Bookkeeping Mistakes & Record-Keeping Errors: Audit Triggers

Meticulous bookkeeping mistakes and superior record-keeping are foundational to fiscal health and regulatory defense. Poor execution in this area is one of the most common precursors to an FTA audit and subsequent penalties. Proper accounting starts here.

Inaccurate & Incomplete Record-Keeping in UAE Business

The Federal Tax Authority (FTA) guidance stipulates that UAE-based businesses must maintain accurate, comprehensive, and legible financial records for a minimum of five years (fifteen years for documents related to real estate). Failure to capture the full scope of a transaction history or to detail the nature of supplies can lead to immediate audit failure. For businesses in Dubai, where complex multi-jurisdictional setups (e.g., mainland and free zone entities) are common, ensuring complete consolidation or clear separation of documentation is vital to demonstrate accurate income attribution and input VAT recovery eligibility.

Failing to Maintain Supporting Documents for Expenses in Dubai

A critical mistake involves neglecting to properly archive supporting documentation for every expense claimed. An invoice alone is often insufficient. For major capital acquisitions or significant deductible costs, the FTA requires a full chain of evidence. Without this chain of evidence, input VAT claims or deductions under the new UAE corporate tax regime can be disallowed retroactively, triggering large back taxes and administrative penalty.

Supporting documentation that must be maintained includes:

- Contracts and agreements related to the transaction.

- Proof of payment (e.g., bank statement entries, receipts).

- Delivery notes or completion certificates.

- Clear justification of the business purpose for the expense.

- Original tax invoices or customs declarations.

Ignoring Data Backup for Financial Records

In the age of digital transformation, financial managers and business owners must ensure the robustness of their accounting system. Relying solely on local hardware or poorly managed spreadsheets exposes the uae business to immense risk. Losing five years of financial records due to a technical failure or cyber incident is not an acceptable excuse to the FTA. Switching to cloud-based accounting systems, which offer automated, redundant backups, is increasingly the only way for smes in dubai to guarantee data accessibility and integrity upon request during an audit.

Neglecting Accurate and Timely Record-Keeping

Delayed or periodic data entry—often termed “shoebox accounting”—guarantees that reconciliations will be complex and time-consuming. Accounting practices demand that entries be made contemporaneously. When reporting periods overlap significantly with data entry periods, the risk of transposition errors, duplicated entries, and misclassification skyrockets. Timely and accurate record-keeping is the only way to generate reliable financial statements that reflect the actual performance of the uae business.

Finance Separation & Internal Accounting Errors

Internal controls and disciplined separation of funds are necessary to maintain the legal integrity of the corporate structure, particularly for startup and smaller operations.

Mixing Personal and Business Finances (Transaction Issue)

This is one of the most common common accounting mistakes for new entrepreneurs. Using a single bank account for both personal and business finances blurs the legal boundary between the individual and the company. Maintaining separate, dedicated bank accounts for business finances is non-negotiable.

Weak Internal Fraud Controls

In rapidly scaling uae-based businesses, the focus on sales can overshadow the need for robust internal financial checks. Lack of segregation of duties (e.g., the same person authorizing payments and performing reconcilement) exposes the company to elevated risk of fraud and theft.

Essential internal controls include:

- Multi-level approval workflows for all disbursements.

- Segregation of duties (different personnel for recording, authorizing, and reconciling).

- Regular, independent bank reconciliations.

- Periodic internal audits or spot checks on high-risk transactions.

Non-Categorizing Income and Expenses

A generic chart of accounts leads to poor decision-making. Failing to use a clear chart of accounts where income and expenses are meticulously categorized by department, project, or type prevents the analysis of key performance indicators (KPIs) and obscures profitability drivers. Worse still, miscategorization can directly impact VAT recoverability or compliance with the UAE corporate tax law by distorting taxable income.

Inadequate Tracking of Business Costs

Accurate cost tracking extends beyond simple expense recording. It requires monitoring inventory costs, capital expenditures (CAPEX), and operational expenses (OPEX) distinctly. Businesses often fail to properly treat fixed assets, leading to incorrect depreciation schedules. Under IFRS, the capitalization and subsequent depreciation of assets must follow a consistent, recognized methodology. Inaccurate asset tracking can result in materially misleading financial statements and non-compliance with statutory financial reporting requirements.

