What Gratuity Is

End-of-service compensation serves as a statutory benefit designed to reward employee loyalty and provide financial security upon contract conclusion. The UAE labour law establishes clear parameters for this entitlement, ensuring workers receive recognition for their contributions while maintaining standardized employer obligations across all sectors.

End-of-Service Benefit: Definition and Significance

The end-of-service benefit constitutes a mandatory payment that employers must remit to qualifying employees upon contract termination. This financial provision acknowledges the duration and quality of service rendered throughout the employment relationship. For workers in the UAE private sector, this benefit often represents a substantial sum that supports career transitions, retirement planning, or personal financial objectives.

The significance extends beyond mere compensation. This mechanism promotes workforce stability, encourages long-term employment relationships, and provides employees with tangible recognition of their professional commitment. Companies operating under UAE jurisdiction must account for these obligations in their financial planning and human resources budgeting.

Gratuity Law in the UAE: Overview of the Legal Basis

Federal Decree-Law No. 33 of 2021 on the Regulation of Labour Relations, commonly referenced as the new UAE labour law, establishes the comprehensive legal foundation for end-of-service entitlements. Article 51 of the UAE labour law specifically addresses calculation methodologies, eligibility criteria, and payment timelines.

The legislation stipulates that calculations must be based on the basic salary component, excluding allowances such as housing, transportation, or variable bonuses. This standardized approach ensures consistency across industries and simplifies compliance verification. The Federal Authority for Government Human Resources and the Ministry of Human Resources and Emiratisation provide ongoing guidance to support proper implementation.

Gratuity Entitlement: Why Employee Rights Matter

Protecting employee rights through transparent benefit administration builds trust and maintains positive workplace relations. Understanding gratuity entitlement prevents disputes, reduces litigation risks, and demonstrates corporate commitment to fair labor practices. For employees, knowing these rights enables informed career decisions and financial planning.

Employers who prioritize accurate gratuity calculations demonstrate regulatory diligence and enhance their reputation within the competitive UAE labor market. This attention to compliance requirements aligns with broader corporate governance standards and supports sustainable business operations.

Who Is Eligible for a Gratuity Payment

Eligibility criteria determine which employees qualify for end-of-service compensation under UAE regulations. These requirements balance the interests of workers seeking earned benefits with employer needs for reasonable administrative parameters.

Eligibility for Gratuity: Minimum Service Requirements

Workers become eligible for gratuity after completing one year of continuous service with the same employer. The UAE labour law defines continuous service as uninterrupted employment under a single contract, though certain approved absences do not break continuity.

Employees who have completed at least one year qualify for proportional payments based on their tenure. Those with less than twelve months of service generally do not receive end-of-service benefits unless specific contractual provisions extend this entitlement. The minimum threshold ensures that both parties make meaningful commitments to the employment relationship before statutory obligations arise.

Gratuity Benefits: What Employees Should Receive

The calculation methodology determines the gratuity amount based on length of service and compensation level. Employees who have completed their service period are entitled to gratuity payments calculated according to specific formulas that vary by contract type and service duration.

For the first five years of employment, workers receive 21 days of basic salary for each year of service. After completing five years of service, the rate increases to 30 days of basic salary for each additional year. This progressive structure rewards long-term employment and provides enhanced benefits for experienced workers.

Understanding these entitlements enables employees to verify payment accuracy and ensures employers fulfill their legal obligations. The last basic salary typically serves as the reference point for all calculations, reflecting the employee’s most recent compensation level.

When Gratuity Is Not Paid: Key Exclusions and Rules

Several circumstances may reduce or eliminate gratuity entitlements. Gratuity is not payable when an employee is dismissed for misconduct as defined in Article 51 of the UAE labour law. Serious violations including theft, fraud, assault, or disclosure of confidential information can result in forfeiture of all end-of-service benefits.

Additionally, employees who resign during probationary periods or those who have not completed at least one year of service typically receive no compensation. Workers who abandon their positions without proper notice may also face reduced or eliminated entitlements, depending on the specific circumstances and applicable regulations.

Employers must document justification for withholding benefits carefully, as improper denial can lead to regulatory penalties and labor disputes. The burden of proof rests with the employer when claiming that an employee is ineligible due to misconduct or contract violations.

