Starting to Sell on Amazon UAE: Business Overview

Entering the digital commerce sector through established Amazon platforms offers distinct advantages for businesses seeking to reach UAE customers efficiently. The decision to establish an online presence requires careful evaluation of market dynamics, regulatory obligations, and operational capacity.

Why Start an Amazon Business?

The Amazon infrastructure provides immediate access to millions of potential customers across the Emirates without requiring independent website development or marketing infrastructure. According to Federal Tax Authority registrations, e-commerce entities have grown by approximately 34% annually since 2021, reflecting sustained consumer confidence in digital purchasing channels.

Three primary factors drive businesses toward marketplace-based selling:

- Market Access and Consumer Trust: Established platforms offer built-in credibility with online shoppers who already maintain payment information and delivery preferences. For new market entrants, this eliminates significant barriers related to payment gateway integration and logistics partnerships.

- Operational Infrastructure: Platform-provided tools handle critical functions including payment processing, customer service frameworks, and analytics dashboards. This allows business owners to concentrate on product sourcing, inventory management, and strategic growth rather than technical infrastructure.

- Scalability Potential: The ability to expand product offerings, increase inventory volume, and reach additional customer segments occurs within an existing framework. Businesses can test market response to new items with minimal upfront investment compared to traditional retail expansion.

Is Amazon the Right Platform for Your Business?

Not every business model aligns optimally with Amazon selling structures. Companies must evaluate whether their products, margins, and operational capabilities suit the platform’s fee structure and competitive environment.

Consider these assessment criteria:

Product categories with high volume potential and reasonable unit economics typically perform well. Items requiring extensive customer education, complex customization, or hands-on demonstration may encounter challenges in the digital Amazon format. Review the platform’s category restrictions carefully, as certain products require additional approvals or documentation.

Brand positioning matters significantly. If your business emphasizes premium positioning with extensive storytelling and personalized customer interaction, the standardized listing format may limit differentiation opportunities. Conversely, value-oriented products with clear use cases often thrive in comparison-driven Amazon environments.

Profit margin calculations must account for all platform-related expenses including referral fees, fulfillment costs, advertising expenditures, and potential return rates. Businesses with gross margins below 30% frequently struggle to maintain profitability after accounting for these operational costs.

