Launching Your Enterprise in Jebel Ali Free Zone

Jebel Ali Free Zone occupies a unique position within the UAE’s economic architecture as the cornerstone of Dubai’s trade infrastructure. As of January 2026, the free zone hosts more than 11,000 businesses from over 100 countries, generating an annual trade value exceeding $169 billion.

This concentration of commercial activity reflects Jafza’s evolution from a traditional transshipment hub into a sophisticated multi-modal economic zone that integrates logistics capabilities with advanced financial governance structures. The free zone serves as the flagship property within DP World’s global portfolio, leveraging its proximity to Jebel Ali Port to offer unparalleled connectivity for companies engaged in international trade, manufacturing, and distribution.

Primary Business Categories

Jafza attracts three distinct investor profiles. Trading companies utilize the zone as a regional distribution hub, benefiting from customs duty suspensions and proximity to maritime shipping routes. Manufacturing enterprises establish production facilities to serve Middle Eastern and African markets while accessing duty-free raw material imports.

Service providers, particularly in technology, consulting, and logistics management sectors, leverage the zone’s digital infrastructure to service regional and global client bases. The regulatory framework accommodates diverse business profiles, from small technology startups requiring only co-working desk space to large-scale industrial conglomerates operating customized manufacturing facilities.

What Is Jebel Ali Free Zone?

Jebel Ali Free Zone operates as a designated economic zone under the governance framework established by Jebel Ali Free Zone Authority. The zone spans 57 square kilometers and is divided into Jafza North and Jafza South, with each section offering specialized infrastructure for different industry sectors.

Governance Structure

Jafza Authority maintains independent regulatory powers to issue business licenses, grant residency visa allocations, and enforce zone-specific compliance standards. The licensing regime aligns with the official business activity classifications maintained by the Dubai Economic Department, ensuring consistency across UAE jurisdictions.

Companies operating within Jafza remain subject to federal UAE legislation regarding corporate taxation, anti-money laundering protocols, and ultimate beneficial ownership disclosure requirements, while simultaneously benefiting from free zone exemptions related to foreign ownership restrictions and customs duties.

Sectoral Focus Areas

The zone’s economic specialization encompasses five primary categories. The logistics and transportation sector includes freight forwarding, warehousing, and supply chain management operations serving over 430 licensed companies. The industrial manufacturing segment covers petrochemicals, automotive components, food processing, and consumer goods assembly.

Trading operations span general merchandise, specialized commodities, and e-commerce distribution. The service economy includes technology, consulting, media, and professional services. The offshore segment provides structures for international asset management, real estate holding, and cross-border investment vehicles.

Why Choose Jebel Ali Free Zone for Your Business

The decision to establish operations in Jafza should be evaluated against specific commercial objectives and operational requirements. The free zone offers distinct advantages across multiple dimensions that directly impact both initial setup efficiency and long-term operational viability.

Complete Foreign Ownership Rights

Jafza permits 100% foreign ownership across all entity types, eliminating the requirement for UAE national partners that applies in mainland jurisdictions. This ownership structure provides international investors with complete operational control, unrestricted profit distribution rights, and simplified governance arrangements.

The framework applies equally to individual entrepreneurs establishing single-shareholder entities and to multinational corporations structuring complex multi-jurisdictional operations. Foreign shareholders maintain full voting rights, can appoint all directors and managers without local participation requirements, and exercise complete discretion over dividend policies.

Tax Optimization Framework

Companies operating within Jafza benefit from zero personal income tax on salaries and distributions to shareholders. Corporate tax treatment depends on qualification status under the Qualifying Free Zone Person framework.

Entities that maintain adequate physical substance within the zone, employ sufficient qualified personnel, and generate income from specified qualifying activities can access a 0% corporate tax rate on qualifying income. The de minimis rule permits non-qualifying income up to 5% of total revenue or AED 5 million, whichever is lower, without jeopardizing QFZP status.

Key Tax Benefits:

- Zero personal income tax on all salary and dividend income

- 0% corporate tax for qualifying free zone activities

- Standard 9% rate applies to non-qualifying income over AED 375,000

- Unrestricted capital and profit repatriation with no exchange controls

- No withholding tax on dividends, interest, or royalty payments

Infrastructure and Facility Options

The physical infrastructure available within Jafza has been purpose-built to accommodate specialized operational requirements. Warehousing facilities feature thermal insulation, floor load capacities of 5 tons per square meter, and ceiling heights ranging from 6 to 12 meters.