How Employment Contract Types Affect Gratuity Calculation

The type of employment contract fundamentally shapes how end-of-service benefits are calculated and distributed. UAE labor regulations recognize two primary contract classifications, each with distinct implications for benefit determination.

Limited Contract Rules and Implications

A limited contract specifies a fixed duration, typically ranging from one to three years. These agreements define the relationship parameters explicitly, including start dates, end dates, and renewal conditions. Under a limited contract, employees generally receive their full gratuity entitlement upon contract completion, regardless of which party initiates the separation.

The certainty provided by defined terms benefits both employers and workers. Companies can plan workforce requirements with precision, while employees understand their commitment duration and benefit expectations. Calculating gratuity in the UAE for fixed-term arrangements follows standardized formulas without the reduction provisions applied to certain resignation scenarios under open-ended agreements.

Unlimited Contract: Key Differences and Rules

An unlimited contract establishes an ongoing employment relationship without a predetermined end date. These open-ended arrangements provide greater flexibility for both parties but introduce different rules for end-of-service calculations when employees voluntarily resign.

Under an unlimited contract, workers who resign receive reduced benefits based on their service duration. Those with less than five years of service are entitled to one-third of full gratuity pay for the first year worked and two-thirds for each subsequent year. Employees with service exceeding five years receive full entitlement for the period beyond the five-year threshold, plus the reduced amount for the initial years.

This structure discourages premature departures while still recognizing service contributions. Employers who terminate an unlimited contract must provide full benefits regardless of service duration, ensuring protection for workers facing involuntary separation.

Type of Contract: How to Determine Yours

Employees should review their signed employment agreement to identify whether they hold a limited or unlimited contract. The document should explicitly state either a fixed term with specific dates or indicate an open-ended arrangement. Human resources departments can provide clarification if the contract language appears ambiguous.

Understanding your type of employment contract is essential for accurate benefit projection and career planning. This classification directly determines the calculation methodology applied when employment concludes, potentially resulting in significant financial differences depending on separation circumstances.

Limited vs. Unlimited: Comparison of Payment Rules

The following comparison illustrates how contract type influences benefit calculations:

Limited Contract:

- Full benefits upon completion or early termination by either party

- No reduction for employee resignation

- Clear end date simplifies calculation timing

Unlimited Contract:

- Full benefits upon employer-initiated termination

- Reduced benefits for employee resignation (based on service duration)

- Graduated entitlement structure for first five years

Both limited and unlimited contracts require employers to base calculations on the same salary components and service period definitions. The distinction lies primarily in how voluntary resignation affects the final payment amount.

Gratuity Calculation Rules

The UAE gratuity calculation framework establishes precise methodologies that ensure consistency and fairness across all employment relationships. Understanding these core principles enables accurate benefit determination and regulatory compliance.

UAE Gratuity Calculation: Core Formula Factors

Three primary elements determine the final benefit amount:

- Last Basic Salary: The foundation for all calculations, representing the employee’s most recent base compensation excluding allowances

- Years of Continuous Service: The total duration of uninterrupted employment with the employer

- Contract Type and Separation Circumstances: Whether the agreement was limited or unlimited, and whether termination was voluntary or involuntary

The gratuity calculation is based on converting monthly basic salary into a daily rate, then multiplying by the applicable number of days earned through service. This standardized approach ensures transparency and enables employees to verify calculations independently.

The Role of Last Basic Salary Component in Calculation

The employee’s basic salary serves as the exclusive reference point for benefit calculations. This component excludes housing allowances, transportation stipends, phone allowances, annual bonuses, commission payments, and other variable or supplementary compensation elements.

Using only the basic salary ensures that calculations remain stable and predictable, unaffected by temporary adjustments to allowances or performance-based payments. Employers must clearly distinguish between basic salary and total compensation in employment contracts to avoid calculation disputes.

For workers whose basic salary changed during their tenure, the last basic salary—the rate in effect at the time of separation—applies to the entire benefit calculation. This approach simplifies administration while ensuring that calculations reflect current compensation levels.

