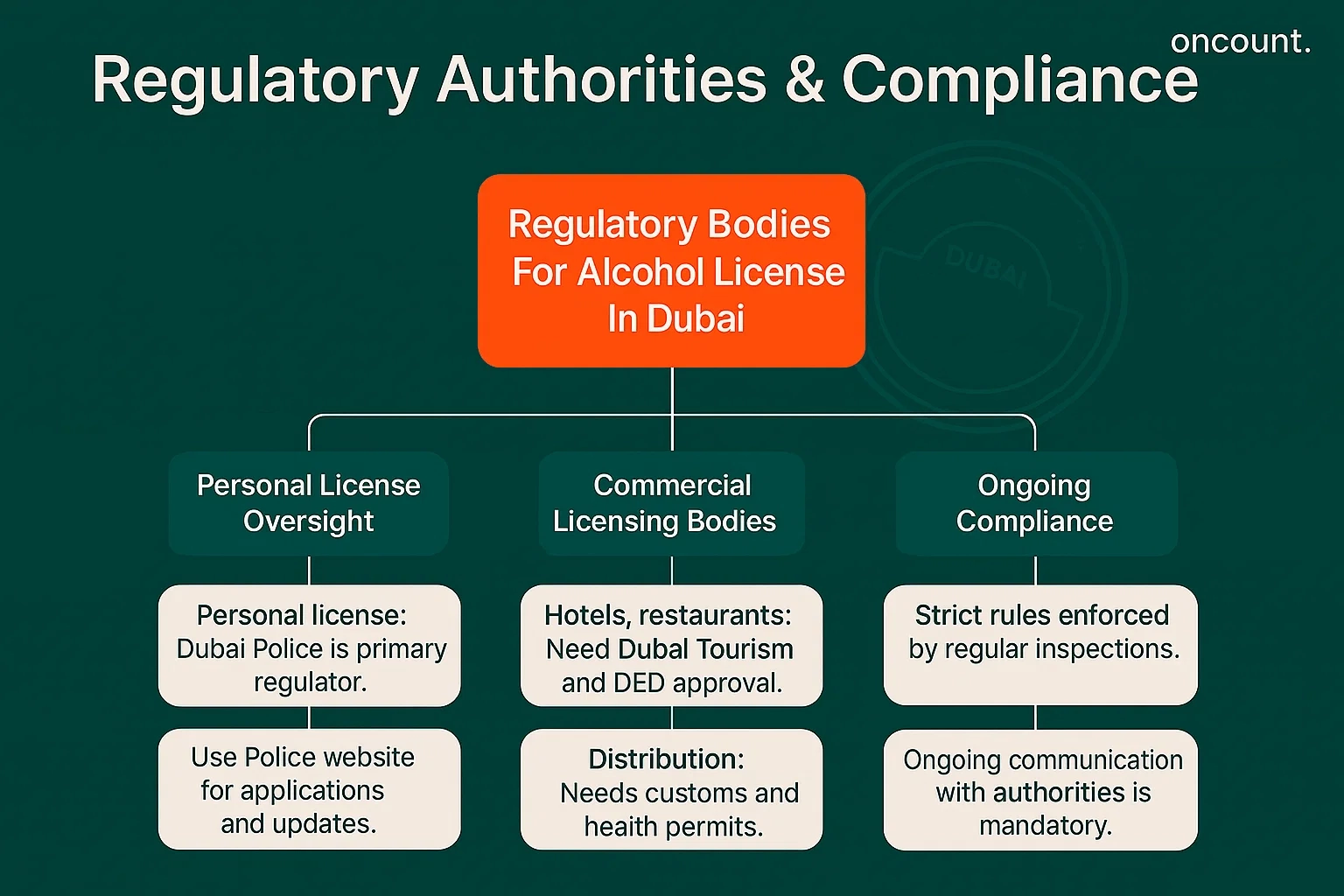

Key Regulatory Authority

Dubai Police serves as the primary regulatory body overseeing personal alcohol licensing, working in coordination with the Department of Economic Development (DED) and other relevant authorities. The Dubai Police website provides official channels for application submission, documentation requirements, and regulatory updates affecting license holders.

Commercial licensing falls under multiple jurisdictions depending on the nature of your business. Hotels and restaurants must secure approval from Dubai Tourism, the DED, and obtain specific permits for beverage service. Trade licenses for alcohol distribution require coordination between multiple government entities, including customs authorities and health departments.

The regulatory oversight ensures strict regulations are enforced consistently, with regular inspections and compliance monitoring. Businesses operating in the hospitality sector must maintain ongoing communication with licensing authorities to remain current on evolving requirements and ensure continued adherence to all applicable standards.

Latest Changes to Alcohol Licensing Laws in the UAE

The regulatory environment surrounding alcohol consumption in Dubai has undergone significant transformation in recent years, reflecting the emirate’s commitment to enhancing its appeal as a global destination while maintaining appropriate controls. These reforms have materially impacted both residents and visitors, creating more streamlined processes and expanded access within defined legal boundaries.