UAE Compliance & Tax Missteps

Regulatory compliance is arguably the most complex area for businesses in UAE, given the recent introduction of VAT in the UAE and the UAE corporate tax regime. Compliance with uae law requires constant vigilance.

Incorrect or Late VAT Filing & Calculation Errors

The Federal Tax Authority (FTA) administers strict penalties for failure to meet obligations regarding VAT. The penalty structure for late payment is particularly steep and escalates quickly:

| Stage | Trigger | Penalty Rate | Cap |

| Immediate | 2% of unpaid tax is due immediately upon due date. | 2% | N/A |

| 7 Days Late | An additional 4% is levied if unpaid after seven days. | +4% (Total 6%) | N/A |

| 1 Month Late | A 1% daily penalty accrues from one month after the due date. | 1% Daily | Capped at 300% of the unpaid tax. |

Incorrect application of reverse charge mechanism (RCM), incorrect calculation of input VAT apportionment, or miscategorization of supplies (e.g., zero-rated vs. exempt) are common accounting mistakes that necessitate costly voluntary disclosures or trigger a full tax audit.

Ignoring UAE Corporate Tax Requirements & New Risks

Since the introduction of UAE corporate tax, uae businesses must now navigate a dual tax structure. Many business leaders mistakenly assume a 0% tax rate applies universally.

UAE Corporate Tax Rates (Applicable to Taxable Income):

| Income Type/Threshold | Tax Rate | Description |

| Up to AED 375,000 | 0% | Applicable to income below the minimum threshold. |

| Exceeding AED 375,000 | 9% | Applicable to taxable income above the threshold. |

| Qualifying Free Zone | 0% / 9% | 0% on Qualifying Income; 9% on Non-Qualifying Income. |

Failing to assess tax residency, identify related party transactions, or apply arm’s length principles are critical mistakes that businesses risk incurring substantial tax liabilities.

Missing Statutory Compliance & Tax Deadlines

Beyond VAT and Corporate Tax, the UAE enforces several statutory deadlines. Accounting services and internal finance teams must maintain rigorous calendars to avoid severe administrative fines.

Key Statutory Deadlines include:

- VAT Return Submissions: Monthly or quarterly (depending on turnover).

- Annual UAE Corporate Tax Return: Due 9 months after the end of the financial year.

- Economic Substance Regulations (ESR) Filing: Annual notification and reporting for businesses engaged in ‘Relevant Activities’.

- Ultimate Beneficial Owner (UBO) Declaration: Mandated reporting to the licensing authority.

Lack of Compliance with ESR & UBO Rules

The ESR mandate requires certain businesses in uae engaging in ‘Relevant Activities’ to demonstrate genuine economic substance in the UAE (sufficient people, premises, and expenditures).

Consequences of Non-Compliance:

- ESR: Significant penalty (up to AED 400,000 for repeated failure) and international information exchange.

- UBO: Administrative fines for failing to identify and report ultimate natural persons of control, violating global AML standards.

Compliance with uae tax and governance laws in these areas is non-negotiable.

Misclassification of Expenses or Income

Accounting mistakes often involve simple misclassification. Treating capital expenditure as a routine operating expense, or vice versa, distorts the Profit and Loss statement and the Balance Sheet. Similarly, miscategorizing revenue from a main service activity as exempt income can lead to under-reported output VAT. This material inaccuracy compromises the reliability of financial statements used for banking, investment, and regulatory submissions, and is a frequent cause of audit adjustments.

Operational Accounting & Poor Cash Flow Management

Efficient operational accounting ensures the smooth running of the uae business. Poor cash flow management and inefficient systems are often intertwined.

Poor Cash Flow & Financial Planning

Failing to generate reliable, forward-looking cash flow forecasts is one of the most common causes of startup and SME failure. Efficient accounting requires generating rolling forecasts based on reconciled accounts, allowing financial managers to anticipate liquidity gaps and make strategic decisions proactively, rather than reactively.