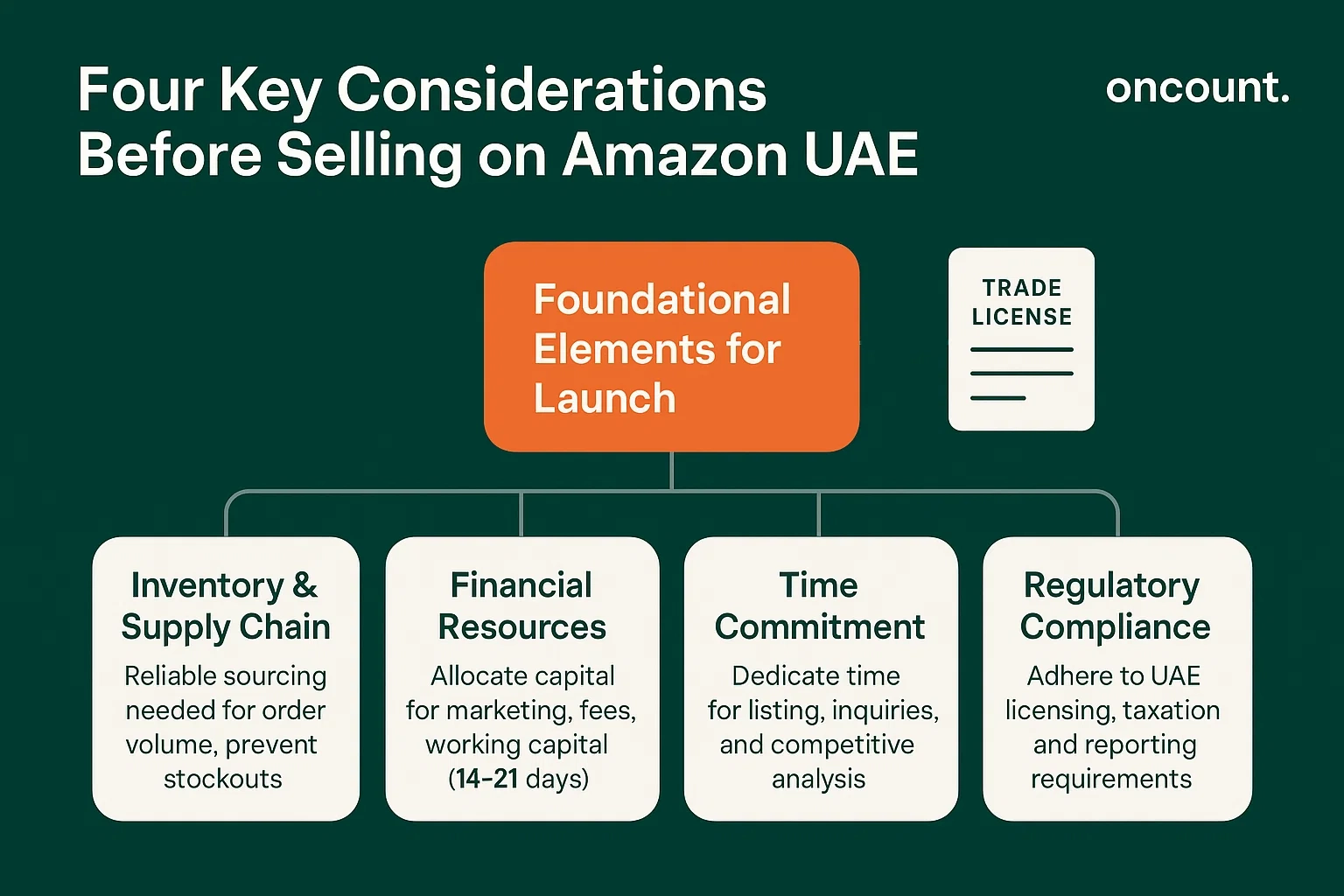

Key Considerations Before Starting on Amazon

Successful Amazon presence requires upfront planning across several operational dimensions. Businesses should address these foundational elements before initiating the registration process:

- Inventory and Supply Chain: Establish reliable sourcing relationships that can accommodate increased order volume. Platform selling often creates demand spikes that overwhelm unprepared suppliers. Maintain safety stock levels that prevent stockouts, which severely impact search visibility and customer ratings.

- Financial Resources: Beyond initial inventory investment, allocate capital for marketing campaigns, platform fees, and working capital to cover the payment cycle. Settlement periods typically range from 14 to 21 days, requiring sufficient cash flow to bridge this gap.

- Time Commitment: Managing seller operations demands consistent attention to listing optimization, customer inquiries, inventory monitoring, and competitive analysis. Business owners should realistically assess whether they can dedicate adequate resources or need to hire specialized staff.

- Regulatory Compliance: Operating within the UAE requires adherence to specific licensing, taxation, and reporting requirements. Non-compliance creates legal exposure and potential account suspension. Understanding these obligations before launch prevents costly corrections later.

Legal Requirements for Selling on Amazon UAE

Regulatory compliance forms the foundation of legitimate commercial operations in the Emirates. The platform enforces strict verification protocols that align with government mandates, making proper business setup non-negotiable for account approval.

Trade License and E-commerce License in Dubai

All commercial activities within the UAE require appropriate licensing from designated regulatory authorities. For digital commerce operations, this typically means obtaining an e-commerce license or a commercial license that explicitly permits online sales activities.

The Department of Economic Development (DED) in Dubai issues mainland commercial licenses, while various free zones offer their own licensing frameworks. Your business name must be registered through these channels and appear on official documentation. The license clearly specifies permitted business activities using standardized codes—ensure your license includes e-commerce trading or equivalent language.