Recent Reforms Impacting Residents and Visitors

Beginning in 2020, the UAE implemented substantial changes to alcohol licensing laws, progressively easing certain restrictions while reinforcing enforcement mechanisms. Key reforms include:

- Elimination of salary certificates: No longer required for personal license applications

- Removal of minimum income thresholds: Previously restricted access for lower-wage workers

- Digital platform transition: Online applications through authorized retailers and Dubai Police website

- Faster processing times: Most applications now approved within 24 to 48 hours

- Enhanced record-keeping: Improved compliance monitoring capabilities for authorities

- Retailer flexibility: License holders can purchase from any licensed store, not just the issuing outlet

The regulatory updates maintained core principles regarding eligibility and consumption locations while removing administrative barriers that previously complicated the application process. These adjustments reflect a broader strategy to enhance Dubai’s vibrant nightlife and hospitality offerings without compromising regulatory oversight.

Updated Rules for Residents

Current regulations permit non-Muslim residents to obtain personal licenses without demonstrating minimum income levels or submitting employer documentation. The streamlined application process requires only basic identification documents, including a valid residence visa and Emirates ID, along with proof of residential address within the emirate.

License holders may now purchase alcohol from any licensed retailer regardless of which outlet issued their permit, providing greater flexibility compared to previous restrictions that tied individuals to specific stores. The amount of alcohol that can be purchased remains subject to monthly limits, though these vary based on location and retailer policies rather than standardized caps.

Residents must ensure their licenses remain current to avoid legal complications. The licensing authorities have implemented automatic renewal reminders through mobile applications and email notifications, helping individuals maintain compliance without administrative lapses. Expired licenses immediately suspend purchasing privileges and may necessitate new applications if not renewed promptly.

New Regulations for Visitors

Tourists visiting Dubai gained significant new privileges under reformed regulations that recognize the emirate’s position as a major international destination. Visitors may now legally purchase alcohol at licensed establishments such as hotels and bars without holding a personal permit, provided they meet the minimum age requirement and consume beverages on-premise.

These changes eliminated previous ambiguities that sometimes exposed tourists to potential penalties for consumption without proper documentation. The reforms clarified that immediate consumption at licensed venues does not require advance authorization, aligning Dubai’s approach with international tourism standards while maintaining controlled access.

Off-premise purchases, such as buying alcohol to transport to private accommodations, follow different rules. Tourists purchasing from duty-free facilities at Dubai International Airport may transport reasonable quantities for personal use, though commercial volumes or redistribution remains strictly prohibited and subject to enforcement action.

Can Tourists Get a License?

Tourists cannot obtain traditional personal licenses of the type issued to residents, as the licensing framework remains fundamentally tied to residence status and long-term presence in the UAE. However, temporary access to alcohol purchase and consumption through licensed venues effectively serves the needs of short-term visitors without requiring formal authorization processes.

For tourists seeking to purchase alcohol from liquor stores for private consumption, limited options exist. Some retailers have introduced temporary purchase permits available to visitors staying at registered hotels, allowing small-quantity purchases upon presentation of passport and hotel confirmation. These arrangements remain retailer-specific and subject to change based on evolving local regulations.

The distinction between resident and visitor access reflects the UAE’s approach to alcohol regulation, which prioritizes control over distribution channels while accommodating legitimate consumption within appropriate settings. Visitors should consult current regulations through official channels or their accommodation providers to understand available options during their stay.

