UAE VAT and Corporate Tax Regulations Overview

The United Arab Emirates introduced value added tax on January 1, 2018, establishing a consumption-based taxation system that fundamentally transformed business operations across the region. This framework, administered by the Federal Tax Authority, requires companies to collect charges on their supplies while simultaneously managing amounts paid on their purchases. The regulatory environment continues to evolve, with recent corporate tax legislation adding another layer of compliance requirements for entities operating within UAE jurisdiction.

UAE Tax Regulations for Local Entities

The Federal Tax Authority oversees all aspects of taxation within the Emirates, including registration requirements, filing obligations, and enforcement actions. Mainland companies face different compliance pathways compared to those established in designated zones, though both must adhere to fundamental principles established under Federal Decree-Law No. 8 of 2017.

Key registration thresholds include:

- Mandatory registration: Annual taxable supplies and imports exceeding AED 375,000

- Voluntary registration: Available for businesses with revenues above AED 187,500

- Immediate registration: Required for businesses expecting to exceed mandatory threshold within 30 days

- Retrospective obligations: Apply from the date threshold was exceeded, not registration date

Businesses must recognize that geographical location within the UAE significantly impacts their obligations. Free zone entities may qualify for specific exemptions or preferential treatment depending on their activities and client base. However, any company making supplies to mainland customers typically must register and comply with standard procedures. The Federal Tax Authority maintains comprehensive guidance on its official portal, clarifying distinctions between designated zones and mainland territories.

Corporate Tax Registration and VAT Obligations

The introduction of corporate tax in June 2023 created parallel compliance requirements that intersect with existing obligations under the taxation system. Companies must now register for corporate tax if they conduct business activities within the UAE, with specific thresholds and exemptions applying to qualifying entities. Unlike the consumption-based system, corporate tax applies to net profits rather than transaction values, requiring separate accounting treatments and filing procedures.

Understanding the interaction between these two tax regimes proves essential for comprehensive compliance. While one system focuses on transaction-level charges throughout the supply chain, corporate tax examines annual profitability after allowable deductions. Businesses must maintain accounting systems capable of tracking both frameworks simultaneously, ensuring accurate reporting to the Federal Tax Authority across multiple filing requirements. The distinction between these systems becomes particularly relevant when companies assess their overall tax position and cash flow management strategies.

Importance of VAT Compliance in the UAE

Adherence to prescribed regulations extends beyond mere legal obligation; it directly impacts business reputation, operational efficiency, and financial stability. The Federal Tax Authority employs sophisticated monitoring systems to identify non-compliance, with penalties ranging from monetary fines to potential business license suspension. In 2023, enforcement actions increased by approximately 18% compared to previous periods, reflecting heightened scrutiny across all business sectors.

Tax compliance serves as a critical component of corporate governance, particularly for companies seeking financing, partnerships, or expansion opportunities. Financial institutions and potential investors routinely examine compliance history during due diligence processes. A clean record demonstrates operational maturity and reduces perceived risk. Furthermore, proper compliance ensures businesses can claim input vat without delays or disputes, directly affecting cash flow and working capital management.

Charging Output VAT on Taxable Supplies

Every transaction involving the sale of goods and services potentially triggers collection obligations under UAE regulations. Companies must implement robust systems to identify taxable supplies, calculate appropriate charges, and document transactions according to Federal Tax Authority specifications. The process requires careful attention to transaction classification, customer categorization, and timing considerations that determine when charges become due.

Output VAT is Essential for Revenue Management

The amounts a business collects from customers on behalf of the government represent a liability that must be carefully tracked and remitted. These collections do not constitute company revenue; rather, they represent funds held in trust until payment to the Federal Tax Authority. Businesses must establish separate accounting treatments to distinguish between actual sales revenue and amounts collected for onward transmission.

Proper management of collected amounts requires implementing internal controls that prevent commingling with operational funds. Many organizations establish separate bank accounts or ledger codes specifically for tracking these liabilities. This segregation proves particularly valuable during cash flow planning, as businesses must ensure sufficient liquidity exists to meet filing obligations when quarterly or monthly periods conclude. The standard vat rate stands at 5% for most supplies, though certain categories qualify for zero-rating or exemption treatment.

VAT that a Business Collects from Customers

Collection occurs at the point of supply, defined by Federal Tax Authority guidance as the earlier of service completion, goods delivery, or payment receipt. Businesses must issue valid tax invoices documenting these transactions within 14 days of the supply date. These documents serve multiple purposes: they provide customers with evidence supporting their own recovery claims, create audit trails for regulatory review, and establish the legal basis for the amounts collected.

Valid tax invoices must contain specific elements mandated by Cabinet Decision No. 52 of 2017.

