Overview of Audit License in the UAE

Holding an audit license is fundamental for maintaining financial integrity throughout the country. This professional document guarantees that certified financial statements adhere to both international and local assurance standards, providing assurance to regulators and stakeholders.

Why UAE is an Attractive Market for Auditors

The UAE is an attractive market for finance professionals, driven by robust economic growth, corporate governance enhancements, and the recent introduction of Corporate Tax. These factors escalate the demand for objective verification services in the UAE. With numerous enterprises in Dubai and across the Emirates needing statutory financial examination, the qualified auditor sits at the center of the UAE financial system. The mandatory application of IFRS further solidifies the reputation for high-quality reporting.

Roles of a Licensed Auditor in the Local Market

A licensed auditor in the UAE carries out several crucial functions. The primary role involves performing the statutory review, confirming that a company’s financials accurately reflect its position in accordance with IFRS. Beyond compliance, these professionals often offer tax verification services, endorse company liquidations, and review internal controls. They act as essential intermediaries between businesses and regulatory bodies, ensuring accuracy and full adherence to UAE tax and regulation.

Authorities Issuing Audit Licenses in Dubai and Other Emirates

The principal federal authority regulating and issuing the audit license in the UAE is the Ministry of Economy (MoE). Registration with the MoE is required for all individuals and assurance firms planning to offer assessment services nationwide. A separate trading license must be secured from the relevant DED or Free Zone authority, such as the Dubai Department of Economy and Tourism (DET) for a Dubai license. The UAE Auditors’ Association (EAAA) is also involved in professional development and administering the qualifying exam.

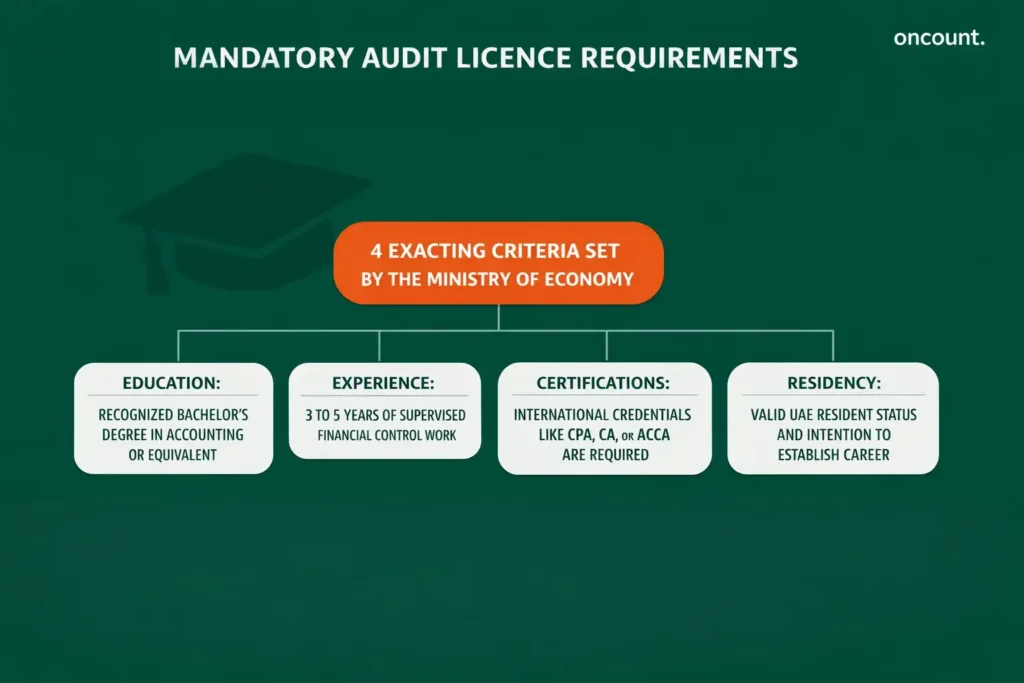

Mandatory Audit Licence Requirements

To successfully get an audit license, applicants must satisfy exacting criteria covering academic background, practical experience, and professional membership. These licensing requirements are established centrally by the Ministry of Economy.

Educational Background for Getting an Audit License

A primary condition is holding a recognized bachelor’s degree in accounting or an equivalent qualification in a financial field from an officially approved institution. The candidate must ensure their educational transcripts are properly attested and legalized, as mandated by the MoE.