Platform policies require that your registered business activities align with what you actually sell. Attempting to sell products outside your licensed categories creates compliance issues that can result in account restrictions. If you intend to offer multiple product categories, secure a license with sufficiently broad activity descriptions or add activities through official amendment procedures.

Documentation requirements include:

- Valid trade license showing current status and e-commerce permissions

- Memorandum of Association or equivalent founding documents

- Passport copies and Emirates ID for all shareholders and authorized signatories

- Tenancy contract for your registered business location

- Initial approval certificates from relevant authorities

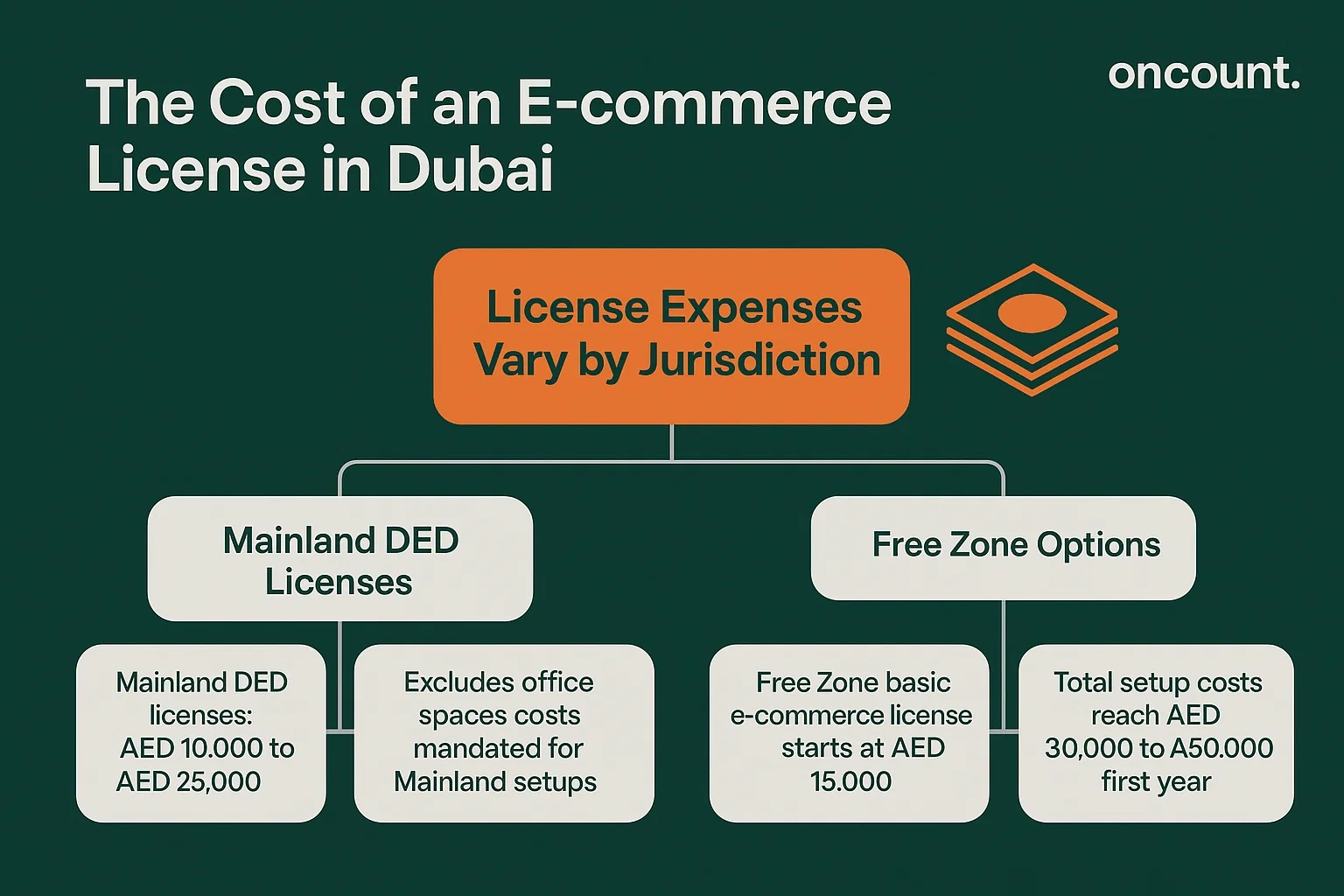

The Cost of an E-commerce License

License expenses vary considerably based on jurisdiction, business structure, and specific activities. Understanding these costs allows accurate budgeting for market entry.

Mainland Dubai licenses from DED typically range from AED 10,000 to AED 25,000 annually depending on activity scope and business classification. This excludes additional costs for office space requirements, which mainland setups generally mandate.

Free zone options present different cost structures. Basic e-commerce licenses in zones like Dubai CommerCity or Dubai South start around AED 15,000 annually for single-shareholder entities. However, total setup costs including registration fees, visa allocations, and facility charges often reach AED 30,000 to AED 50,000 in the first year.

Additional considerations affecting cost include:

- Number of visa allocations required for employees

- Office or warehouse space requirements

- Professional service fees for license processing and documentation

- Ministry approvals for specific product categories

- Corporate bank account opening charges

Budget conservatively and factor in renewal expenses, which recur annually. Some authorities require advance payment for multi-year licenses, offering modest discounts for longer commitments.

Free Zone Versus Mainland Company Setup

Choosing between free zone and mainland establishment significantly impacts operational flexibility, market access, and ongoing compliance obligations.

Free Zone Advantages: These designated areas offer 100% foreign ownership, exemption from certain customs duties, and streamlined business setup procedures. Free zone licenses typically process faster than mainland alternatives, often completing within two to three weeks. For businesses focused exclusively on digital commerce without physical retail presence, free zones provide cost-effective entry.