Industrial units provide power capacities from 42 KW for light manufacturing to 120 KVA for heavy industrial processes. Office solutions range from single-desk co-working arrangements in premium towers to dedicated floor plates in commercial complexes. Companies requiring unique specifications can access customized development programs where Jafza collaborates with the client to design and construct bespoke facilities.

Digital Efficiency

The 2026 incorporation framework operates entirely through digital channels, leveraging the Dubai Trade Portal and Jafza’s internal electronic systems. Standard processing timelines range from 3 to 14 business days when documentation meets accuracy standards.

The implementation of the eDAS 2.0 attestation system has streamlined the legalization of foreign-issued corporate documents through QR code verification, reducing delays previously associated with manual authentication processes.

Types of Companies You Can Register in Jebel Ali Free Zone

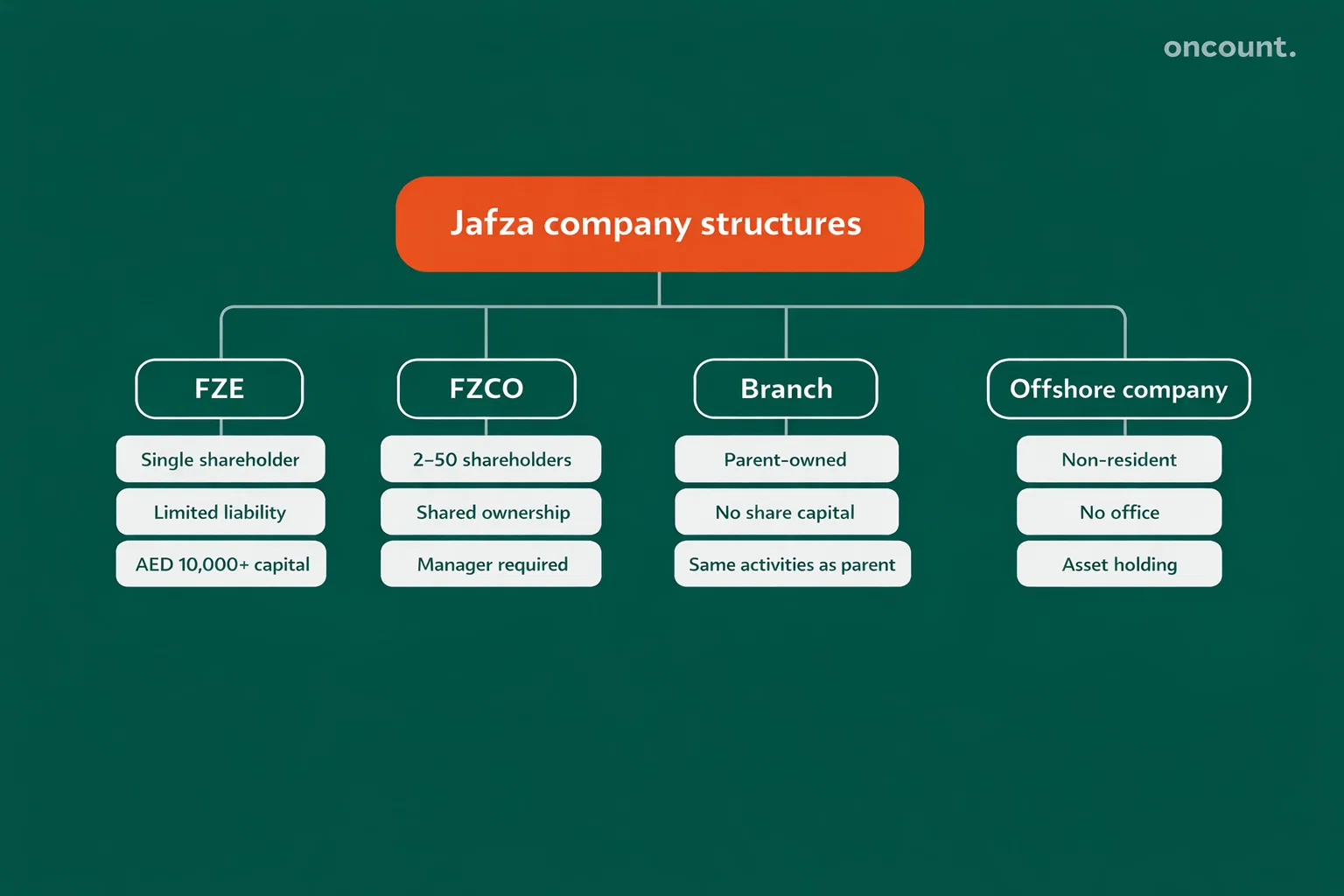

The selection of a legal entity type is the foundational step that governs the company’s independent legal identity and its relationship with regulatory authorities. Investors must evaluate five primary formation types, each offering distinct advantages in terms of shareholding capacity, liability protection, and capital requirements.

Free Zone Establishment (FZE)

The FZE structure is optimized for solo entrepreneurs or single corporate owners, allowing for 100% foreign ownership within a limited liability framework. This entity type permits one shareholder, which can be either an individual or a corporate body, to maintain complete operational control without partnership obligations.

The FZE offers limited liability protection, meaning the shareholder’s financial exposure is restricted to the amount of capital contributed to the company. Capitalization requirements have been liberalized in 2026, with Jafza mandating only sufficient share capital aligned with the company’s licensed activities. For most service and trading operations, a stated capital of AED 10,000 satisfies registration requirements.

Free Zone Company (FZCO)