Professional Experience Needed to Obtain an Audit License

Candidates must provide proof of sufficient practical experience requirements, typically a minimum of three to five years of financial control work, supervised by a licensed professional or firm. This background should include exposure to various aspects of the internal review and external financial check, confirming the applicant’s competence to offer verification services.

Recognized Certifications to Get Your UAE Audit Qualification

Possession of recognized professional assurance certifications is essential for getting a review qualification. International credentials like CPA, CA, or ACCA are generally required. These certifications confirm advanced expertise and are a vital element in the overall process to get your audit license.

Legal Residency Status for Auditor Registration

To formally apply for an audit license, the applicant must hold a valid resident status in the UAE. Furthermore, they must demonstrate an intention to establish a career in the UAE, as the professional permit is specifically for individuals planning to provide assurance services throughout the UAE.

Preparing for UAE Fellowship Programme and Exam

The final stage of the individual licensing process involves joining the EAAA and passing a competency exam set under the supervision of the MoE.

EAAA Membership and Exam Eligibility

The applicant must first register as a member of the UAE Auditors’ Association. Eligibility to sit for the final exam is confirmed by the Ministry of Economy only after all prior licence requirements, including education and experience, have been verified as complete.

Process to Get Your UAE Audit Fellowship Certificate

Upon meeting all conditions and passing the technical exam, the candidate is awarded the EAAA Fellowship Certificate. This validates their expertise and is necessary before proceeding to formally obtain your audit license, which is subsequently issued by the Ministry of Economy UAE. This qualification confirms adherence to the high standards set by the regulator.

UAE Audit Exam Structure and Format

The qualifying exam assesses the candidate’s proficiency in local commercial legislation, UAE tax and regulation, professional ethics, and adherence to both IFRS and Global Internal Audit Standards. It is a comprehensive assessment that tests the practical application of assurance standards specific to the local commercial environment.

Study Guides for Successfully Passing the Exam

Applicants should focus preparation on the latest Federal Tax Authority (FTA) guidance related to the new Corporate Tax regime, the Commercial Companies Law of the UAE, and recent changes to local reporting mandates. Enrollment in officially accredited preparatory training courses is strongly recommended to enhance the likelihood of passing this crucial assessment.

Steps to Apply for an Audit License

Once the Fellowship Certificate is in hand, the individual must transition to the formal application for the professional permit.

- Registering with Ministry of Economy: The individual must formally register with the MoE. This submission requires the Fellowship Certificate, personal details, and evidence of meeting all regulatory requirements. This step is paramount to get license approval, granting the auditor the authority to practice within the federation.

- Professional Indemnity Insurance: Adequate Professional Indemnity Insurance is compulsory. The minimum level of coverage is stipulated by the MoE, and proof of this policy must be supplied when applying for the license.

- Final Procedures: The closing stage involves MoE review and final authorization. Following successful verification of all documents and prerequisites, the audit license is issued by the federal economic regulator.

- Verification of Practical Experience: For new applicants, the Ministry of Economy conducts a detailed verification of the practical experience claimed, often confirming the quality of work completed under a previous licensed professional.

Registering with Ministry of Economy to Get Audit License

The individual must formally register with the MoE. This submission requires the Fellowship Certificate, personal details, and evidence of meeting all regulatory requirements. This step is paramount to get license approval, granting the auditor the authority to practice within the federation.

Requirements for Professional Indemnity Insurance

To protect clients and uphold professional standing, adequate Professional Indemnity Insurance is compulsory. The minimum level of coverage is stipulated by the MoE, and proof of this policy must be supplied when applying for the license.

Final Procedures to Obtain an Audit License in the UAE

The closing stage involves MoE review and final authorization. Following successful verification of all documents and prerequisites, the audit license is issued by the federal economic regulator. This document legally permits the individual to offer assurance services or start an assurance firm in the country.

Verification of Practical Experience for New Applicants

For new applicants, the Ministry of Economy conducts a detailed verification of the practical experience claimed. This often entails confirming the quality of the work completed under the direct supervision of the previous licensed professional or firm, ensuring competence within the assurance profession in the UAE.