Mainland Advantages: Companies established through emirate-level authorities can operate freely throughout the UAE without geographic restrictions. Mainland entities can bid on government contracts and engage in direct business-to-business relationships more easily. They also avoid free zone renewal complexities and potential restrictions on physical trading locations.

Regulatory Considerations: From a tax perspective, both structures must register for corporate tax if meeting threshold requirements under Federal Decree-Law No. 47 of 2022. Value-Added Tax registration follows similar rules regardless of setup type, triggered by crossing the mandatory registration threshold of AED 375,000 in taxable supplies.

The platform accepts seller registrations from both structure types, provided proper documentation exists. Your decision should consider long-term business strategy rather than just initial Amazon entry.

Corporate Bank Account Setup

Establishing a business bank account in the UAE represents a mandatory step that often proves more time-consuming than anticipated. Financial institutions maintain stringent due diligence requirements aligned with Central Bank regulations and anti-money laundering protocols.

Account opening typically requires:

- Original trade license and attested copies

- Memorandum and Articles of Association

- Board resolution authorizing account opening and designating signatories

- Passport copies, visa pages, and Emirates ID for all authorized persons

- Business plan or commercial activity description

- Proof of registered address

- Utility bill or tenancy contract

- Bank account statement from shareholder’s personal accounts (usually last six months)

Processing timelines vary by institution but commonly extend three to six weeks. Some banks impose minimum balance requirements or request initial deposits ranging from AED 25,000 to AED 100,000 depending on account type and relationship.

Platform integration requires account details in your business name. Personal accounts cannot substitute for business accounts in the verification process. Ensure your account supports electronic payments and international transfers, as settlement payments arrive through cross-border banking channels.

Setting Up Your Amazon Seller Account

Technical account creation follows regulatory compliance. The registration process involves multiple verification stages designed to confirm business legitimacy and operational capacity.

Step-by-Step Amazon Seller Account Registration

Navigate to the seller registration portal and select the appropriate geographical marketplace. For UAE-based operations, this means registering specifically for the .ae Amazon rather than other regional platforms.