The FZCO functions as a partnership structure supporting between 2 and 50 shareholders. Shareholders can be individuals or corporate entities from any jurisdiction, with ownership percentages distributed according to the agreed shareholding arrangement.

This structure provides limited liability protection to all shareholders proportional to their capital contributions. The FZCO requires the appointment of a manager who handles day-to-day operations and serves as the signatory for official documents and banking relationships. The formation is ideal for businesses where multiple investors wish to pool resources while maintaining defined ownership stakes.

Branch of a Company

For established global organizations, the Branch formation provides a direct extension of a parent entity from either the UAE mainland or an international jurisdiction. Branches do not constitute independent legal entities but operate as continuations of the head office.

This structure eliminates separate share capital requirements since the parent company’s financial standing supports the branch operations. However, permitted activities are strictly tethered to those already licensed by the parent company, preventing diversification into unrelated business lines.

Offshore Company Formation

Beyond onshore formations, Jafza offers a Special Status Non-Resident Offshore Company governed by the Jebel Ali Free Zone Offshore Companies Regulations 2018. These entities are designed for international asset protection, real estate ownership in Dubai’s freehold areas, and global trading activities conducted outside the UAE.

Offshore companies cannot lease physical office space within Jafza or sponsor residence visas for employees. However, they offer 100% foreign ownership and are frequently utilized for managing cross-border portfolios with zero tax liability on foreign-source income.

| Entity Type | Shareholder Requirements | Capital Considerations | Ideal For |

| FZE | Single shareholder | Sufficient for activities; typically AED 10,000+ | Solo entrepreneurs, holding companies |

| FZCO | 2 to 50 shareholders | Sufficient for activities; proportional distribution | Joint ventures, partnerships |

| Branch | 100% owned by parent | No separate capital requirement | International corporations expanding regionally |

| Offshore | Minimum one shareholder | No minimum prescribed | Asset management, IP holding, international trading |

