Establishing Your Enterprise in DWTCA Free Zone

The DWTCA free zone operates as a central component of Dubai’s D33 economic agenda, aiming to double the city’s economy over the coming decade. Unlike specialized free zones, DWTCA maintains sector-agnostic flexibility while excelling in services, events management, and digital economy sectors, including virtual asset services.

DWTCA’s CBD location provides immediate proximity to the Dubai International Financial Centre (DIFC), major hotels, and Dubai Metro. This geographic advantage benefits companies requiring regular interaction with financial institutions, international clients, and government entities.

The free zone attracts diverse business profiles:

- Service providers (consultants, IT firms, legal advisors)

- Trading companies (import/export, distribution)

- Event organizers (exhibitions, conferences)

- Digital businesses (e-commerce, SaaS platforms)

- Financial services (family offices, wealth management)

- Blockchain companies (virtual asset providers, crypto exchanges)

The 2026 environment emphasizes transparency, ESG accountability, and technological integration. DWTCA guarantees complete capital and profit repatriation with no currency restrictions—a fundamental pillar of UAE investment appeal.

Understanding the Dubai World Trade Centre Authority

DWTCA functions as an autonomous free zone jurisdiction under UAE federal law while maintaining autonomy for commercial licensing. The authority issues trade licenses, manages residency visa allocations, and enforces compliance with financial reporting and ESG standards.

The jurisdiction encompasses the Dubai International Convention and Exhibition Centre, positioning it uniquely for events sectors. DWTCA permits over 1,200 business activities across commercial trading, professional services, event management, technology development, virtual assets, e-commerce, and family office operations.

Key Advantages of DWTCA for Business Formation

Complete Foreign Ownership Rights

DWTCA eliminates local sponsor requirements. Foreign investors maintain 100% ownership and control without nominee arrangements, providing genuine corporate control over all strategic decisions, bank accounts, and profits.

Optimized Tax Environment

The UAE’s tax framework includes 9% federal corporate tax on profits exceeding AED 375,000. However, DWTCA entities can qualify for 0% tax on “Qualifying Income” by meeting substance requirements.

| Tax Type | Rate | Applicability |

| Personal Income Tax | 0% | All individuals |

| Corporate Tax (Standard) | 9% | Profits above AED 375,000 |

| Corporate Tax (Qualifying FZ) | 0% | Qualifying income only |

| VAT | 5% | Taxable supplies |

To achieve qualifying status, businesses must maintain adequate physical substance, derive income from qualifying activities, comply with transfer pricing rules, and maintain audited IFRS-compliant financial statements.

Multi-Activity Licensing Flexibility

DWTCA permits up to seven business activities under a single license, accommodating diverse business models without multiple legal entities. This proves particularly valuable for businesses requiring multi-faceted operations under one corporate umbrella.

Digital Administrative Infrastructure

The eServices platform enables 24/7 remote management of corporate affairs, visa applications, and license renewals. For businesses requiring professional company formation services, DWTCA’s streamlined processes integrate smoothly with service providers managing documentation and compliance.