The registration workflow proceeds through several stages:

- Initial Information Collection: Provide your email address and create account credentials. Use a business email rather than personal addresses to maintain professional communication channels. This becomes your primary access point to Seller Central.

- Business Information Submission: Enter legal business details exactly as they appear on your trade license. Discrepancies between submitted information and official documents trigger verification delays. Include your registered business address, company name, and license numbers precisely.

- Primary Contact Details: Designate an authorized person as the account manager with valid mobile number and email. This individual receives critical notifications regarding account status, policy updates, and verification requirements.

- Billing Information: Submit your corporate bank account details including IBAN, bank name, and branch information. Ensure these match your registered business name exactly—mismatches prevent payment settlement.

- Product Information: Indicate which product categories you intend to offer. Some categories require pre-approval or additional documentation before you can create listings in those classifications.

- Identity Verification: Upload required documents including trade license, Emirates ID, passport, and bank account statement. Documents must be current (typically within 90 days for bank statements) and clearly legible. Poor quality uploads extend verification timelines significantly.

E-commerce License Verification

License verification represents the most critical approval stage. The compliance team examines your documentation to confirm legitimate business establishment and appropriate activity permissions.

Submit complete, unobscured copies of your trade license showing:

- Current validity status

- All pages including activity descriptions

- Clear visibility of official stamps and signatures

- English translations if original documents appear in Arabic

Verification typically requires three to seven business days for straightforward applications. Complex cases involving multiple shareholders, specialized product categories, or documentation inconsistencies may extend to several weeks.

Common rejection reasons include expired licenses, missing activity codes for e-commerce, name mismatches between documents, and insufficient documentation quality. Address these proactively to avoid delays.

Individual Seller Versus Professional Seller Plan

The platform offers two types of seller plans with distinct cost structures and feature access:

- Individual Seller Plan: Designed for occasional sellers with limited inventory. This option charges per-item fees for each unit sold rather than monthly subscriptions. Individual sellers face restrictions on certain selling tools, advertising options, and reporting capabilities. This plan suits businesses testing market viability before full commitment.

- Professional Seller Plan: Targets serious commercial operations with regular inventory turnover. A monthly subscription fee provides unlimited listing capacity and access to advanced features including bulk listing tools, detailed analytics, advertising platforms, and API integration capabilities. For businesses anticipating more than 40 sales monthly, the professional tier typically proves more economical than per-item charges.

UAE residents and businesses should carefully evaluate expected sales volume when selecting their seller plan. The professional option offers substantially more control and growth potential, making it the preferred choice for established businesses entering the market.

Switching between plans occurs within account settings, allowing flexibility as your business scales. However, starting with appropriate infrastructure prevents early limitations on growth trajectory.

Requirements for an Amazon UAE Seller Account

Beyond initial registration, maintaining an active seller account requires ongoing compliance with platform policies and regulatory standards.

Mandatory requirements include:

- Active Business License: Your license must remain current throughout your selling period. License expiration triggers automatic account suspension until renewal documentation is provided. Monitor renewal dates carefully and submit updated documents promptly.

- Valid Bank Account: Maintain the registered corporate bank account in active status. Account closures or changes require immediate notification and updated information to prevent payment settlement failures.

- Tax Registration: Businesses meeting Value-Added Tax thresholds must complete VAT registration with the Federal Tax Authority. Submit your Tax Registration Number through Seller Central when applicable. Corporate tax registration requirements depend on revenue thresholds and business structure under current legislation.

- Product Compliance: Items offered must comply with UAE import regulations, safety standards, and platform policies. Certain products require certifications from Emirates Authority for Standardization and Metrology (ESMA) or other regulatory bodies.

- Responsive Communication: Account managers must respond to platform inquiries within specified timeframes, typically 24 to 48 hours. Unresponsive accounts face performance warnings and potential restrictions.