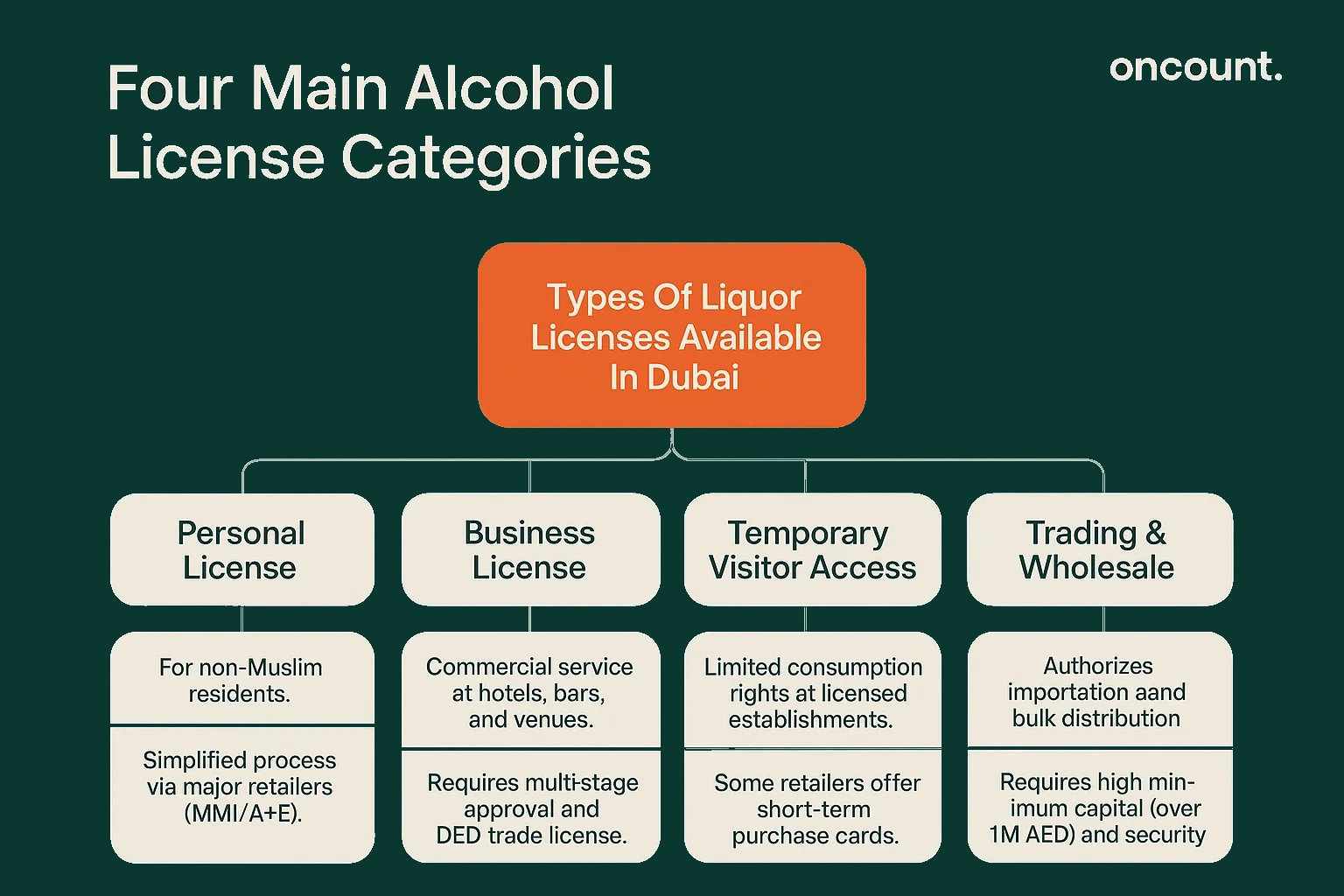

Types of Liquor Licenses Available in Dubai

The licensing framework encompasses several distinct categories, each designed to address specific use cases ranging from personal consumption to commercial operations and wholesale distribution. Understanding the types of alcohol licenses available ensures applicants select the appropriate authorization for their intended purpose while maintaining full compliance with regulatory requirements.

The main license categories include:

- Personal License for Residents: Authorizes individual purchase and private consumption

- Business License for Establishments: Permits commercial service at hotels, restaurants, and bars

- Temporary License for Visitors: Limited access mechanisms for short-term tourists

- Trading and Wholesale License: Commercial importation and distribution authorization

Personal License for Residents

Personal licenses authorize non-Muslim residents to legally purchase alcohol from designated liquor stores and transport beverages to their residence for private consumption. This license type represents the most common form of authorization, enabling individuals to buy alcohol without the need to consume exclusively at commercial establishments.

The personal license application process has been simplified considerably, with most major retailers offering integrated services that combine application submission with immediate purchasing capability upon approval. African + Eastern and Maritime and Mercantile International (MMI) represent the two primary liquor control operators in Dubai, each managing multiple store locations and processing applications through their respective systems.

License validity typically extends for one year, after which renewal becomes necessary to maintain purchasing privileges. The required documents for initial applications include a valid passport copy, Emirates ID, residence visa documentation, and current residential address proof such as utility bills or tenancy contracts. Application fees vary by retailer but generally range between 100 and 270 AED, including initial setup and annual charges.

Business License for Establishments

Establishments seeking to serve alcohol to customers must secure comprehensive commercial authorization through a multi-stage approval process involving several regulatory bodies. The business license for alcohol service permits restaurants, hotels, nightclubs, and similar venues to legally offer alcoholic beverages for immediate consumption at licensed premises.

The nature of your business significantly influences the specific requirements and approval pathway. Key licensing considerations include:

Establishment Types Eligible for Licensing:

- Hotels with restaurant and bar facilities

- Standalone restaurants in authorized zones

- Nightclubs and entertainment venues

- Private clubs with membership structures

- Event spaces with hospitality permits

Core Approval Requirements:

- Valid trade license from DED or free zone authority

- Detailed business plans demonstrating zoning compliance

- Architectural plans showing designated service areas

- Proof of adequate capitalization and financial stability

- Management qualifications and experience documentation

Key prerequisites include detailed business plans demonstrating compliance with zoning regulations, architectural plans showing designated service areas, and proof of adequate capitalization. The approval process involves site inspections, verification of management qualifications, and assessment of proposed operational controls to prevent unauthorized distribution or consumption by prohibited individuals.

Commercial licenses impose ongoing compliance obligations including staff training requirements, regular inventory reporting, and strict adherence to operating hours and service protocols. Violations can result in temporary suspension, substantial fines exceeding 50,000 AED, or permanent license revocation depending on severity and repetition.

Temporary License for Visitors

Temporary authorization mechanisms for visitors have evolved alongside broader regulatory reforms, though true temporary licenses comparable to resident permits remain limited. What exists instead is a framework allowing tourists to access alcohol through licensed establishments without advance permits, effectively creating temporary consumption rights within defined contexts.

Some retailers have introduced short-term purchase cards for hotel guests, allowing limited off-premise purchases during their stay. These arrangements typically require coordination between the hotel and specific liquor store operators, with purchases charged to the guest’s room or paid directly with passport verification and hotel confirmation.

The temporary access model reflects pragmatic recognition that tourists represent significant consumers within Dubai’s hospitality economy while maintaining the principle that sustained, regular purchasing requires formal residency-based licensing. Visitors should inquire at their accommodation regarding available options and any partnerships with licensed retailers offering temporary purchasing capabilities.

Trading and Wholesale License

Commercial entities engaged in alcohol importation, wholesale distribution, or retail operations must obtain specialized trading licenses that authorize large-scale handling of alcoholic beverages. The trading and wholesale license category involves substantially more complex regulatory requirements compared to personal or establishment licenses, reflecting the greater control concerns associated with bulk distribution.

