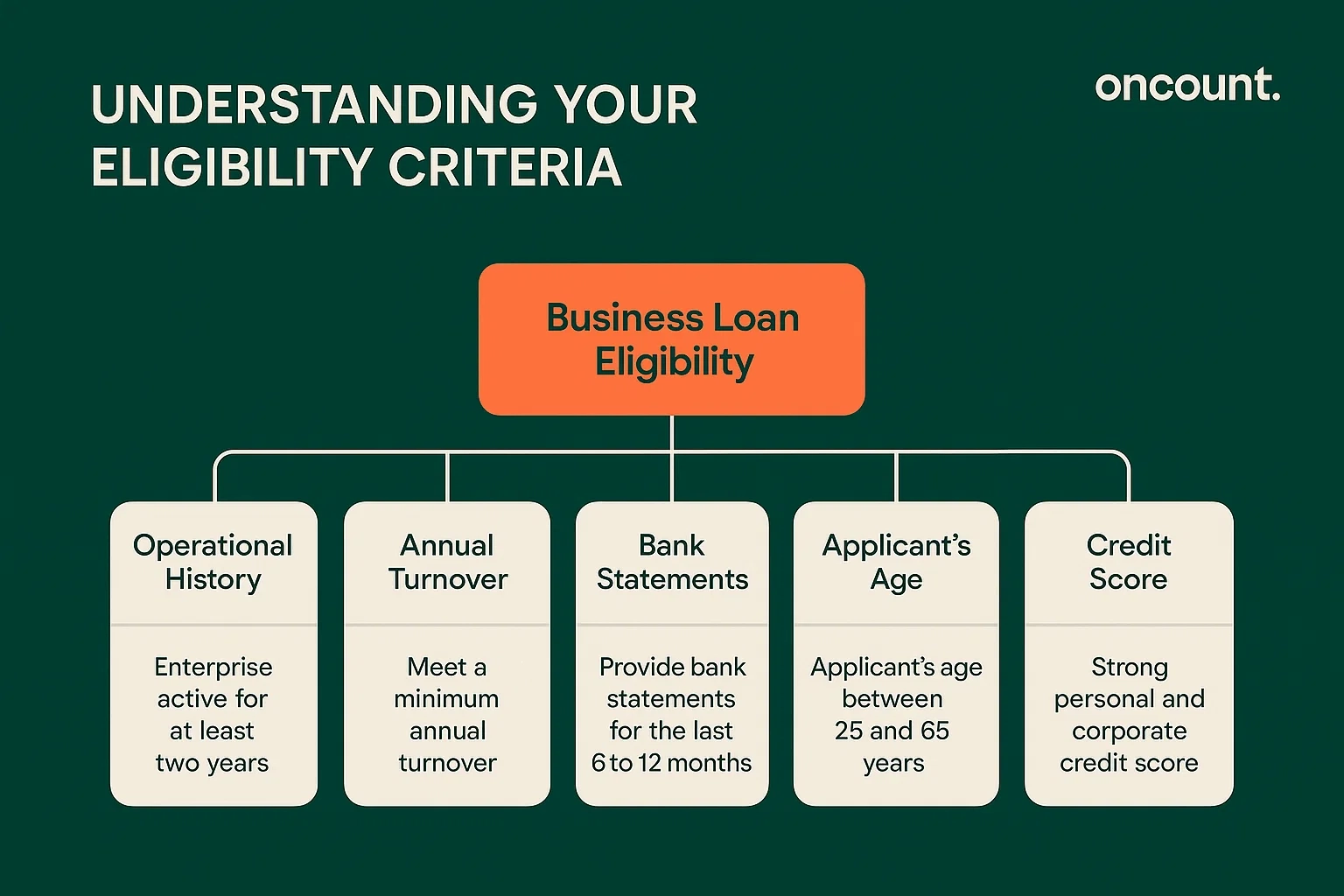

Understanding Your Eligibility Criteria

Before you apply for a business loan, it’s crucial to understand what lenders are looking for. While the specific eligibility criteria can vary between banks, most financial institutions in the UAE follow a common framework.

To be eligible to apply, your company must typically meet the following conditions:

- Operational History: The enterprise should generally be active for at least two years. Some banks offer start-up financing solutions for newer ventures, but this is less common.

- Annual Turnover: Your registered organization must meet a minimum annual turnover. This threshold differs significantly from one bank in the UAE to another.

- Bank Statements: You will need to provide company or personal bank statements for the last 6 to 12 months to show a healthy flow of funds.

- Applicant’s Age: The primary applicant or firm owner should usually be between 25 and 65 years of age.

- Credit Score: A strong personal and corporate credit score is essential for a successful loan application.