Accessing and Managing Seller Central

Seller Central serves as your operational dashboard for all Amazon activities. This web-based interface provides tools for inventory management, order processing, performance monitoring, and customer communication.

Key functional areas include:

- Inventory Management: Add new product listings, update existing inventory, adjust pricing, and manage stock levels. The interface supports both individual item entry and bulk upload using provided templates.

- Order Processing: Review incoming orders, confirm shipment, upload tracking information, and manage returns or cancellations. Unless using fulfillment services, you must process orders within specified handling times.

- Performance Metrics: Monitor critical indicators including order defect rate, customer response time, and shipping performance. These metrics directly impact account health and search visibility.

- Financial Dashboard: Track sales revenue, fees, reimbursements, and upcoming settlement amounts. Download detailed reports for accounting and tax compliance purposes.

- Communication Center: Respond to customer inquiries, address product questions, and handle service requests. Timely, professional communication directly influences seller ratings and repeat business.

Access Seller Central regularly—daily monitoring during initial launch phases helps identify issues quickly and maintain performance standards. The platform provides mobile applications for on-the-go management, though full functionality requires desktop access.

Listing Products on Amazon.ae

Effective product presentation directly correlates with conversion rates and search visibility. Successful listings balance technical accuracy, persuasive content, and search optimization.

How to Sell Products on Amazon

Product availability begins with creating or matching to existing catalog entries. The platform maintains a centralized catalog where multiple sellers may offer identical items, or you can establish new listings for unique products.

Catalog Matching: Search existing listings using Global Trade Item Numbers (GTINs) such as UPC, EAN, or ISBN codes. If an identical product exists, match your offer to that listing rather than creating duplicates. This consolidates customer reviews and search rankings.

New Listing Creation: For unique items or brands, create comprehensive listings including:

- Detailed product titles with key attributes (brand, model, size, color, material)

- Multiple high-resolution images showing different angles and use contexts

- Bullet points highlighting features, benefits, and specifications

- Comprehensive product descriptions with dimensions, materials, and usage instructions

- Accurate categorization using the platform’s taxonomy

- Required attributes specific to your product category

Content Quality Standards: The platform requires upload original content that accurately represents your items. Avoid copying competitor descriptions or using generic manufacturer text. Instead, craft unique descriptions addressing customer questions and search intent.

Product information must comply with UAE market standards including Arabic language options for certain categories, metric measurements, and locally relevant specifications.

Optimizing Your Listing for SEO

Search visibility within the Amazon depends on relevance signals including keywords, sales velocity, and customer engagement metrics.

Keyword Integration: Identify terms potential customers use when searching for your product type. Incorporate these naturally into titles, bullet points, and descriptions without forced repetition. Backend search terms provide additional keyword space invisible to shoppers but indexed for search.

Title Optimization: Front-load important information including brand, primary keyword, and distinguishing features. Titles should be descriptive yet concise, typically 150-200 characters. Avoid promotional language, excessive capitalization, or special characters.

Visual Content: High-quality images significantly impact conversion rates. Include minimum seven images showing product details, scale references, packaging, and real-world usage. Infographics highlighting key features perform well for technical products.

Enhanced Content Options: Eligible brand owners can access enhanced brand content tools providing additional layout flexibility, comparison charts, and enriched storytelling capabilities. These premium content features improve engagement and conversion rates.

Review Accumulation: Customer reviews represent critical trust signals and ranking factors. Encourage satisfied customers to share experiences while strictly adhering to review solicitation policies. Never incentivize or manipulate review generation.

Selecting the Right Products

Product selection determines Amazon success more than any other factor. Businesses should apply systematic analysis rather than intuition when choosing what to offer.

Demand Analysis: Use Amazon search data and third-party analytics tools to identify categories with strong search volume but reasonable competition. Look for products with consistent demand rather than trending items with short lifecycles.