Available Legal Structures in DWTCA

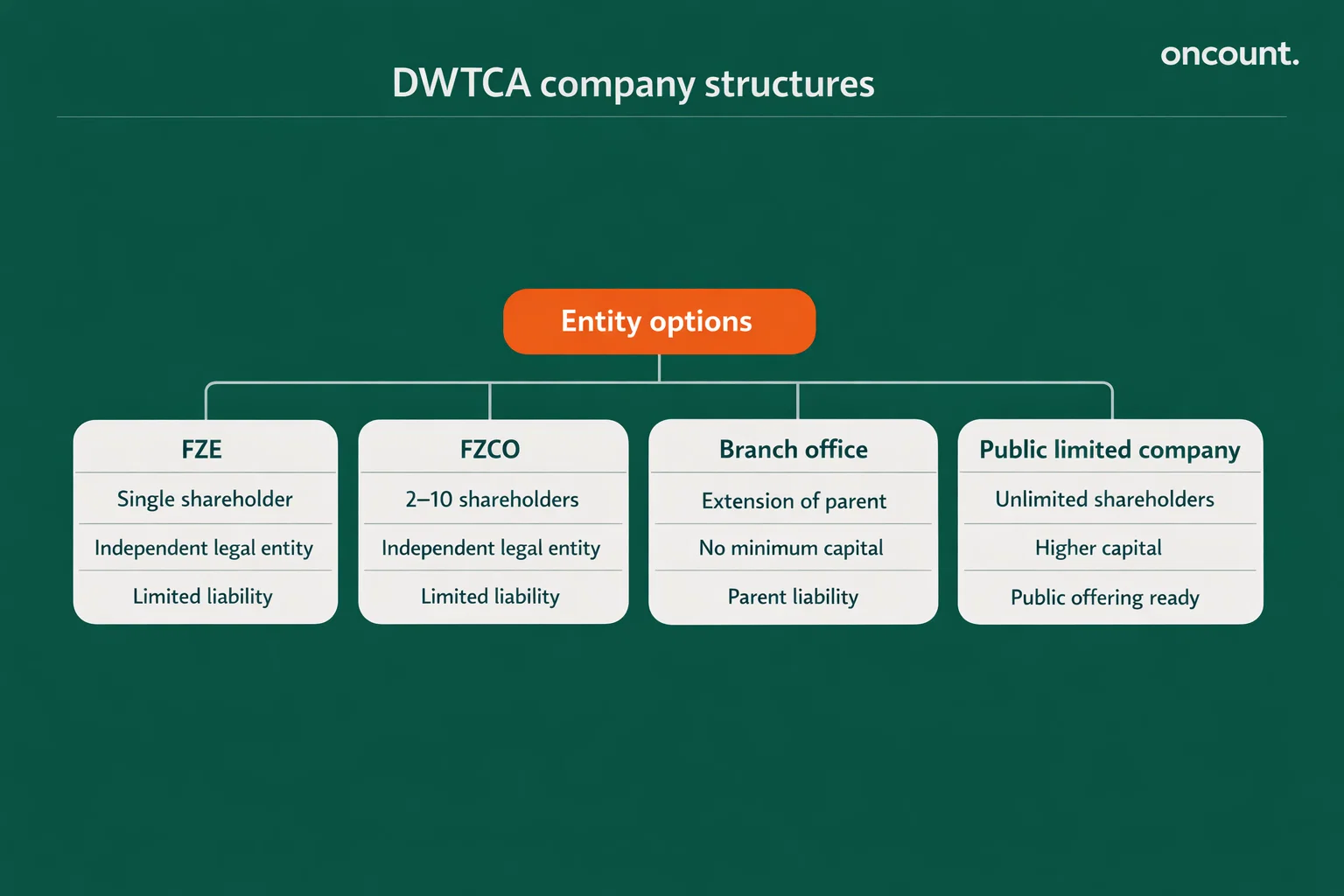

Free Zone Establishment (FZE)

The FZE serves solo entrepreneurs with exactly one shareholder (individual or corporate), limited liability protection, and simplified governance. This structure suits consultants, specialized service providers, and single-owner trading firms seeking complete control.

Free Zone Company (FZCO)

The FZCO accommodates 2 to 10 shareholders with more complex governance requiring at least one manager and up to five directors. This structure suits SMEs, joint ventures, and partnerships pooling diverse expertise or capital.

Branch Office

Established companies may create a DWTCA Branch as a legally dependent extension of the parent company. Branches must use the parent name and conduct identical activities, with no minimum capital requirement facilitating cost-effective expansion.