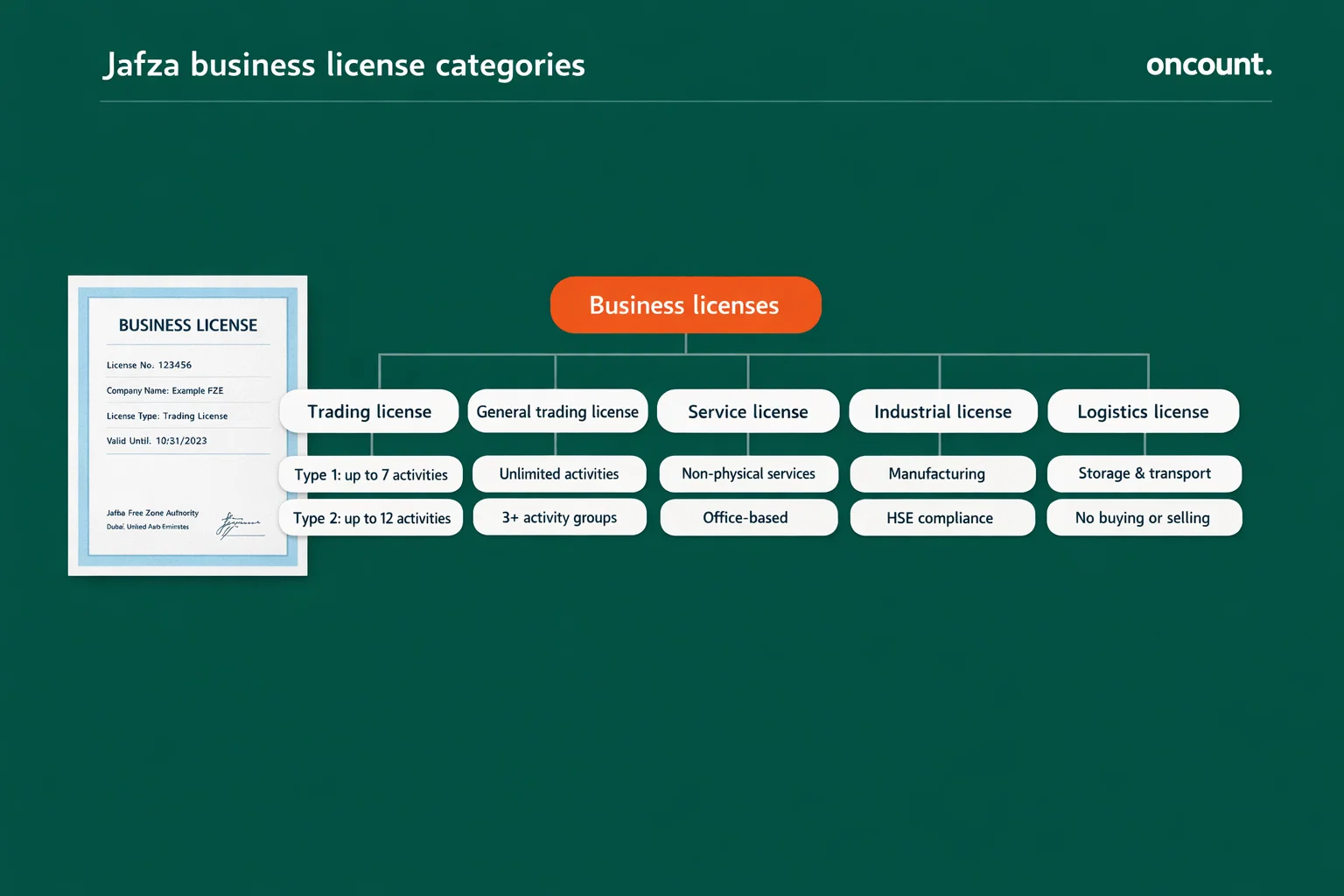

Types of Business Licenses in Jebel Ali Free Zone

The operational scope of a Jafza entity is defined by its business license. As of 2026, the licensing regime is highly structured, inheriting the official list of business activities from the Dubai Economic Department to ensure cross-jurisdictional consistency.

Trading License Options

The Trading License covers the import, export, distribution, and storage of physical goods. Jafza offers two trading license tiers based on activity scope and operational requirements.

Trading License Type 1 permits up to seven activities selected from a single business activity group. This license suits companies focused on specific product categories such as electronics, textiles, or food products. Trading License Type 2 accommodates up to twelve activities spanning two different business activity groups, providing greater operational flexibility for companies handling diverse product portfolios.

General Trading License

The General Trading License represents a premium tier allowing unlimited activities across three or more business activity groups. The annual fee approaches AED 30,000, reflecting the comprehensive permissions granted. This license proves particularly valuable for diversified trading houses, commodity brokers, and distribution companies serving multiple market segments.

Service License

The Service License is tailored for consulting, information technology, media, and knowledge-based services. This license restricts operations to non-tangible offerings where no physical stock is held or traded. Annual fees range from AED 5,000 to AED 8,000 based on the number of activities selected.