Failing to Reconcile Accounts Regularly

To reconcile bank statements, vendor statements, and customer ledgers with the General Ledger is a fundamental accounting procedure. Without regular reconciliation, discrepancies accumulate, and internal theft or unauthorized transactions can go undetected.

Minimum reconciliation requirements:

- Bank Statements (Monthly minimum).

- Vendor/Supplier Statements.

- Customer/Accounts Receivable Ledgers.

- Credit Card Statements.

- Inventory Records (if applicable).

Using Outdated Accounting Software & Manual Data Entry

Many businesses, especially smes in dubai, still rely on rudimentary spreadsheets or old, isolated desktop accounting software. This perpetuates accounting errors by requiring excessive manual data entry, which is highly prone to human error and difficult to audit.

Benefits of Cloud-Based Accounting Solutions:

- Eliminates redundant manual data entry.

- Provides real-time access to financial metrics.

- Automates reconciliation processes.

- Dramatically simplifies compliance for VAT returns and audit document generation.

Switching to cloud-based accounting is an investment in future growth and compliance.

No Clear Payroll or Staff Compensation Records

Accurate payroll records are essential for labor law compliance and for justifying salary expenditures as deductible costs under UAE corporate tax.

Essential payroll records include:

- Comprehensive records of gross salary and all allowances.

- Detailed documentation of all deductions.

- Accurate calculations and provisions for End-of-Service Benefits (EOSB).

- Proof of payment (WPS records or bank transfers).

Misclassifying Employees and Contractors

The line between a full-time employee and a contracted service provider can be legally sensitive, especially concerning tax and labor law in dubai and abu dhabi. Misclassification can have implications for payroll tax reporting and labor entitlements. Proper accounting dictates that the nature of the relationship, not just the payment mechanism, defines the classification, and all associated liabilities must be accurately tracked.

Professional Expertise & Avoiding Costly Mistakes

Accounting is crucial, and lack of sufficient expertise leads to the most critical mistakes.

DIY Accounting Without Necessary Expertise

The belief that an entrepreneur or administrative staff can handle complex UAE accounting and tax matters without specialized knowledge is a recipe for disaster. While a small startup might manage basic entries, once VAT registration is mandated or when cross-border transactions occur, the technical knowledge required for accurate compliance rapidly exceeds layperson ability. Avoiding costly penalties depends on recognizing the limits of in-house capabilities.

Failing to Hire Right Accounting Professionals

The specific expertise needed to navigate the complexities of accounting in the UAE differs from global practice. Businesses often hire generalists instead of dedicated experts in VAT in the UAE, UAE corporate tax, and IFRS-compliant financial reporting. The ideal solution involves partnering with a professional accounting firm or dedicated in-house accountant with proven expertise in uae regulations. Top accounting standards require specialist knowledge.

Last-Minute Audit Panic

A panicked, last-minute gathering of disordered financial records before an audit is costly, stressful, and often unsuccessful. Audit success is determined months or years in advance by the quality of daily accounting practices.

Key documents for maintaining “Audit-Readiness”:

- FTA Audit File (FAF) generated from the accounting system.

- Compliant tax invoices (sales and purchases).

- Detailed bank statements reconciled to the GL.

- Customs declarations for imports/exports.

- List of fixed assets and their depreciation schedules.

Not Conducting Annual Audits

While not all entities are legally mandated to conduct an external audit annually, obtaining one, even voluntarily, is a sound accounting practice. An independent audit validates the financial statements and gives confidence to stakeholders, investors, and banks. Crucially, the auditor provides an external layer of assurance that accounting ensures compliance and identifies potential accounting pitfalls before they become regulatory failures.

Not Seeking Professional Help Early Enough

Many businesses only seek help from an accounting firm after an FTA assessment or penalty notice has been issued. Proactive consultation is far more cost-effective. Seeking assistance early for setting up a clear chart of accounts, choosing the right accounting software, or ensuring correct treatment of personal and business finances helps businesses grow on a solid foundation, thereby avoiding costly penalties and accounting mistakes uae.