| Feature | FZE | FZCO | Branch |

| Shareholders | 1 | 2-10 | 0 (Parent owned) |

| Legal Status | Independent | Independent | Extension |

| Liability | Limited | Limited | Parent liable |

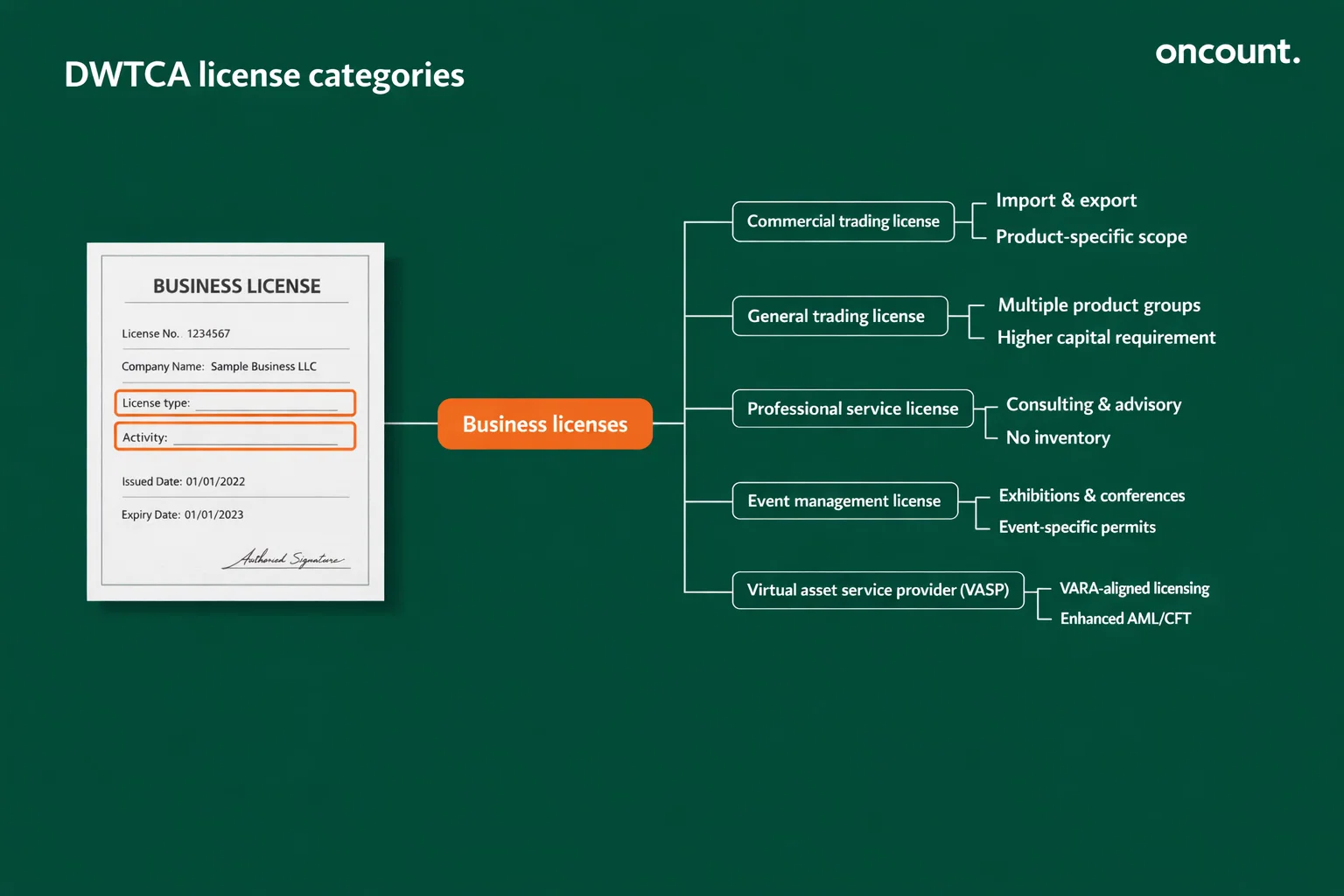

Business License Categories in DWTCA

Commercial Trading Licenses

Commercial licenses authorize trading, import, export, and distribution of specified goods like “Electric Cars Trading” or “Electronics Export.” Each activity may require different government approvals.

General Trading License

General Trading allows unrestricted commodity trade but requires mandatory executive office lease and additional AED 12,000 annual deposit. This suits established businesses with diverse product portfolios.

Professional Service Licenses

Professional licenses cater to service businesses: management consultancy, IT implementation, legal advisory, and accounting. These typically have lower setup costs than trading entities and benefit from streamlined administrative requirements.

Event Management Licenses

Event Management licenses permit organization and hosting of exhibitions, conferences, and seminars. Note: The DWTCA license differs from the separate DTCM Event Permit required per event for public activations.

Virtual Asset Service Provider Licenses

DWTCA issues VASP licenses coordinated with VARA, covering exchange services, broker-dealer operations, custody, and advisory services with rigorous AML/CFT requirements.