Required invoice elements include:

- Supplier’s legal name and tax registration number (TRN)

- Invoice date and unique sequential invoice number

- Customer’s name and address (TRN if registered)

- Clear description of goods or services supplied

- Quantity and unit price of supplies

- Total amount payable excluding charges

- Separately stated VAT amount and applicable rate

- Currency of transaction if not AED

Failure to issue compliant documentation can result in penalties and may jeopardize the customer’s ability to recover associated payments to suppliers. Digital invoicing systems must maintain these requirements while offering enhanced efficiency and reduced error rates.

Managing VAT on Taxable Goods and Services

Not all business activities trigger collection obligations. The Federal Tax Authority distinguishes between taxable supplies (both standard-rated and zero-rated), exempt supplies, and out-of-scope transactions. This classification system determines whether businesses must charge customers and, critically, whether they can claim input vat on related costs.

Supply Classification Framework:

| Supply Category | VAT Rate | Recovery Rights | Common Examples |

| Standard-rated | 5% | Full recovery | Retail sales, professional services, hospitality |

| Zero-rated | 0% | Full recovery | Exports, international transport, education |

| Exempt | N/A | No recovery | Financial services, residential property leasing |

| Out-of-scope | N/A | Case-specific | Supplies outside UAE, employee salaries |

Standard-rated supplies include most commercial activities within the UAE, from retail sales to professional services. Zero-rated supplies—such as international transportation, certain education services, and precious metal transactions—technically bear a 0% rate while maintaining taxability for recovery purposes. Exempt supplies, including certain financial services and residential property leasing, fall outside the standard framework entirely. Businesses engaged in mixed activities must apportion their recovery claims according to Federal Tax Authority methodologies, ensuring only amounts attributable to taxable activities receive consideration.

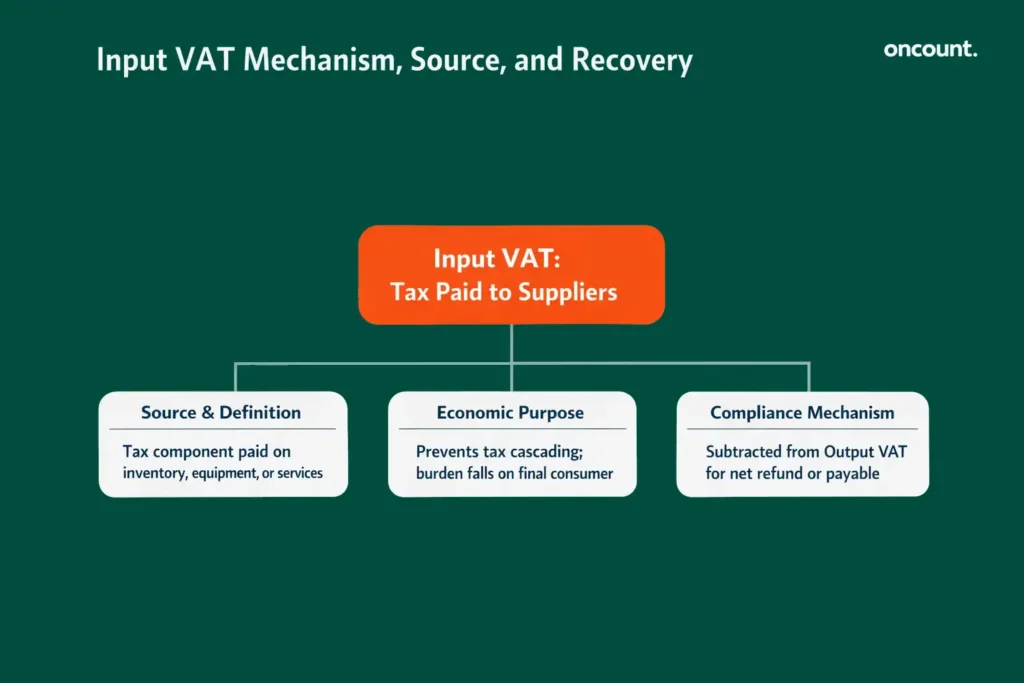

Input VAT and Output VAT Recovery Principles

The fundamental mechanism of the UAE taxation system allows businesses to recover amounts paid to suppliers when purchasing goods and services for business purposes. This recovery right prevents tax cascading throughout supply chains and ensures the ultimate burden falls on final consumers rather than intermediate business entities. However, strict conditions govern recovery eligibility, requiring meticulous documentation and clear business purpose demonstration.

Input VAT is the Tax a Business Pays to Suppliers

When companies purchase inventory, equipment, services, or other business inputs, they typically pay amounts to their suppliers that include charges at the applicable rate. These payments represent input vat, which businesses can generally recover through their periodic filings. The ability to reclaim these amounts significantly impacts cash flow management, particularly for companies with substantial capital expenditure or inventory requirements.