Common service license activities include management consulting, software development, digital marketing, engineering design, financial advisory, and human resources services. Service license holders typically occupy office spaces rather than warehouse facilities.

Industrial License

The Industrial License is mandatory for manufacturing, assembly, and production operations within the free zone. This license requires possession of a physical production facility equipped with appropriate manufacturing infrastructure. Companies must demonstrate compliance with Jafza’s Health, Safety, and Environment standards through regular audits and inspections.

Industrial license holders benefit from duty-free importation of raw materials and machinery for manufacturing purposes. The zone’s customs-bonded status enables cost-efficient production workflows where components sourced globally can be assembled without upfront duty payments.

Logistics License

The Logistics License serves third-party logistics providers, freight forwarders, and supply chain management companies. This specialized license allows for storage and transportation services but strictly prohibits the licensee from buying or selling the goods they handle. Over 430 companies currently operate under logistics licenses, benefiting from Jafza’s proximity to Jebel Ali Port.

| License Type | Annual Fee (AED) | Activity Limit | Facility Requirement |

| Trading Type 1 | 5,500 – 9,000 | 7 activities (1 group) | Office or warehouse |

| Trading Type 2 | 7,000 – 9,000 | 12 activities (2 groups) | Office or warehouse |

| General Trading | 30,000 | Unlimited (3+ groups) | Warehouse facility |

| Service | 5,000 – 8,000 | 7-12 activities | Office or desk space |

| Industrial | 5,500+ | Production-specific | Manufacturing facility |

| Logistics | 30,000 | Service-focused | Jafza verification required |

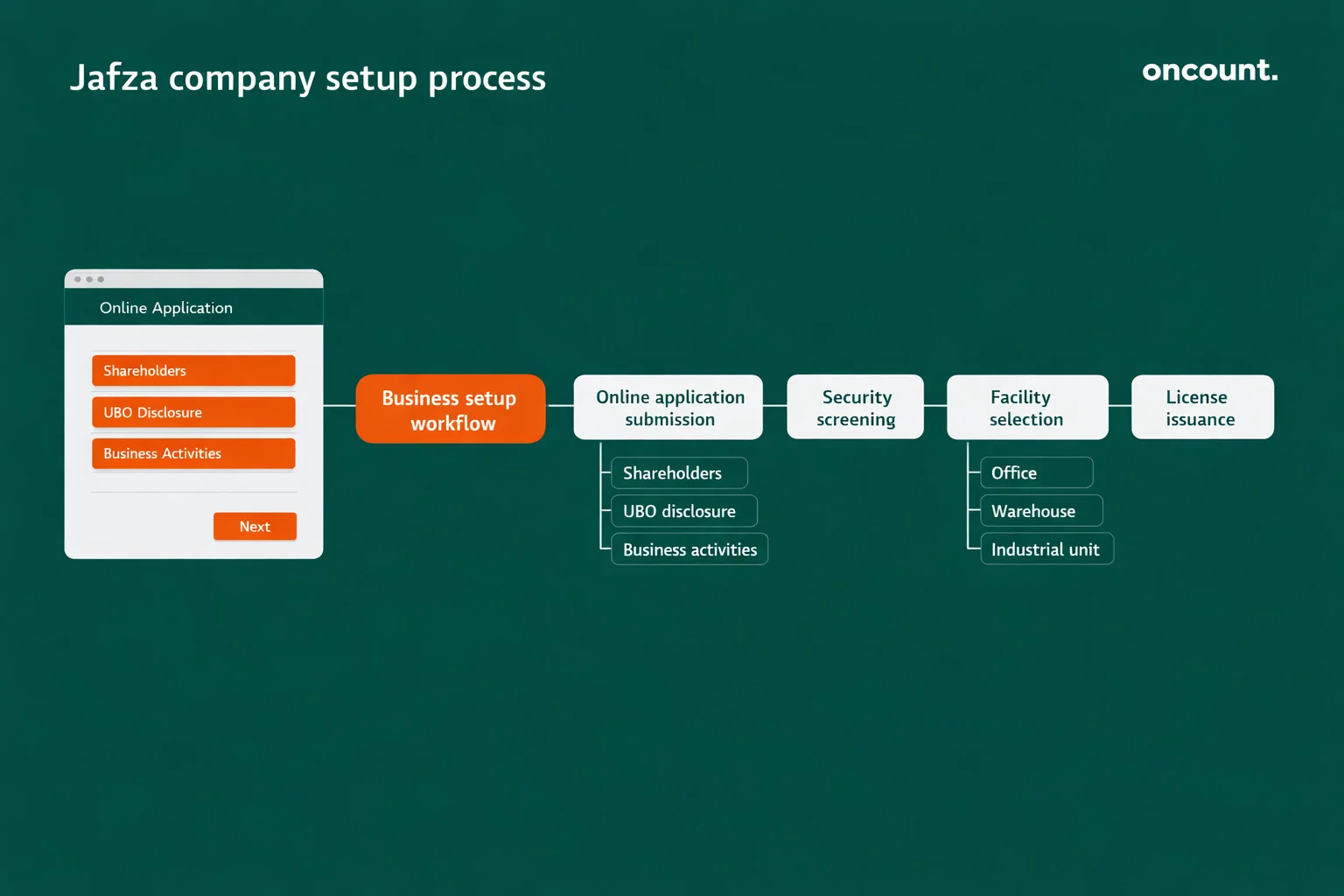

Step-by-Step Process to Set Up a Business in Jebel Ali Free Zone

The Jafza company formation process has been fully digitized, leveraging the Dubai Trade Portal and Jafza’s internal electronic channels to provide a paperless experience. This digital transformation has reduced setup timelines to between 3 and 14 business days when all documentation meets accuracy standards.

Step One: Trade Name Reservation

The incorporation journey begins with submitting proposed trade names through the Jafza website or Dubai Trade Portal. Names must comply with specific guidelines ensuring uniqueness and appropriate business representation. Names cannot infringe on existing trademarks, include prohibited terms related to government entities, or suggest activities outside the intended license scope. Jafza typically provides name approval within two to three business days.

Step Two: Online Application Submission

Upon name approval, investors receive a secure link to the digital application portal. This comprehensive form requires detailed information about shareholders, directors, managers, and the intended business model. The application captures shareholder ownership percentages, director appointment details, and operational descriptions that align with selected license activities.