Margin Assessment: Calculate true profitability including all costs: product cost, shipping to fulfillment centers, referral fees, fulfillment fees, storage fees, advertising costs, and return rates. Products should maintain minimum 30-40% net margins after all expenses.

Competition Evaluation: Analyze existing sellers in your target category. Markets dominated by established brands with substantial review counts present difficult entry barriers. Conversely, categories with weak listings, poor images, or incomplete information offer differentiation opportunities.

Regulatory Considerations: Certain products face import restrictions, certification requirements, or category-specific approvals. Electronics require ESMA certificates, cosmetics need health authority clearances, and food items involve extensive documentation. Verify requirements before inventory investment.

Seasonality Patterns: Understand demand fluctuations throughout the year. Products with extreme seasonality require careful inventory planning to avoid excess stock during slow periods or stockouts during peaks.

Leveraging Fulfillment By Amazon (FBA)

Fulfillment services fundamentally change operational dynamics by transferring storage, picking, packing, and delivery responsibilities to the platform’s logistics network.

How FBA Functions: Ship inventory to designated fulfillment centers where it undergoes receiving and storage. When customers place orders, warehouse staff handle picking, packing, and shipping. Customer service and returns management for fulfilled orders also transfer to the platform.

FBA Advantages: Prime badge eligibility dramatically increases conversion rates, with Prime members showing significantly higher purchase propensity. The platform handles shipping your products to customers faster than most independent sellers can match. Fulfillment expertise results in lower damage rates and more professional packaging.

Cost Structure: FBA involves multiple fee components including fulfillment fees per unit, monthly storage fees based on cubic volume, and potential long-term storage surcharges for slow-moving inventory. Calculate these costs carefully against your margins.

Inventory Management: Replenishment planning becomes critical with FBA. Stockouts hurt search rankings and miss sales opportunities. Conversely, excessive inventory generates storage fees that erode profitability. Use sales forecasting tools to optimize stock levels.

Multi-Channel Fulfillment: FBA inventory can fulfill orders from other sales channels, providing unified inventory management. This reduces complexity for businesses selling through multiple platforms simultaneously.

Alternatives to FBA include self-fulfillment where you handle storage and shipping directly. This maintains greater control but requires robust logistics capabilities and prevents Prime eligibility.

Business Growth Strategies on Amazon UAE

Initial account setup represents just the foundation. Sustainable success requires ongoing optimization, strategic marketing investment, and operational excellence.

Amazon Advertising and Marketing

Organic visibility alone rarely generates sufficient sales velocity for competitive categories. Paid advertising accelerates discovery and drives initial sales that boost organic rankings.

Sponsored Products: These cost-per-click advertisements display within search results and product pages, targeting specific keywords or related products. They represent the primary advertising tool for most sellers. Start with automatic targeting campaigns to identify high-performing keywords, then transition to manual campaigns for precise control.

Sponsored Brands: Available to registered brand owners, these advertisements feature custom headlines, logos, and multiple products. They appear prominently in search results, driving both immediate sales and brand awareness. The format works particularly well for sellers with multiple related items.

Sponsored Display: These advertisements target customers based on browsing behavior and interests, appearing both on and off the Amazon platform. They support remarketing to previous visitors and reaching audiences interested in competitive products.

Campaign Optimization: Monitor advertising performance daily during launch phases. Adjust bids based on return on ad spend (ROAS), pause underperforming keywords, and scale investment in profitable campaigns. Advertising costs typically range from 15% to 35% of sales during growth phases, gradually declining as organic rankings improve.

External Marketing: Drive traffic from social media, email marketing, and content marketing to your storefront. While the platform provides access to millions of shoppers, additional traffic sources diversify customer acquisition and reduce platform dependence.

Managing Orders and Fulfillment

Operational excellence directly impacts customer satisfaction ratings and account performance metrics. Establish systems that ensure consistent, reliable order processing.

Order Management: For self-fulfilled items, confirm orders promptly and ship within promised timeframes. Late shipments severely impact performance ratings and search visibility. Invest in reliable courier partnerships with tracking capabilities.