For further details on how lending practices are regulated, you can review the Central Bank of the UAE Rulebook: Regulations Regarding Bank Loans & Other Services Offered to Individual Customers, which outlines standards on loan classification, transparency, and disclosure. While this document does not list SME eligibility point by point, it provides insight into the broader expectations that banks must follow when offering financing.

Types of Business Loans Available in the UAE

Dubai offers a diverse range of financing products tailored to different commercial needs. Understanding the various loan options will help you choose the best fit for your company.

Standard Business Loans

This is the most common type, offering a lump sum amount with a structured repayment schedule. These loans, such as installment facilities, are ideal for long-term investments like purchasing assets or funding a major project. The loan amount can go up to AED 2 million or more, depending on the provider.

Alternative Financing Options

For immediate or smaller capital needs, owners can consider credit card loans. However, these usually come with higher interest rates. Another option for a new venture is seeking funds from friends and family, though this requires clear legal agreements.

Government-Backed Loan Schemes

To promote the ease of doing business, some programs supported by the UAE government and organizations like the Small Business Association offer financing solutions, particularly for SMEs. These can be a great alternative if your loan application is rejected by traditional banks.

Islamic Finance Solutions

For enterprises seeking Sharia-compliant funding, Islamic finance is an excellent choice. These products avoid interest (riba), as interest is prohibited in Shariah law.

- They operate on a profit and loss sharing principle (Mudarabah).

- These loans are interest-free, with the bank earning a pre-agreed profit margin.

- This type of loan is a popular choice for many firms in the UAE.