Document upload requirements include colored passport copies of all shareholders, directors, managers, and secretaries. Industrial and logistics applicants must submit detailed business plans demonstrating operational feasibility. Ultimate Beneficial Owner forms identify all individuals holding 25% or more ownership interests, as required under UAE Cabinet Decision No. 109 of 2023.

Step Three: Security Screening

Jafza conducts a comprehensive evaluation process that includes security screening of all applicants. This review examines shareholder backgrounds, business activity legitimacy, and compliance with UAE regulations regarding restricted industries. The screening timeline typically extends three to seven business days for straightforward applications. Upon successful screening, investors receive Initial Approval, which serves as a prerequisite for facility selection.

Step Four: Facility Selection

Physical presence within Jafza is mandatory for all onshore entities. Investors must select a suitable facility from Jafza’s portfolio, ranging from co-working desks to industrial plots. A booking fee, typically representing one to three months of rent, secures the selected facility. The lease agreement establishes the annual rental obligation, facility specifications, and renewal terms.

Step Five: License Issuance

Following lease execution, Jafza invoices the final setup fees encompassing license charges and registration fees. Upon payment confirmation, Jafza issues the Certificate of Incorporation, Memorandum of Association, Articles of Association, and Business License. These documents enable the company to open corporate bank accounts, apply for establishment cards, and commence lawful business operations.

Documents Required for Company Registration

The documentation requirements for Jafza company formation have been standardized to facilitate efficient processing while ensuring regulatory compliance. All documents must be authentic, current, and properly formatted according to Jafza specifications.

Personal Documentation

All individuals holding roles as shareholders, directors, managers, or authorized signatories must provide valid passport copies in color, showing all pages including the bio-data page. Passport validity should extend at least six months beyond the anticipated license issuance date. For shareholders or managers already residing in the UAE, current Emirates ID copies must be submitted alongside passport documentation.

Corporate Shareholder Requirements

When shareholders include corporate entities, comprehensive documentation regarding the corporate shareholder becomes necessary. The parent company’s Certificate of Incorporation from its home jurisdiction must be submitted to establish legal existence. A current Certificate of Good Standing issued within three months confirms that the corporate shareholder maintains active status.