Years of Continuous Service: Impact on the Final Amount

Service duration directly influences both the total days credited and, for unlimited contracts with voluntary resignation, the proportion of full benefits paid. Employees must complete at least one year of continuous service to qualify for any end-of-service compensation.

Each complete year of service adds to the employee’s entitlement according to the prescribed rates: 21 days’ salary per year for the first five years, and 30 days’ salary for each year beyond that threshold. Partial years are calculated proportionally based on completed months, ensuring that workers receive credit for all qualifying service time.

Interruptions to employment, such as unpaid leave exceeding certain thresholds, may affect the calculation of continuous service years. Employers should maintain detailed attendance and leave records to support accurate service period determinations.

Calculate Gratuity for a Limited Contract

Fixed-term employment arrangements follow straightforward calculation protocols that provide certainty for both employers and employees. Understanding these methodologies ensures accurate benefit determination when contracts conclude.

Gratuity Pay Calculation for a Limited Duration

Employees under limited contracts are entitled to full gratuity pay regardless of who initiates the separation, provided they have completed at least one year of service. The calculation follows this structure:

- Years 1-5: 21 days of basic salary for each year

- Year 6 onward: 30 days of basic salary for each additional year

This approach rewards long-term employment while maintaining consistent standards across all fixed-term arrangements. The absence of reduction provisions for voluntary departure reflects the mutual understanding that contract completion represents a natural conclusion to the employment relationship.

Resignation from a Limited Contract: Payout Scenarios

When an employee resigns from a limited contract before the specified end date, they typically remain entitled to full gratuity benefits for the service period completed. However, premature resignation may trigger other contractual obligations, such as notice requirements or compensation for early termination costs.

The end-of-service benefit calculation remains unchanged by voluntary departure, as the fixed-term nature of the agreement establishes clear expectations for both parties. This structure provides financial security for workers while maintaining contractual certainty for employers.

Termination of a Limited Contract: Full Benefit Payment

Employer-initiated termination of a limited contract before the specified end date requires full gratuity payment based on completed service. Additionally, employers may face obligations to compensate for the remaining contract period, depending on the termination circumstances and applicable notice provisions.

The combination of full gratuity entitlement and potential additional compensation protects employees from arbitrary dismissal and ensures that fixed-term commitments receive appropriate legal recognition. Employers should document termination reasons carefully to demonstrate compliance with regulatory requirements.

Steps to Calculate Gratuity for Limited Contract Service

Follow these steps to determine accurate entitlements:

- Identify the last basic salary amount (monthly rate)

- Calculate the daily wage: Divide monthly basic salary by 30

- Determine completed service years and months

- Apply the formula:

- For years 1-5: (Daily wage × 21) × number of years

- For years beyond 5: (Daily wage × 30) × number of additional years

- Add results from both calculations to determine total gratuity amount

This systematic approach ensures consistency and enables verification by all parties. Employers should provide detailed calculation breakdowns to employees upon payment, promoting transparency and reducing potential disputes.

Calculate Gratuity for an Unlimited Contract

Open-ended employment arrangements introduce additional complexity to benefit calculations, particularly when employees voluntarily resign. Understanding these nuances ensures accurate payment determination and regulatory compliance.

Gratuity Pay Calculation for an Unlimited Duration

Workers under unlimited contracts follow the same basic rate structure as limited contracts—21 days of basic salary for the first five years, and 30 days for each year beyond that threshold. However, the application of these rates depends on separation circumstances.

When employers terminate an unlimited contract, employees receive full benefits using the standard calculation methodology. This protection ensures that workers facing involuntary separation receive complete compensation for their service contributions.