Applicants for trading licenses must demonstrate significant financial capacity, with minimum capital requirements often exceeding one million AED. The company formation process for alcohol trading businesses necessitates specific corporate structures and shareholder compositions, with restrictions on ownership and control by individuals from certain nationalities or religious backgrounds.

The licensing process requires approval from federal customs authorities, health inspectors, Dubai Police, and economic regulators. Applicants must secure dedicated storage facilities meeting strict specifications for temperature control, security, and inventory tracking. These premises undergo regular inspections to verify compliance with storage standards and prevent diversion to unauthorized channels.

Trading license holders face comprehensive reporting obligations, including detailed transaction records, inventory reconciliation, and verification that all sales occur exclusively to properly licensed purchasers. The regulatory framework aims to maintain complete traceability throughout the distribution chain, from importation through final retail sale or service consumption.

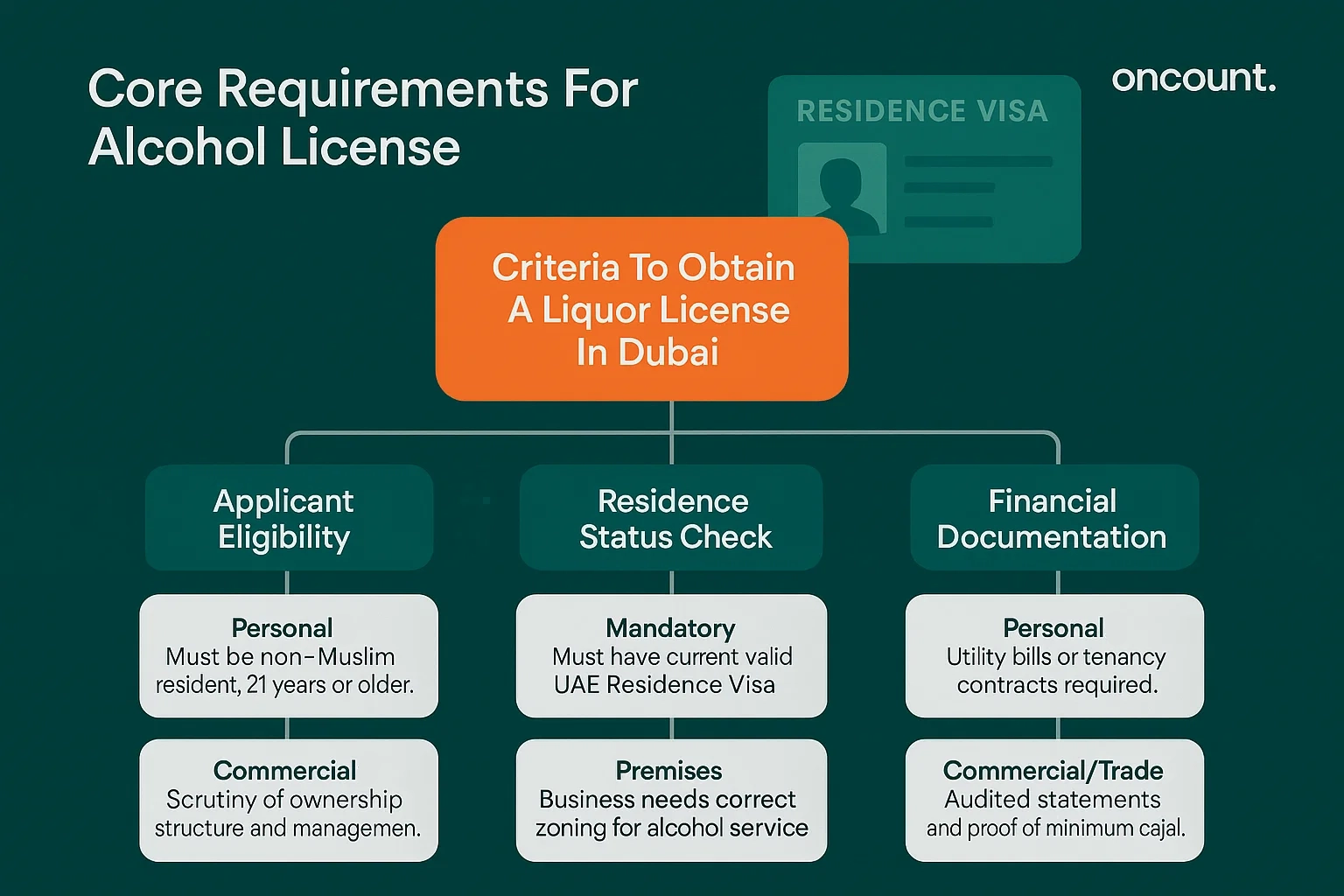

Criteria to Get a Liquor License in Dubai

Securing authorization to purchase or handle alcohol requires meeting specific eligibility standards and providing documentation that establishes identity, legal status, and compliance with regulatory prerequisites. The criteria to obtain a liquor license vary based on license type, though certain foundational requirements apply universally across personal and commercial applications.

Applicant Eligibility Requirements

Personal license applicants must be non-Muslim residents aged 21 or older with valid legal status in the UAE. The requirement for non-Muslim status stems from religious considerations and remains strictly enforced, with applicants sometimes required to provide affirmations regarding religious affiliation. False declarations expose individuals to immediate license revocation and potential legal action.

Residency status must be current and valid throughout the license period. Individuals on visit visas or tourist status remain ineligible for personal licenses regardless of intended duration of stay or other qualifications. The residence visa status check represents a fundamental screening mechanism ensuring only authorized long-term residents gain purchasing privileges.