Smart Accounting Practices & System Solutions

Implementing streamlined, technology-driven processes is the hallmark of sophisticated financial management for businesses in uae.

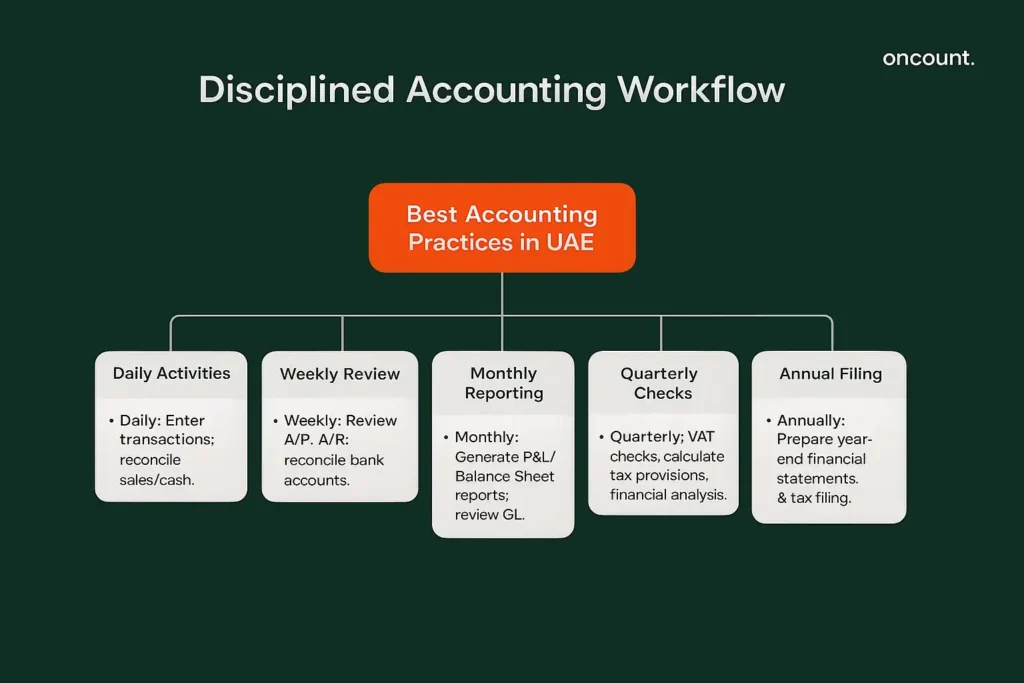

Implementing Best Accounting Practices

Best accounting practices in the UAE include a disciplined workflow that minimizes errors and ensures real-time accuracy:

- Daily: Data entry for all transactions and reconciliation of daily sales/cash.

- Weekly: Review of accounts payable/receivable and bank account reconciliation.

- Monthly: Management reporting (P&L, Balance Sheet) and review of the General Ledger.

- Quarterly: VAT review checks, tax provision calculations, and financial analysis.

- Annually: Preparation of year-end financial statements and tax return filing.

This disciplined workflow minimizes the potential for accounting errors and ensures that financial statements are always accurate and current.

Leveraging Professional Accounting Services for Compliance

Specialized accounting services and accounting professionals are experts in the rapidly changing uae regulations. They leverage their comprehensive understanding of local laws, including the nuances of VAT in the UAE and the evolving UAE corporate tax landscape. Outsourcing ensures that your tax filing is accurate and timely, protecting the uae business from administrative fines and providing peace of mind to business owners.

When to Outsource: Smart Business Calculator

The decision to outsource financial operations is a strategic one.

| Factor | Internal Accountant (Generalist) | Outsourced Accounting Firm (Specialist) |

| Cost | High fixed salary, plus benefits/visa costs. | Variable retainer, based on complexity. |

| Expertise | General knowledge; specific UAE tax expertise may be lacking. | Dedicated experts in UAE VAT, CT, and IFRS. |

| Risk Exposure | Higher, due to reliance on one individual’s knowledge. | Lower, firm assumes liability for compliance accuracy. |

| Scalability | Low; requires hiring additional staff for growth. | High; firm can immediately allocate more resources. |

For a small startup or smes in dubai where complexity is moderate but compliance risk is high, outsourcing often provides better expertise and lower overall risk exposure than hiring a single internal generalist.