How to Establish an Audit Firm in the UAE

An assurance firm requires specific regulatory clearances beyond a standard business registration to provide review services.

Choosing Legal Structure for Your Audit Business

Most assurance firm entities in the UAE are established as a Professional Services Company or a limited liability structure where the managing partner holds the financial license. When deciding to start an audit firm, the chosen structure must comply with local DED/Free Zone rules and facilitate the specific professional activity.

Partnership Rules for an Audit Firm in UAE

If the structure includes partners, the majority ownership and management control must typically be held by licensed professionals in the UAE. Specific regulations require the entity to be registered as an assurance firm with the MoE, with an approved licensed auditor serving as the managing partner.

Implementing Risk Management in Your New Audit Firm

Assurance firms must establish and document a comprehensive Quality Control and Risk Management Framework. This structure ensures ongoing adherence to financial scrutiny and minimizes exposure to non-compliance, which is essential for maintaining client trust and regulatory standing.

Requirements for Physical Office Space and Business in Dubai

To operate legally, the assurance firm in Dubai (or any other Emirate) must secure approved physical office premises. This is a condition for acquiring the local trade license and must meet DED’s commercial standards, confirming the firm’s status as a professional service provider.

Opening Corporate Bank Account for UAE Business Setup

Following the issuance of the trade license and initial MoE approval, the next crucial step for UAE business setup is opening a corporate business bank account in Dubai or the respective Emirate. This step formalizes the financial legitimacy of the verification business.

Jurisdiction Options: Mainland vs Free Zone Audit License

The decision between a mainland license and a Free Zone authority permit is a strategic consideration for an assurance firm in the UAE.

| Feature | Mainland License (DED/MoE) | Free Zone Permit (e.g., DMCC, JAFZA) |

| Operating Area | Across the entire UAE | Restricted to the Free Zone territory |

| Statutory Review | Required and Authorized | Usually limited to internal or consultancy services |

| Ownership | Often requires local service agent or partner | 100% Foreign Ownership (typical) |

| Primary Authority | Ministry of Economy (MoE) for professional license | Free Zone Authority for trade license |

Benefits of Obtaining a Dubai Audit License on Mainland

A mainland license, issued by the Ministry of Economy via the DED (in Dubai), grants the assurance firm the freedom to operate across the entire UAE, including outside designated Free Zone territories. This path is preferred for firms aiming to offer verification services to the wider national economy.

Specifics of Free Zone Audit Permits and Regulations

While most Free Zones issue trade licenses, they often restrict the firm to conducting only internal review and consultancy services within that zone. To perform a statutory external review for a mainland or regulated Free Zone entity, the assurance firm must secure the full licensing from the MoE, independent of the office location.

Selecting Right Location for Your Audit Services

The decision depends heavily on the target client base. If the firm aims to serve large, locally incorporated corporations, the mainland license route is typically required. If the focus is on specialized consultancy or small Free Zone businesses, that setup may suffice, but the individual auditor must still hold the MoE professional qualification.