Input vat is the tax component embedded in every business purchase that qualifies for recovery under Federal Tax Authority rules. Companies must track these amounts carefully, maintaining supporting documentation that proves both the payment and its connection to taxable business activities. The recovery mechanism operates through the filing system, where businesses subtract input vat from output vat to determine net amounts payable or refundable for each period.

How to Qualify for Input VAT Recovery

Recovery eligibility depends on satisfying multiple conditions simultaneously.

Essential qualification criteria:

- Registration status: Business must be registered with Federal Tax Authority

- Taxable activities: Purchase must relate to making taxable supplies

- Valid documentation: Possession of compliant tax invoices or approved alternatives

- Business purpose: Clear demonstration that purchases serve taxable operations

- Timing compliance: Claims submitted within prescribed periods (generally five years)

- Proper accounting: Accurate recording and categorization in business records

The Federal Tax Authority applies a purpose test when evaluating recovery claims. Businesses must demonstrate that purchased goods or services serve their taxable activities. This requirement proves straightforward for direct costs like inventory purchases but becomes more complex for overhead expenses supporting mixed activities. Companies engaged in both taxable and exempt supplies must implement approved apportionment methodologies, recovering only the portion attributable to taxable operations.

Timing considerations also affect recovery rights. Businesses can typically claim input vat in the period when they receive valid tax invoices, provided all other conditions are satisfied. However, Federal Tax Authority guidance permits claiming amounts in subsequent periods if documentation arrives late, subject to a five-year limitation period from the original transaction date.

Conditions for Accurate VAT Recovery in the UAE

Documentation requirements extend beyond merely retaining invoices. The Federal Tax Authority expects businesses to maintain comprehensive records demonstrating the business purpose of each expenditure.

Required supporting documentation:

- Purchase orders showing business authorization

- Delivery notes confirming receipt of goods or services

- Payment evidence (bank statements, receipts, transfer confirmations)

- Accounting entries linking costs to specific business activities

- Contracts or agreements establishing commercial relationships

- Import declarations for goods entering UAE territory

Certain expenses face specific restrictions regardless of business purpose. The Cabinet Decision No. 52 of 2017 lists blocked categories, including entertainment expenses that do not qualify for recovery even when supporting taxable activities. Similarly, purchases of passenger vehicles face limitations unless the business operates in specific sectors like taxi services or vehicle rental. Companies must carefully review Federal Tax Authority guidance to identify these restrictions and adjust their recovery calculations accordingly.

Businesses should implement robust approval processes before claiming recovery. Best practices include requiring multiple authorizations for significant expenditures, maintaining clear links between purchases and revenue-generating activities, and conducting regular internal reviews to ensure compliance with Federal Tax Authority standards. These controls reduce audit risk and demonstrate the organization’s commitment to accurate reporting.

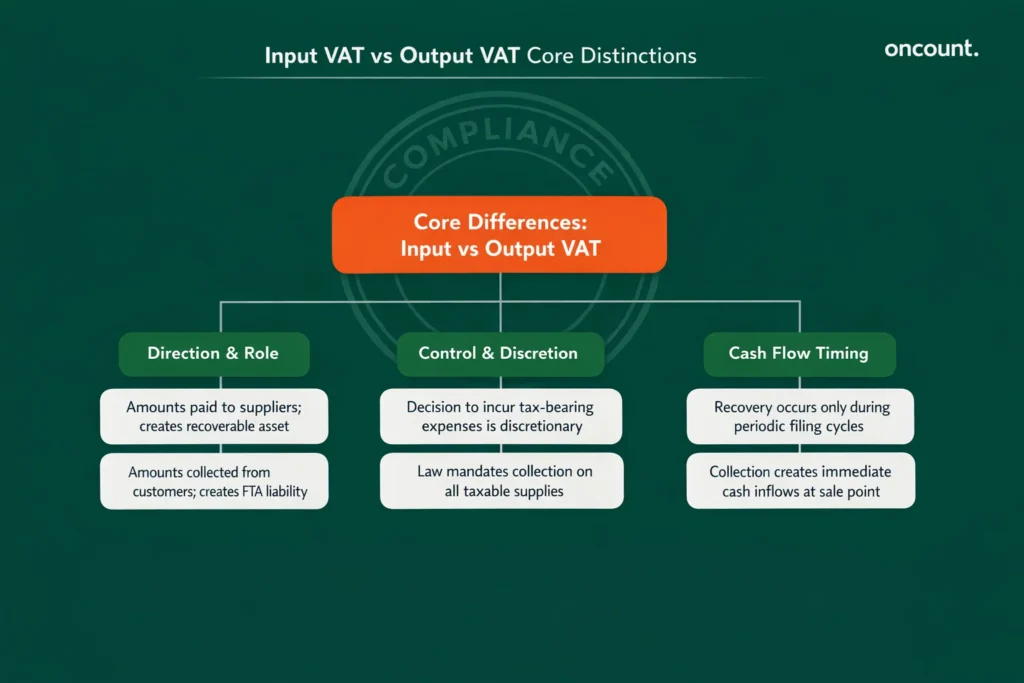

Key Differences Between Input VAT and Output VAT

While both concepts operate within the same regulatory framework, they represent fundamentally different aspects of tax management. One reflects amounts a business collects from customers and must remit to authorities, while the other represents amounts paid to suppliers that businesses can potentially recover. Understanding these distinctions proves essential for accurate accounting, compliance management, and strategic financial planning.