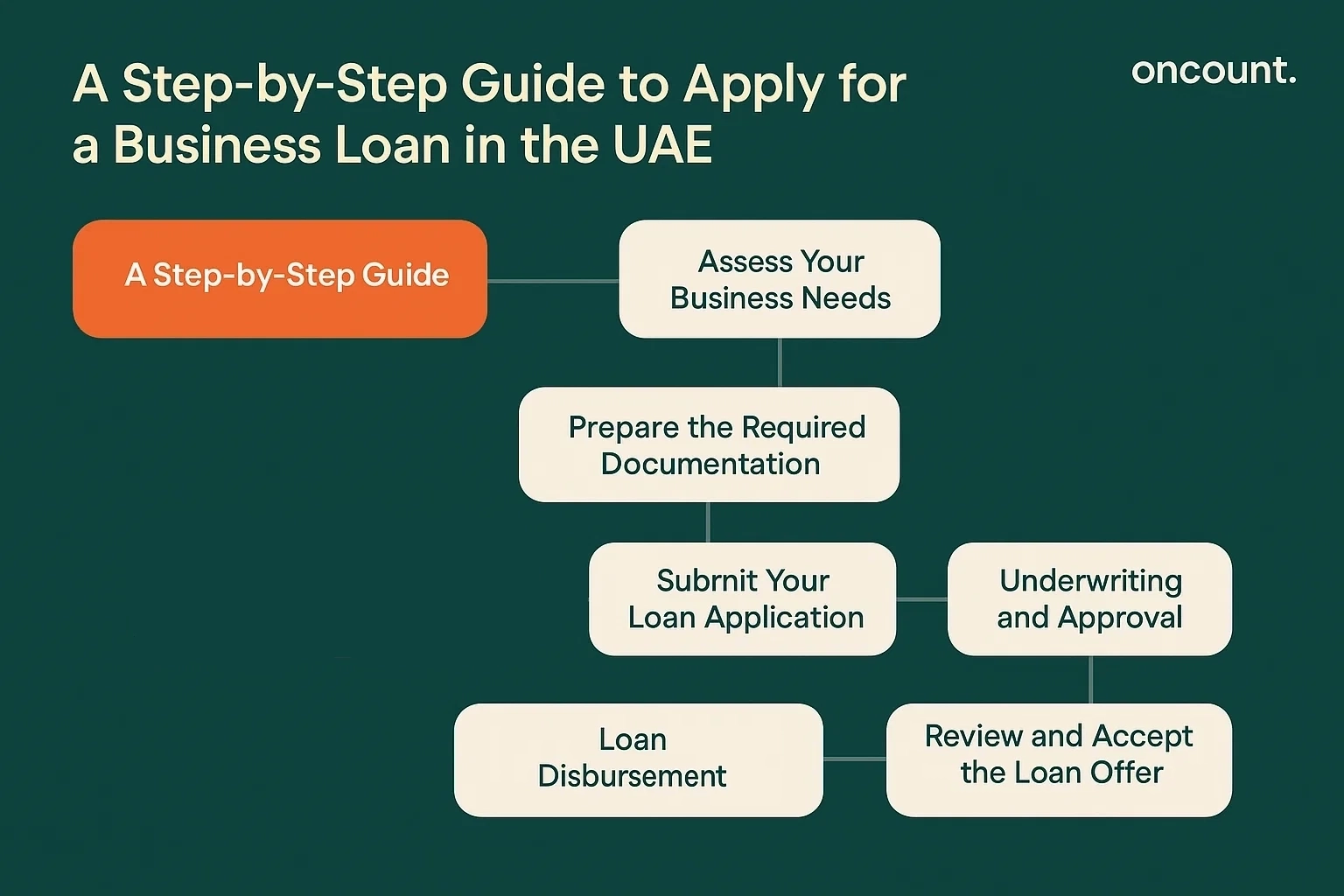

A Step-by-Step Guide to Apply for a Business Loan in the UAE

The application process for a loan in UAE is systematic. Following these steps will improve your chances of a successful outcome.

Step 1: Assess Your Business Needs

First, determine why your business requires financing. Do you need a small business loan for inventory, or a larger sum for expansion? Calculate the exact loan amount needed to avoid over-borrowing.

Step 2: Prepare the Required Documentation

A well-prepared application in Dubai is crucial. Lenders will scrutinize your paperwork, so ensure you have all documents required for a successful application:

- Completed bank application form.

- Bank statements for the past 6-12 months from your business account.

- A valid Trade License copy.

- Memorandum of Association or Partnership Agreement.

- Passport and Emirates ID copies for all partners.

- Additional documents may be requested, such as a VAT certificate, audit reports, or high-volume invoices.

Step 3: Open a Business Bank Account

Most banks in Dubai require you to have an active business bank account with them for at least 3-6 months before you can apply for financing. This helps them assess your business’s financial health.

Step 4: Submit Your Loan Application

You can submit your application in UAE either at a physical branch or through the bank’s online portal. Ensure all information is accurate and all required documents are attached.

Step 5: Underwriting and Approval

Once submitted, the bank may review your financials, creditworthiness, and business plan. This underwriting process can take anywhere from a few days to a few weeks.

Step 6: Review and Accept the Loan Offer

If your application is approved, you will receive a term sheet detailing the loan amount, interest rate, repayment period, and other conditions. Review this carefully before signing the agreement.

Step 7: Loan Disbursement

After the final paperwork is signed, the loan amount will be disbursed into your business account, providing the capital to support your business growth.

Key Benefits of Getting UAE Business Loan

| Benefit | Description |

| Access to Capital for Growth | Provides essential funds to expand operations, purchase equipment, hire staff, or invest in marketing, helping enterprises scale effectively. |

| Cash Flow Management | Financing helps manage cash shortfalls from seasonal sales, delayed payments, or inventory buildup, ensuring smooth daily activities. |

| No Equity Dilution | Unlike equity financing, borrowing does not require giving up ownership or control of the company, allowing founders to retain full equity. |

| Competitive Interest Rates | Many UAE banks offer attractive fixed or variable rates with flexible repayment terms, easing the financial burden on organizations. |

| Builds Credit History | Regular repayments strengthen the credit profile of the venture, making it easier to obtain funding in the future. |

| Supports Asset Acquisition | Financing can cover major purchases such as machinery, vehicles, or property, enabling upgrades without straining working capital. |

| Improves Business Credibility | Having a repayment agreement with a reputable bank enhances credibility with suppliers, partners, and clients, showing financial stability. |

| Access to Additional Banking | Borrowers often gain entry to other financial products, benefits, and advisory services that contribute to enterprise growth. |

| Shariah-Compliant Financing | For those seeking Islamic structures, Sharia-compliant options operate on profit-sharing models without charging interest. |

| Potential Government Support | Certain government-backed programs for SMEs may provide subsidized or interest-free funding, reducing borrowing costs. |

These benefits collectively help businesses in the UAE to invest, manage finances prudently, build creditworthiness, and maintain control while growing their ventures.

Key Loan Features to Know Before You Apply

When comparing loan offers, consider these key features:

- Amounts: Lenders offer loans up to AED 3 million, sometimes more for established businesses.

- Repayment Terms: The repayment period typically ranges from 12 to 60 months.

- Collateral: Many banks offer a collateral-free business loan, which is highly beneficial for SMEs and startups without significant assets.

- Interest Rates: Rates can be fixed or variable. Compare offers from different lenders, including major banks like ADCB and Emirates NBD.

- Processing Time: Some banks offer expedited processing, with approvals in as little as 48 hours.

By carefully preparing and understanding the landscape of finance in Dubai, you can secure the funding needed to start your business or take it to the next level. The right loan gives your business the power to achieve its full potential.