For commercial licenses, eligibility extends to business entities rather than individuals, though the company’s ownership structure and management composition undergo scrutiny. Entities with Muslim majority ownership may face restrictions or outright ineligibility for alcohol-related business licenses, depending on the specific ownership configuration and applicable regulations.

Residence Visa Status Check

Verification of valid residence authorization constitutes a mandatory component of all license applications. Applicants must provide copies of their residence visa page showing current validity, with systems automatically flagging expiring or expired visas for rejection. The residence visa status check occurs both at initial application and periodically throughout the license validity period.

Some retailers have implemented automated verification systems linked to immigration databases, allowing real-time confirmation of visa status. This integration reduces processing delays and prevents inadvertent issuance to individuals whose residence status has lapsed. Applicants should verify their visa validity before initiating the application process to avoid unnecessary rejections.

For establishment licenses, the business must operate under valid trade licenses issued by relevant free zone or mainland authorities. The premise must have appropriate zoning classification permitting alcohol service, as residential or certain commercial zones prohibit such operations regardless of other qualifications. The approval process includes verification that the establishment’s legal structure aligns with permitted ownership patterns for alcohol-related businesses.

Financial Status Documents

While recent reforms eliminated minimum income requirements for personal licenses, applicants may still need to demonstrate financial capacity to pay associated fees and provide basic residential stability proof. Required documents typically include recent utility bills or tenancy contracts showing Dubai residency, which serve dual purposes of confirming address and demonstrating established presence in the emirate.

Commercial license applicants face substantially more rigorous financial scrutiny. The financial status documents required for business licenses include audited financial statements, bank guarantees, proof of paid-up capital meeting minimum thresholds, and detailed business projections. Establishments must demonstrate adequate financial resources to maintain compliant operations, including staff training, security measures, and proper storage or service facilities.

Trading license applicants encounter the most demanding financial requirements, often needing to post bonds or guarantees securing compliance with customs and tax obligations. The substantial capital requirements reflect regulatory intent to ensure only serious, well-capitalized entities enter the wholesale distribution sector, reducing risks of financial instability leading to control lapses.

Required Permits and Approvals

Beyond the core license itself, various supplementary permits and approvals create the complete authorization framework. Personal license holders need only the single permit issued by their chosen retailer in coordination with Dubai Police systems. However, establishments require layered permissions addressing different regulatory aspects.

Food service establishments must hold valid health department permits covering food safety and hygiene standards before applying for alcohol service authorization. The premise must meet physical requirements including separate storage areas for alcoholic beverages, appropriate ventilation, and adequate security measures preventing unauthorized access or theft.

Trading operations require customs registration, secure storage facility approval from Dubai Police, and coordination with free zone authorities if operating within designated zones. Import licenses necessitate additional clearances from federal agencies overseeing controlled substances. The cumulative approval process for commercial operations can extend six months or longer, requiring careful planning and coordination across multiple regulatory entities.

Step-by-Step Guide to Apply for a Liquor License in Dubai

The application process for personal licenses has been streamlined significantly through digital platforms and retailer integration, while commercial licensing remains more complex and time-intensive. This systematic guide outlines the procedural steps for individuals seeking personal authorization, with notes on commercial licensing pathways where applicable.

Prepare Required Documents

Begin by assembling all necessary documentation before initiating the formal application. For personal licenses, gather your original passport, current residence visa (showing at least three months remaining validity), Emirates ID, and proof of residential address such as a utility bill or tenancy contract issued within the past three months. Some retailers may request additional documentation, though the core requirements remain consistent across providers.

Ensure all documents are current and clearly legible, as quality issues can cause processing delays or rejections. Digital copies typically suffice for online applications, though some retailers may request physical presentation of original documents upon first purchase for verification purposes. Organizing documents in advance expedites the process significantly, allowing same-day approval in many cases.

Commercial applicants should engage professional advisors to compile substantially more comprehensive documentation packages including detailed business plans, site plans, ownership declarations, financial statements, and regulatory clearances. The complexity of business setup for alcohol-related operations typically necessitates specialized legal and accounting support to navigate the multi-agency approval process successfully.

Choose a Licensed Retailer

Dubai’s alcohol retail landscape is dominated by two main operators: African + Eastern (which operates stores under various brand names) and MMI (Maritime and Mercantile International). Both organizations maintain multiple locations throughout the emirate and offer integrated application services alongside their retail operations. Selection between retailers largely comes down to location convenience and personal preference, as licensing privileges extend across all licensed stores once issued.

Visit the retailer’s website or mobile application to initiate the digital application process. Both major retailers have developed user-friendly platforms allowing document upload, application tracking, and electronic payment. Some individuals prefer in-person application at physical store locations, which remains available though increasingly uncommon given the efficiency of digital channels.

The chosen retailer coordinates with Dubai Police systems to process applications and issue authorization once approved. This integration ensures that licenses meet official standards and are properly registered in government databases, enabling enforcement and compliance monitoring. The licensing process occurs seamlessly from the user perspective, with the retailer handling backend coordination with authorities.

Submit Application and Pay the Fee

Complete the online application form accurately, providing all requested information and uploading clear copies of required documents. Typical application fees range between 100 and 270 AED, which includes initial setup charges and the first year’s license validity. Some retailers bundle application fees with initial purchase minimums, effectively reducing the upfront cost through store credit.