Choosing Best Accounting System for Startup

A startup or smaller enterprise must prioritize an accounting software that is affordable, scalable, and FTA-compliant. The best accounting solutions are typically cloud-based accounting platforms that offer:

- Affordability and scalability (grows with the business).

- Automated bank reconciliation features.

- Tracking of multi-currency transactions.

- Generation of VAT-compliant reports and tax invoices.

- Simplified creation of the FTA Audit File (FAF).

This investment from the outset creates a foundation for efficient accounting that can handle growth and future regulatory demands.

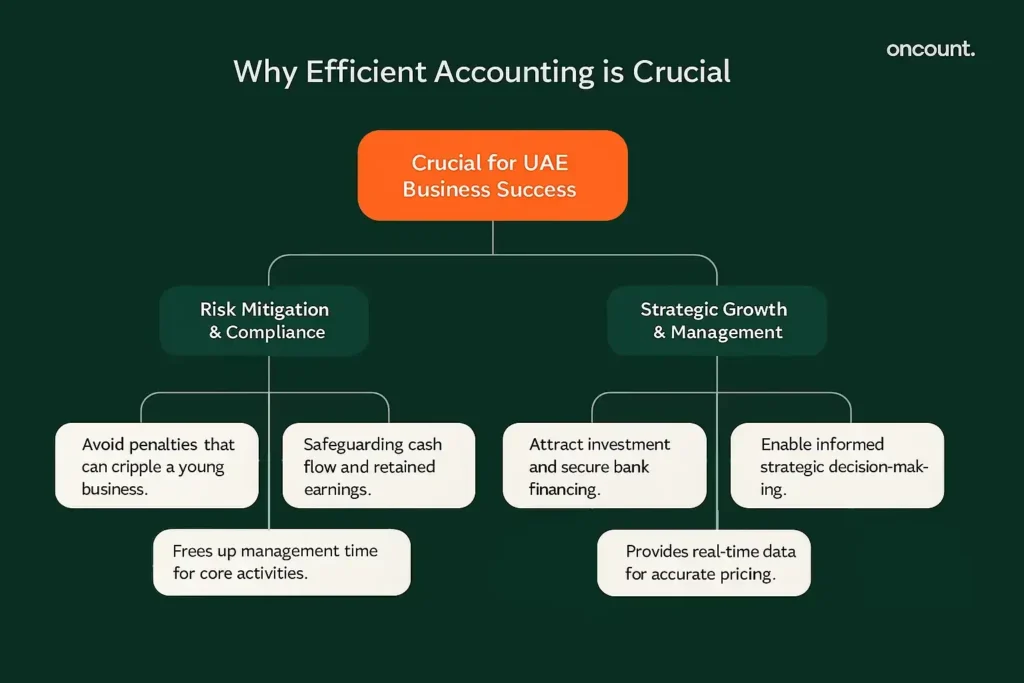

Why Efficient Accounting Is Crucial for UAE Business Success

Accounting is crucial not just for compliance, but for sustained success in the competitive dubai market.

Avoiding Costly Penalties and Fines

The primary incentive for rigorous accounting is the avoidance of severe financial consequences. The penalties for late VAT payment, failure to register for UAE corporate tax, or non-compliance with ESR/UBO rules are significant and can cripple a young uae business. Accounting ensures compliance with uae law, safeguarding cash flow and retained earnings. Mistakes can lead to legal action and reputational damage.

Preparing Business for Smooth Financial Management

Proper accounting provides the financial transparency required to:

- Attract investment and secure bank financing.

- Enable informed strategic decision-making.

- Confidently manage inventory and optimize pricing.

- Transition from reactive operational issues to strategic growth planning.

The Ripple Effect on Business Performance

Efficient accounting has a positive ripple effect. It provides real-time data for accurate pricing decisions, highlights areas of overspending (improving cash flow), and ensures statutory filings are done accurately, freeing up management time to focus on core activities. In essence, robust financial governance enables the entire uae business to operate more profitably and strategically.