Core Difference Between Input and Output Tax

The primary distinction centers on transaction direction and party roles. Output vat collected from customers represents amounts a business charges when making supplies, creating a liability to the Federal Tax Authority. These collections increase company cash flow temporarily but must eventually be paid to regulatory authorities. Conversely, amounts paid to suppliers represent cash outflows that businesses can potentially recover, creating assets on their balance sheets until settlement through the filing process.

Another significant difference between input vat and output tax relates to control and discretion. Businesses generally cannot choose whether to charge customers—the law mandates collection on taxable supplies. However, the decision to incur expenses carrying charges remains within management discretion. This asymmetry affects financial planning, as companies must account for collection obligations regardless of customer preferences while maintaining control over their expenditure decisions.

The timing of cash flows also differs substantially. Businesses typically collect amounts from customers at or near the point of sale, creating immediate cash inflows. However, recovery of amounts paid to suppliers occurs only during periodic filing cycles, potentially creating significant timing gaps between payment and reimbursement. Companies with substantial capital expenditures or long project cycles must carefully manage these timing differences to maintain adequate liquidity.

Comparative Analysis: Input vs Output VAT

From an accounting perspective, the two concepts occupy different positions within financial statements. Amounts collected from customers appear as current liabilities, specifically as obligations to the Federal Tax Authority. These liabilities increase with each sale and decrease upon payment during filing. Conversely, recoverable amounts paid to suppliers appear as current assets, representing claims against future liabilities or refund entitlements.

Key Comparative Distinctions:

| Aspect | Input VAT | Output VAT |

| Cash Flow Direction | Outflow to suppliers | Inflow from customers |

| Balance Sheet Position | Current asset (recoverable) | Current liability (payable) |

| Business Control | Discretionary (expense decision) | Mandatory (must charge) |

| Recovery Timeline | Periodic filing cycles | Immediate upon collection |

| Documentation Burden | Valid tax invoices required | Must issue compliant invoices |

| Audit Risk Priority | Denied claims increase costs | Under-collection triggers penalties |

The net effect of these opposing flows determines a company’s overall position. When output vat exceeds amounts paid to suppliers, businesses face net liabilities and must remit the difference to the Federal Tax Authority. This scenario typically occurs for companies with high margins, service providers with minimal input costs, or businesses in growth phases with strong sales but controlled expenditure. When paid amounts exceed collections, companies become entitled to refunds, though processing these claims requires additional scrutiny from regulatory authorities.

Risk profiles also differ between the two concepts. Collection errors expose businesses to penalties for under-remitting amounts owed to the Federal Tax Authority. Documentation failures regarding amounts paid can result in denied recovery claims, effectively increasing business costs. However, the Federal Tax Authority generally views under-collection more seriously than aggressive recovery claims, as the former directly reduces government revenue while the latter merely delays it.

Source of VAT that Business Pays and Receives

Understanding the origin of these flows provides strategic insight for management decisions. Collections originate from customer payments, meaning customer creditworthiness and payment terms directly affect cash flow timing. Businesses extending long credit terms to customers collect amounts that remain unavailable for offsetting against their own supplier payments until customer settlement. This dynamic creates working capital challenges that require careful cash flow forecasting.

The source of recoverable amounts lies in supplier relationships and procurement decisions. Businesses purchasing from unregistered suppliers or from sources outside the UAE may find themselves unable to recover amounts paid, effectively increasing their cost base. Strategic sourcing decisions should therefore consider registration status and location of potential suppliers, particularly for significant expenditure categories. Working with registered UAE suppliers typically ensures access to valid tax invoices supporting recovery claims.

Calculating Net VAT Liability for UAE Business

Determining obligations to the Federal Tax Authority requires systematic calculation processes that accurately capture all relevant transactions during each filing period. Companies must implement accounting systems capable of segregating different transaction types, maintaining required documentation, and producing compliant filings within prescribed timeframes. The calculation methodology follows straightforward principles but demands careful attention to detail and comprehensive transaction capture.