Certified copies of the parent company’s Memorandum and Articles of Association provide Jafza with visibility into the corporate shareholder’s governance structure. A Board Resolution authorizing the investment in the Jafza entity must be provided, along with UBO declarations identifying ultimate beneficial owners.

Attestation Process

For documents issued outside the UAE, a multi-stage attestation process ensures their authenticity. Documents must be notarized by a public notary in the country of origin, stamped by the Ministry of Foreign Affairs in the issuing country, legalized by the UAE Embassy or Consulate in that country, and finally attested by the UAE Ministry of Foreign Affairs through the eDAS 2.0 system.

| Attestation Service | Fee (AED) | Processing Time |

| UAE MOFA Commercial Document | 2,100 – 2,300 | 1-3 working days |

| Commercial Invoice (eDAS 2.0) | 150 | Instant (12 minutes) |

| Jafza Original Attestation | 200 | 5 working days |

| Legal Translation Services | Varies by length | 1-2 working days |

Cost of Setting Up a Business in Jebel Ali Free Zone

The total cost of establishing a Jafza company varies significantly based on entity type, license category, facility selection, and visa requirements. Transparency regarding these costs enables accurate budget planning and prevents unexpected financial obligations.

License and Registration Fees

The business license represents the primary annual recurring cost, with fees determined by license type and activity scope. Service licenses begin at approximately AED 5,000 annually, while Trading License Type 1 ranges from AED 5,500 to AED 9,000. General Trading Licenses command premium pricing at AED 30,000 annually. Registration fees cover administrative processing and typically range from AED 5,000 to AED 15,000 depending on entity complexity.

Facility Costs

Office and warehouse rental costs represent the largest variable expense component. Co-working desk arrangements start at approximately AED 10,000 annually. Dedicated office spaces in premium towers range from AED 25,000 to AED 100,000+ annually depending on size. Warehouse facilities command AED 100 to AED 300 per square meter annually.

Visa Processing Costs

Residence visa expenses depend on the number of employees and shareholders requiring UAE residency. Each visa involves multiple cost components including entry permit processing, medical fitness examinations, Emirates ID issuance, and visa stamping procedures.

Visa Cost Breakdown:

- Entry Permit Application: AED 3,500 – 5,000 per person

- Medical Fitness Test: AED 250 – 500 per person

- Emirates ID (2-year validity): AED 100 – 300 per person

- Visa Stamping/Activation: AED 500 – 1,000 per person

- Establishment Card (annual): AED 1,975

Total Investment Range

Total setup costs typically range from AED 30,000 for a minimal service company configuration with one visa to AED 150,000+ for trading companies requiring warehouse facilities and multiple employee visas. Industrial operations can substantially exceed these ranges due to specialized facility requirements.

Free Zone vs Mainland Company Setup

The decision between Jafza free zone incorporation and UAE mainland company formation involves strategic trade-offs across ownership structure, market access, taxation, and regulatory compliance.

Ownership Structure

Jafza permits complete foreign ownership without requiring UAE national partners. International investors maintain 100% equity ownership, full voting control, and unrestricted profit distribution rights. Mainland companies historically required 51% UAE national ownership for most business activities, though recent legislative reforms have introduced greater flexibility in certain sectors.

Market Access Considerations

Free zone companies face restrictions on direct trading within the UAE mainland market. Jafza entities cannot sell directly to UAE consumers or businesses located outside free zones without appointing a local distributor. Mainland companies enjoy unrestricted access to the UAE domestic market and can conduct business throughout the country without limitations.

Taxation Comparison

Both Jafza and mainland companies now operate under the UAE’s federal corporate tax regime. The standard rate of 9% applies to taxable profits exceeding AED 375,000 for both jurisdictions. However, Jafza companies can qualify for 0% corporate tax under the Qualifying Free Zone Person framework when maintaining adequate substance requirements. Mainland companies cannot access this preferential rate.

Facility Requirements

Jafza mandates physical office or warehouse space within the free zone boundaries for all licensed entities. Mainland companies enjoy greater flexibility in facility selection, with options including traditional commercial offices, home-based business registrations for certain activities, and virtual office arrangements.

Accounting, Tax, and Regulatory Compliance Requirements

Operating within Jafza imposes ongoing compliance obligations that extend beyond initial company formation. These requirements encompass accounting standards, tax filings, regulatory reporting, and audit obligations.