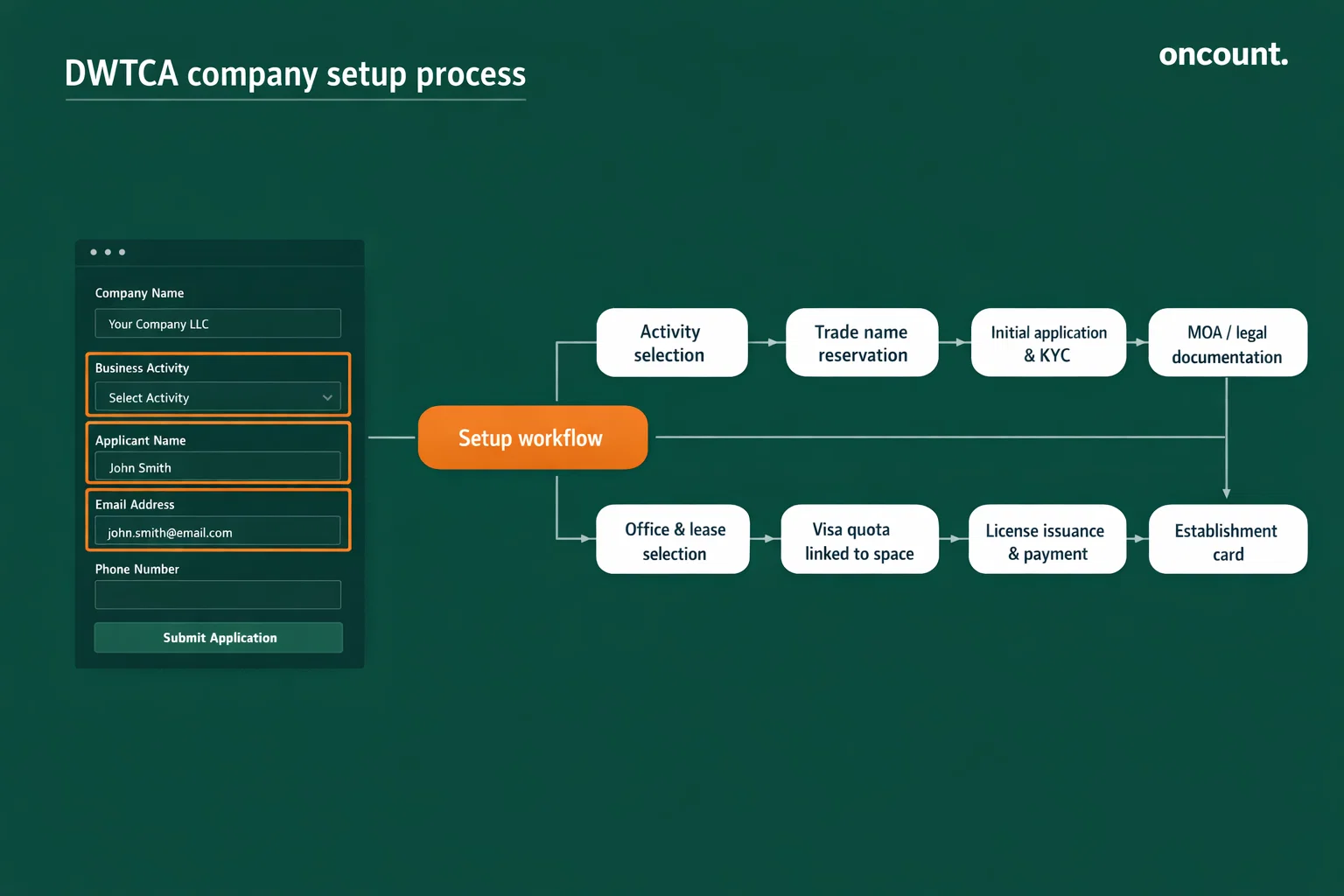

Complete Registration Process in DWTCA

The DWTCA process typically completes within 2 to 4 weeks with proper documentation.

Activity Selection and Name Reservation

Define up to seven business activities affecting license fees, approvals, banking eligibility, and visa quotas. Propose three trade names complying with UAE regulations prohibiting political, religious, or offensive references.

Initial Application and KYC Submission

Submit applications via eServices with:

- Passport copies (all shareholders, directors, manager)

- Emirates ID and residency visa (UAE residents)

- Business plan or company profile

- No Objection Certificate (if manager currently UAE resident)

Processing takes 5 to 7 working days for preliminary KYC checks.

Initial Approval and Legal Documentation

Upon approval, draft and sign the Memorandum and Articles of Association (MOA/AOA). Corporate shareholders require board resolutions, incorporation certificates, and UBO organization charts. All foreign documents need UAE Embassy attestation—this process can take several weeks.