Determining Total VAT Payable to Federal Tax Authority

The calculation begins with aggregating all output vat collected during the relevant period. This total includes amounts collected on standard-rated supplies, adjustments for bad debts, and corrections for prior period errors. Companies must review all revenue streams to ensure complete capture, including one-off transactions, deposits received, and advance payments that trigger supply recognition under Federal Tax Authority guidance.

After establishing total collections, businesses subtract input vat from output vat amounts to determine the net vat position. This subtraction includes all recoverable amounts for which valid documentation exists and business purpose requirements are satisfied. The resulting figure represents either a liability payable to authorities or a refund claim, depending on which component exceeds the other.

Adjustments may apply in various circumstances. Businesses discovering errors in prior returns must correct them in current filings, either increasing or decreasing net liabilities accordingly. Similarly, capital asset disposals may trigger adjustments if recovery was previously claimed on their acquisition. The Federal Tax Authority provides detailed guidance on these adjustment mechanisms through its online resources and published manuals.

Formula for Net VAT Liability Assessment

The basic calculation follows this structure: Total output vat collected minus total recoverable input vat equals net liability or refund position. While conceptually simple, this formula requires supporting processes that ensure accuracy across both components. Businesses should implement monthly reconciliation procedures even when filing quarterly, preventing accumulation of errors and facilitating timely identification of issues.

When output vat exceeds paid amounts, businesses face net liabilities requiring payment to the Federal Tax Authority within 28 days of the period end. Payment must accompany the electronic filing, with various methods available including bank transfer, online payment portals, and authorized payment service providers. Late payment triggers penalties calculated as a percentage of outstanding amounts, making timely settlement financially advantageous.

Conversely, when paid amounts exceed collections, businesses may request refunds through their filings. However, the Federal Tax Authority subjects refund claims to enhanced scrutiny, often requesting supporting documentation and conducting desk reviews before approving payments. Businesses should anticipate processing times of several weeks to months for refund claims, planning their cash flow accordingly. Companies experiencing consistent refund positions—such as exporters or capital-intensive businesses—may benefit from applying for accelerated refund status through Federal Tax Authority procedures.

Practical VAT Calculations for Dubai Businesses

Consider a Dubai-based trading company during a quarterly period. The company reports sales of AED 2,000,000, all standard-rated, generating output vat collected of AED 100,000 (calculated as 2,000,000 × 5%). During the same period, the company purchased inventory for AED 1,500,000, paying input vat of AED 75,000 to suppliers. Operating expenses totaled AED 200,000, with associated recoverable amounts of AED 10,000.

The net calculation proceeds as follows: Total collections equal AED 100,000. Total recoverable amounts equal AED 85,000 (inventory plus operating expenses). The company must therefore pay the Federal Tax Authority AED 15,000 (100,000 minus 85,000), representing the net vat liability for this period. This payment accompanies the electronic filing submitted within 28 days of quarter-end.

Service providers typically experience different patterns. A consulting firm with AED 500,000 in quarterly revenue generates collections of AED 25,000. With minimal inventory requirements but substantial operating costs of AED 150,000, the firm pays AED 7,500 to suppliers for recoverable amounts. The net liability equals AED 17,500, reflecting the service sector’s typically higher margins and lower input requirements compared to trading operations.