Payment methods typically include credit cards, debit cards, and sometimes digital payment platforms, with immediate processing upon successful transaction. The system generates a confirmation receipt and application reference number, which should be retained for tracking purposes and future reference. Most applications receive automated acknowledgment within minutes, with substantive processing commencing shortly thereafter.

For establishment licenses, fees escalate substantially based on premise type, size, and intended service scope. Annual fees for restaurant or hotel alcohol licenses can exceed 50,000 AED, with additional costs for inspections, staff training certifications, and compliance monitoring. Trading licenses carry even higher fee structures reflecting the greater regulatory intensity associated with wholesale operations. Submit the application and pay the fee through channels designated by the relevant authorities, which varies based on license type and regulatory jurisdiction.

Process Timeline and Duration

Personal license applications submitted through major retailers typically process within 24 to 48 hours, with many approvals occurring same-day during business hours. The expedited timeline reflects the streamlined digital systems and integrated coordination between retailers and Dubai Police. Applicants receive notification via email or mobile application alert once approved, with immediate activation of purchasing privileges.

Delays occasionally occur due to document quality issues, visa status questions, or system backlogs during peak application periods. Applicants should monitor their application status through the retailer’s tracking system and respond promptly to any requests for additional information or clarification. Most issues resolve quickly once applicants provide requested supplementary documentation.

Commercial licensing timelines extend considerably, typically requiring three to six months from initial application to final approval. The process timeline and duration depends heavily on the complexity of the establishment, completeness of initial submissions, and responsiveness to regulatory inquiries during the review process. Applicants should build adequate lead time into their business planning, avoiding commitments to opening dates before securing final approvals.

Collect Your License

Upon approval, personal licenses are delivered electronically, with digital copies accessible through the retailer’s mobile application or customer portal. Some retailers also provide physical cards for those preferring tangible licenses, though the digital version is fully sufficient for purchasing purposes. The license displays key information including the holder’s name, license number, validity period, and applicable terms.

Present the license (digital or physical) when making purchases at any licensed liquor store in Dubai. Retailers scan or verify the license number to confirm validity and record the transaction for regulatory reporting purposes. This verification process takes only seconds and ensures all sales occur exclusively to properly authorized individuals, maintaining system integrity.

Establishment licenses are typically issued as official certificates displayed prominently at the premise, with copies maintained in business records. Staff members should be trained on proper license presentation during inspections and verification that the authorization remains current. Commercial licensees must renew their permits annually, maintaining continuous validity to avoid operational interruptions.

Rules and Restrictions for Liquor Consumption in Dubai

Compliance with consumption regulations requires understanding where alcohol may be legally consumed, quantity limitations, transport rules, and consequences of violations. The rules and regulations governing alcohol use extend beyond simple licensing to encompass a comprehensive framework addressing various consumption scenarios and public conduct expectations.

Key Liquor Regulations

Compliance with consumption regulations requires understanding the comprehensive framework addressing various scenarios and public conduct expectations. The fundamental rules and regulations include:

- No public consumption: Alcohol strictly prohibited in streets, parks, beaches, shopping centers, and public spaces

- Licensed venues only: Legal consumption limited to private residences and licensed establishments such as hotels and restaurants

- Sealed transport: Alcohol must remain in original sealed packaging when moving between stores and residences

- Zero tolerance for driving: Any detectable alcohol consumption prevents legal driving under UAE law

- Age-restricted service: Serving alcohol to anyone under 21 is strictly prohibited regardless of circumstances

- Religious restrictions: Providing alcohol to Muslim individuals constitutes a serious legal violation

Even license holders face potential penalties for public consumption, as the permit authorizes purchase and private use but does not create blanket permission for consumption anywhere. Opening containers or consuming alcohol in vehicles while driving constitutes a serious offense regardless of license status, with zero-tolerance policies applied to drinking and driving.

License holders must exercise judgment and caution when sharing beverages with others, ensuring recipients meet eligibility criteria. Providing alcohol to prohibited individuals can result in license revocation and potential criminal charges depending on circumstances.

Where to Consume Alcohol Legally

Understanding approved consumption venues is essential for maintaining compliance with local laws. Legal alcohol consumption occurs in the following locations:

Licensed Commercial Establishments:

- Hotels with appropriate beverage service permits

- Standalone bars and nightclubs in designated zones

- Restaurants authorized to serve alcoholic beverages

- Private clubs with membership and licensing requirements

- Lounges and entertainment venues holding valid permits

Private Residences:

- Personal homes and apartments of license holders

- Private property where consumption occurs away from public view

- Residential gatherings within reasonable bounds and noise regulations

Licensed establishments provide the primary legal venues for alcohol consumption outside private residences. Hotels with appropriate permits operate bars, lounges, and restaurants serving alcoholic beverages to guests and visitors who meet age requirements. These venues implement verification procedures to ensure compliance with licensing laws and prevent service to ineligible individuals.

Standalone bars and nightclubs operating under proper licenses offer additional consumption venues, contributing to Dubai’s vibrant nightlife scene. These establishments often operate in commercial districts or hospitality zones where alcohol service is specifically permitted. Patrons should verify that venues hold valid licenses, as consumption without a license at unauthorized locations remains illegal regardless of payment or other factors.

Private residences represent the other primary legal consumption location for license holders. Individuals may consume alcohol purchased from licensed retailers within their homes without additional restrictions, provided they remain in compliance with general conduct expectations. However, hosting large gatherings with alcohol service may attract regulatory attention if noise complaints or other issues arise, potentially exposing hosts to enforcement action if unlicensed guests consume beverages.