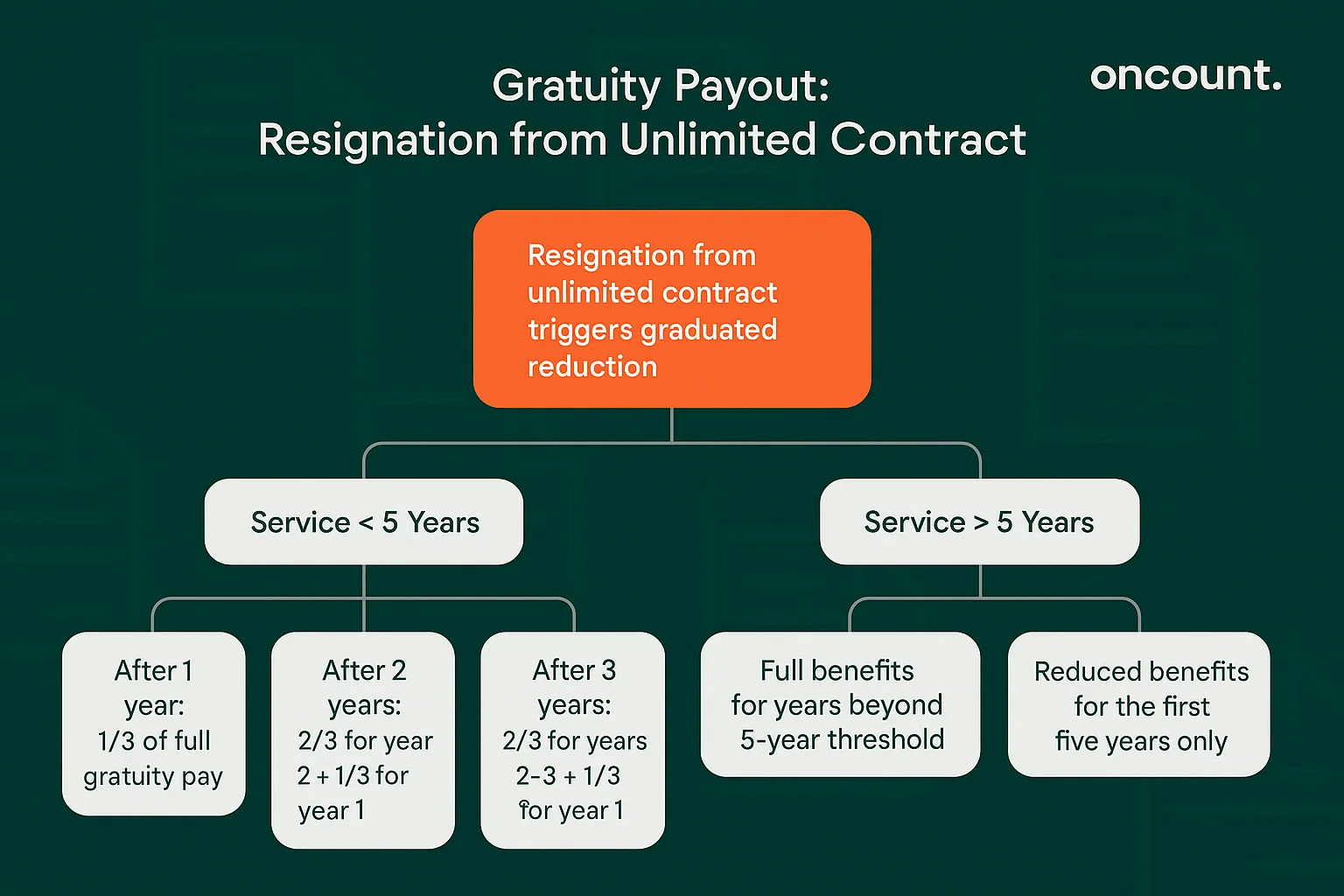

Resignation from an Unlimited Contract: Payout Reduction Rules

Voluntary resignation from an unlimited contract triggers graduated reduction provisions that vary by service duration:

Service Duration Less Than Five Years:

- After completing one year: One-third of full gratuity pay

- After two years: Two-thirds of full gratuity for year two, plus one-third for year one

- After three years: Two-thirds of full gratuity for years two and three, plus one-third for year one

- Similar progression continues through year five

Service Duration Exceeding Five Years:

- Full benefits for all years beyond the five-year threshold

- Reduced benefits (as described above) for the first five years only

This structure recognizes that long-term employees have demonstrated sustained commitment deserving of enhanced protection, while encouraging workers to consider carefully the timing of voluntary departures.

Termination of an Unlimited Contract: Full Benefit Payment

Employees whose unlimited contracts are terminated by the employer receive entitled to full gratuity payments without any reduction provisions. This safeguard protects workers from financial disadvantage resulting from employer-initiated separation.