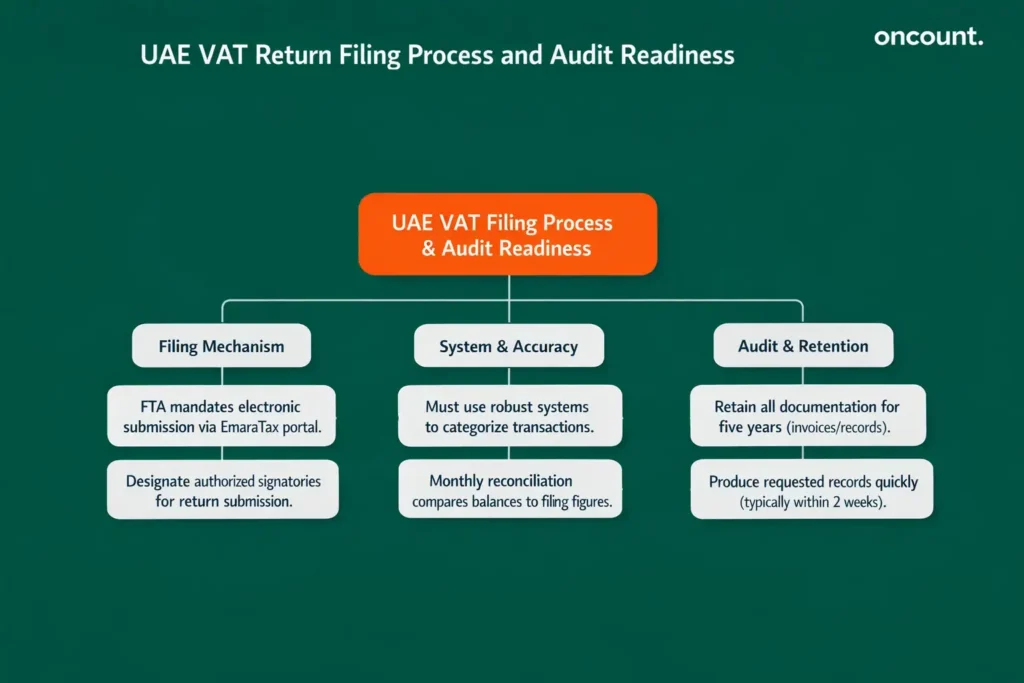

Managing VAT Return and Process in the UAE

Periodic filing represents the primary mechanism through which businesses discharge their obligations to the Federal Tax Authority. The process involves comprehensive reporting of all taxable activities, collections, recoverable amounts, and adjustments during each designated period. Most businesses file quarterly, though some high-volume entities may face monthly obligations, while others might qualify for extended periods under specific circumstances.

How to File VAT Returns Correctly

The Federal Tax Authority requires electronic submission through its EmaraTax portal, a comprehensive system enabling registration, filing, payment, and correspondence with regulatory authorities. Businesses must designate authorized signatories with appropriate access credentials to submit filings on behalf of the entity. The portal guides users through required data fields, performing basic validation checks before accepting submissions.

Accurate filings begin with robust accounting systems that properly categorize transactions according to Federal Tax Authority requirements. Systems should distinguish between standard-rated, zero-rated, and exempt supplies while tracking associated amounts paid and collected. Many businesses implement specialized accounting software with built-in compliance features, reducing manual effort and error risk. However, regardless of system sophistication, human oversight remains essential to ensure classification accuracy and completeness.

The filing itself requires reporting several key figures: total supplies made during the period, broken down by rate category; total output vat collected; total recoverable input vat paid; any adjustments or corrections; and the resulting net liability or refund claim. Supporting schedules may be required depending on transaction complexity, particularly for businesses with international transactions, capital asset acquisitions, or correction requirements.

Ensuring Accurate VAT Returns for Audit Readiness

The Federal Tax Authority conducts regular audits to verify filing accuracy and overall compliance. During these reviews, inspectors examine source documentation, accounting records, internal control procedures, and management oversight mechanisms. Businesses should maintain filing readiness continuously rather than scrambling to organize records when audit notices arrive.

Best practices for audit readiness include implementing monthly reconciliation processes that compare accounting system balances to filing figures, even during quarters between submissions. These reconciliations identify discrepancies early, allowing correction before they compound. Additionally, businesses should conduct annual internal audits examining their tax positions comprehensively, identifying potential risks and implementing remediation measures proactively.

Documentation retention requirements extend for five years from the transaction date, covering all invoices, contracts, payment records, and correspondence relevant to filed amounts. Electronic storage systems must ensure documents remain accessible and searchable throughout this period. During audits, the Federal Tax Authority expects businesses to produce requested documentation promptly, typically within two weeks of request. Delays can trigger negative inferences about compliance quality and potentially lead to assessments based on best judgment rather than actual figures.

Timeline to File VAT on Regular Basis

Quarterly filers must submit filings and make payments within 28 days of period-end. For calendar quarters, this means deadlines of April 28, July 28, October 28, and January 28. Monthly filers face similar 28-day windows following each month’s conclusion. The Federal Tax Authority does not grant automatic extensions, making deadline adherence critical to avoid penalties.

Penalty Structure for Non-Compliance:

| Violation Type | First Offense | Subsequent Offenses | Timeframe |

| Late filing | AED 1,000 | AED 2,000 | Within 24 months |

| Late payment (immediate) | 2% of amount due | 2% of amount due | Upon default |

| Late payment (7+ days) | Additional 4% | Additional 4% | After 7 days |

| Daily penalties | 1% per day | 1% per day | After initial charges |

Late filing triggers fixed penalties of AED 1,000 for the first offense, increasing to AED 2,000 for subsequent violations within 24 months. Late payment incurs additional penalties calculated as percentage charges on outstanding amounts: 2% immediately upon default, with an additional 4% assessed if payment remains outstanding after seven days, followed by further penalties accumulating daily. These charges can quickly exceed the original liability, making timely compliance financially imperative.

Businesses anticipating difficulties meeting deadlines should contact the Federal Tax Authority proactively. While formal extension procedures are limited, authorities may show leniency when businesses demonstrate good faith efforts and face genuine obstacles beyond their control. However, relying on such discretion remains risky; companies should instead implement internal processes ensuring adequate time exists between period-end and deadline for thorough preparation and review.