Consequences of Drinking Without a License

Understanding the legal risks associated with unlicensed consumption helps individuals avoid serious penalties. Violations can result in:

Individual Penalties:

- Immediate fines starting at several hundred AED for first-time violations

- Confiscation of all alcoholic beverages in possession

- Criminal prosecution for serious or repeat offenses

- Potential impact on residence visa status for expatriates

- Escalating consequences for repeat violations

Public Intoxication Consequences:

- Arrest and detention for disruptive behavior

- Prosecution under public indecency or disturbance laws

- Imprisonment for serious cases involving safety concerns

- Substantial fines potentially reaching thousands of AED

- Deportation risk for expatriate residents

Business Violations:

- Forced closure of establishments serving without proper authorization

- Fines potentially exceeding 100,000 AED for commercial violations

- Prosecution of responsible managers and owners

- Permanent license revocation preventing future operations

- Criminal charges for systematic unauthorized service

Consuming alcohol without proper authorization constitutes a legal violation subject to various enforcement responses. The combination of unlicensed consumption and disruptive behavior represents a serious offense that can lead to severe legal complications. The authorities maintain strict enforcement particularly in cases involving public disruption or safety concerns.

The regulatory framework treats unauthorized commercial service as particularly serious given the broader public access implications and potential for systematic violations. Businesses operating in the hospitality sector must prioritize licensing compliance as fundamental to their legal operation.

Maximum Alcohol Purchase Amount

Personal license holders do not face strictly defined monthly purchase limits under current regulations, though retailers maintain transaction records that could theoretically flag unusually large or frequent purchases for review. Practical limitations arise from retailer policies and inventory availability rather than legal caps. Most retailers implement internal controls to prevent suspected commercial resale by personal license holders, including questioning customers making exceptionally large purchases.

The amount of alcohol that individual transactions may contain varies by retailer policy, with some stores limiting single purchases to ensure product availability for all customers. These internal limits typically exceed reasonable personal consumption needs, such as 50 bottles of wine or equivalent volumes in other beverage categories. Customers requiring larger quantities for special occasions can usually accommodate needs through advance arrangements with store management.

Commercial licensees face different considerations, with purchase volumes typically unlimited provided proper documentation establishes legitimate business use. However, trading license holders must reconcile inventory purchases with sales records, maintaining complete traceability to prevent diversion to unauthorized channels. Discrepancies between purchasing volumes and documented sales trigger regulatory scrutiny and potential violations charges.

Liquor Stores in Dubai: Where to Purchase Alcohol

Legal alcohol purchase occurs exclusively through licensed retailers, which operate under strict regulatory oversight and maintain comprehensive transaction records. Understanding store locations, operating parameters, and purchasing procedures ensures consumers can access products conveniently while remaining fully compliant with applicable requirements.

Popular Liquor Store Locations

Legal alcohol purchase occurs exclusively through licensed retailers, which operate under strict regulatory oversight and maintain comprehensive transaction records. The two major operators dominate Dubai’s retail landscape:

African + Eastern Store Locations:

- Barsha Heights retail outlet

- Al Wasl neighborhood store

- Jumeirah area location

- Multiple outlets under Le Clos and Cheers brands

- Extensive wine, spirits, and beer selections

MMI (Maritime and Mercantile International) Locations:

- Al Quoz distribution center and retail

- Deira traditional commercial area

- Various shopping district locations

- Integrated retail spaces with complementary products

- Comprehensive international beverage catalog

Smaller independent operators hold licenses in certain areas, though these remain far less common than the dominant major retailers. Hotel-based liquor stores operate at some properties, primarily serving guests but sometimes open to general public with proper licensing. Consumers should verify that any store holds valid licensing before making purchases, as buying alcohol from unauthorized sources remains illegal regardless of payment or other considerations.

Operating Hours and Purchase Rules

Licensed liquor stores typically operate daily, though specific hours vary by location and operator policies. Many stores open by mid-morning and close in late evening, with some locations offering extended hours to accommodate working residents. Operating hours may be restricted during Ramadan, the holy month of fasting, when stores often close or limit hours out of respect for religious observances. Consumers should verify current hours before visiting, particularly during religious observance periods.

All purchases require license verification, with stores scanning or recording license numbers to document compliance. Customers must present valid identification along with their license, particularly for first-time purchases at new locations. The verification process is streamlined and typically completes in seconds, causing minimal purchasing delay while maintaining regulatory compliance.

Some stores implement minimum or maximum purchase amounts, though these policies vary by retailer. Credit card and cash payments are widely accepted, with some locations offering loyalty programs providing discounts or benefits for regular customers. Retailers may restrict certain premium or allocated products to prevent hoarding, ensuring fair access across their customer base.

Online Alcohol Purchase and Delivery

Digital purchasing has expanded significantly, with both major retailers offering comprehensive online platforms and mobile applications. These services allow browsing complete product catalogs, placing orders, and scheduling delivery to residential addresses. Online alcohol purchase and delivery must still comply with licensing requirements, with systems verifying license status during checkout and requiring verification upon delivery.

Delivery services typically operate within defined zones covering most residential areas of Dubai, though some remote locations may fall outside service boundaries. Delivery fees vary based on order size and destination, with many retailers offering free delivery above minimum purchase thresholds. Orders placed during business hours often deliver same-day, providing convenient access without physical store visits.