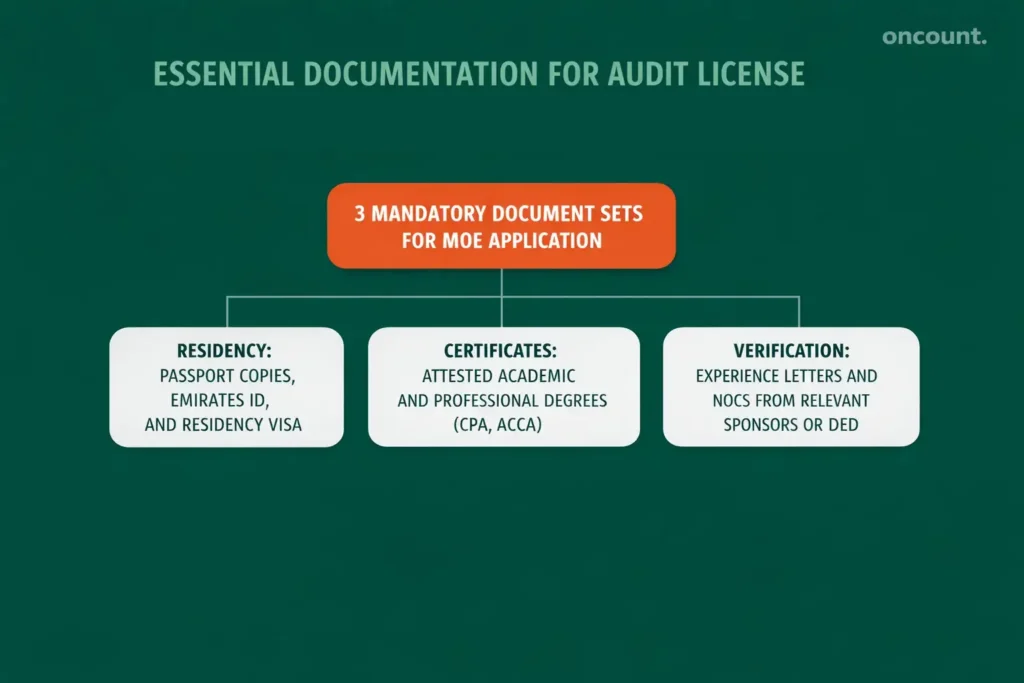

Essential Documents to Get Audit License in UAE

A meticulous approach to gathering and submitting documentation is required when applying for the license.

Identification and Residency Paperwork

This includes:

- Valid passport copies.

- Emirates ID.

- Residency visa.

- Necessary No Objection Certificates (NOCs) from current or past sponsors.

Accurate identification is crucial when engaging with UAE government bodies.

Attested Academic and Professional Certificates

All degree certificates (e.g., bachelor’s degree in accounting) and professional assurance certifications (CPA, ACCA, etc.) must be attested by the UAE Ministry of Foreign Affairs (MoFA) and the country of origin’s embassy. This validates their authenticity for the MoE application.

Experience Letters and No Objection Certificates

The applicant must provide official, detailed letters verifying their previous review experience, signed by the supervising certified professional or firm. NOCs from the DED or other pertinent authorities are also required during the setup process of the assurance firm in Dubai.

Cost of Obtaining an Audit License and Firm Setup

The cost of obtaining an audit assurance is multi-faceted, encompassing both the individual’s certification and the business establishment fees.

Ministry of Economy Registration and Exam Fees

Fees are mandatory for initial registration, exam application, and the final license issuance by the MoE. These governmental charges are standard and must be paid to get license approval.

Total Price of Trade License for Audit Business

This expense varies based on jurisdiction (mainland license vs. Free Zone) and the scope of the professional services license. It includes DED registration, commercial name reservation, and initial governmental approval fees for the verification business license.

Estimated Insurance and Office Lease Costs

Professional Indemnity Insurance expenses fluctuate based on the range of verification services provided and anticipated annual income. Office lease costs are variable, but securing suitable physical premises is a compulsory aspect of starting an assurance company.

New Audit License Rules and Regulatory Compliance

The UAE has recently tightened regulations to better align with international standards of financial integrity. Auditors must remain current with these changes.

Auditing Standards Under UAE Corporate Tax Law

With the introduction of the new Corporate Tax regime, auditors are now required to verify not only financial statements but also the client’s compliance with FTA guidance and tax calculations. The new CT law directly influences how statutory assurance reports are prepared and presented to the authorities.

Anti-Money Laundering Compliance for Audit Firms in the UAE

Key AML/CTF obligations for assurance firms must include:

- Implementing rigorous Know Your Customer (KYC) protocols.

- Mandatory reporting of suspicious transactions.

- Conducting enhanced due diligence on high-risk clients.

- Maintaining comprehensive transaction records for mandated periods.

Assurance firms must fully comply with the UAE’s Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) legislation, which is a fundamental regulatory requirement.

Maintaining Ethical Standards and Professional Conduct

The MoE and EAAA enforce strict codes of professional ethics. Licensed professionals are expected to maintain complete independence, objectivity, and confidentiality, which is essential to the credibility of the assurance profession in the UAE.

Consequences of Non-Compliance with UAE Audit Regulations

Failure to adhere to assurance standards or local tax and regulation can lead to serious penalties, including:

- Financial fines imposed by the MoE or DED.

- Suspension of the audit license.

- Permanent revocation of the audit license.

- Legal action under commercial and tax laws.

The UAE has strict regulations to protect its financial market integrity, and non-compliance by assurance firms must be avoided at all costs.