Corporate Tax and QFZP Status

The UAE’s federal corporate tax regime applies to all Jafza entities, with a standard rate of 9% on taxable profits exceeding AED 375,000. Companies can qualify for 0% taxation on qualifying income by obtaining Qualifying Free Zone Person status. QFZP qualification requires maintaining adequate substance within Jafza, generating qualifying income from permitted activities, and ensuring non-qualifying income remains below 5% of total revenue or AED 5 million.

Audit Requirements

All Jafza entities must appoint an auditor from Jafza’s approved auditor list to conduct annual financial statement audits. Audited financial statements must be filed within 90 days of the financial year-end. Failure to meet this deadline triggers financial penalties of AED 5,000 for every month the report remains outstanding.

VAT Compliance

Companies with annual taxable supplies exceeding AED 375,000 must register for Value Added Tax with the Federal Tax Authority. VAT at the standard rate of 5% applies to most goods and services. Registered businesses must file VAT returns quarterly or monthly depending on annual turnover thresholds.

Economic Substance and UBO Reporting

Economic Substance Regulations require companies conducting certain relevant activities to demonstrate adequate economic presence in the UAE. All Jafza companies must maintain current Ultimate Beneficial Owner registers identifying individuals who ultimately own or control 25% or more of the company’s shares or voting rights.

Common Mistakes When Setting Up a Free Zone Company

International investors frequently encounter predictable challenges during Jafza company formation and early operations. Understanding these common errors enables preventive planning and more efficient navigation of the incorporation process.

License Activity Misalignment

One of the most frequent errors involves selecting license activities that inadequately cover the company’s intended operations. This misalignment creates problems during banking relationships, as banks scrutinize whether customer profiles match licensed activities. The preventive approach requires detailed activity mapping before license application and selecting all reasonably anticipated activities.

Banking Preparation Failures

Opening a corporate bank account frequently proves more time-consuming than the actual company formation process. Banks conduct intensive Know Your Customer and anti-money laundering due diligence, often requiring substantially more documentation than Jafza registration. Investors commonly arrive at bank meetings without adequate proof of business activity, insufficient shareholder documentation, or unclear business models that raise compliance concerns.

Capitalization Strategy Errors

While Jafza has eliminated fixed minimum capital requirements, declaring inappropriately low share capital creates downstream complications. Banks evaluate stated capital when assessing account applications, with low capitalization suggesting insufficient business seriousness. The optimal approach involves declaring capital that reasonably aligns with business scope and license activities.

Tax Planning Oversights

Many investors establish Jafza companies assuming automatic zero taxation without understanding QFZP qualification requirements. Companies that fail to maintain adequate substance or generate significant non-qualifying income face unexpected 9% corporate tax liabilities. Preventive tax planning should occur during entity structuring to evaluate whether activities qualify for QFZP treatment.

Why Work With a Professional Business Setup and Accounting Firm

The complexity of UAE business regulations, Jafza-specific requirements, and ongoing compliance obligations creates substantial value in professional advisory relationships.

Strategic Jurisdiction Selection

Professional advisors provide comparative analysis of Jafza versus alternative free zones and mainland jurisdictions based on specific business requirements. They evaluate factors including industry focus, target markets, ownership preferences, and growth strategies to recommend optimal structures. This guidance proves particularly valuable for businesses that might benefit from multi-entity structures.

Documentation Management

Professional service providers manage the entire documentation workflow including passport attestation coordination, corporate document legalization through multi-country chains, and proper formatting of all submission materials. This eliminates investor time investment in understanding technical attestation requirements and coordinating with embassies across multiple countries.

Regulatory Compliance Support

Advisors ensure ongoing compliance with audit filing deadlines, tax return submission requirements, UBO reporting obligations, and Economic Substance Regulations. They implement proper accounting infrastructure from inception, engage professional accountants familiar with UAE IFRS requirements, and coordinate audit completion well before deadlines.

Cost Optimization

Professional firms identify cost-saving opportunities in facility selection, license structuring, and visa allocation strategies. They can negotiate favorable terms with Jafza, recommend appropriate facility sizes based on actual operational needs, and structure shareholder arrangements to minimize visa processing costs.