The distinction between voluntary and involuntary departure reflects policy objectives of promoting employment stability while ensuring that workers do not face penalties for employer decisions. Accurate classification of termination circumstances is essential for proper benefit determination.

Calculation of Gratuity for Unlimited Contract Service

To calculate your gratuity in UAE contexts under an unlimited contract with voluntary resignation:

- Determine service duration (complete years and months)

- Calculate the daily wage from last basic salary

- If service is less than five years:

- Calculate 21 days × daily wage × 1/3 for the first year

- Calculate 21 days × daily wage × 2/3 for each subsequent year

- Sum all amounts for total gratuity

- If service exceeds five years:

- Calculate reduced benefits for first five years (as above)

- Calculate 30 days × daily wage for each year beyond five years

- Sum both portions for total gratuity amount

This methodology ensures that employees who have completed significant service receive appropriate recognition, while maintaining incentives for continued employment commitment.

Step-by-Step Gratuity Calculation in the UAE

Implementing accurate calculations requires systematic application of statutory formulas and careful attention to employee-specific circumstances. This section provides practical guidance for determining benefit amounts.

Determine Daily Wage Based on Basic Salary

The first step in any calculation involves converting monthly basic salary into a daily rate. Per UAE labour law standards, this conversion uses a 30-day month regardless of the actual calendar days in any given month.

Daily Wage Formula: Monthly Basic Salary ÷ 30

For example, an employee with a monthly basic salary of AED 15,000 would have a daily wage of AED 500. This standardized approach simplifies calculations and ensures consistency across all benefit determinations.

Apply Gratuity Calculation Rules Based on Service Years

After establishing the daily wage, determine which rates apply based on the employee’s total service duration:

Years 1-5: Multiply daily wage by 21 to determine the annual benefit amount for each year within this range.

Year 6 onward: Multiply daily wage by 30 to determine the annual benefit amount for each year beyond the five-year threshold.

For partial years, calculate proportional benefits based on completed months. For instance, 7 months of service would equal 7/12 of the full annual amount for that year’s applicable rate.

Calculate the Gratuity Amount Using the Formula

Combine the results from each service period to determine the total gratuity payment:

Total Gratuity = (First 5 Years Benefits) + (Subsequent Years Benefits)

Adjust this calculation for contract type and separation circumstances:

- Limited contracts: Apply full calculated amount

- Unlimited contracts with employer termination: Apply full calculated amount

- Unlimited contracts with employee resignation: Apply reduction provisions to first five years as previously described

Formula Example for Service Over Five Years

Consider an employee with 7 years of continuous service under an unlimited contract, earning a last basic salary of AED 18,000 monthly, who resigns voluntarily.

Step 1: Calculate daily wage

- AED 18,000 ÷ 30 = AED 600 per day

Step 2: Calculate benefits for first five years with reduction

- Year 1: (AED 600 × 21 × 1/3) = AED 4,200

- Years 2-5: (AED 600 × 21 × 2/3) × 4 years = AED 33,600

- Subtotal for first five years: AED 37,800

Step 3: Calculate full benefits for years 6-7

- (AED 600 × 30) × 2 years = AED 36,000

Step 4: Calculate total gratuity amount

- AED 37,800 + AED 36,000 = AED 73,800

This example demonstrates how the progressive rate structure and reduction provisions combine to determine final entitlements. Employees working under limited contracts or facing employer-initiated termination would receive higher amounts due to the absence of reduction provisions.

Special Cases and Gratuity Deductions

Certain circumstances introduce exceptions to standard calculation protocols. Understanding these special situations ensures proper benefit determination and regulatory compliance.

Dismissal for Misconduct: The Zero Gratuity Scenario

Article 51 of the UAE labour law permits employers to withhold all end-of-service benefits when dismissing employees for serious misconduct. Qualifying violations include:

- Theft or fraud involving company property or funds

- Physical assault against colleagues, supervisors, or clients

- Deliberate damage to employer property

- Disclosure of confidential business information

- Intoxication during working hours

- Repeated violations after written warnings

Employers must document misconduct thoroughly and follow proper disciplinary procedures before withholding benefits. In practice, free zone entities often apply these provisions strictly, recognizing that gratuity forfeiture represents a significant consequence requiring substantial justification.