Avoiding Mistakes with VAT Liabilities and Compliance

Despite relatively straightforward principles, businesses frequently encounter compliance challenges stemming from misunderstanding requirements, inadequate systems, or insufficient attention to procedural details. These errors can result in penalties, increased audit scrutiny, reputational damage, and financial losses from denied recovery claims. Understanding common pitfalls enables businesses to implement preventive measures and maintain strong compliance postures.

Common Errors in UAE VAT Registration

Many businesses delay registration beyond mandatory thresholds, either through ignorance of requirements or deliberate avoidance. The Federal Tax Authority monitors various data sources—including trade licenses, customs declarations, and third-party information—to identify potentially unregistered entities. Failure to register when required triggers backdated obligations and substantial penalties calculated from the point registration should have occurred.

Frequent Registration Mistakes:

- Threshold miscalculation: Failing to monitor cumulative revenues across 12-month periods

- Delayed registration: Missing the 30-day window after exceeding thresholds

- Improper deregistration: Canceling registration while still conducting taxable activities

- Outdated information: Operating with incorrect contact details or ownership structures

- Group registration errors: Misunderstanding eligibility criteria for tax groups

- Free zone confusion: Assuming automatic exemption based on geographical location

Conversely, some businesses register prematurely without understanding implications. Voluntary registration commits entities to ongoing filing obligations regardless of activity levels. Businesses experiencing seasonal operations or long project cycles may find themselves filing nil or minimal returns for extended periods while maintaining registration costs and compliance burdens. Careful threshold analysis and projection should precede registration decisions, particularly for start-ups with uncertain revenue trajectories.

Registration data accuracy poses another common challenge. Businesses must ensure their registration reflects current ownership structures, contact details, and activity descriptions. Changes in these fundamental elements require formal amendment through the EmaraTax portal. Operating under outdated registration information can create correspondence failures, with important Federal Tax Authority communications going undelivered, potentially resulting in missed deadlines and default penalties.

Impact of Incorrectly Charging Output VAT

Overcharging customers—applying standard rates to supplies that qualify for zero-rating or exemption—creates multiple complications. First, businesses collect amounts they have no legal entitlement to retain, creating potential unjust enrichment issues. Second, customers relying on these incorrect invoices for their own recovery claims may face challenges during audits when Federal Tax Authority inspectors identify the misclassification. Third, correcting these errors requires navigating credit note procedures and potentially refunding customers, creating administrative burdens and relationship strain.

Undercharging proves equally problematic. When businesses fail to charge customers on taxable supplies, they remain liable to the Federal Tax Authority for amounts that should have been collected. The authority does not accept explanations about customer relationship preservation or competitive pressures; legal obligations exist regardless of commercial considerations. Businesses discovering undercharging must either absorb the cost themselves or attempt to recover amounts from customers retroactively, both unappealing options.

Mixed-use scenarios—where supplies contain both taxable and exempt components—frequently cause confusion. Businesses must carefully analyze each transaction’s composition, applying appropriate treatments to each element. Bundled supplies require particular attention, with Federal Tax Authority guidance establishing principal supply rules for determining overall treatment. Professional advice often proves valuable for businesses regularly encountering complex mixed-supply situations.

Penalties for Failing to Charge VAT Properly

The Federal Tax Authority distinguishes between deliberate evasion and innocent mistakes when assessing penalties, though both trigger financial consequences. Repeated errors or patterns suggesting systematic non-compliance attract enhanced penalties and potential criminal referrals. The authority published extensive guidance clarifying penalty calculations, mitigation circumstances, and appeal procedures.

Administrative Penalty Framework:

- Deliberate violations: Up to 50% of tax shortfall

- Negligent errors: 30% of underpaid amounts (lacking reasonable care)

- Simple mistakes: 5% of shortfall (minor calculation errors)

- Record-keeping failures: AED 10,000 fixed penalty

- Missing registration certificate display: AED 15,000 fixed penalty

- Obstructing FTA inspections: AED 20,000 or higher

- Repeated violations: Enhanced penalties plus potential license suspension

Beyond financial penalties, serious violations can trigger license suspension or cancellation proceedings through coordination between the Federal Tax Authority and licensing authorities. These measures effectively prevent businesses from operating legally within the UAE, representing existential threats for affected entities. Recent enforcement trends show increasing willingness to pursue such severe sanctions against persistent violators, particularly those demonstrating deliberate non-compliance patterns.

Real-Life UAE Business Case Studies

Examining practical scenarios illuminates how theoretical principles apply in actual business contexts. These case studies reflect common situations encountered by companies operating in the UAE across different sectors and business models. They demonstrate both successful compliance approaches and costly mistakes, providing valuable lessons for businesses seeking to optimize their obligations management.