Inventory Accuracy: Maintain accurate stock counts to prevent overselling. Out-of-stock situations after purchase create negative customer experiences and performance penalties. Implement inventory management systems that track stock across all sales channels in real-time.

Returns Processing: Handle returns professionally and promptly. While returns hurt profitability, poor returns management damages ratings permanently. Evaluate return reasons to identify product issues, description inaccuracies, or quality problems requiring correction.

Customer Communication: Respond to inquiries within 24 hours using professional, helpful language. Proactive communication about shipping delays, stock issues, or other problems prevents negative feedback. Using automated response tools for common questions improves efficiency while maintaining service quality.

Quality Control: Implement inspection protocols for inventory before fulfillment center shipment or customer delivery. Quality issues generate returns, negative reviews, and potential account restrictions for persistent problems.

Selling Expenses, Pricing, and Fees

Understanding complete cost structure enables profitable pricing strategies and realistic financial projections.

Referral Fees: The platform charges percentage-based referral fees on each item sold, varying by product category. Most categories incur 15% fees, though some reach 20% or have minimum fee amounts. These fees are deducted by amazon from your settlement amount automatically.

Fulfillment Fees: FBA users pay per-unit fulfillment fees based on product size and weight. Small, lightweight items incur lower fees while oversized products generate substantial charges. Calculate these fees carefully when assessing product viability.

Storage Fees: Monthly storage fees depend on cubic footage occupied in fulfillment centers. Rates increase significantly during peak seasons (October through December) and for inventory stored beyond 365 days.

Additional Selling Tools: Advanced features including premium shipping options, advertising campaigns, and enhanced content may involve additional costs. Budget for these strategic investments when planning growth initiatives.

Transaction Costs: Payment processing fees, currency conversion charges, and potential chargebacks affect net revenue. While relatively minor compared to other expenses, they should factor into pricing calculations.

Pricing Strategy: Maintain sufficient margins to absorb all platform fees, product costs, advertising expenditures, and operational expenses while generating acceptable profit. Monitor competitor pricing but avoid unsustainable price wars that erode entire category profitability. Dynamic pricing tools help maintain competitiveness while protecting margins.

Scaling Your Amazon Business for Growth

Sustained growth requires systematic approaches to expansion rather than ad-hoc decision making.

Product Line Extension: Add complementary items that existing customers might purchase. Cross-selling opportunities increase average order values and customer lifetime value. Analyze purchase data to identify logical additions to your catalog.

Brand Development: Transition from commodity reselling to branded products offering differentiation and pricing power. Register trademarks and enroll in brand protection programs that provide enhanced content options, advertising tools, and intellectual property safeguards.

Geographic Expansion: After establishing presence in one emirate, consider expanding to additional regional marketplaces. The platform operates multiple Middle East and international marketplaces accessible to UAE-based sellers. Cross-border selling requires understanding different regulatory environments and logistics networks.

Operational Automation: Implement software tools that automate repetitive tasks including repricing, inventory forecasting, financial reporting, and customer communication. Automation improves efficiency and reduces manual errors as volume increases.

Team Building: Recognize when operational demands exceed individual capacity. Hire specialists for critical functions including listing optimization, advertising management, customer service, and supply chain coordination. Consider virtual assistants for routine tasks before full-time staff.

Financial Management: Maintain detailed accounting records separating platform sales from other revenue streams. Track profitability by product, category, and sales channel. Work with accountants familiar with e-commerce taxation and UAE corporate tax requirements for Federal Decree-Law No. 47 of 2022 compliance.

Performance Monitoring: Establish key performance indicators including conversion rate, average order value, return rate, advertising efficiency, and inventory turnover. Regular analysis identifies trends requiring strategic adjustments before they impact profitability.

Long-Term Planning: Develop three-to-five-year growth projections including revenue targets, product expansion plans, and resource requirements. While Amazon dynamics change rapidly, strategic planning provides direction for daily operational decisions.