Workers dismissed for misconduct may challenge the decision through labor courts if they believe the employer’s actions were unjustified. The burden of proving serious misconduct rests with the employer, who must demonstrate clear evidence supporting the dismissal decision.

Unpaid Leave: Effect on Service Period Calculation

Extended unpaid leave may affect the calculation of continuous service for benefit purposes. In line with UAE labour law provisions, periods of unpaid absence exceeding certain thresholds do not count toward service duration for end-of-service benefit calculations.

Employers should maintain detailed leave records distinguishing between paid annual leave, sick leave, and approved unpaid absence. These records support accurate service period determination and help prevent calculation disputes when employment concludes.

Approved unpaid leave for specific purposes, such as educational pursuits or family emergencies, typically does not break service continuity but may extend the total employment duration required to reach service milestones. Employees should clarify how unpaid leave affects their benefit calculations before requesting extended absences.

Unjustified Termination: Additional Compensation

Employees facing unjustified termination may be entitled to compensation beyond standard end-of-service benefits. The UAE labour law provides protections against arbitrary dismissal, requiring employers to demonstrate legitimate business reasons or employee performance issues before terminating contracts.

When courts determine that termination was unjustified, employers may face obligations to compensate for remaining contract periods (in limited contracts), pay additional damages, or reinstate the employee. These protections ensure that workers in the UAE private sector receive fair treatment and maintain recourse against improper employer actions.

Understanding the right to gratuity and related protections enables employees to assert their entitlements effectively while encouraging employers to maintain proper documentation and follow appropriate termination procedures.

UAE Labour Law Updates on Gratuity 2025

Regulatory frameworks evolve to address changing employment practices and economic conditions. Staying informed about legislative developments ensures ongoing compliance and protects both employer and employee interests.

New Gratuity Law: Key Changes and Amendments

The implementation of Federal Decree-Law No. 33 of 2021 represented the most significant reform to UAE labor regulations in decades. This new UAE labour law introduced several important modifications to end-of-service benefit calculations and entitlements:

- Standardization of calculation methodologies across all private sector employers

- Enhanced clarity regarding limited and unlimited contracts distinctions

- Refined provisions addressing misconduct and benefit forfeiture

- Improved protections for long-serving employees

These amendments reflect government objectives of modernizing labor relations, attracting international talent, and maintaining the UAE’s competitive position in global business markets. Employers operating in UAE 2025 must ensure their policies align with these updated requirements.

Gratuity Law in the UAE: Recent Legislative Changes

Beyond the core labor law reforms, supplementary guidance from the Ministry of Human Resources and Emiratisation continues to refine implementation practices. Recent clarifications address:

- Documentation requirements for service period verification

- Procedures for disputed calculations

- Integration with end-of-service savings schemes

- Cross-border employment considerations for multinational organizations

Businesses should monitor official government channels for announcements regarding regulatory updates that may affect benefit calculation procedures or compliance requirements. Proactive attention to these developments minimizes the risk of inadvertent violations and associated penalties.

UAE Labor Law Resources for Compliance

Multiple authoritative resources support proper understanding and implementation of end-of-service benefit requirements:

Ministry of Human Resources and Emiratisation: Provides official guidance, complaint resolution mechanisms, and compliance resources through its digital platforms and regional offices.

Federal Authority for Government Human Resources: Offers comprehensive explanations of labor regulations and maintains updated documentation reflecting current legal standards.

UAE Labour Law Official Text: The complete text of Federal Decree-Law No. 33 of 2021 remains the definitive source for all statutory requirements and should be consulted for authoritative interpretation.

Legal and Accounting Professionals: Specialized advisors with expertise in UAE employment law and financial compliance provide valuable support for complex situations or unique business circumstances.

Employers and employees alike benefit from consulting these resources when questions arise regarding eligibility, calculation methodologies, or payment obligations. Accurate gratuity calculations depend on thorough understanding of applicable regulations and consistent application of statutory formulas.