Delivery acceptance requires presence of the license holder or authorized representative, with drivers verifying identification and license validity before completing the handover. This verification ensures beverages reach only authorized recipients, maintaining control throughout the distribution chain. Online ordering has become increasingly popular, particularly following pandemic-related adaptations that accelerated digital service development.

Purchase Limits at Stores

While formal regulatory purchase limits do not exist for personal licenses, practical constraints and retailer policies create effective boundaries on transaction sizes. Stores monitor purchasing patterns to prevent suspected commercial resale by personal license holders, which violates license terms and regulatory intent. Customers attempting unusually large or frequent purchases may face questioning or transaction limitations pending clarification of use purposes.

Most retailers accommodate reasonable bulk purchases for special occasions such as parties or gatherings, provided customers can credibly explain the intended use. Advanced notice for very large orders helps stores manage inventory and ensure product availability. The cooperative relationship between retailers and customers generally allows flexibility within reasonable bounds while maintaining system integrity.

For tourists using temporary purchase mechanisms, limits are typically more restrictive, often capping transactions to reasonable short-term consumption volumes such as one or two bottles. These limitations reflect the temporary nature of visitor access and prevent potential abuse of simplified purchasing procedures designed to accommodate tourism rather than enable large-scale acquisition.

Renewing or Cancelling an Alcohol Trade License in Dubai

Maintaining current authorization requires timely renewal before expiration, while individuals departing the UAE or no longer requiring access should properly cancel licenses. Understanding renewal procedures, associated costs, and cancellation pathways ensures continued compliance and proper administrative closure when appropriate.

Renewal Process and Requirements

Personal licenses expire one year from issuance, requiring renewal to maintain purchasing privileges. The renewal process and requirements are simplified compared to initial applications, typically requiring only confirmation of continued residency and visa validity. Most retailers offer automated renewal reminders via email or mobile notifications as expiration approaches, prompting timely action before authorization lapses.

Renewal can usually be completed entirely online through retailer platforms, with immediate reactivation upon payment processing. Required documents are minimal, often limited to updated Emirates ID if the original has been renewed during the license period. The streamlined process reflects the established verification completed during initial application, with renewals primarily confirming continued eligibility rather than repeating full screening.

Commercial license renewal involves more extensive procedures, including facility inspections, staff training verification, and confirmation of continued compliance with operating standards. Establishments must maintain current trade licenses and other underlying permits, as expiration of any component authorization can delay or prevent liquor license renewal. The renewal timeline should begin several months before expiration to allow adequate processing time and address any identified compliance issues.

Costs of the Renewal Process

Personal license renewal fees generally match initial application costs, ranging between 100 and 270 AED annually depending on retailer. Some operators offer discounted renewal pricing for long-term customers or bundle renewal with promotional purchasing credits. The modest cost reflects administrative processing rather than substantial regulatory expenses, making annual renewal easily affordable for most license holders.

Commercial renewal fees are substantially higher, often matching or exceeding initial licensing costs. Annual fees for establishment licenses can range from 10,000 to over 50,000 AED based on premise size, service scope, and regulatory classification. Trading licenses command even higher renewal fees, reflecting the intensive oversight and compliance monitoring associated with wholesale operations.

Additional costs may arise if renewals occur after expiration, with late fees or penalties potentially applying. Some retailers impose graduated penalty structures for overdue renewals, increasing costs the longer licenses remain expired. Timely renewal avoids these additional expenses and prevents administrative complications that can arise from lapses in authorization.

Penalties for License Expiration

Operating with an expired license carries similar legal risks to never having obtained authorization, as purchases or operations conducted after expiration lack valid regulatory backing. Individuals caught purchasing with expired personal licenses face potential fines and confiscation of purchased items. While inadvertent brief lapses may receive lenient treatment, extended expiration periods or repeated violations generate more serious enforcement responses.

Establishments serving alcohol with expired licenses face severe consequences including immediate operational suspension, substantial fines, and potential permanent license revocation. The penalties for license expiration in commercial contexts reflect the public safety implications of unauthorized service and the regulatory expectation that professional operators maintain rigorous compliance standards. Businesses must implement internal calendar controls ensuring renewal occurs well before expiration to avoid any service interruption or legal exposure.

For trading operations, expired licenses trigger automatic suspension of importing and distribution privileges, potentially disrupting business operations substantially. The financial impact of lost business during suspension periods often far exceeds renewal costs, making proactive license management a critical business priority. Customs authorities may hold shipments destined for operators whose licenses have expired, adding logistical complications to financial penalties.

Procedure for License Cancellation

Individuals leaving the UAE permanently or no longer wishing to maintain purchasing privileges should formally cancel their licenses rather than allowing passive expiration. The cancellation procedure typically involves notifying the issuing retailer and confirming identity and license details. Some retailers process cancellations automatically upon visa cancellation in immigration systems, though explicit notification ensures proper administrative closure.

Cancellation does not generate refunds for unused license periods, as annual fees are non-refundable once paid. However, formal cancellation creates a clean administrative record that can facilitate future reapplication if the individual returns to the UAE. The process takes minimal time and avoids potential complications from abandoned active licenses appearing in regulatory systems.

Establishments closing operations must ensure proper license cancellation as part of broader business closure procedures. This cancellation coordinates with trade license cancellation and involves final inventory accounting to document proper disposal or transfer of remaining alcoholic beverages. Failure to properly close commercial licenses can generate ongoing regulatory obligations and potential penalties for non-compliance with reporting or renewal requirements despite ceased operations.