Case Study: Correct VAT Handling for Sharjah Construction

A Sharjah-based construction company secured a contract to build a residential compound for a property developer. The AED 50 million project spanned 18 months, with progress billing occurring quarterly based on completion milestones. The company faced complex classification questions regarding residential construction treatment and time of supply determination for long-term contracts.

After consulting Federal Tax Authority guidance, the company determined that residential building construction qualifies for zero-rating under specific conditions outlined in Cabinet Decision No. 52 of 2017. The developer provided necessary documentation confirming residential use intent, enabling the constructor to apply 0% rates on progress invoices. This treatment meant charging output vat of zero while maintaining full recovery rights for input vat paid to suppliers, including materials, equipment, and subcontractor costs.

Over the project lifecycle, the company paid approximately AED 2.5 million in input vat to various suppliers. Because charging output vat occurred at 0% despite taxable supply status, the company filed consistent refund claims quarterly. The Federal Tax Authority subjected these claims to enhanced scrutiny, requesting detailed project documentation, progress reports, and supplier invoices. However, because the company maintained comprehensive records demonstrating residential use and proper zero-rating eligibility, refunds processed successfully, typically within 45 days of submission.

This case illustrates the importance of proper supply classification and thorough documentation maintenance. Had the company incorrectly applied standard rates, it would have collected AED 2.5 million from the developer unnecessarily, creating reconciliation complications and relationship friction. Conversely, treating the supply as exempt rather than zero-rated would have eliminated recovery rights, increasing project costs substantially.

Case Study: Service Provider in the UAE Mainland

A Dubai-based marketing consultancy provides services to both UAE mainland clients and customers located in other Gulf Cooperation Council countries. The company employs 25 staff members and operates from leased office space in a mainland commercial area. Monthly revenues average AED 400,000, split approximately 70% from UAE clients and 30% from regional customers.

The company initially struggled with determining appropriate treatment for its regional customers. After Federal Tax Authority consultation, management learned that services supplied to customers located outside the UAE typically qualify for zero-rating under place of supply rules. However, this treatment requires obtaining evidence of customer location, including registration certificates, correspondence confirming addresses, and contractual documentation.

The consultancy implemented systematic procedures for collecting this evidence at engagement inception. For UAE clients, the company applies standard 5% rates, collecting output vat of approximately AED 14,000 monthly on domestic revenues. For regional clients, zero-rating applies, resulting in no collections but maintaining recovery rights. Monthly operating expenses generate input vat of approximately AED 8,000, covering office rent, utilities, professional services, and supplies.

The net monthly filing typically shows a liability of AED 6,000 (14,000 collected minus 8,000 paid), remitted quarterly to the Federal Tax Authority. The company initially filed monthly due to exceeding the AED 150 million annual revenue threshold for quarterly eligibility during its first year. However, after revenues stabilized below this threshold, the Federal Tax Authority approved conversion to quarterly filing, reducing administrative burden while maintaining compliance.

This case demonstrates the importance of understanding place of supply rules for service providers and implementing systems to capture required evidence. It also illustrates how businesses can optimize their administrative burden by selecting appropriate filing frequencies based on their actual revenue levels.

Case Study: Freezone Entity vs Output VAT Scenarios

A technology company established in Dubai Internet City provides software development services to clients globally. The company initially believed free zone status automatically exempted it from all obligations. However, upon reviewing Federal Tax Authority guidance, management discovered that free zone location affects treatment only for qualifying zone supplies—those made to other free zone entities or international customers.

When the company began attracting mainland UAE clients, it triggered registration requirements despite physical location in a designated zone. Supplies to mainland customers constitute taxable supplies occurring within the UAE, requiring standard rate application and full compliance with filing obligations. The company registered and implemented systems distinguishing between qualifying zone supplies (zero-rated) and mainland supplies (standard-rated).

Currently, the company generates approximately AED 300,000 monthly from international and free zone clients (zero-rated) and AED 100,000 monthly from mainland customers (standard-rated at 5%). This structure generates quarterly collections of AED 15,000 on mainland supplies while maintaining recovery rights across all business expenditure. Quarterly operating costs generate input vat of approximately AED 25,000, including equipment purchases, software licenses, and facility expenses.

The resulting filing shows a refund claim of AED 10,000 quarterly (25,000 paid minus 15,000 collected). The Federal Tax Authority initially questioned this pattern, concerned about potential misclassification of mainland supplies as qualifying zone transactions. However, upon examination of customer contracts, invoicing records, and delivery documentation, inspectors confirmed correct classification, and refunds processed successfully.

This case emphasizes that free zone location does not provide automatic relief from all obligations. Businesses must carefully analyze their customer base and supply locations to determine applicable treatments. Free zone entities making supplies to mainland customers face identical compliance requirements as mainland-based businesses, despite their geographical location advantages for other purposes.