Office Solution Selection

Physical addresses are mandatory. Options include:

- Flexi-desk: AED 7,500-15,000 annually, 1-2 visas

- Co-working: AED 15,000-25,000 annually, 2-4 visas

- Executive office: AED 40,000-60,000+ annually, 3-6+ visas

Office selection directly influences visa quota—critical for businesses planning team expansion.

License Issuance and Establishment Card

Following verification and payment, DWTCA issues the Trade License and Establishment Card with GDRFA, enabling residence visa applications.

Required Documentation for Company Formation

Individual Shareholder Documents

- Valid passport (6 months minimum validity)

- Current visa and Emirates ID (UAE residents)

- Passport photographs and proof of address

- No Objection Certificate (if employed in UAE)

Corporate Shareholder Documentation

- Certificate of Incorporation

- Memorandum and Articles of Association

- Board resolution authorizing investment

- Certificate of Good Standing

- Ultimate Beneficial Owner declaration with ownership chart

- All documents attested by UAE Embassy in country of origin

Proper attestation is critical—incomplete documentation causes significant delays.

Comprehensive Cost Analysis for DWTCA Setup

License and Registration Fees

| Component | Estimated Cost (AED) |

| Trade License | 10,000 – 15,000 |

| Registration Fee | 5,000 – 7,000 |

| Establishment Card | 2,300 |

| General Trading Deposit | 12,000 (if applicable) |

Visa Processing Expenses

| Visa Component | Inside UAE | Outside UAE |

| Entry Permit | 3,200 | 2,000 |

| Medical Fitness | 755 | 755 |

| Emirates ID | 390 | 390 |

Total per visa: approximately AED 4,500-5,000.

Additional Setup Costs

Factor in supplementary expenses:

- Bank account opening assistance: AED 2,000 – 5,000

- Professional service provider fees: AED 5,000 – 15,000

- Document attestation and courier: AED 1,000 – 3,000

- Initial share capital deposit: Typically AED 50,000 minimum

Total setup estimate: A basic single-shareholder FZE with one visa typically ranges from AED 30,000 to AED 50,000 depending on office selection and service provider engagement.

DWTCA Free Zone vs UAE Mainland Companies

Ownership and Market Access

Free Zone: 100% foreign ownership without restrictions. Direct UAE local market trading requires registered distributors or agents. Free zones facilitate international trade and services to other free zones.

Mainland: 100% foreign ownership now available for most activities. Unrestricted local market access and government contract eligibility.

This distinction critically impacts businesses planning significant local sales versus international operations.

Taxation and Compliance

Both structures face identical 9% federal corporate tax, with free zone entities eligible for 0% on qualifying income. Free zone entities require mandatory annual audits regardless of size, while mainland requirements vary by legal form and revenue.

Ongoing Compliance and Regulatory Requirements

Value Added Tax (VAT)

Registration mandatory when taxable supplies exceed AED 375,000 annually. Registration required within 30 days of crossing this threshold. Once registered, companies must issue tax invoices, file quarterly returns, and maintain detailed records for 5 years.

Federal Corporate Tax

All entities must register with the Federal Tax Authority. To achieve 0% qualifying status:

- Maintain adequate physical substance (office and local management)

- Derive income from qualifying activities

- Conduct transactions primarily with free zones or internationally

- Comply with transfer pricing requirements

- Submit IFRS-compliant audited statements

Non-qualifying income triggers standard 9% corporate tax rates, making careful structuring essential.

Mandatory Annual Audits

Every DWTCA entity requires annual audits by DWTCA-approved auditors adhering to IFRS. Failure prevents license renewal and causes operational suspension. Budget AED 8,000 – 15,000 annually for audit fees.

Ultimate Beneficial Owner Declaration

Companies must maintain current UBO declarations identifying individuals with ultimate ownership or control. Any changes require updates within 15 days to comply with international anti-money laundering standards.

Economic Substance Regulations

Entities conducting relevant activities (banking, insurance, headquarters, shipping, holding companies, IP businesses) must file annual ESR notifications demonstrating adequate UAE economic substance within six months post-financial year. Non-compliance results in penalties from AED 50,000 to AED 400,000.

Climate Change and ESG Compliance

Federal Decree-Law No. 11 of 2024 mandates universal compliance by May 30, 2026. All UAE businesses must measure, report, and reduce greenhouse gas emissions.

Requirements include:

- Scope 1 and 2 emissions measurement and reporting

- Digital MRV system implementation

- Senior executive appointment for climate accountability

- Five-year data retention

- Science-based reduction strategy development

Companies must register climate data and submit verified reduction strategies through MOCCAE’s national platform. This represents a significant operational commitment, particularly for small businesses lacking ESG infrastructure.

Corporate Banking: Navigating Compliance and KYC

Opening a corporate bank account represents a critical milestone. UAE banks adhere to strict Anti-Money Laundering (AML) regulations, making onboarding rigorous and document-intensive.

Bank Selection

Traditional banks (Emirates NBD, ADCB, FAB) suit established businesses with high turnover but impose high minimum balances (AED 50,000 – 500,000) and lengthy timelines (4-8 weeks).

Digital banks (Wio Business, Mashreq NeoBiz) suit startups and SMEs with zero or low minimum balances (AED 0 – 10,000) and faster onboarding (1-2 weeks).

KYC Documentation Checklist

Banks require comprehensive documentation:

Corporate documents:

- Valid DWTCA Trade License and MOA/AOA

- Establishment Card

- Board resolution authorizing account opening

Personal documents:

- Valid passports, visas, Emirates IDs

- Proof of residential address (within 3 months)

- Bank reference letters and statements (6 months)

Business documentation:

- Detailed business plan with financial projections

- List of anticipated clients and suppliers

- Proof of physical presence (lease agreement)

- Ultimate Beneficial Owner declaration

Banks scrutinize business plans carefully. Vague or implausible plans trigger immediate rejections. Many applicants underestimate documentation depth required—incomplete submissions face outright rejection rather than requests for additional information.

| Bank Type | Minimum Balance | Onboarding Time | Best For |

| Traditional (ADCB, FAB) | AED 50,000 – 500,000 | 4 – 8 Weeks | Large Corps, MNCs |

| Digital (Wio, NeoBiz) | AED 0 – 10,000 | 1 – 2 Weeks | Startups, SMEs |

Frequent Errors in Free Zone Company Formation

Incorrect Activity Selection

Select activities precisely matching your business model. Misalignment creates banking complications, renewal issues, visa quota limitations, and tax treatment problems. Banks verify activity alignment—mismatches trigger enhanced due diligence or rejection.

Insufficient Banking Preparation

Common mistakes include inadequate business plans, missing UBO documentation, insufficient address proof, lack of reference letters, and unrealistic business models. Prepare comprehensive documentation packages before approaching banks. Budget 6-8 weeks for traditional bank account opening.

Misunderstanding Tax Implications

Free zone status doesn’t guarantee zero corporate tax. Qualifying status requires actively meeting multiple conditions including maintaining adequate substance, deriving income from qualifying activities, and maintaining proper documentation. Engage tax advisors during incorporation to structure operations correctly.

Inadequate Compliance Planning

Budget for mandatory annual audits, UBO and ESR filing deadlines, and climate compliance requirements from day one. Establish compliance calendars immediately. The cost of non-compliance—fines, operational disruptions, visa cancellations—vastly exceeds compliance management fees.

Poor Office Space Decisions

Office selection impacts visa quotas and compliance. Flexi-desks are insufficient for General Trading licenses requiring executive offices. Evaluate requirements considering operational needs, license type requirements, client meeting frequency, and growth plans.

Value of Professional Business Setup Services

Jurisdiction and Structure Optimization

Professional advisors identify optimal free zones and legal structures based on business models, target markets, and growth objectives, preventing costly future restructuring.

Documentation Management

Experienced providers ensure documentation meets authority standards before submission, coordinating attestation, translation, and completeness checks. Documentation errors represent the leading cause of delays—professional review eliminates most common mistakes.

Banking Relationship Facilitation

Established providers maintain bank relationships, expediting account opening through documentation pre-checks and compliance interview coordination. Given that banking often takes longer than license issuance, professional facilitation significantly reduces time-to-operation.

Compliance System Implementation

Professional firms establish systems covering annual audit coordination, tax registration and filing, ESR and UBO tracking, renewal reminders, and climate compliance setup. These systems prevent missed deadlines ensuring continuous good standing.

Cost Optimization

Advisors identify savings through package bundling, activity optimization, visa quota maximization, and tax structuring for qualifying status. Professional fees (typically AED 5,000 – 15,000) often represent a fraction of costs saved through proper structuring.